What Is A 1099 Misc Nov 4 2024 nbsp 0183 32 The tax form 1099 is a return you file to the IRS which includes information about your business There are several types of 1099 forms but the most common ones are the 1099

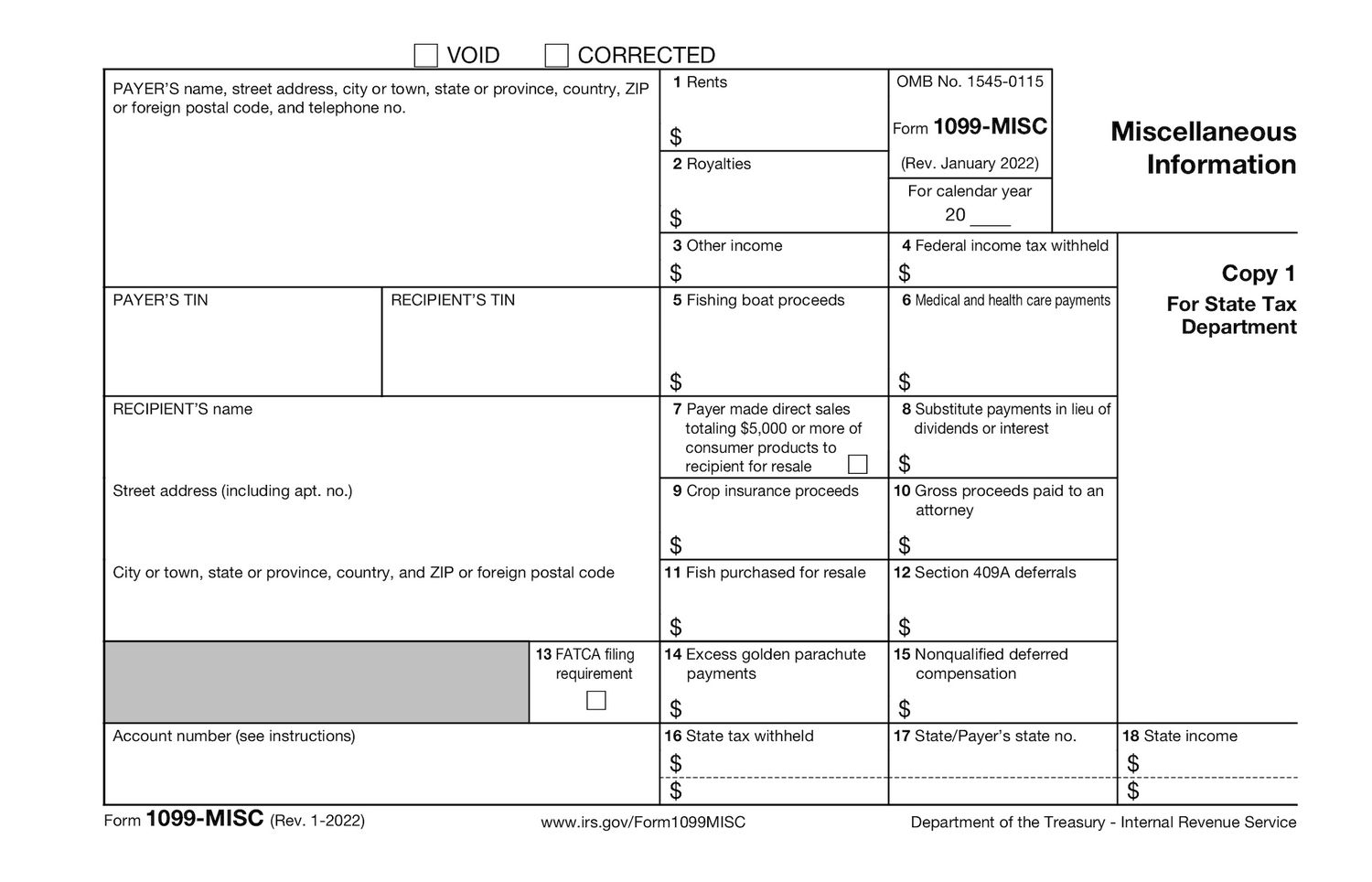

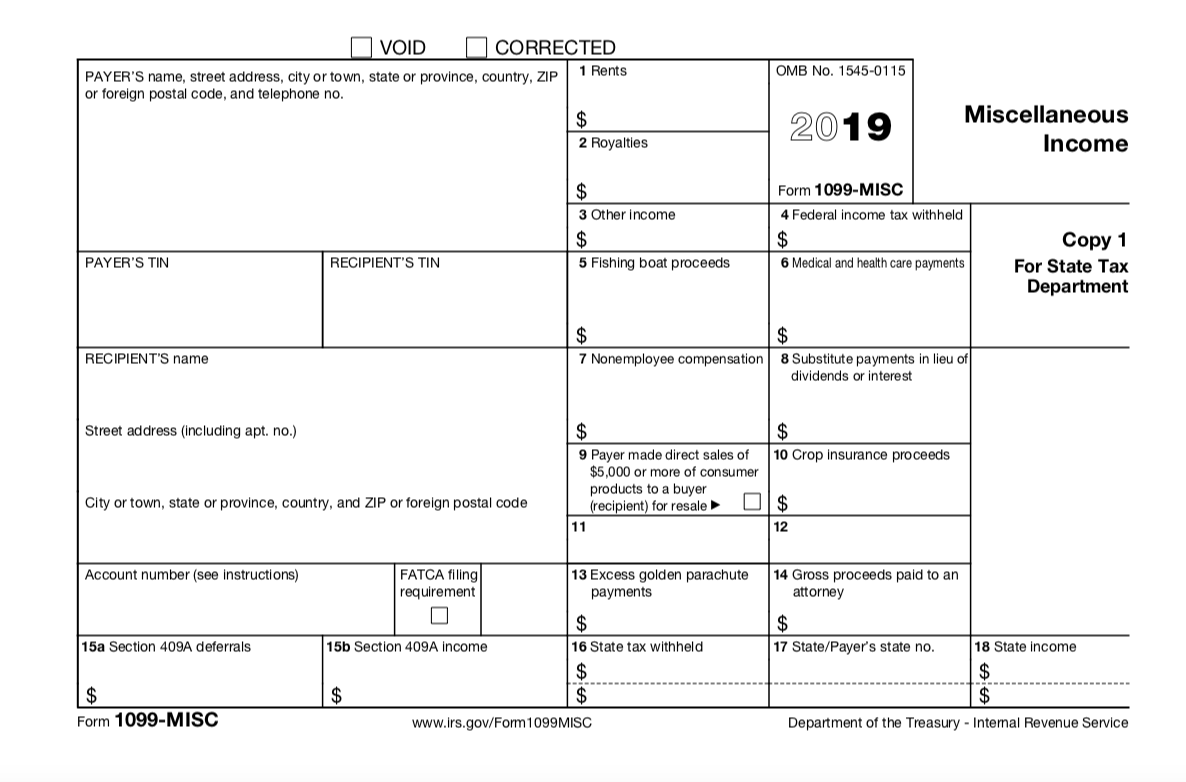

Mar 20 2024 nbsp 0183 32 1099 MISC reports several types of miscellaneous payments for example if you earned 600 or more in prizes and awards plus other types of income May 26 2022 nbsp 0183 32 Form 1099 is a type of tax form that records payments received that don t come from salary or wages Income you receive from any sources other than an employer must be

