Income Tax Rates Ay 2022 23 Old Regime Web Aug 15 2023 nbsp 0183 32 Income Tax Slab Rates for FY 2022 23 AY 2023 24 In this system Specifically there are 2 slabs one is the old slab and the second is the New Slab rate Let s check both with the use of Table Assessee having net taxable income less than or equal to 5 lacks will be eligible for a Tax Rebate of Rs 12 500 u s 87A

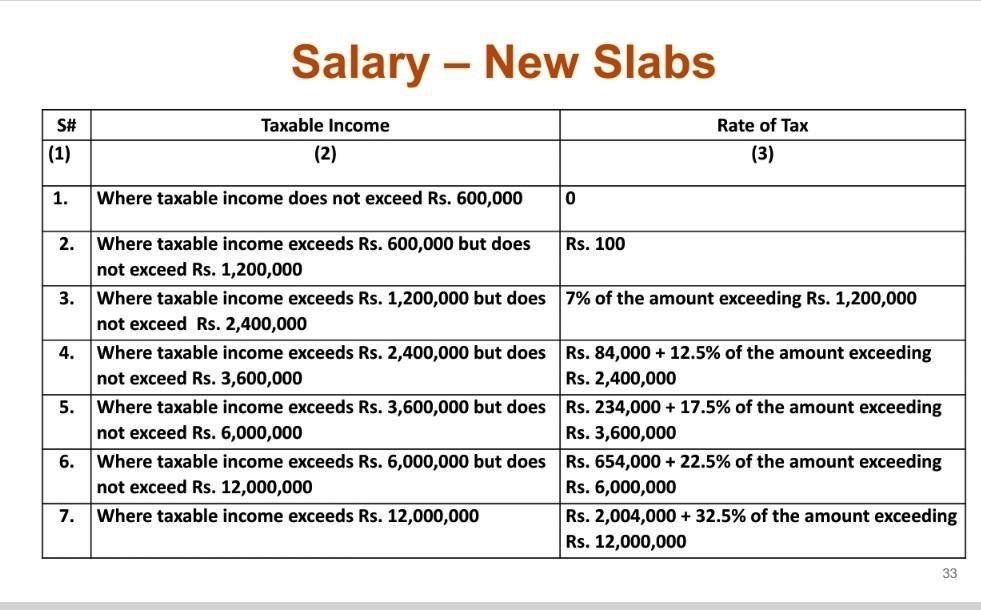

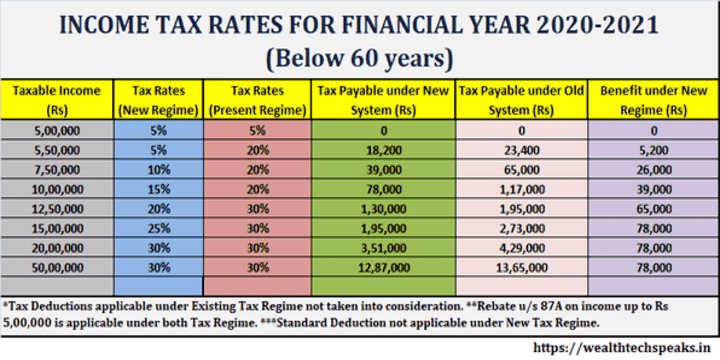

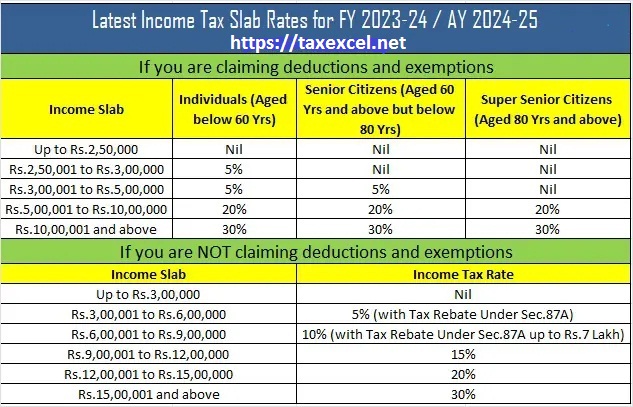

Web As per old tax regime the income tax slab rates for super senior citizen for FY 2022 23 are as follows The above calculated tax for senior and super senior citizens shall be increased by Health and Education Cess 4 of the income tax Additionally surcharge is applicable on the