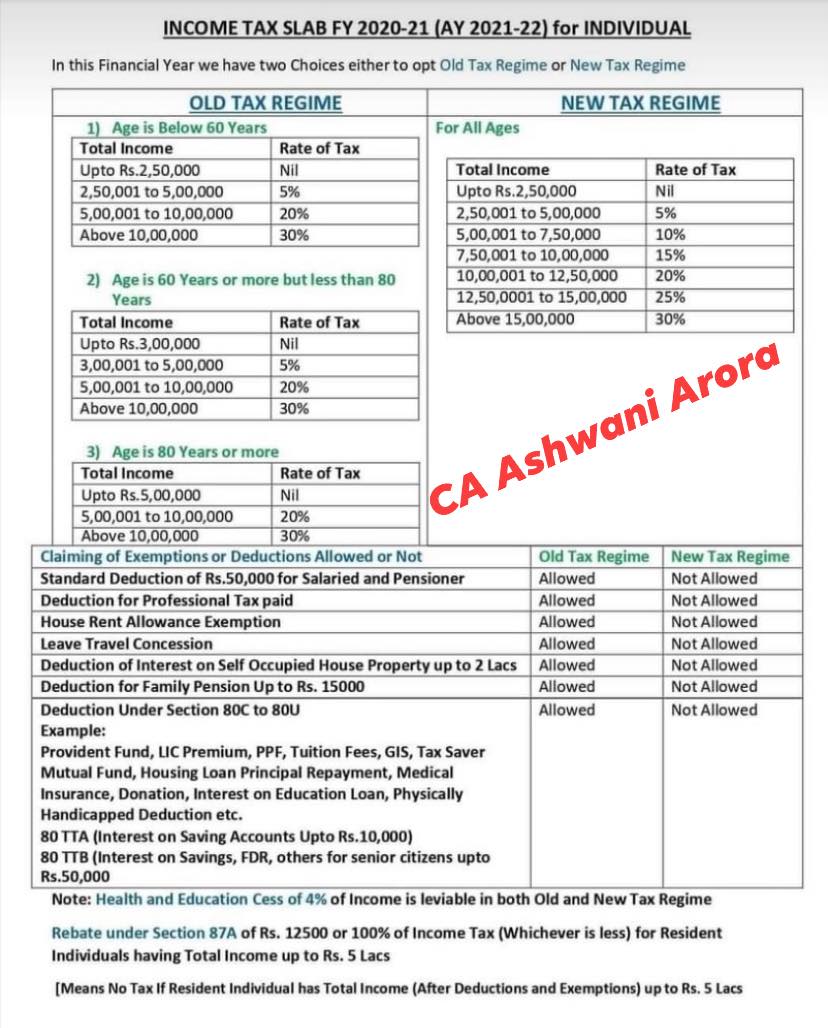

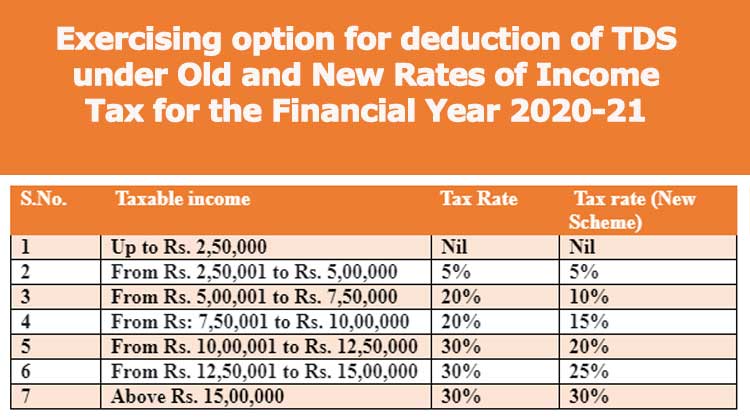

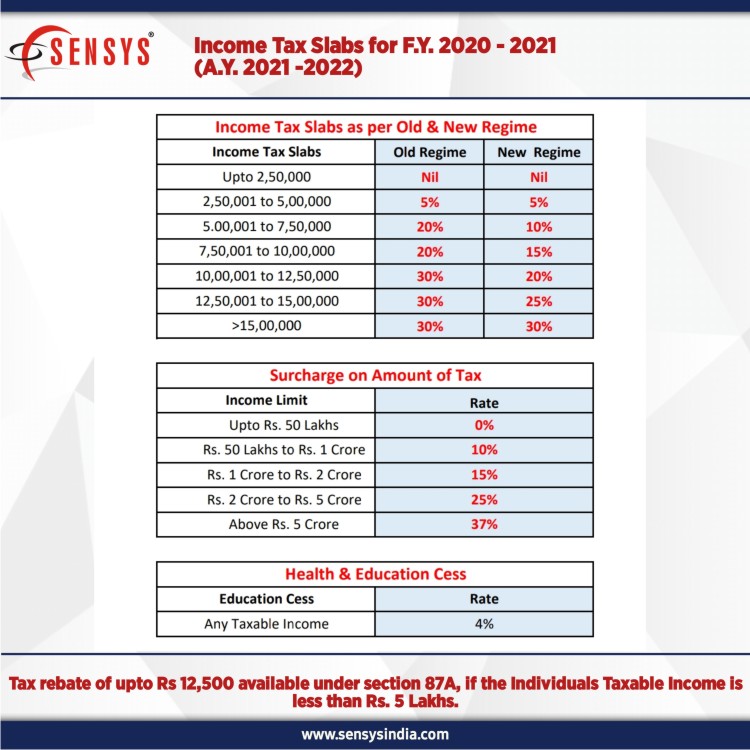

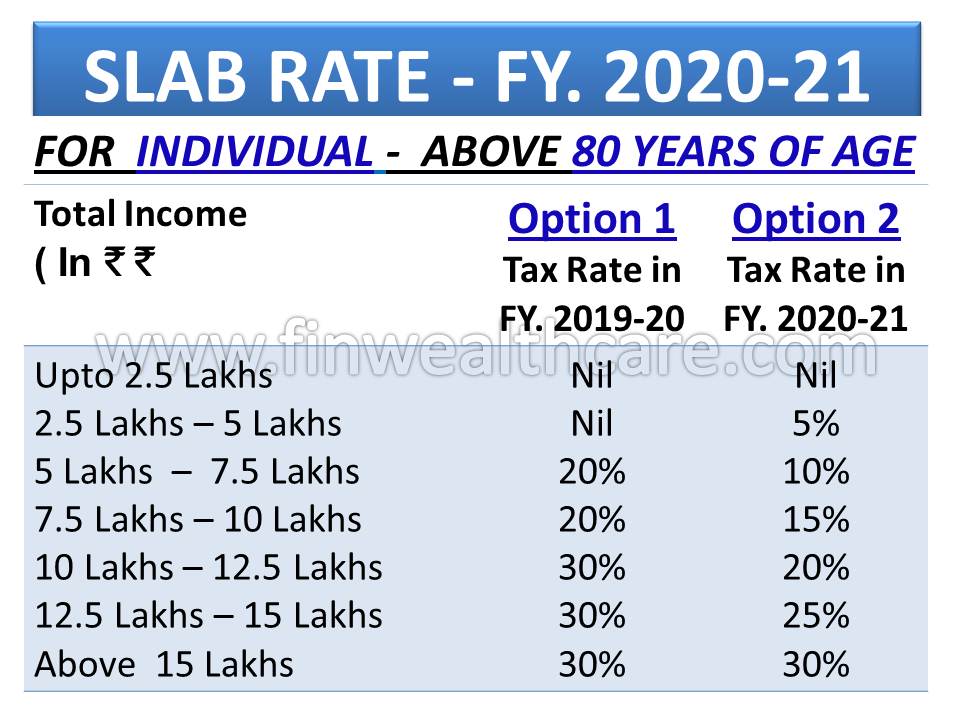

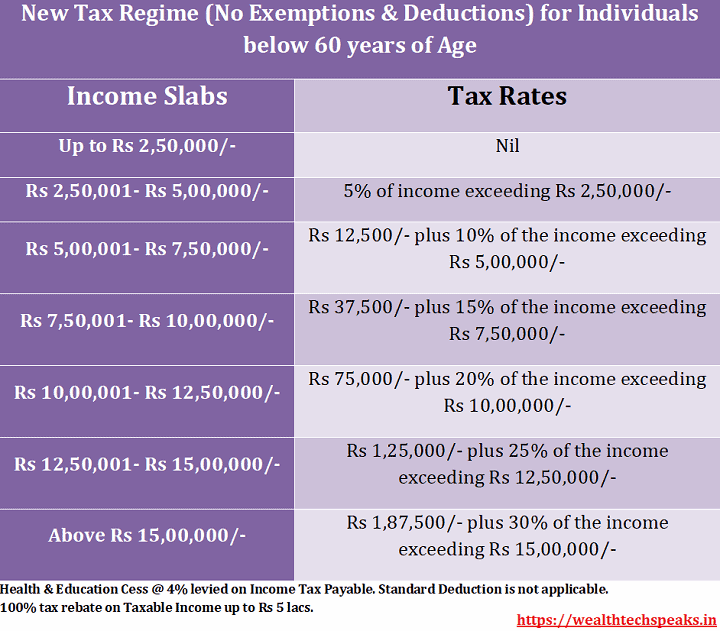

Income Tax Slab Rate For Financial Year 2022 23 Web Feb 18 2022 nbsp 0183 32 Income Tax Slabs amp Rates under the existing tax regime with income tax deductions amp exemptions remain unaltered in the Union Budget 2022 for the Financial Year 2022 23 Tax Rebate U S 87A up to maximum of Rs 12 500 is available to the Individuals with income up to Rs 5 lacs

