Income Tax Slab Rate For Ay 2022 23 For Salaried Person WEB Net Income Range Rate of Income tax Assessment Year 2024 25 Assessment Year 2023 24 Up to Rs 2 50 000 Rs 2 50 000 to Rs 5 00 000 5 5 Rs 5 00 000 to Rs 10 00 000 20 20 Above Rs 10 00 000 30 30 Resident Senior Citizen who is 60 years or more but less than 80 years at any time during the previous year Net Income

WEB Advisory Information relates to the law prevailing in the year of publication as indicated Viewers are advised to ascertain the correct position prevailing law before relying upon any document Disclaimer The above calculator is only to enable public to have a quick and an easy access to basic tax calculation and does not purport to give correct tax calculation WEB Jan 16 2024 nbsp 0183 32 Income Tax Slab Rates 2022 23 Updated New Income Tax Regime Section 115BAC Updated on 16 Jan 2024 05 49 PM New Tax Regime Slabs Rates Exemptions amp Deductions Availability analysis New income tax regime for Individuals and HUF has been proposed under Section 115BAC in the budget 2020

Income Tax Slab Rate For Ay 2022 23 For Salaried Person

Income Tax Slab Rate For Ay 2022 23 For Salaried Person

Income Tax Slab Rate For Ay 2022 23 For Salaried Person

https://news24online.com/wp-content/uploads/2023/02/New-tax-slab.jpg?w=696&h=0&crop=1

WEB Jun 10 2022 nbsp 0183 32 The new coalition government has introduced seven slabs of income tax on the salaried class in the country for the upcoming budget year According to the finance bill 2022 23 the government has

Pre-crafted templates offer a time-saving solution for developing a varied variety of documents and files. These pre-designed formats and designs can be utilized for numerous personal and expert tasks, consisting of resumes, invites, leaflets, newsletters, reports, discussions, and more, improving the material creation procedure.

Income Tax Slab Rate For Ay 2022 23 For Salaried Person

Income Tax Calculator Ay 2023 24 Excel Old And New Regime Pay Period

Download Auto Fill Income Tax Preparation Software In Excel For The F Y

Income Tax Calculator FY 2021 22 AY 2022 23 Excel Download 2023

Income Tax Slab 2023 New Income Tax Slab Rates For FY 2023 24 AY 2024

Personal Income Tax Slab For FY 2020 21

Income Tax Slab Fy 2022 23 Ay 2023 24 New Income Tax Slab Rate For Fy

https://tax.net.pk/2022/07/09/income-tax-slabs...

WEB Jul 9 2022 nbsp 0183 32 There are different Income Tax Slabs for 2022 2023 year in Pakistan on Salary Income Table of Contents DIVISION OF SALARY INCOME IN PAKISTAN BASIC SALARY HOUSE RENT ALLOWANCE HRA CONVEYANCE ALLOWANCE MEDICAL AND OTHER ALLOWANCES Medical Allowance Exemption Limit LATEST SALARY

https://www.incometax.gov.in/iec/foportal/help/individual/return-applicable-1

WEB New Tax Regime u s 115BAC Income Tax Slab Income Tax Rate Income Tax Slab Income Tax Rate Up to 2 50 000 Nil Up to 3 00 000 Nil 2 50 001 5 00 000 5 above 2 50 000 3 00 001 6 00 000 5 above 3 00 000 5 00 001 10 00 000 12 500 20 above 5 00 000 6 00 001 9 00 000

https://taxguru.in/income-tax/income-tax-rates-fy...

WEB Feb 4 2022 nbsp 0183 32 1 Tax Rates applicable to Individuals Resident Non Resident for FY 2021 22 amp FY 2022 23 2 Income Tax Rates for HUF AOP BOI Other Artificial Juridical Person for FY 2021 22 amp FY 2022 23 3 Special Rates for Individual amp HUF u s 115BAC for FY 2021 22 amp FY 2022 23 4 Tax Rates applicable to Company for FY 2021 22 amp FY 2022

https://www.taxmann.com/post/blog/income-tax-slab-rates-for-ay-2022-23

WEB Mar 30 2021 nbsp 0183 32 Last Updated on 6 March 2023 Union Budget 2022 23 Highlights Table of Contents Income Tax Slab Rate for Individuals opting for old tax regime Individual resident or non resident who is of the age of fewer than 60 years on the last day of the relevant previous year

https://taxguru.in/income-tax/income-tax-rates...