What Is A 1099 Misc

What Is A 1099 Misc

What Is A 1099 Misc

https://www.wiztax.com/wp-content/uploads/2023/09/1099-MISC.jpeg

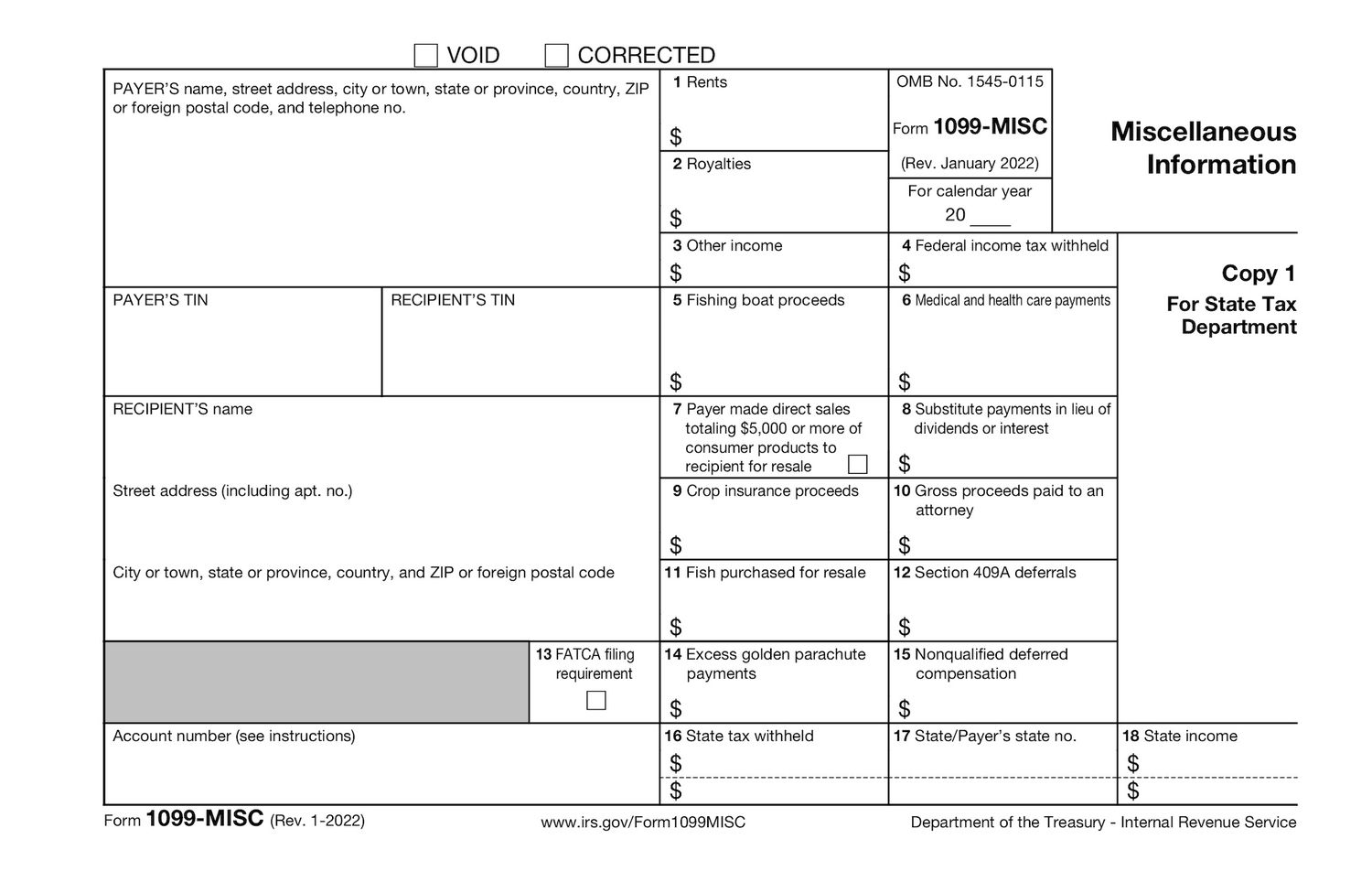

IRS Form 1099 MISC is used to report exactly what its name implies miscellaneous items of income The treatment of amounts reported on this form generally depends upon which box of

Templates are pre-designed documents or files that can be used for different functions. They can save time and effort by offering a ready-made format and layout for producing different type of content. Templates can be used for individual or professional projects, such as resumes, invitations, flyers, newsletters, reports, discussions, and more.

