1099 Div Form Definition Jan 12 2025 nbsp 0183 32 Form 1099 DIV is an Internal Revenue Service IRS tax document reporting the dividends and distributions paid to you throughout the tax year The form captures dividend

Nov 17 2024 nbsp 0183 32 Form 1099 DIV reports dividend income and distributions to taxpayers Here s a detailed breakdown of the most important boxes and what they mean Definition Includes all What Is a 1099 DIV Form and How Is It Used for Tax Filing Investors who earn dividends or capital gains distributions from stocks mutual funds or exchange traded funds ETFs typically

1099 Div Form Definition

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.15.35AM-a3c24d655e9748e19bab699b55c1b7b6.png) 1099 Div Form Definition

1099 Div Form Definition

https://www.investopedia.com/thmb/MkGTbPDH1XxYZ2i6UugzE-T9M5g=/1661x1093/filters:no_upscale():max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.15.35AM-a3c24d655e9748e19bab699b55c1b7b6.png

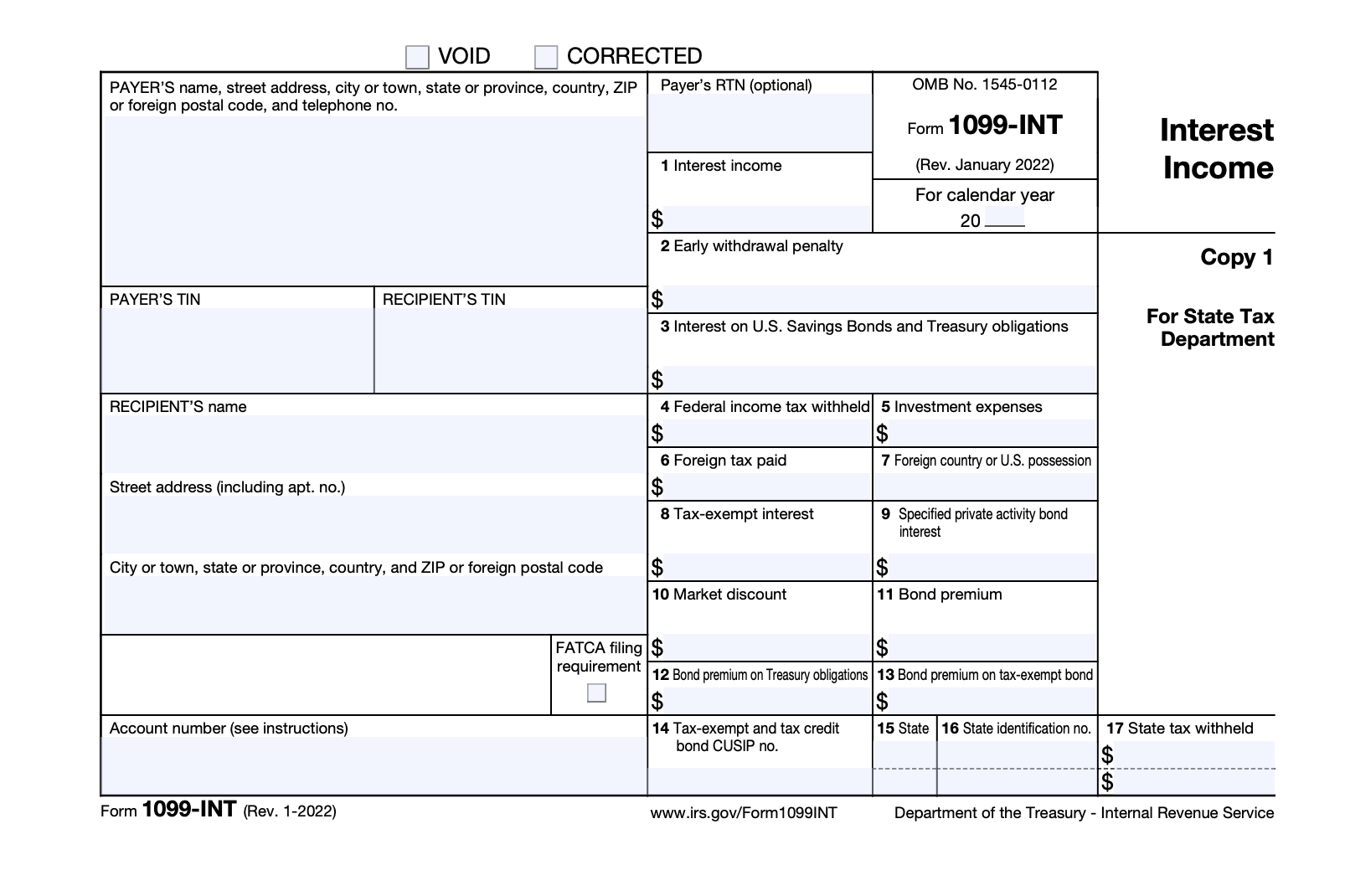

Mar 11 2025 nbsp 0183 32 In this article we ll help you understand everything you need to know about IRS Form 1099 DIV including What you should expect to see in each box on this form How this tax information will impact your income tax

