Meaning Of Cooling Period In Banking WEB The activation of the beneficiary will be instant and cooling period of 4 days will not be applicable if approved by the branch You may also approve such beneficiaries without having to visit a branch by using IRATA

WEB The cooling off period is defined as the time between when a new request e g the provisioning of OCBC OneToken is submitted and when it comes into effect It is intended to protect you from scammers seeking to make WEB What is a Cooling Off period Starting 30 June 2023 as part of our security measures to combat fraud there will be a cooling off period of 12 hours when you install the CIMB Clicks CIMB OCTO App for the first time or on a new device

Meaning Of Cooling Period In Banking

Meaning Of Cooling Period In Banking

Meaning Of Cooling Period In Banking

http://blog.gemalto.com/wp-content/uploads/2016/11/Digital-banking-13.10.16.jpg

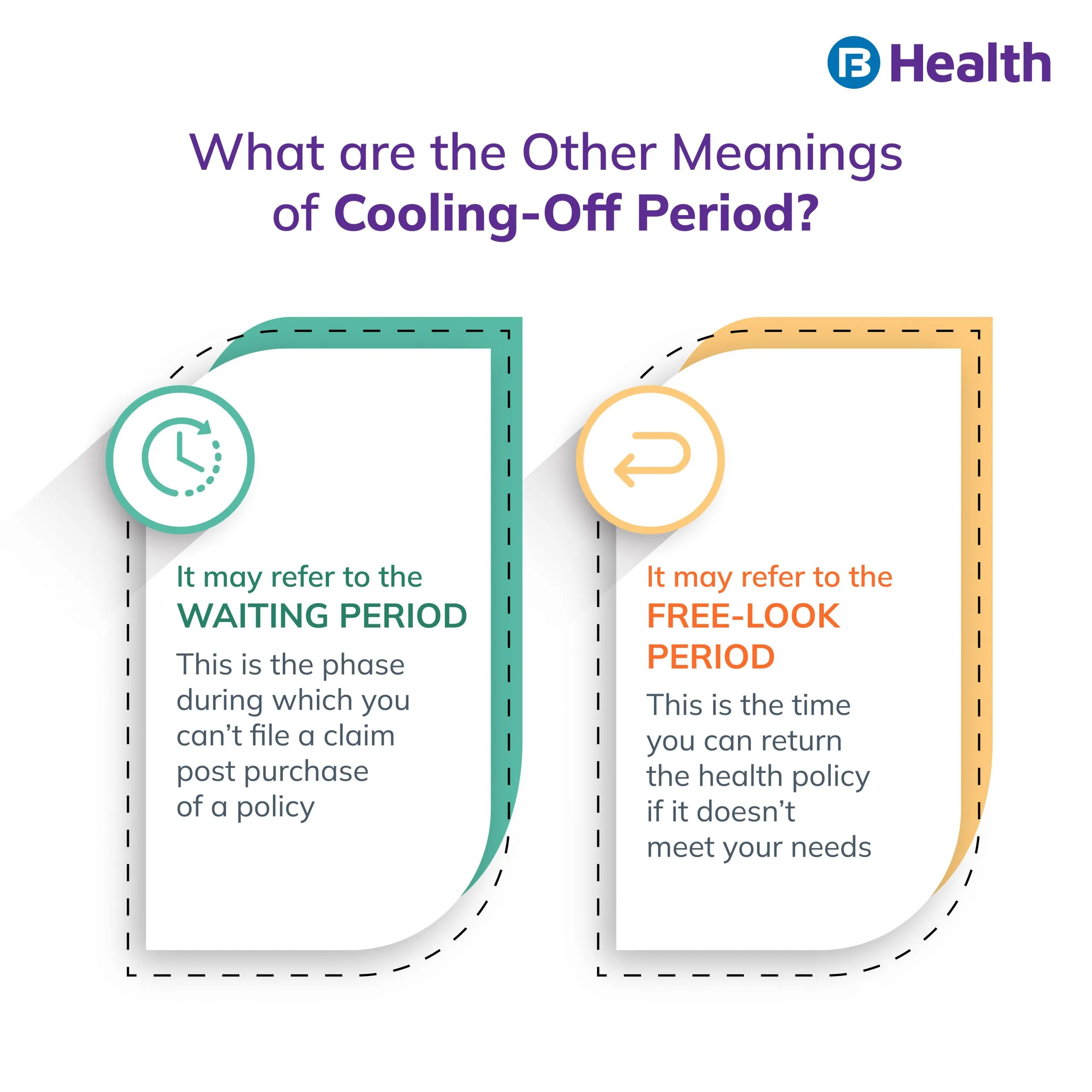

WEB If you start investing you have up to 30 days to cancel if you change your mind known as a cooling off period Here s everything you need to know

Pre-crafted templates offer a time-saving service for producing a diverse range of documents and files. These pre-designed formats and designs can be made use of for various personal and professional tasks, including resumes, invites, leaflets, newsletters, reports, discussions, and more, streamlining the material creation procedure.

