2022 Income Tax Rates In Ghana Calculate you Annual salary after tax using the online Ghana Tax Calculator updated with the 2022 income tax rates in Ghana Calculate your income tax social security and pension deductions in seconds

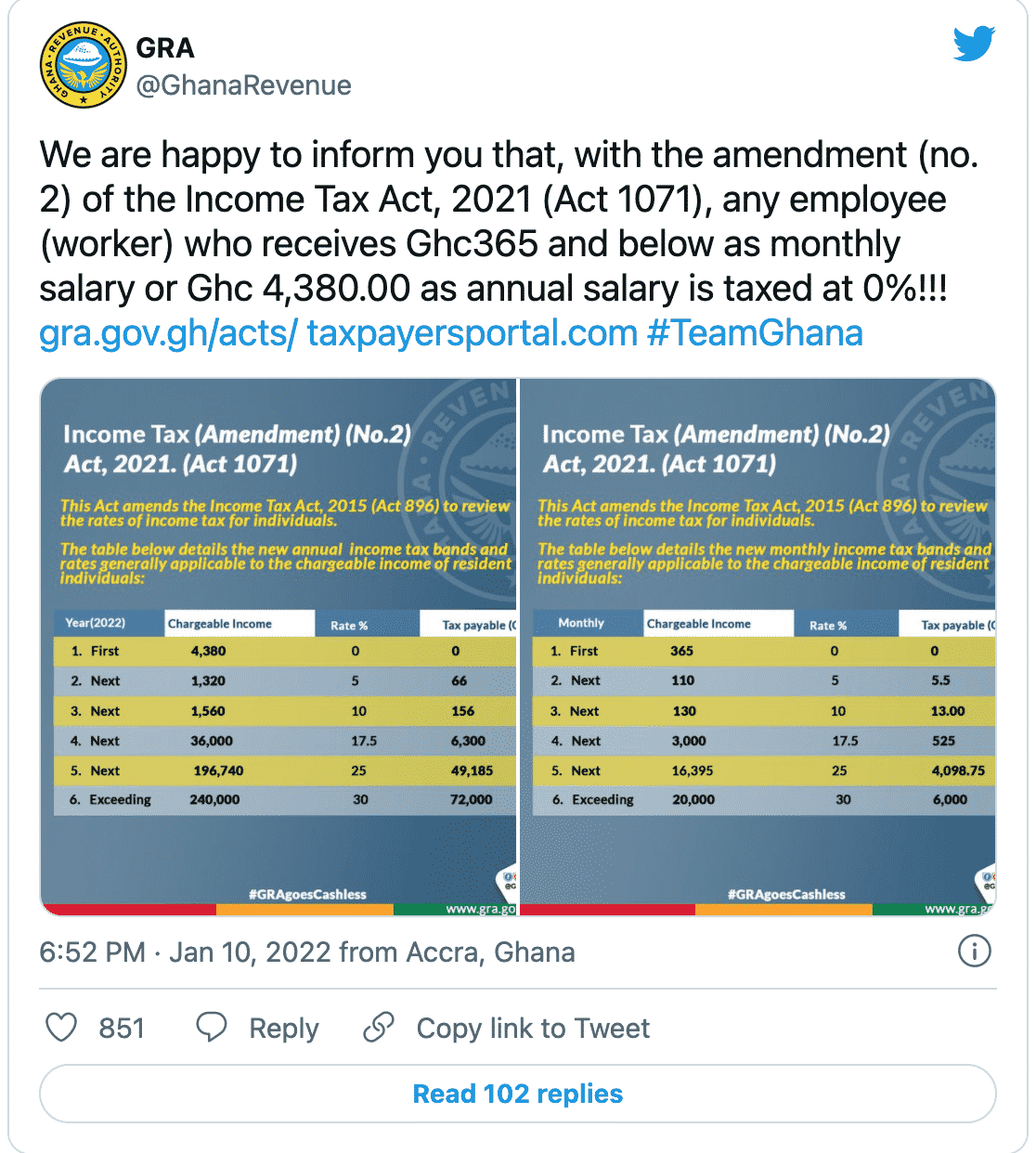

Welcome to the 2022 Income Tax Calculator for Ghana which allows you to calculate Income Tax Due the Effective Tax Rate and the Marginal Tax Rate based on your taxable income in Feb 1 2022 nbsp 0183 32 The revision aligns the tax free income threshold with the current minimum wage of GHS 4 380 per annum GHS 365 per month The graduated tax schedule for resident