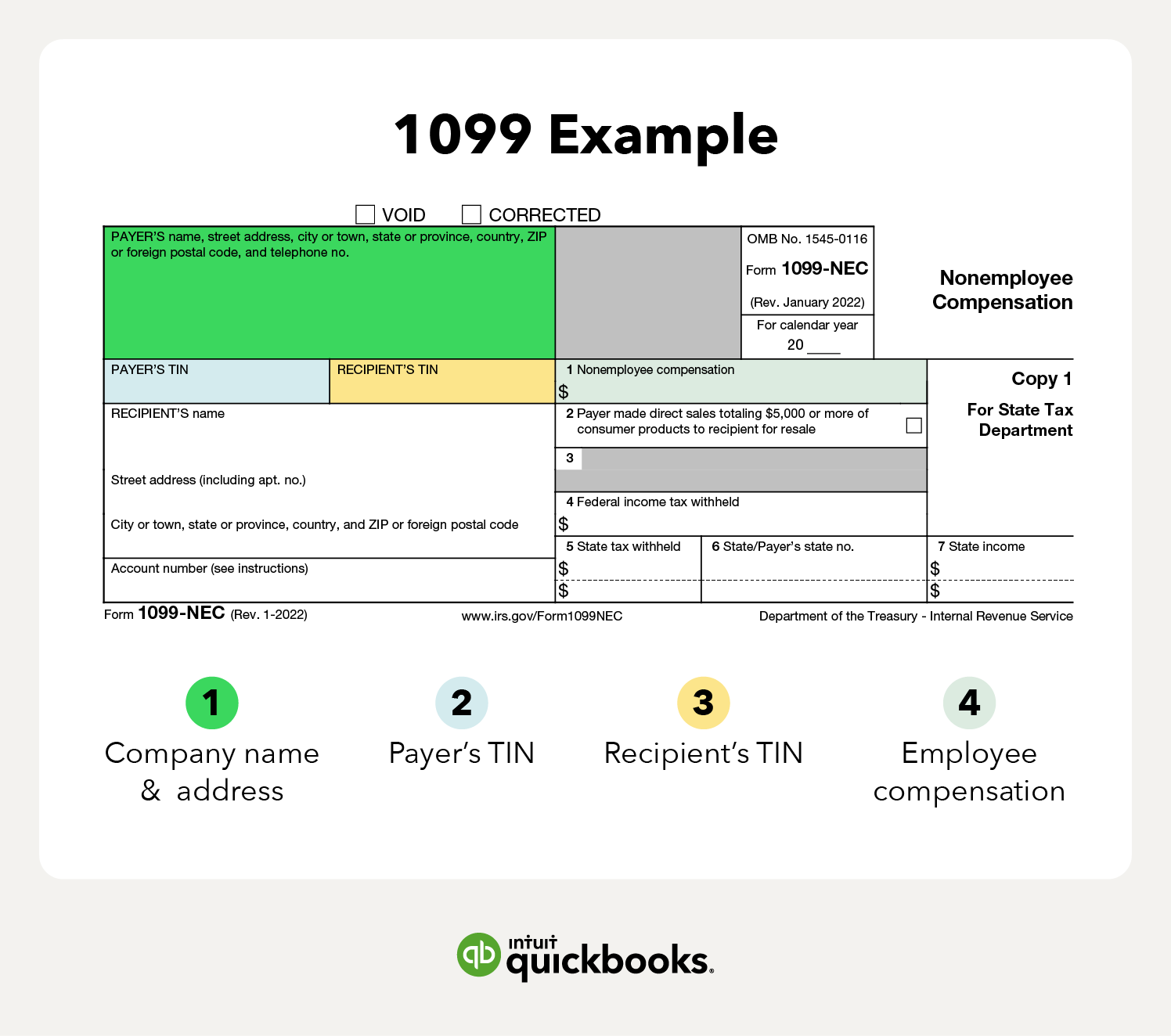

Pre-crafted templates provide a time-saving option for creating a varied series of documents and files. These pre-designed formats and designs can be used for numerous individual and professional projects, including resumes, invites, flyers, newsletters, reports, discussions, and more, streamlining the material creation process.