Meaning Of Cooling Period In Banking

What Is The Cooling Period In SBI Yono Internet Banking

How To Add Beneficiary Without Any Cooling Off Period

Cooling Off Period Meaning In Hindi Cooling Off Period Ka Matlab Kya

What Is Cooling off Period Importance And Difference

Investment Banking Free Of Charge Creative Commons Green Highway Sign

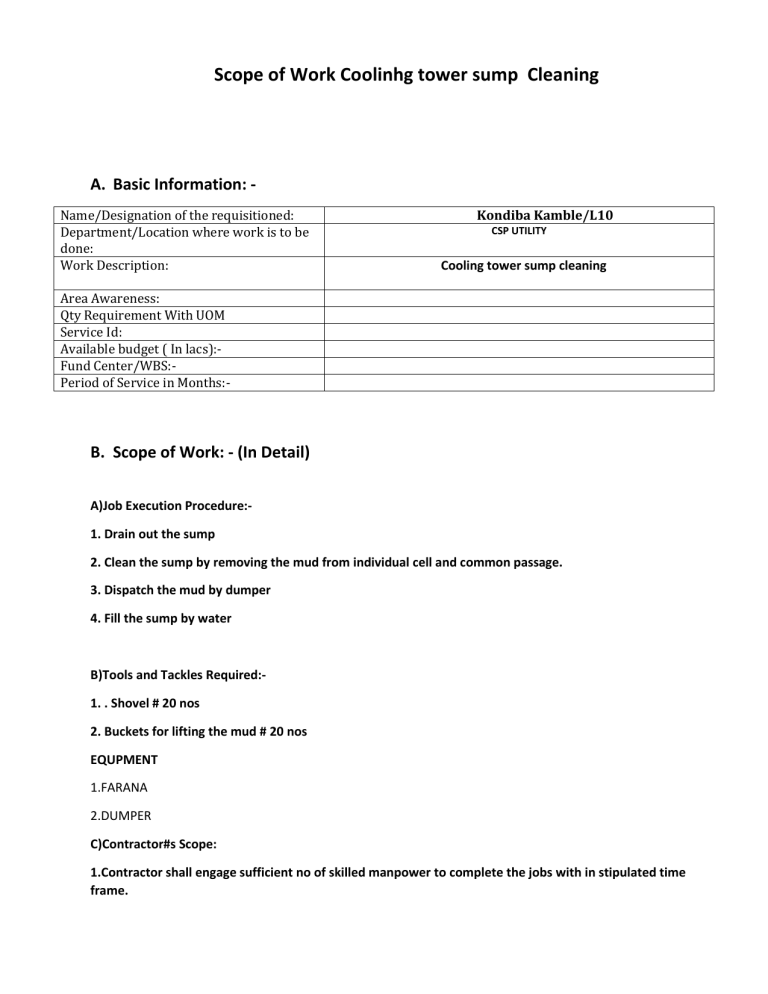

SCOPE OF WORK For Cooling Tower Sump CLEANING

https://infobanksindia.com/sbi-cooling-period

WEB Mar 26 2024 nbsp 0183 32 In banking terms it is called the Cooling Period The duration is only 4 days in SBI During these 4 days you are allowed to transfer only 5 00 000 5 lakh or you can say only 1 00 000 1 lakh is allowed per day Transaction Failed Beneficiary is

https://razorpay.com/blog/business-banking/no...

WEB May 16 2024 nbsp 0183 32 In banking after adding a beneficiary usually a period of 30 min to 4 hours is needed by the bank before any transaction can be made to this beneficiary This is known as the cooling off period

https://bankingschool.co.in/foreign-exchange/...

WEB The Cooling period is thus the actual time of waiting by the collecting bank for confirming the definite clearance of cheque presented to drawee bank The collecting bank releases the amount lying in its Nostro account to its customer s

https://finviewnews.com/explanation-of-cooling-period-in-banking

WEB Jun 13 2024 nbsp 0183 32 By explaining the considerations that led to the adoption of the cooling period it is possible to understand why the measure is important and needed to guard financial stability and consumers as well as finance institutions

/iStock-682395884.tashka2000.online.banking-5c6c9639c9e77c00018ccac8.jpg?w=186)

https://www.nobroker.in/forum/what-is-cooling-period-in-sbi-yono

WEB Aug 24 2022 nbsp 0183 32 The cooling period is the word used in banking In SBI this period only lasts four days You can only transfer a total of 5 00 000 throughout the course of these four days or 1 00 000 every day

WEB 13 hours ago nbsp 0183 32 Maybank has announced a new update effective on 31 July 2024 in which there will be a 12 hour cooling off period for each adjustment in the money transfer limit via the Maybank2U website as well as its MAE mobile app According to the bank this measure aims to combat online banking fraud and prevent unauthorised increases in WEB What is a Transaction Cooling Off Period Any transaction which are deemed abnormal will undergo a cooling off period in which the transaction will be placed on hold for a period of time before it is released to the beneficiary

WEB Sep 30 2022 nbsp 0183 32 A cooling off period is a time period during which a borrower can exit the loan by repaying the principal amount and the proportionate annual percentage interest rate without any penalty The banks and NBFC are free to fix