2022 Income Tax Rates In Ghana

2022 Income Tax Rates In Ghana

2022 Income Tax Rates In Ghana

https://i.ytimg.com/vi/dzc3djHMRIo/maxresdefault.jpg

Apr 17 2023 nbsp 0183 32 The 2022 tax tables provide full details of tax rates and thresholds for Ghana PIT Personal Income Tax and Ghana CIT Corporate Income Tax Supporting tax calculators

Templates are pre-designed documents or files that can be used for different purposes. They can conserve effort and time by supplying a ready-made format and layout for developing various kinds of material. Templates can be used for personal or expert projects, such as resumes, invitations, flyers, newsletters, reports, presentations, and more.

2022 Income Tax Rates In Ghana

What Is Standard Deduction For Ay 2021 22 Standard Deduction 2021

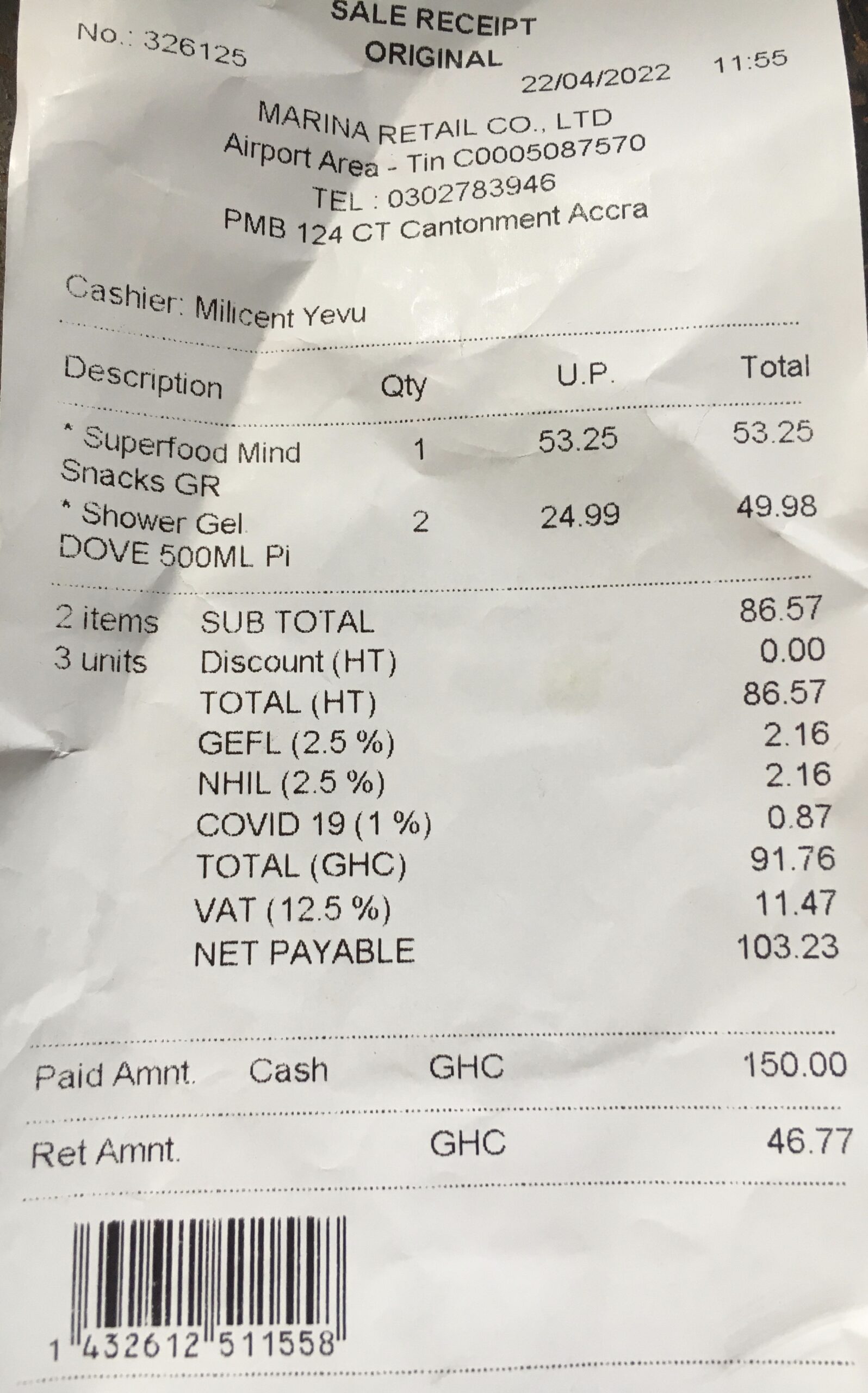

IMG 4760 Ghana Business News

Workers Paid Monthly Salary Of GH 365 Or Below Won t Be Taxed GRA

Salary Calculator Ghana Sugiono Salary

Understanding Property Rate In Ghana Labone Express

Personal Factors That Affect Insurance Rates In Ghana Ghanacompares

https://gra.gov.gh › domestic-tax › tax-types › paye

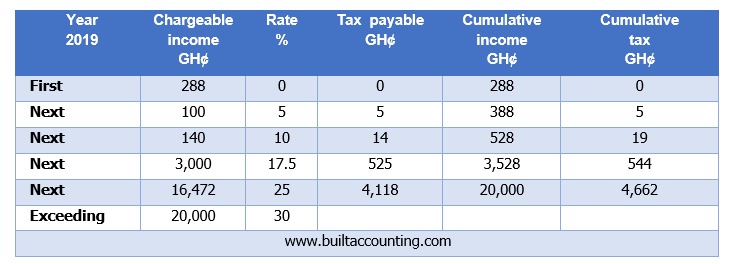

The table below details the monthly income tax bands and rates generally applicable to the chargeable income of resident individuals The chargeable income of non resident individuals