1099 Div Form Definition

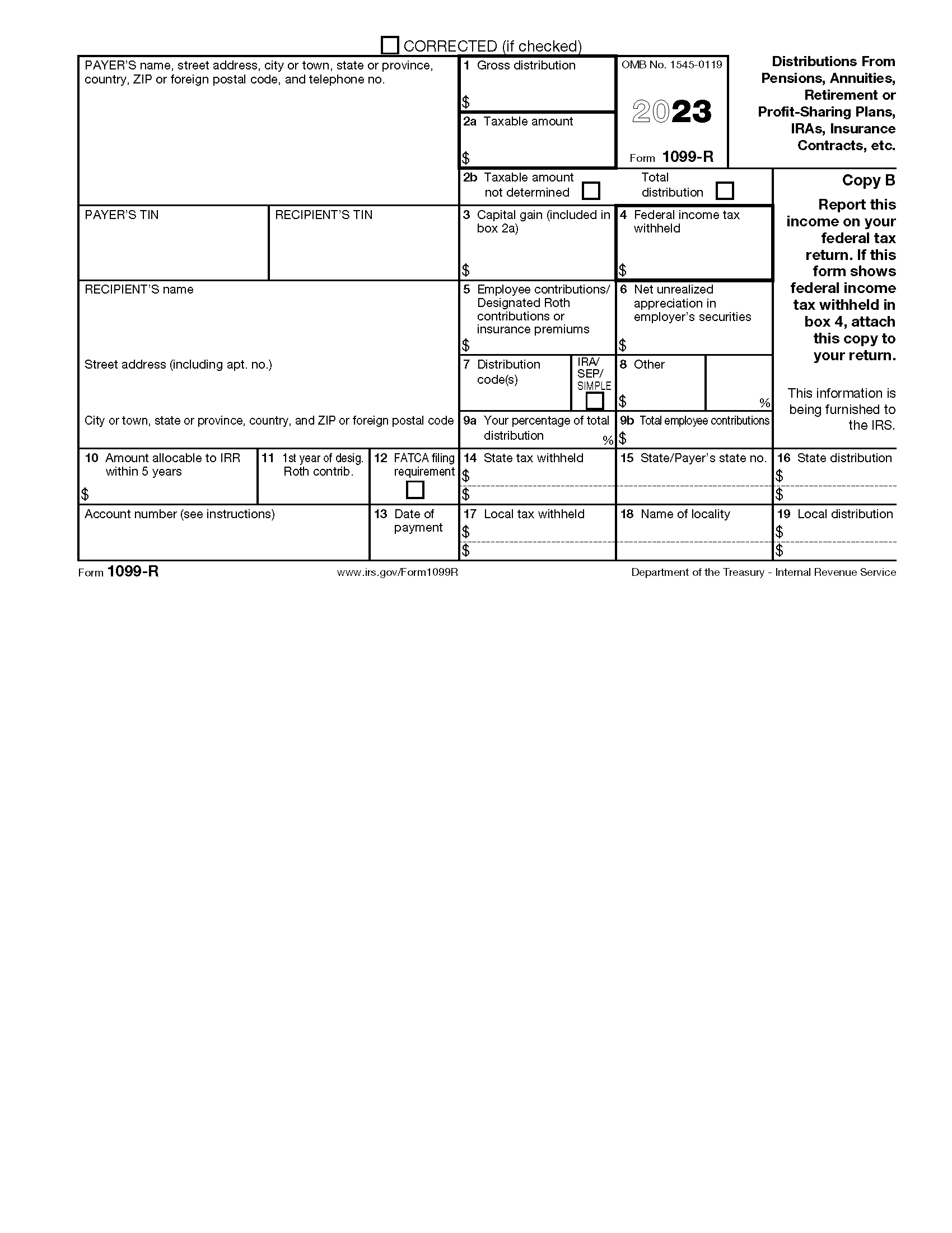

1099 R Form 2024 2025

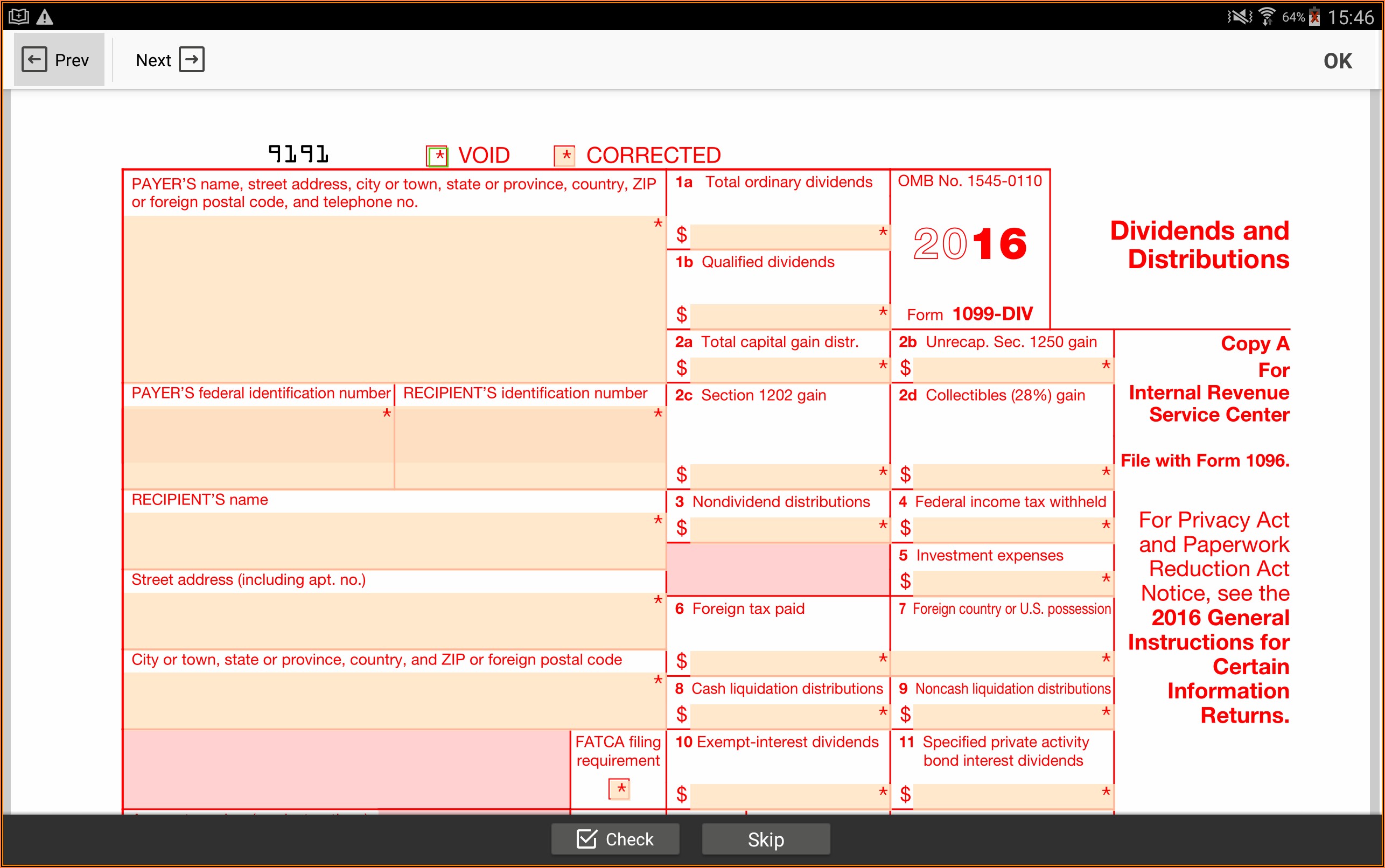

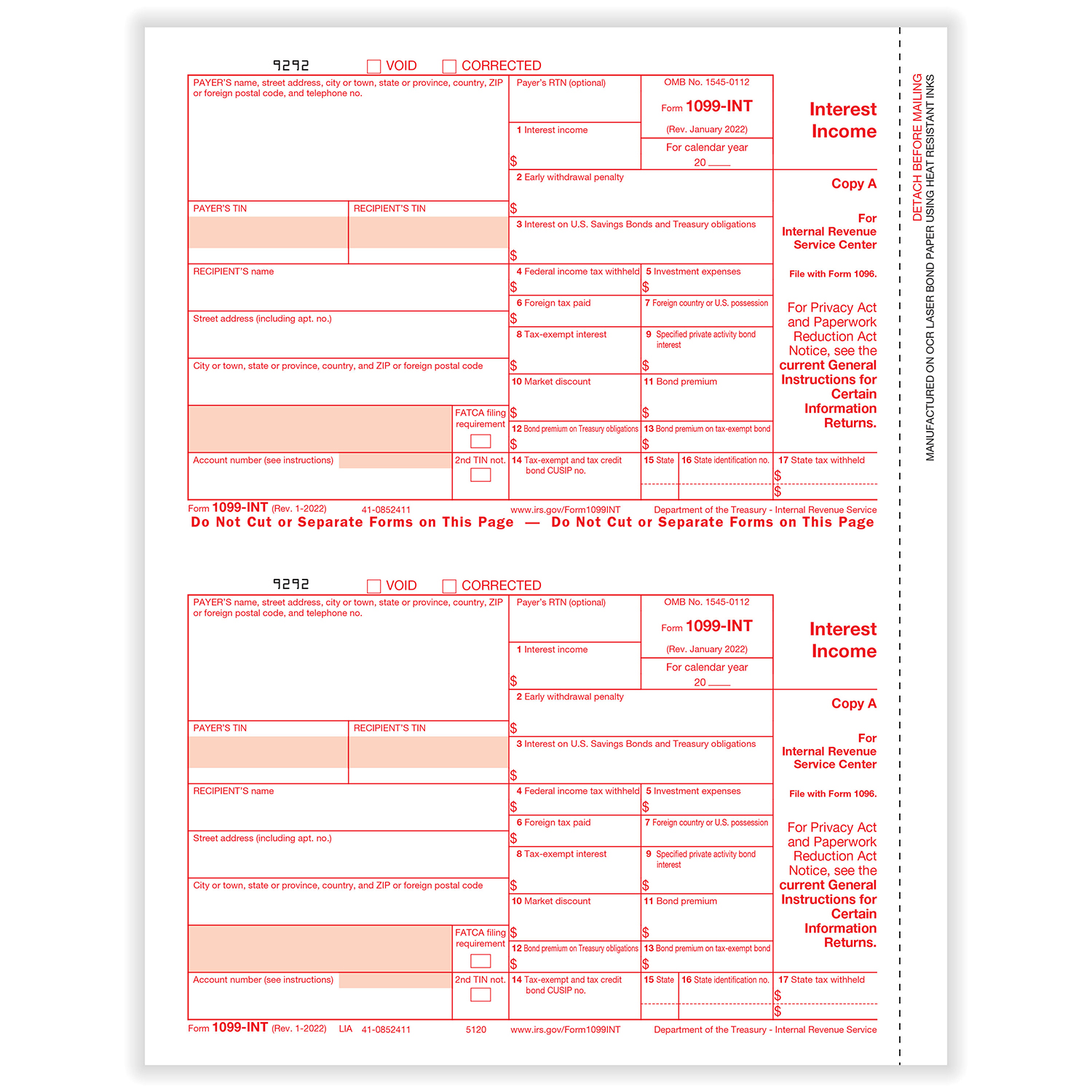

Form 1099 DIV Dividends And Distributions IRS Copy A

Free IRS 1099 R PDF EForms

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.31.57PM-22f2d44f32ac447aa561bd652c2c11e4.png)

Form 1099 R Definition

Where To Get Form 1099 Div Form Resume Examples l6YNl7y23z

1099 DIV Software To Create Print E File IRS Form 1099 DIV

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.15.35AM-a3c24d655e9748e19bab699b55c1b7b6.png?w=186)

https://www.irs.gov › pub › irs-pdf

Taxable dividend distributions from life insurance contracts and employee stock ownership plans These are reported on Form 1099 R

