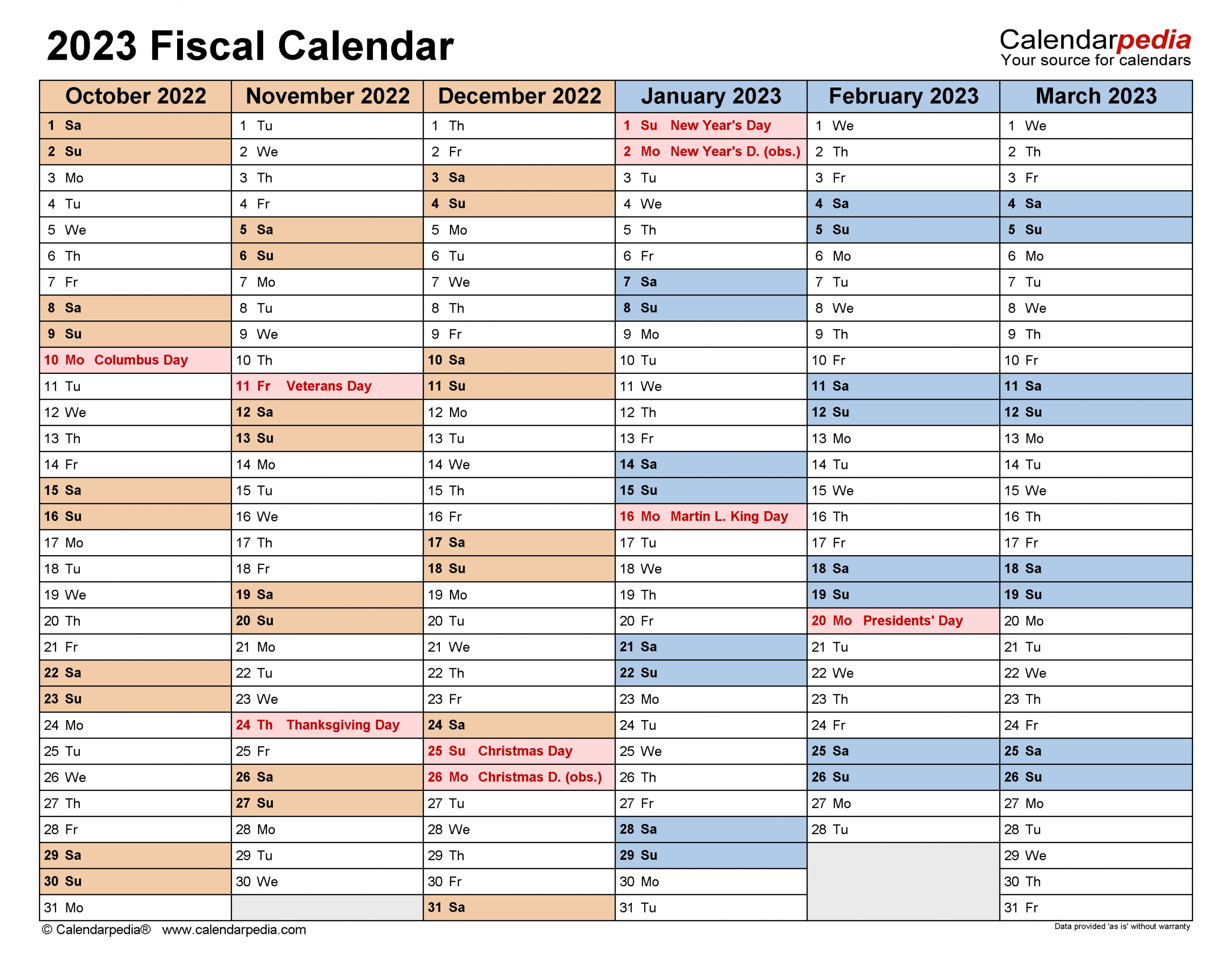

Nz Tax Year End Dec 20 2024 nbsp 0183 32 The New Zealand tax year ends on 31 March Tax returns Returns if required must be filed by 7 July each year depending on the income type and or the country of source

