2022 Annual Tax Brackets Web Jan 29 2024 nbsp 0183 32 The seven federal income tax brackets for 2023 and 2024 are 10 12 22 24 32 35 and 37 Your bracket depends on your taxable income and filing status

Web IR 2021 219 November 10 2021 The Internal Revenue Service today announced the tax year 2022 annual inflation adjustments for more than 60 tax provisions including the tax rate schedules and other tax changes Revenue Procedure 2021 45 provides details about these annual adjustments Web for businesses whose tax return deadline is April 18 2022 1st installment deadline to pay 2022 estimated taxes due Last day to file federal income tax returns for individuals Tax filing deadline to request an extension until Oct 17 2022 for individuals whose tax return deadline is April 18 2022 Last day to contribute to Roth or

2022 Annual Tax Brackets

2022 Annual Tax Brackets

2022 Annual Tax Brackets

https://www.irstaxapp.com/wp-content/uploads/2022/01/2022-tax-bracket-1024x576.png

Web Nov 10 2021 nbsp 0183 32 The IRS also announced that the standard deduction for 2022 was increased to the following Married couples filing jointly 25 900 Single taxpayers and married individuals filing separately

Pre-crafted templates offer a time-saving service for developing a varied series of documents and files. These pre-designed formats and designs can be utilized for different individual and expert jobs, consisting of resumes, invites, leaflets, newsletters, reports, presentations, and more, streamlining the content creation process.

2022 Annual Tax Brackets

Federal Withholding Tax Tables Review Home Decor

Tax Tips KTD Tax Services

The 2022 Tax Brackets In Canada Based On Annual Income And Broken Down

Revised Withholding Tax Table Bureau Of Internal Revenue

2022 Tax Brackets Married Filing Jointly

JoannaKadie

https://www.irs.com/en/2022-federal-income-tax...

Web Feb 21 2022 nbsp 0183 32 These are broken down into seven 7 taxable income groups based on your federal filing statuses e g whether you are single a head of household married etc The federal income tax rates for 2022 are 10 12 22 24 32 35 and 37 depending on the tax bracket

https://www.forbes.com/sites/ashleaebeling/2021/11/...

Web Nov 10 2021 nbsp 0183 32 2022 Tax Bracket and Tax Rates There are seven tax rates in 2022 10 12 22 24 32 35 and 37 Here s how they apply by filing status

https://www.investopedia.com/irs-announces-tax...

Web Nov 11 2021 nbsp 0183 32 Standard deductions and about 60 other provisions have been adjusted for inflation to avoid bracket creep The maximum Earned Income Tax Credit for 2022 will be 6 935 vs 6 728 for tax year 2021

https://www.irs.gov/filing/federal-income-tax-rates-and-brackets

Web Jan 31 2024 nbsp 0183 32 Head of household See the tax rates for the 2024 tax year Taxable income Page Last Reviewed or Updated 23 Jan 2024 Share See current federal tax brackets and rates based on your income and filing status

https://www.gov.uk/income-tax-rates

Web Income over 163 100 000 Current rates and allowances How much Income Tax you pay in each tax year depends on how much of your income is above your Personal Allowance how much of your income falls

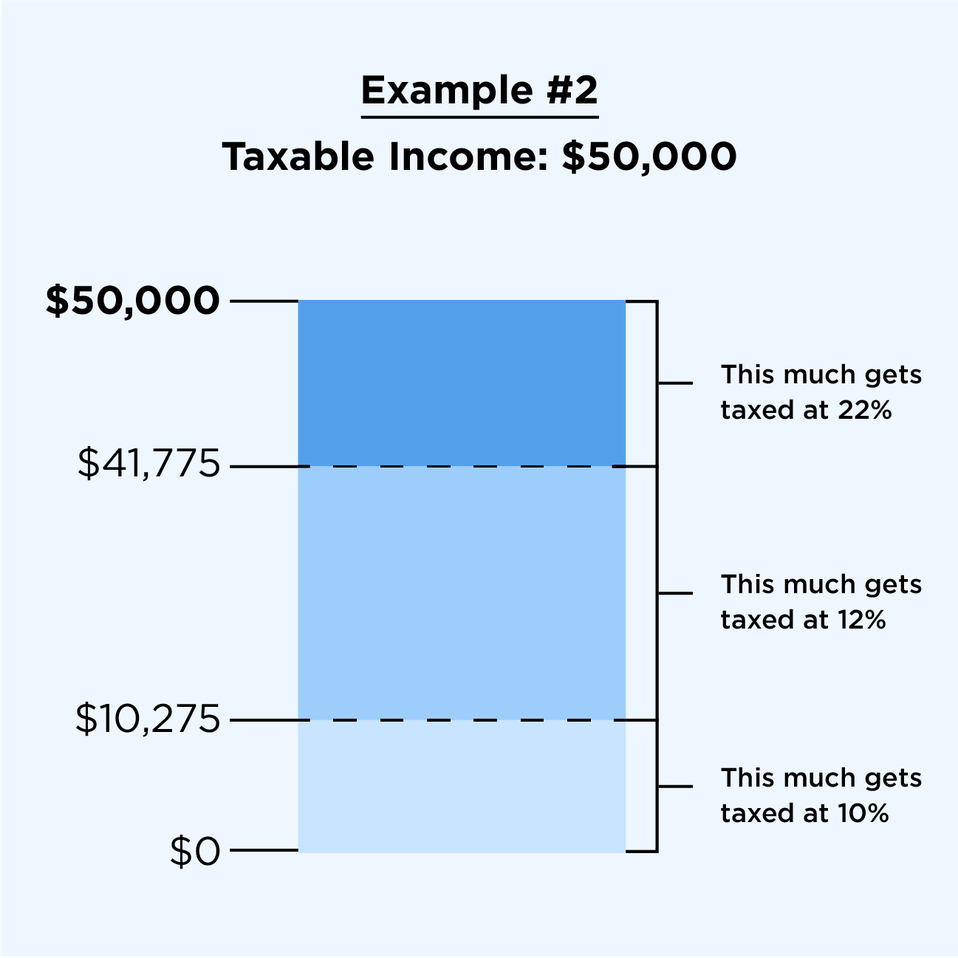

Web Tax brackets in 2022 What happens if you didn t file your taxes for 2022 yet The rates are a bit different Take note Tax Rate Single Filers Married Filing Separate Married Individuals Filing Jointly Qualifying Surviving Spouse Heads of Households 10 0 10 275 0 20 550 Web Use our Tax Bracket Calculator to understand what tax bracket you re in for your 2023 2024 federal income taxes Based on your annual taxable income and filing status your tax bracket determines your federal tax rate

Web Apr 14 2023 nbsp 0183 32 What are the brackets for 2022 The income tax brackets vary depending on filing status For tax year 2022 here are the brackets for single filers Single Taxable income The tax is 10 0 to