WEB Jun 13 2022 nbsp 0183 32 Net Income Range Rate of Income tax Assessment Year 2023 24 Assessment Year 2022 23 Up to Rs 5 00 000 Rs 5 00 000 to Rs 10 00 000 20 20 Above Rs 10 00 000 30 30 Hindu Undivided Family Including AOP BOI and Artificial Juridical Person Net Income Range Rate of Income tax Assessment Year

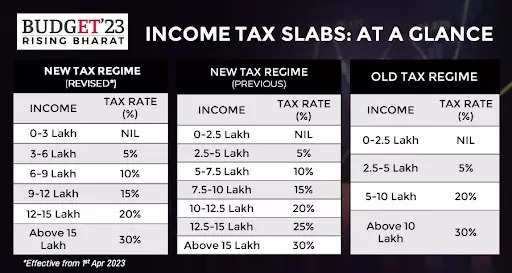

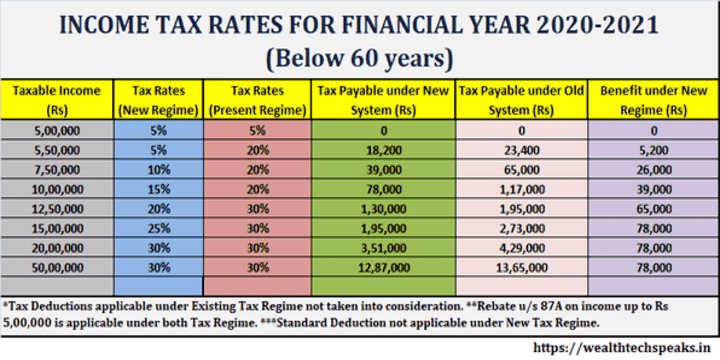

WEB Feb 4 2023 nbsp 0183 32 Synopsis Income tax slab The Finance Minister made changes in the income tax slabs under the new tax regime The changes announced in the income tax slabs under the new tax regime is applicable for incomes earned in current the FY 2023 24 starting from April 1 2023 WEB Jun 1 2023 nbsp 0183 32 New Tax Regime u s 115BAC Income Tax Slab Income Tax Rate Income Tax Slab Income Tax Rate Up to Rs 2 50 000 Nil Up to Rs 2 50 00 0 Nil Rs 2 50 001 Rs 5 00 000 5 above Rs 2 50 00 0 Rs 2 50 001 Rs 5 00 00 0 5 above Rs 2 50 00 0 Rs 5 00 001 Rs 10 00 00 0 Rs 12 500 20 above Rs 5 00 00 0 Rs 5 00 001 Rs

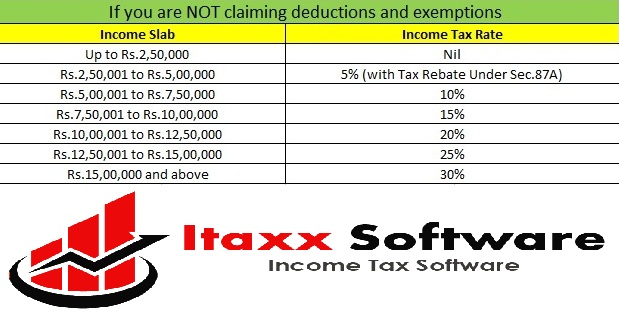

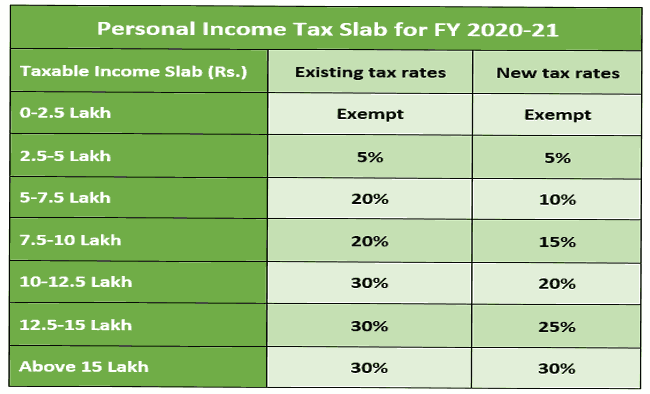

WEB Income Tax Slabs for FY 2022 2023 Old tax regime With deductions and exemptions Total Income New tax regime With deductions and exemptions Nil Up to Rs 2 5 lakh Nil 5 per cent From 2 50 000 to 5 lakh 5 per cent 20 per cent From 5 00 001 to 7 5 lakh From 7 50 001 to 10 lakh 10 per cent 15 per cent 30 per cent From 10 00 001 to