https://www.irs.gov › forms-pubs

Information about Form 1099 DIV Dividends and Distributions Info Copy Only including recent updates related forms and instructions on how to file Form 1099 DIV is used by banks and

https://dimovtax.com

Mar 16 2025 nbsp 0183 32 Financial institutions and brokerage firms issue 1099 DIV forms when a taxpayer receives 10 or more in dividend income within a tax year Understanding how to handle a 1099 DIV form is crucial for accurate tax

https://turbotax.intuit.com › tax-tips › investments...

Jan 22 2025 nbsp 0183 32 Form 1099 DIV reports dividends and capital gains distributions from investments Learn how to include this information on your tax return understand the different types of dividends and how they are taxed

https://gordonlaw.com › learn

Let s start with the basic question what is Form 1099 DIV from the IRS Put simply IRS Form 1099 DIV Dividends and Distributions is a type of tax form It s issued when a company such

A form that every company is required to submit to all persons or companies earning taxable capital gains on the company The form contains information on all dividends interest and Mar 25 2025 nbsp 0183 32 On Form 1099 DIV Box 1a shows Total Ordinary Dividends which includes all taxable dividends you received except those explicitly designated as nondividend

Oct 12 2024 nbsp 0183 32 Essentially all that is required is that the recipient has had been paid more than 10 of dividends from a business or been paid 600 from a liquidation of a business The most