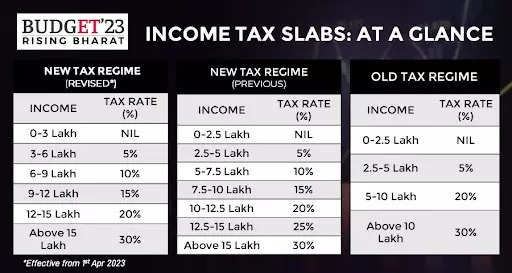

Web Aug 15 2023 nbsp 0183 32 Income Tax Slab Rates for FY 2022 23 AY 2023 24 In this system Specifically there are 2 slabs one is the old slab and the second is the New Slab rate Let s check both with the use of Table Assessee having net taxable income less than or equal to 5 lacks will be eligible for a Tax Rebate of Rs 12 500 u s 87A Web 2 days ago nbsp 0183 32 Income tax slabs change every year Know the current slabs to calculate your tax payable Income Tax Slab Rates for FY 2022 23 AY 2023 24 The surcharge rates are the same for FY 2022 23 as that of the last financial year FY 2021 22 As per Budget 2023 the highest surcharge rate of 37 has been reduced to 25 under the new

Income Tax Slab Rate For Financial Year 2022 23

Income Tax Slab Rate For Financial Year 2022 23

Income Tax Slab Rate For Financial Year 2022 23

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-12.jpg

Web May 12 2023 nbsp 0183 32 Income Tax Slab For Women For FY 2022 23 Tax Limit And Exemptions HOME INCOME TAX Income Tax Slab For Women For FY 2022 23 Tax Limit And Exemptions Updated on May 12th 2023 20 min read CONTENTS Show

Pre-crafted templates offer a time-saving service for developing a varied range of documents and files. These pre-designed formats and layouts can be used for numerous personal and expert projects, including resumes, invitations, leaflets, newsletters, reports, discussions, and more, streamlining the material creation procedure.

Income Tax Slab Rate For Financial Year 2022 23

Income Tax Slab Rate For Financial Year 2020 2021 Assessment Year 2021

Income Tax Rates For Financial Year 2020 21 Incorp Advisory Mobile

Income Tax Slab Rate For Ay 2022 23 Pdf Printable Forms Free Online

Income Tax Slab Rates For FY 2021 22 Budget 2021 Highlights

New Income Tax Slab FY 2020 21 India Vs Old

Income Tax

https://taxguru.in/income-tax/income-tax-rates...

Web Sep 9 2023 nbsp 0183 32 i in case where net income exceeds Rs 50 lakh but doesn t exceed Rs 1 Crore the amount payable as income tax and surcharge shall not exceed the total amount payable as income tax on total income of Rs 50 Lakh by more than the amount of income that exceeds Rs 50 Lakhs

https://cleartax.in/s/income-tax-slabs

Web Updated on Jan 7th 2024 56 min read CONTENTS Show The income tax slabs are different under the old and the new tax regimes Further the slab rates under the old tax regime are divided into three categories Indian Residents aged lt 60 years All the non residents 60 to 80 years of age Resident Senior citizens

https://www.incometax.gov.in/iec/foportal/help/individual/return-applicable-1

Web New Tax Regime u s 115BAC Income Tax Slab Income Tax Rate Income Tax Slab Income Tax Rate Up to 5 00 000 Nil Up to 2 50 000 Nil 5 00 001 10 00 000 20 above 5 00 000 2 50 001 5 00 000 5 above 2 50 000 Above 10 00 000 1 00 000 30 above 10 00 000 5 00 001 7 50 000

https://www.news18.com/news/business/tax/income...

Web Feb 1 2022 nbsp 0183 32 Finance Minister Nirmala Sitharaman presented Union Budget 2022 23 in Parliament today February 1 2021 The Finance Minister announced no change in personal income tax slabs and rates

https://economictimes.indiatimes.com/wealth/income-tax-slabs

Web Table of Content Income tax slabs for FY 2023 24 AY 2024 25 under the new tax regime Income tax slab rates for FY 2023 24 AY2024 25 FY 2022 23 AY 2023 24 FY 2021 22 AY 2022 23 under old tax regime How to calculate income tax payable under new tax regime How to calculate income tax liability under old tax regime

Web Jan 16 2024 nbsp 0183 32 As soon as your taxable income crosses the threshold of Rs 5 lakhs the benefit u s 87A will not be available and tax would be payable at 5 for income above Rs 2 5 lakhs but up to Rs 5 lakhs Let us understand this with the help of an example The above calculations are excluding cess What is the eligibility criteria to opt for New Tax Web Yes the new income tax slabs for AY 2023 24 FY 2022 23 under the new tax regime does not change based on the age of the tax payer So the limit of maximum tax exempt income is Rs 2 5 lakh regardless of the individual taxpayer s age

Web Jul 28 2022 nbsp 0183 32 Table of Content Income tax slabs for FY 2023 24 AY 2024 25 under the new tax regime Income tax slab rates for FY 2023 24 AY2024 25 FY 2022 23 AY 2023 24 FY 2021 22 AY 2022 23 under old tax regime How to calculate income tax payable under new tax regime How to calculate income tax liability under old tax regime