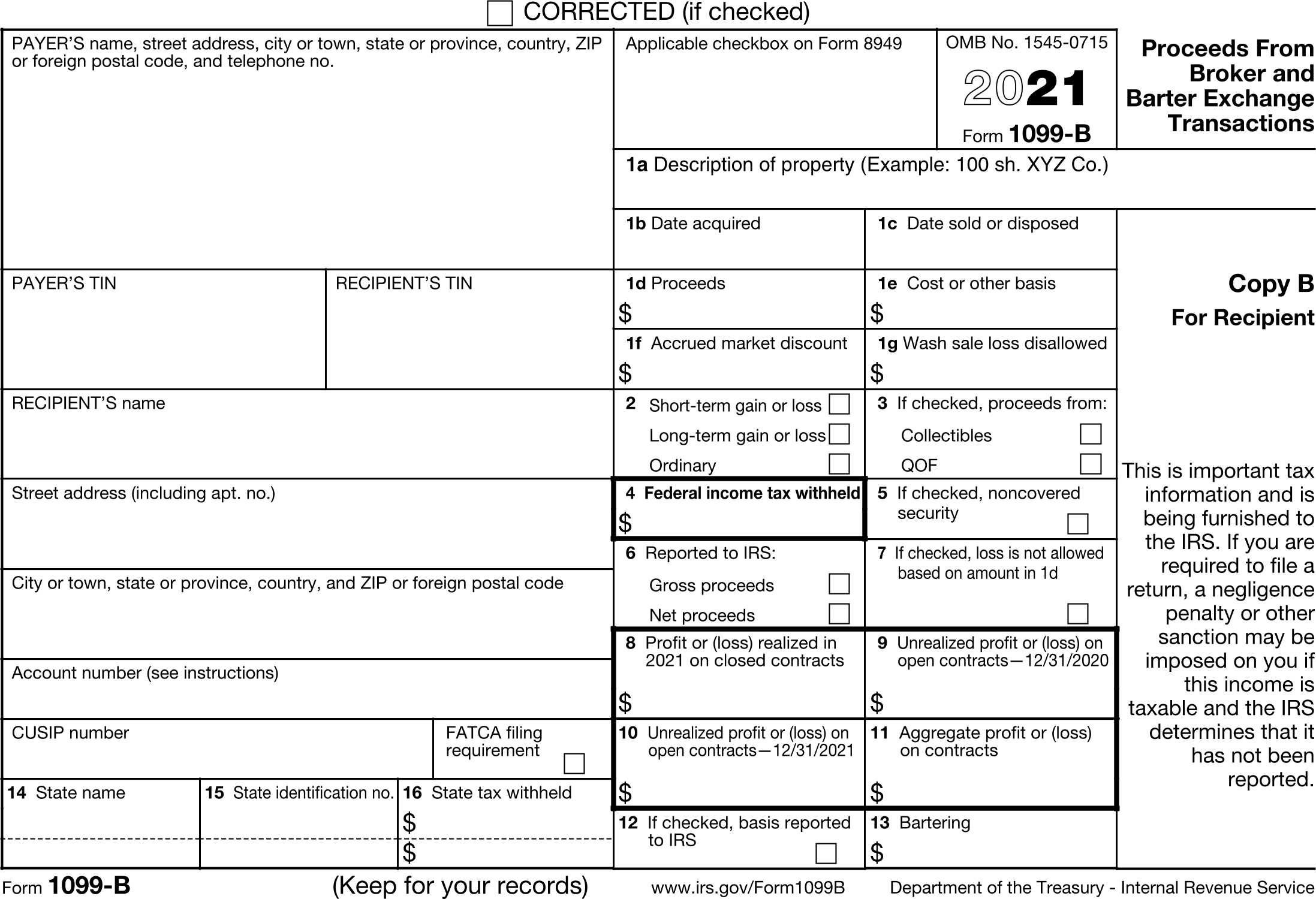

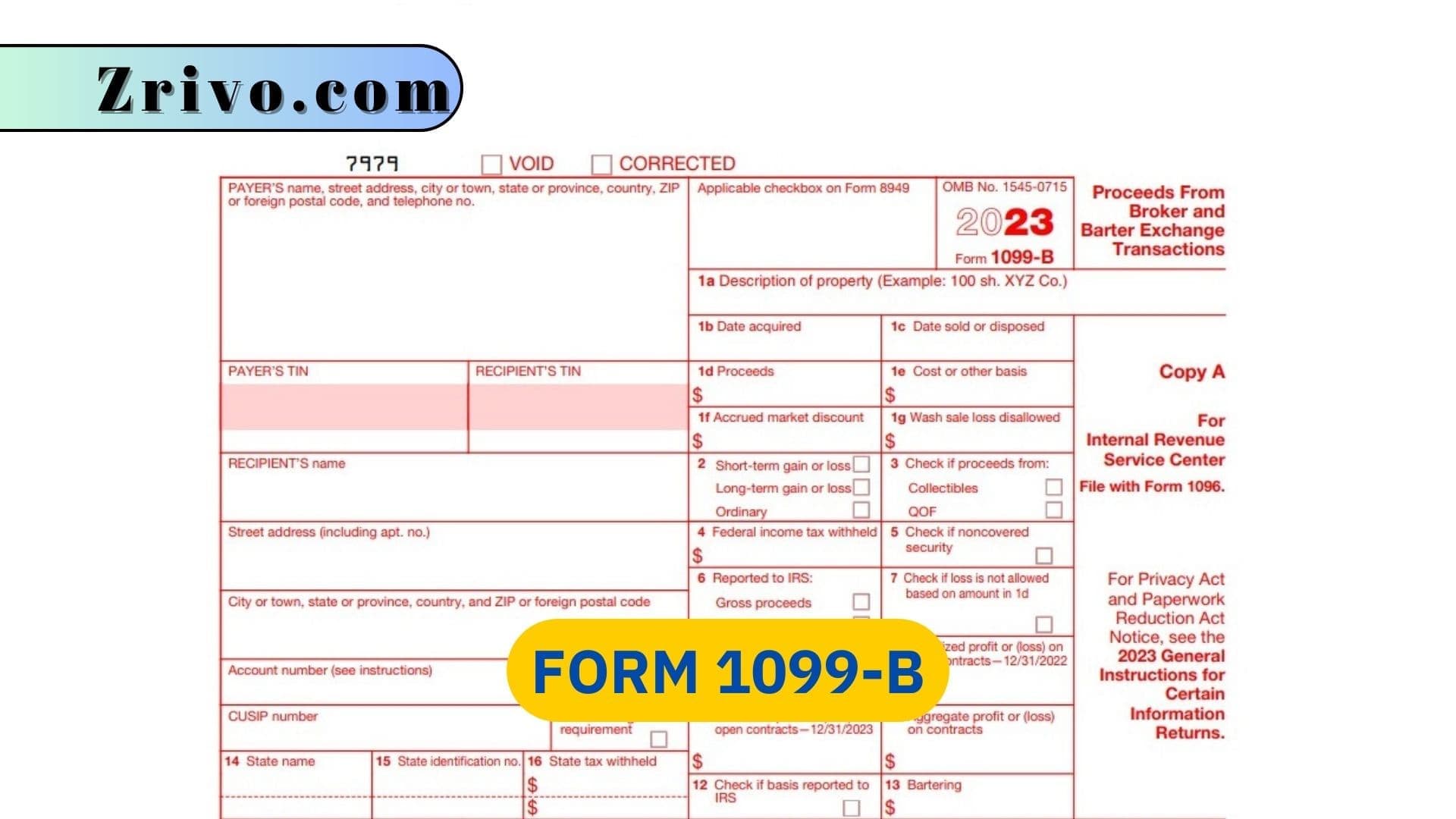

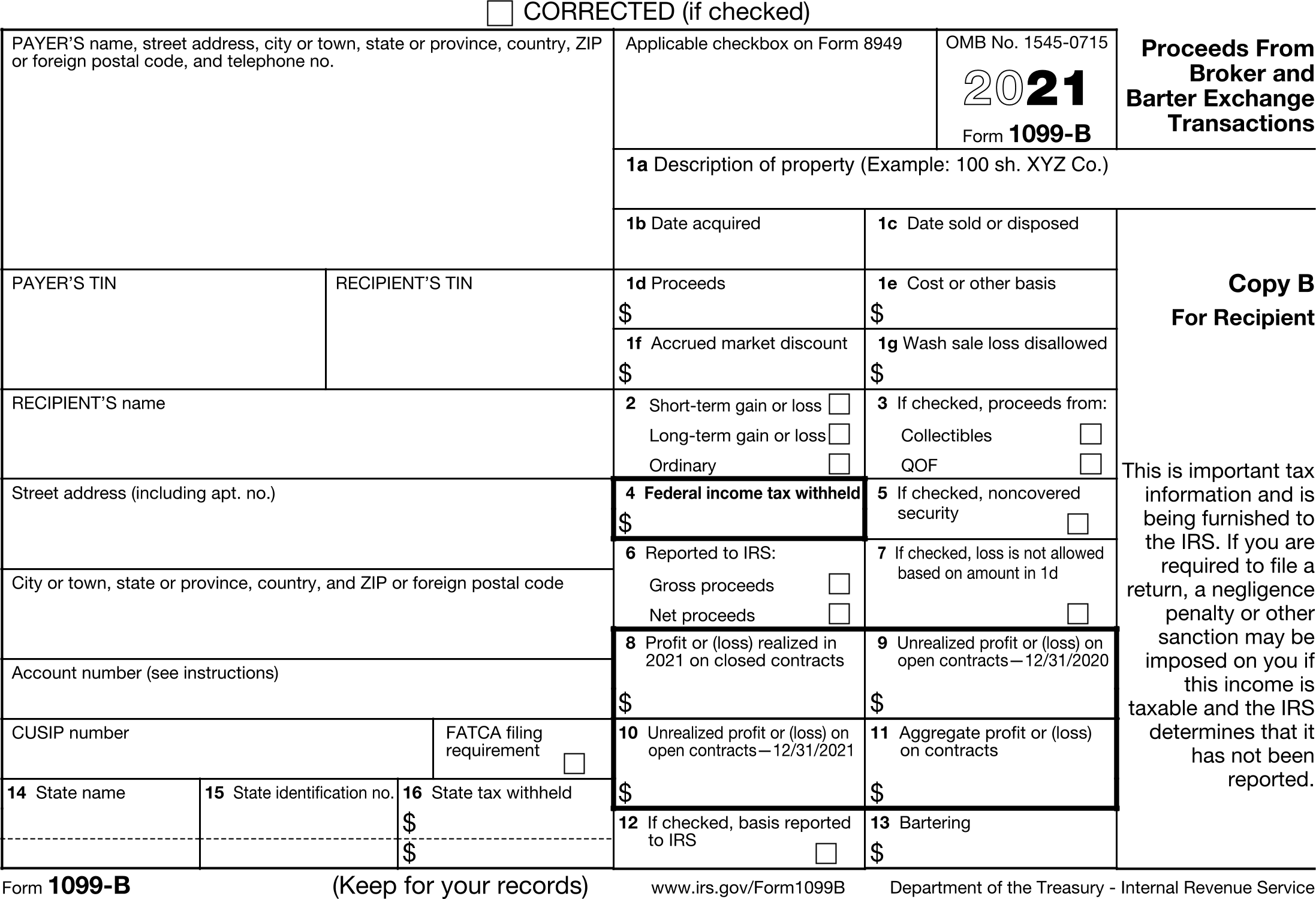

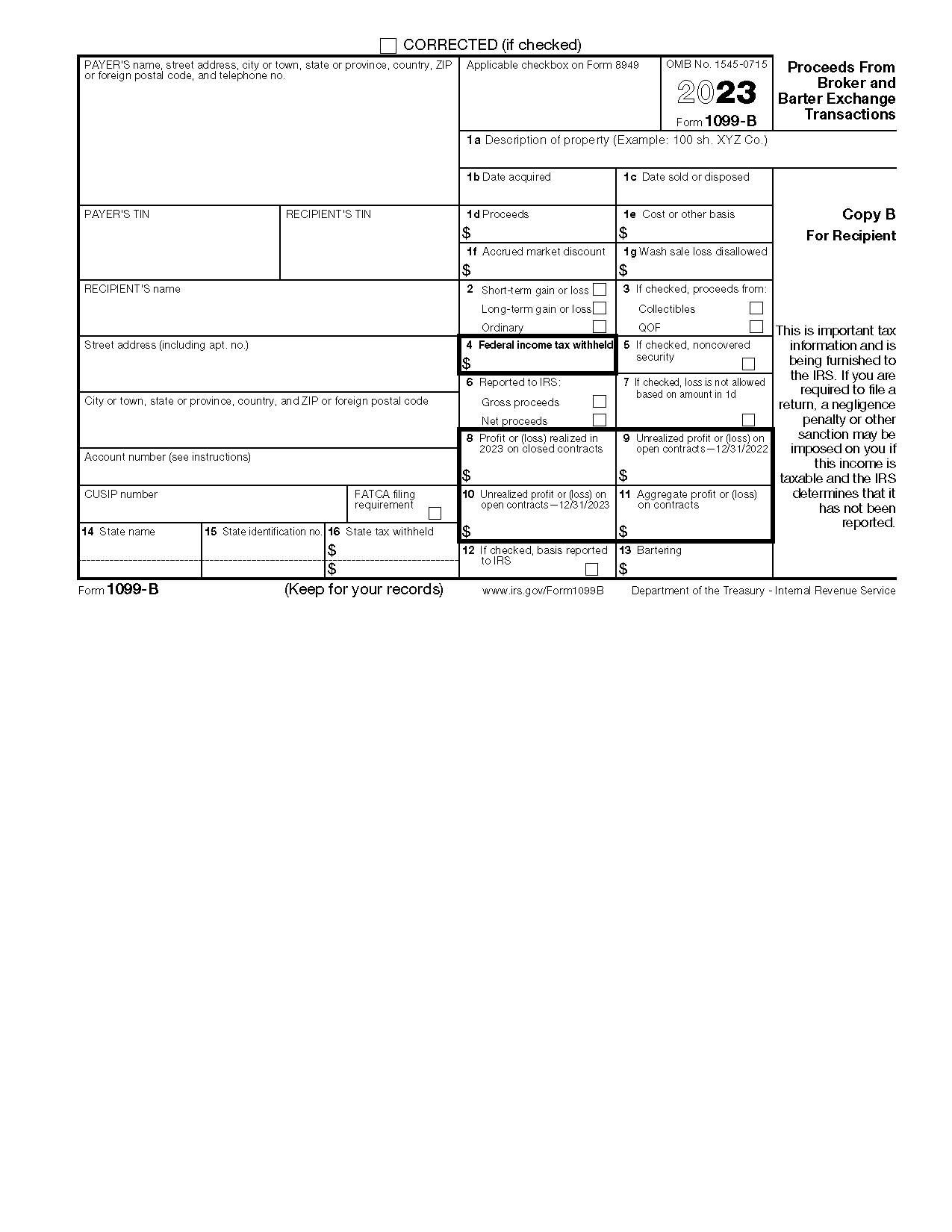

1099 B Form Meaning Mar 24 2025 nbsp 0183 32 What is Form 1099 B Form 1099 B is a tax form issued by broker dealers to report proceeds from selling stocks bonds and other securities through a broker in a tax year Officially titled quot Proceeds from Broker and

Feb 18 2025 nbsp 0183 32 Form 1099 B is used to report gains or losses from selling stocks bonds derivatives or other securities through a broker and for barter exchange transactions The form contains details like the description of the item sold Feb 8 2025 nbsp 0183 32 So what is a 1099 B and who gets one As it says on the right side of the form the 1099 B is for Proceeds from Broker and Barter Exchanges In the vast majority of cases this form is issued for brokerage transactions which in

1099 B Form Meaning

1099 B Form Meaning

1099 B Form Meaning

https://www.form8949.com/img/form-1099-b/f1099b.2021.4.trimmed.png

Aug 3 2023 nbsp 0183 32 Form 1099 B is a tax document that reports proceeds from broker and barter exchange transactions It provides detailed information about the sale of stocks bonds mutual funds and other securities including If the cost basis

Pre-crafted templates offer a time-saving service for developing a varied range of documents and files. These pre-designed formats and designs can be made use of for different personal and expert tasks, consisting of resumes, invites, flyers, newsletters, reports, discussions, and more, improving the content development process.