https://taxsummaries.pwc.com › Ghana …

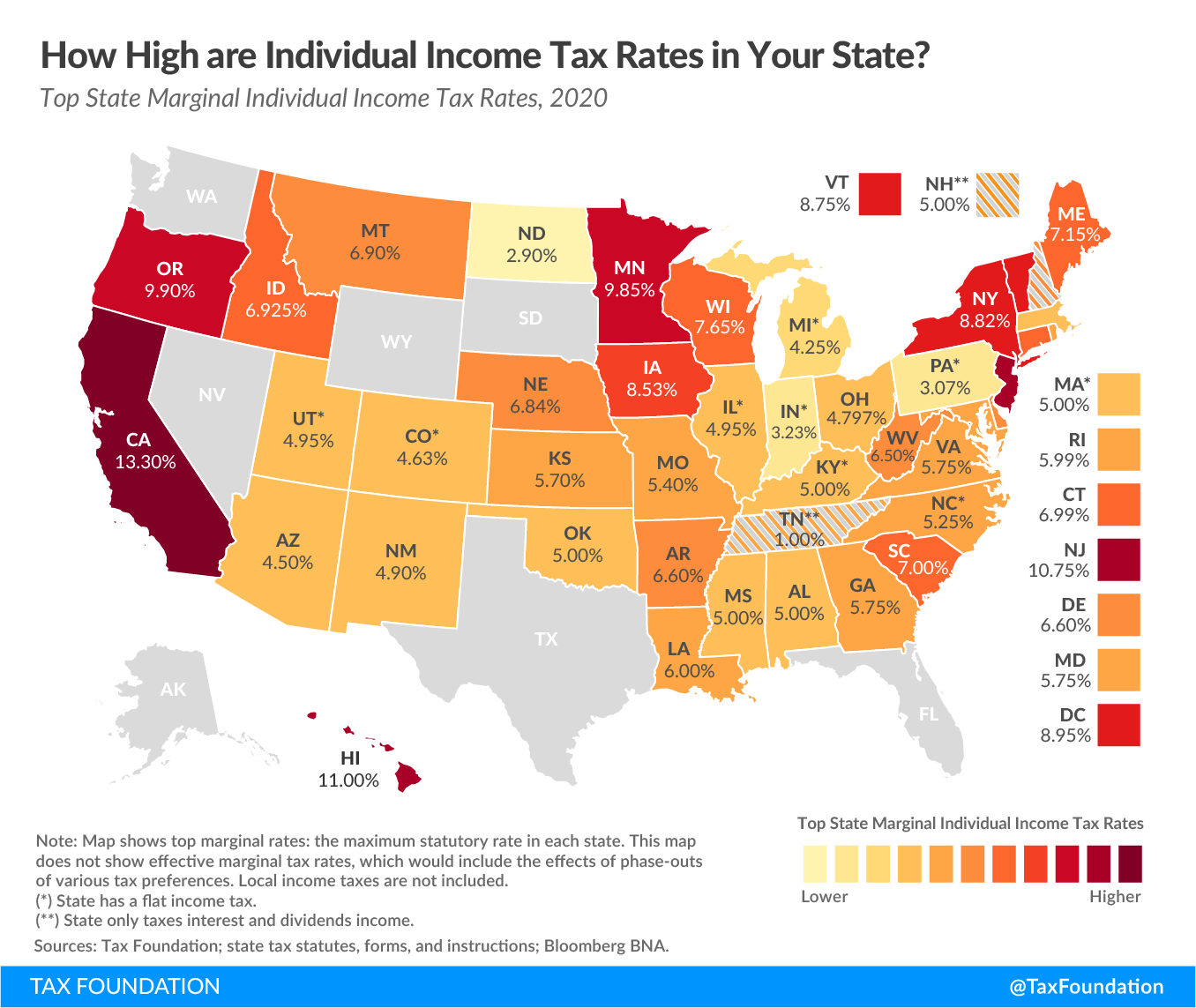

Personal income tax rates Residents are subject to tax at rates ranging between 0 and 35 on the following annual graduated scale of income Non residents pay taxes at the flat rate of 25 Local income taxes There are no local taxes

https://taxnews.ey.com › news

Jan 7 2022 nbsp 0183 32 The Act has revised the graduated annual income tax rate for individuals reduced the withholding tax rate for the sale of unprocessed gold by small scale miners increased the

https://gra.gov.gh › wp-content › uploads

AN ACT to amend the Income Tax Act 2015 Act 896 to review the rates of Income tax for Individuals to reduce the withholding tax rate for sale of unprocessed gold by small scale

https://gra.gov.gh › domestic-tax › perso…

It is a tax charged on an individual s total income income from employment business and investment You must pay Income Tax if you are an employee a sole proprietor or a person in partnership and you earn income above GH 162

May 27 2024 nbsp 0183 32 The 2024 edition of our Tax Facts and Figures publication provides an overview of the direct and indirect tax regime of Ghana as at the date of this publication This publication is May 9 2023 nbsp 0183 32 On 31 March 2023 the Parliament of Ghana approved the Income Tax Amendment No 2 Bill 2022 1 which provided for the introduction of an additional top

KPMG s individual income tax rates table provides a view of individual income tax rates Use our interactive Tax rates tool to compare tax rates by country or region Legal