The end of the financial year is a confusing time what tax forms do I have to complete What are the deadlines for these tax forms What do I do with my expenses In this guide we ll Feb 28 2023 nbsp 0183 32 As we are fast approaching the end of the 2023 tax year there are some key developments that need to be actioned before 31 March for those with a standard balance date along with some standard year end tax issues to

Nz Tax Year End

Nz Tax Year End

Nz Tax Year End

https://ph.icalculator.com/img/og/PH/199.png

Feb 14 2025 nbsp 0183 32 When is the end of the financial year What are the key dates for EOFY What do I need to prepare for the end of the financial year Tax and business planning for the next

Templates are pre-designed files or files that can be utilized for numerous purposes. They can save time and effort by supplying a ready-made format and design for producing various kinds of content. Templates can be utilized for individual or professional jobs, such as resumes, invitations, flyers, newsletters, reports, discussions, and more.

Nz Tax Year End

How To Calculate 2023 Taxes PELAJARAN

Tax Return 2024 New Zealand Image To U

2024 Tax Year Dates In New Zealand Beany New Zealand Online

.png)

Why KeyPay KeyPay NZ

Kondensieren Sieg Trottel Gaming Laptop Reduziert Zwiebel Zehen Fl te

Fact Check False Claim That Paying Income Tax Isn t Required By Law

https://www.ird.govt.nz › end-of-tax-year

The tax year is from 1 April to 31 March After the end of the tax year we work out if you ve paid the right amount of tax if you have tax to pay or if you re due a refund

https://www.aba.org.nz › getting-ready-for-the-nz-tax-year-end

The New Zealand tax year runs from 1 April to 31 March marking a crucial time for individuals sole traders businesses and property owners to ensure their financial records are in order and

https://www.myob.com › nz › eofy

Feb 15 2024 nbsp 0183 32 When is End of Financial Year The Financial Year in New Zealand runs from 1 April to 31 March During end of financial year is when most businesses are required to submit

https://www.bdo.nz › en-nz › services › tax …

With the tax year end fast approaching for most taxpayers there are a number of steps that you can take prior to balance date to help you maximise any tax opportunities that you re entitled to

https://www.beany.com › en-nz › tax-year-dates-nz

Mar 31 2024 nbsp 0183 32 Stay on top of the NZ tax year dates with our guide for NZ businesses From key deadlines to expert tips we cover everything you need to know for the 2023 2024 tax year

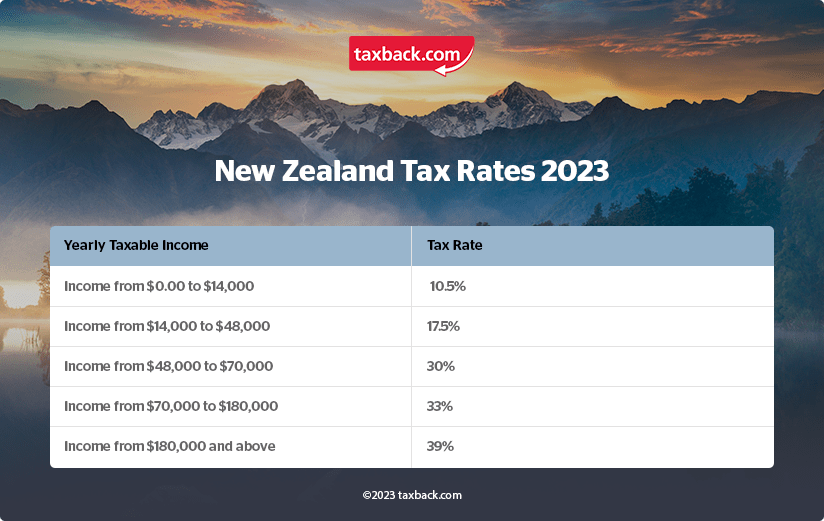

Feb 26 2025 nbsp 0183 32 This applies to tax losses incurred from the 2013 14 year onwards The ability to offset losses against the net income of other group companies requires common shareholding 3 hours ago nbsp 0183 32 Payment of provisional tax If you had to pay more than 5 000 tax at the end of the year from your last tax return then you are considered a provisional taxpayer Provisional tax

At the end of the tax year you may need to file an Individual income tax return IR3 which tells us about your income for the year and the expenses you re claiming calculates if you re due a