1099 B Form Meaning

The Different Types Of 1099 Forms Explained DecoBizz Lifestyle Blog

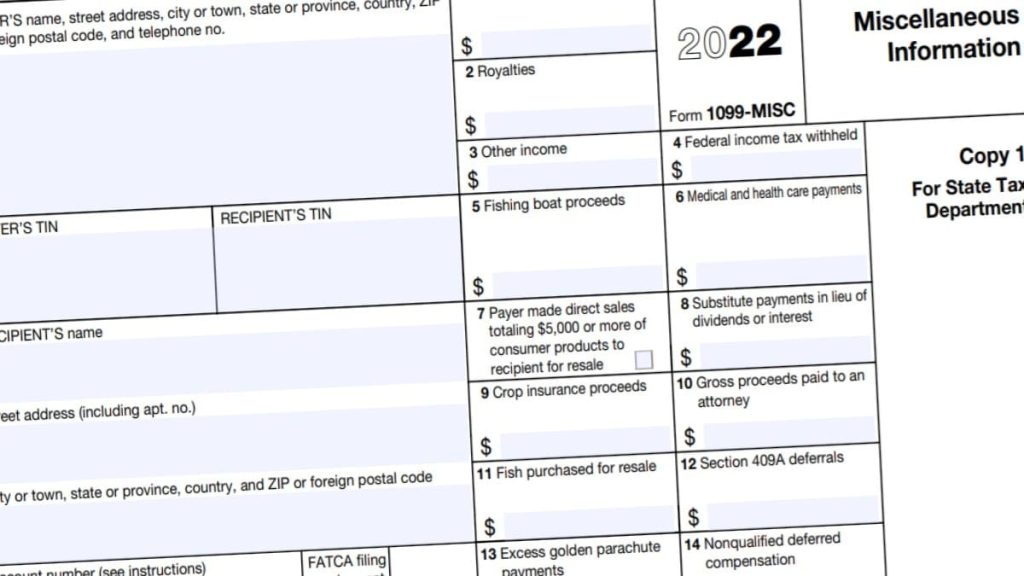

Fillable Form 1099 Misc 2023 Fillable Form 2024

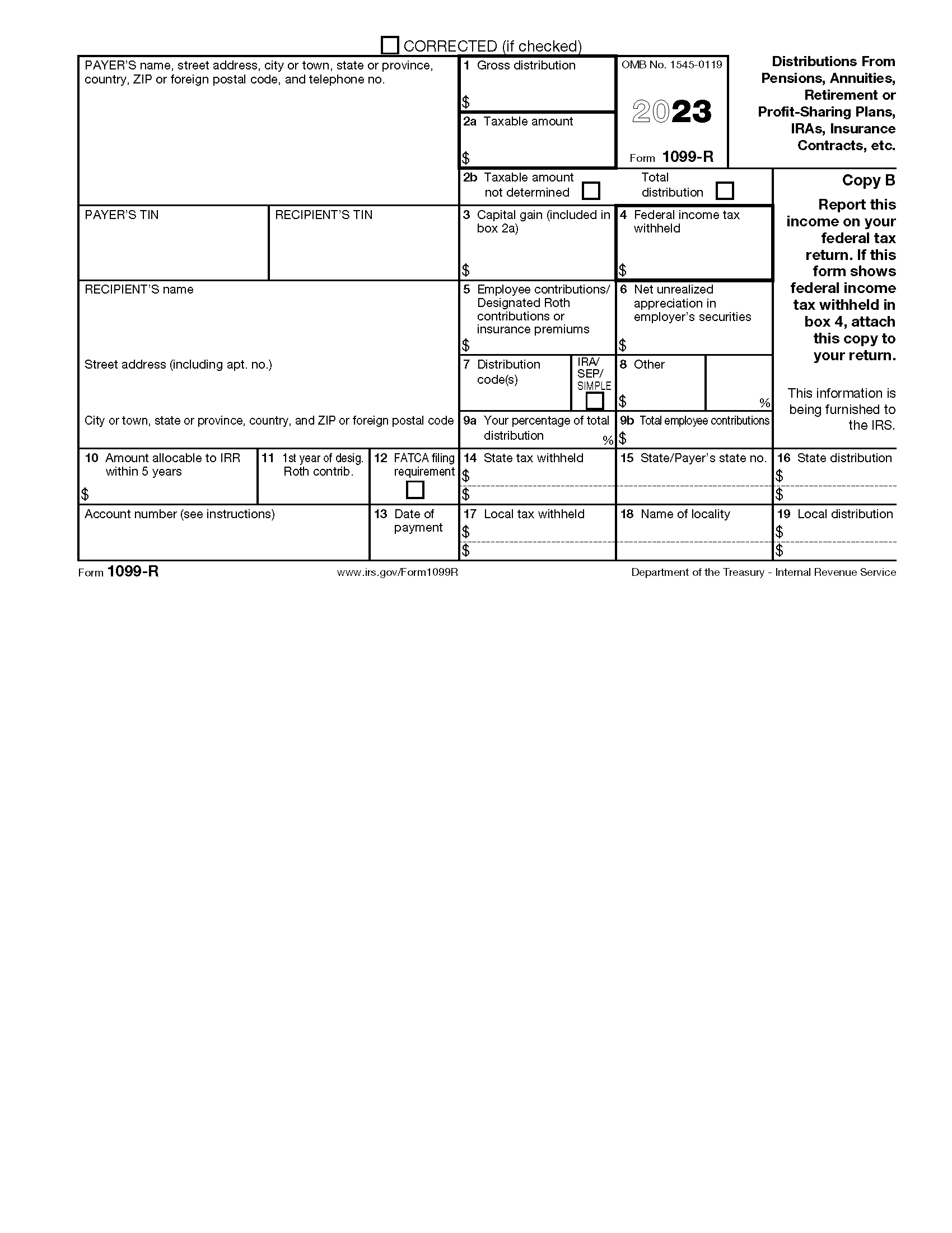

Free IRS 1099 R PDF EForms

:max_bytes(150000):strip_icc()/ScreenShot2022-01-24at10.05.23AM-cf89715f09964cbca096821b63196735.png)

1099 K Form 2023 Printable Forms Free Online

Form 1099 MISC Illinois Fill Exactly For Your State

Form 1099 B 2023 2024

https://www.nerdwallet.com › article › taxes

Sep 14 2023 nbsp 0183 32 A 1099 B is an informational document brokers send to people who have sold securities such as stocks or bonds through a brokerage during

https://accountinginsights.org

Jan 30 2025 nbsp 0183 32 Form 1099 B is an essential document for taxpayers involved in securities transactions providing critical details about the sale or exchange of stocks and other financial

https://accountinginsights.org

Mar 11 2025 nbsp 0183 32 Learn how to interpret Form 1099 B including key details on proceeds cost basis and tax implications to ensure accurate reporting on your return

https://www.fidelity.com › learning-center › smart-money

Jan 7 2025 nbsp 0183 32 Form 1099 B also known as the Proceeds from Broker and Barter Exchange Transactions form is a tax document used to report sales made via brokerages and exchanges made through formal barter networks

https://www.tax1099.com › blog

Mar 14 2023 nbsp 0183 32 Form 1099 B is an IRS tax form used to report proceeds from broker transactions including sales of stocks bonds commodities and other investments This form must be filed with the Internal Revenue Service IRS

What Is Form 1099 B and Why Is It Important Form 1099 B is an IRS tax form that brokers and barter exchanges use to report the proceeds from asset sales Sep 12 2024 nbsp 0183 32 Form 1099 B Proceeds from Broker and Barter Exchange Transactions is an IRS tax form used to report sales of securities and barter exchanges It details the gains or losses

Oct 20 2024 nbsp 0183 32 What Is Taxable on Form 1099 B In most cases the taxable amount on Form 1099 B is difference between the gross proceeds minus the basis or cost If the proceeds are