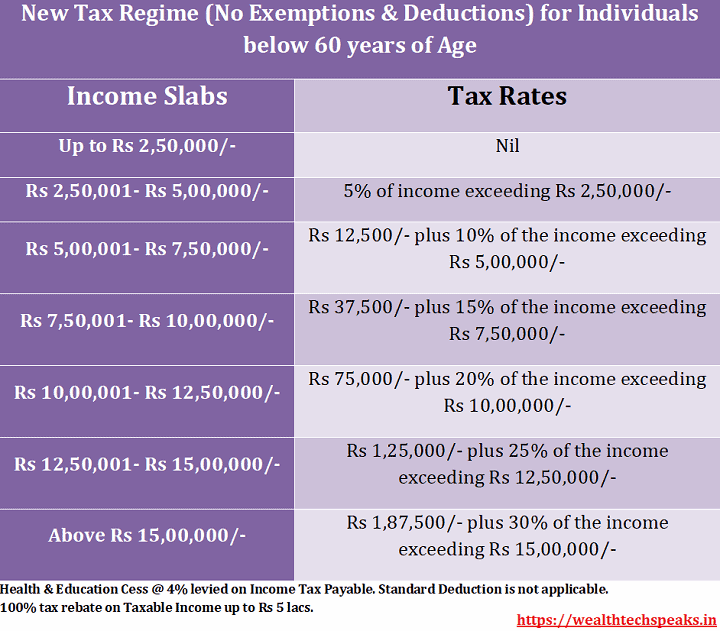

2022 Company Tax Rates WEB Income Tax Slab Rates For FY 2022 23 AY 2023 24 a New Tax regime Refer to the above image for the rates applicable to FY 2023 24 AY 2024 25 for the upcoming tax filing season b Old Tax regime Select your Age Group Income tax slabs for individual aged below 60 years amp HUF NOTE

WEB Jun 29 2023 nbsp 0183 32 Corporate Tax Rate Applicable for AY 2022 2023 Income Tax for Companies with Turnover or gross receipts in 2019 2020 up to 400 crores Income Tax Rate 25 Income Tax for Companies with WEB Aug 2 2022 nbsp 0183 32 as the Worldwide Corporate Tax Guide in such a shifting tax landscape especially if they are contemplating new markets The content is straightforward Chapter

2022 Company Tax Rates

2022 Company Tax Rates

2022 Company Tax Rates

https://www.cloud8.com.au/wp-content/uploads/2020/06/register-a-business.jpg

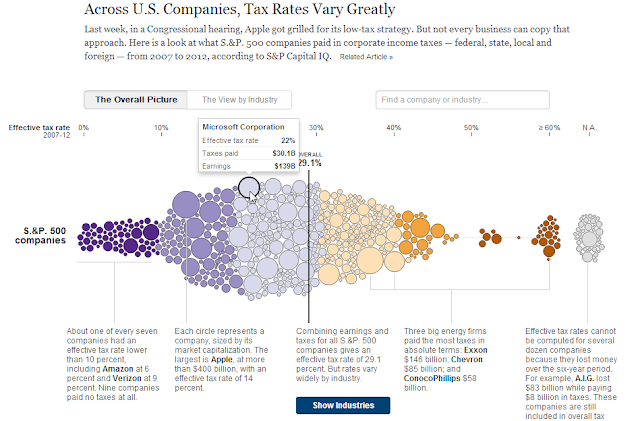

WEB Sep 27 2022 nbsp 0183 32 Corporations in the United States pay federal corporate income taxes levied at a 21 percent rate Forty four states and D C also levy taxes on corporate income

Templates are pre-designed files or files that can be used for numerous purposes. They can save effort and time by providing a ready-made format and layout for producing various sort of content. Templates can be used for individual or expert jobs, such as resumes, invitations, flyers, newsletters, reports, discussions, and more.

2022 Company Tax Rates

BloggoType Company Tax Rates Contribution To Society

Changes To Company Tax Rates Less Tax REM Accounting And Advisory

Business Update 19 May 2022 Xperion

Company Tax Rates For UK And Non resident Cos Landlords Tax Services

2022 Tax Brackets JeanXyzander

Income Tax Rate Malaysia 2023 Calculator Printable Forms Free Online

https://www.ato.gov.au/tax-rates-and-codes/company-tax-rates

WEB Last updated 4 June 2023 Print or Download Tax rates 2022 23 Company tax rates for the 2022 23 income year Tax rates 2021 22 Company tax rates for the 2021 22

https://www.ato.gov.au/tax-rates-and-codes/company...

WEB Jun 29 2023 nbsp 0183 32 From the 2021 22 income year onwards companies that are base rate entities must apply the 25 company tax rate The rate was previously 27 5 from the

https://www.deloitte.com/global/en/services/tax/...

WEB Mar 14 2023 nbsp 0183 32 Global tax rates 2022 provides corporate income tax historic corporate income tax and domestic withholding tax rates for around 170 jurisdictions

https://www.claconnect.com/en/resource…

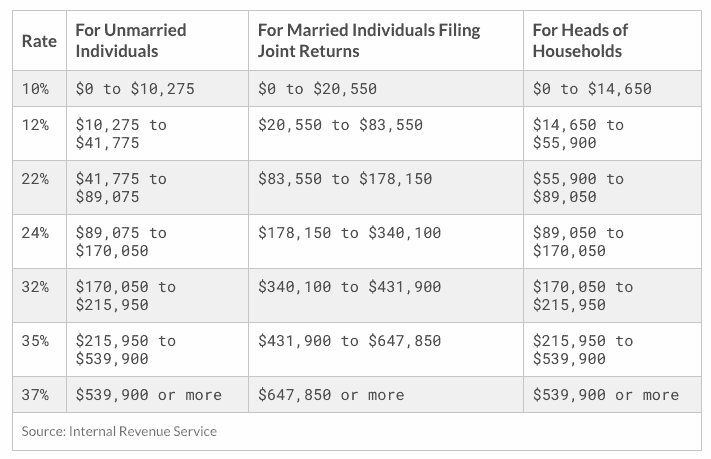

WEB 1 14 2022 Plan your 2022 finances with this tax guide for filing rates deductions exemptions retirement limits HSAs payroll tax estates and more The IRS announced the 2022 tax rates which went into effect on

https://www.sars.gov.za/tax-rates/income-tax/...

WEB Companies 21 February 2024 No changes from last year Top Tip Personal Service Providers are no longer taxed separately and are taxed as a company or as a Trust

WEB 12 hours ago nbsp 0183 32 Nigeria has hired investment banks including Citibank NA JPMorgan Chase amp Co and Goldman Sachs Group Inc to advise it on its first eurobond issue since 2022 WEB Jun 4 2023 nbsp 0183 32 2022 23 tax rates Not for profit companies that are base rate entities see note 5 Income category Rate Taxable income 0 416 Nil Taxable income

WEB Rachel Blakely Gray Dec 14 2022 Your company s tax liability largely depends on the business structure you choose And if you structure your business as a corporation