basis of total income as follows Web Apr 24 2023 nbsp 0183 32 New Tax Regime Slabs for Salaried FY 2022 23 1 Up to Rs 2 5 lakh 2 Rs 2 5L to Rs 5L 3 Rs 5L to Rs 7 5L 4 Rs 7 5L to Rs 10L 5 Rs 10L to Rs 12 5L 6 Rs 12 5L to Rs 15L 7 Above Rs 15 lakh

Income Tax Rates Ay 2022 23 Old Regime

Income Tax Rates Ay 2022 23 Old Regime

Income Tax Rates Ay 2022 23 Old Regime

https://taxguru.in/wp-content/uploads/2022/02/icome-tax-rates.jpg

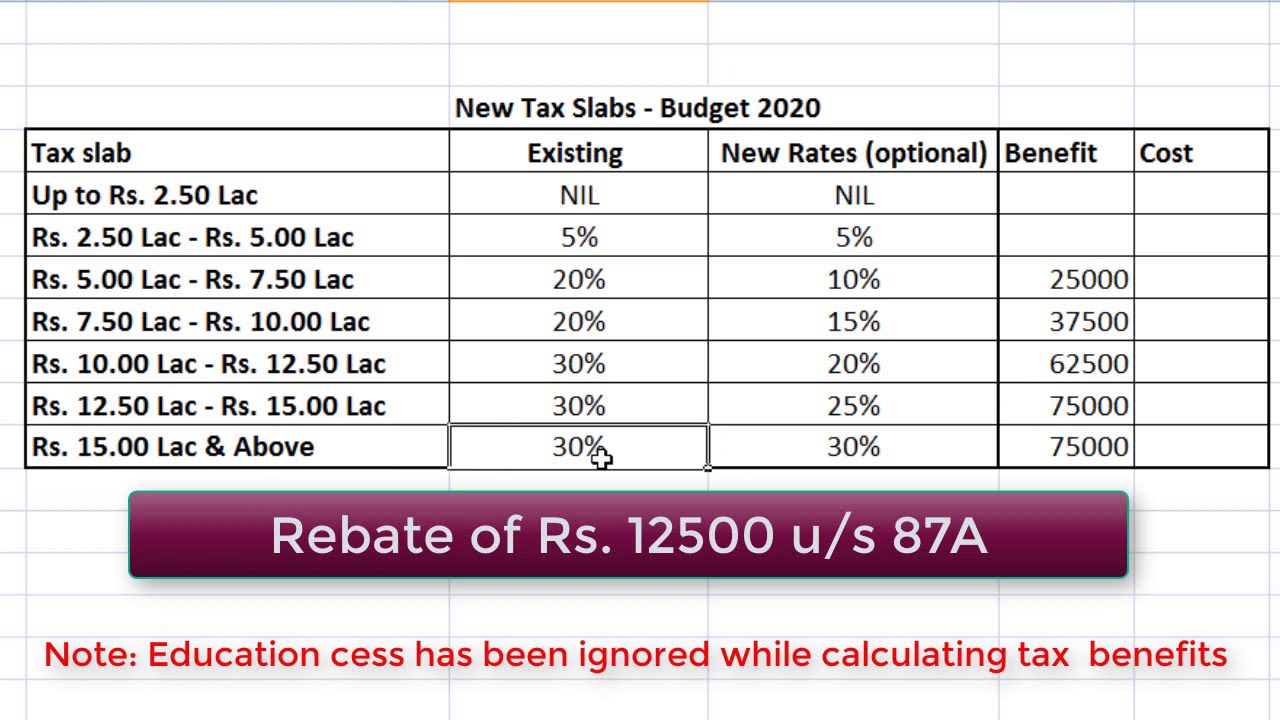

Web Old Tax Regime Slab Rate FY 2021 22 New Tax Regime Slab Rate FY 2021 22 Net Taxable Income Tax Rate Taxable Income Tax Rate Up to Rs 5 00 000 Nil Up to Rs 2 50 000 Nil Rs 2 50 001 to Rs 5 00 000 5 Rs 5 00 001 to Rs 7 50 000 10 Rs 7 50 001 to Rs 10 00 000 15 Rs 5 00 001 to Rs 10 00 000 20 Rs 10 00 001 to Rs