What Is A 1099 Misc

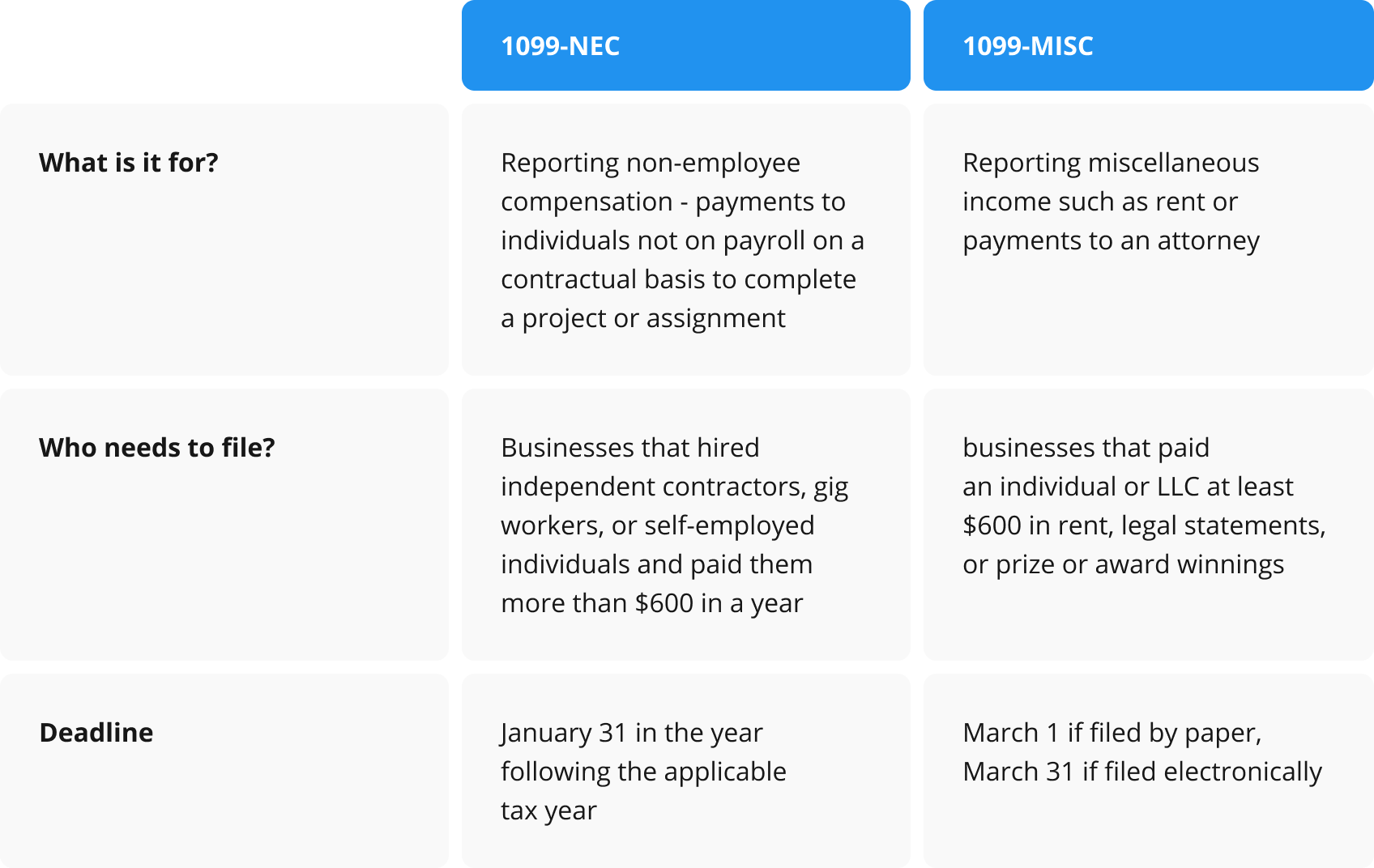

Determining Who Gets A 1099 MISC Form And When It s Due

Fast Answers About 1099 Forms For Independent Workers Blog Site Of

As A Freelancer Am I Required To File A 1099 Form

1099 Misc Transmittal Form Form Resume Examples kLYrK8Z3V6

Top 8 1099 Misc Vs 1099 Nec 2022

Form 1099 MISC How To Report Your Miscellaneous Income PdfFiller Blog

https://www.investopedia.com/terms/f/form1099-misc.asp

Jun 10 2024 nbsp 0183 32 Form 1099 MISC Miscellaneous Information is an Internal Revenue Service IRS form used to report certain types of miscellaneous compensation such as rent prizes awards

https://www.nerdwallet.com/article/taxes/1099-misc-form

Mar 28 2024 nbsp 0183 32 Here s how the 1099 MISC titled quot Miscellaneous Information quot works What is a 1099 MISC A 1099 MISC form is a type of IRS Form 1099 that reports certain types of

https://www.irs.gov/instructions/i1099mec

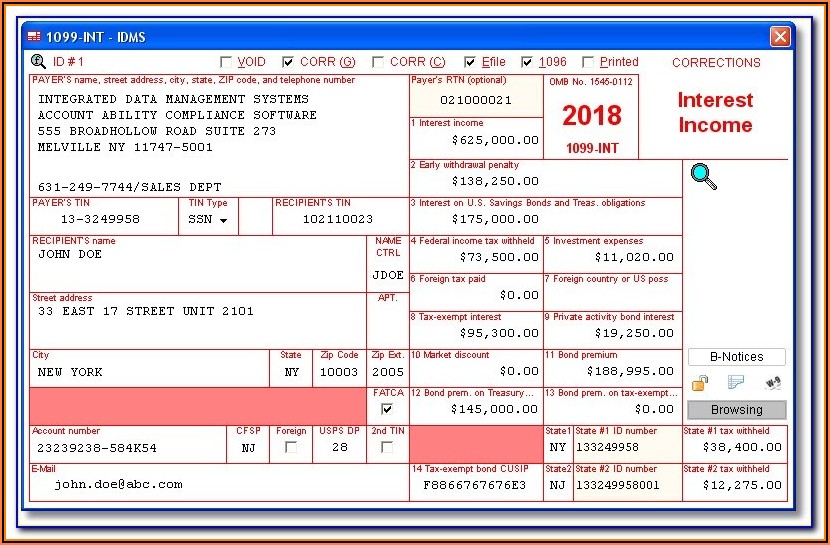

The Taxpayer First Act of 2019 authorized the Department of the Treasury and the IRS to issue regulations that reduce the 250 return e file threshold

https://turbotax.intuit.com/tax-tips/self-employment-taxes/what-is...

Key Takeaways Form 1099 MISC is used to report payments made to others in the course of a trade or business not including those made to employees or for nonemployee compensation

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at12.01.40PM-9e232e8b991047fabfe3041a51889486.png?w=186)

https://www.investopedia.com/financial-edge/0110/10-things-you...

Aug 20 2024 nbsp 0183 32 Form 1099 is used to report certain types of non employment income to the IRS such as dividends from a stock or pay you received as an independent contractor Businesses

[desc-11] [desc-12]

[desc-13]