Templates are pre-designed files or files that can be utilized for various functions. They can save time and effort by supplying a ready-made format and layout for producing different sort of material. Templates can be used for individual or expert jobs, such as resumes, invitations, leaflets, newsletters, reports, discussions, and more.

Income Tax Rates Ay 2022 23 Old Regime

Income Tax Slabs Year 2022 23 Info Ghar Educational News

Income Tax Slab Fy 2022 23 Ay 2023 24 Old New Regime Kisah Sekolah

Income Tax Rates For Fy 2021 22 Pay Period Calendars 2023

Income Tax Slab For 2022 23 Pay Period Calendars 2023

Income Tax Calculator For FY 2020 21 AY 2021 22 Excel Download

Latest Income Tax Slab Rates FY 2020 21 AY 2021 22 BasuNivesh

https://cleartax.in/s/income-tax-slabs

Web New Tax Regime FY 2022 23 AY 2023 24 New Tax Regime FY 2023 24 AY 2024 25 0 2 50 000 2 50 000 3 00 000 5 3 00 000 5 00 000 5 5 5 00 000 6 00 000 10 5 6 00 000 7 50 000 10 10 7 50 000 9 00 000 15 10 9 00 000 10 00 000 15 15 10 00 000 12 00 000

https://www.incometax.gov.in/iec/foportal/help/individual/return-applicable-1

Web Old Tax Regime New Tax Regime u s 115BAC Income Tax Slab Income Tax Rate Income Tax Slab Income Tax Rate Up to 2 50 000 Nil Up to 2 50 000 Nil 2 50 001 5 00 000 5 above 2 50 000 2 50 001 5 00 000 5 above 2 50 000 5 00 001 10 00 000 12 500 20 above 5 00 000 5 00 001 7 50 000

https://www.news18.com/news/business/tax/income...

Web Jul 13 2022 nbsp 0183 32 Income Tax Return AY 22 23 There are over 70 exemptions and deductions available under the old tax regime to lower the tax burden of the individuals New tax regime has lower tax rates compared to old system What should you choose

https://life.futuregenerali.in/.../old-tax-regime

Web Mar 9 2023 nbsp 0183 32 Income Tax slabs amp Rates as Per Old Regime FY 2022 23 Given below are the three tables for the alternative Income Tax Slabs Income Tax Slab for Individual who are below 60 years Individuals who have an income up to 5 lakh are eligible for tax deductions under Section 87A

https://www.taxmann.com/post/blog/income-tax-slab-rates-for-ay-2022-23

Web Mar 30 2021 nbsp 0183 32 Income tax rates applicable to Individuals and HUF under new optional tax regime Section 115BAC Income tax applicable to Co operative Society under new optional tax regime Section 115BAD 1 Income Tax Slab Rate for Individuals opting for old tax regime

Web Tax Calculator Old Regime vis 224 vis New Regime as proposed by Finance Bill 2023 Web Updated Jul 24 2023 10 36 AM IST Taxpayers filing their ITR for FY2022 23 under old tax regime can claim several deductions Pic Canva Pro TIMES NOW DIGITAL ITR Filing The deadline for filing income tax returns ITR for

Web Jun 13 2022 nbsp 0183 32 Net Income Range Rate of Income tax Assessment Year 2023 24 Assessment Year 2022 23 Up to Rs 2 50 000 Rs 2 50 000 to Rs 5 00 000 5 5 Rs 5 00 000 to Rs 10 00 000 20 20 Above Rs 10 00 000 30 30 Senior Citizen who is 60 years or more at any time during the previous year Net Income Range Rate