Income Tax Rate For Ay 2022 23 Old Regime Web Nov 7 2022 nbsp 0183 32 Updated on Jan 30 2024 Delving deeper into the old and new tax regimes for the Indian taxpayer the income tax slabs under both the regimes and the rates for the FY 2022 23 We pay taxes to avail the essential amenities that our country provides for our benefit The tax money collected by the Indian government is put to use to serve us better

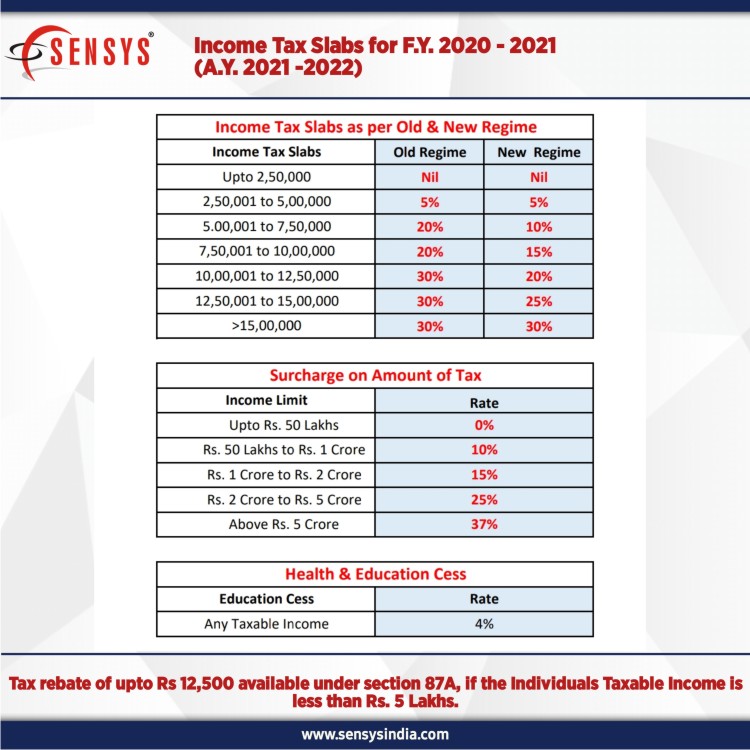

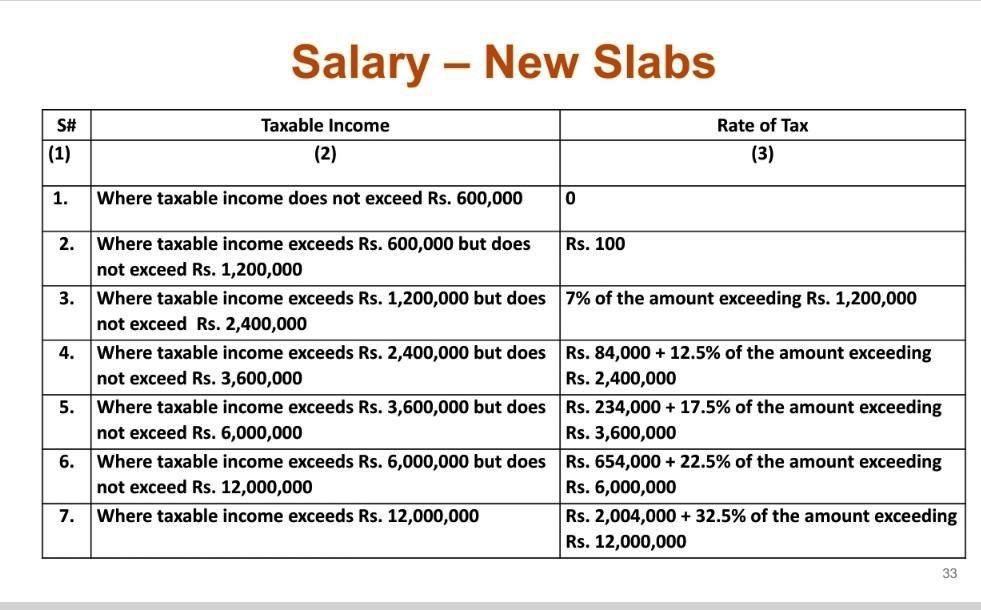

Web Sep 26 2023 nbsp 0183 32 30 The new tax system has more tax categories and lower tax rates compared to the old one In the recent budget the finance minister introduced six different tax categories or slabs These slabs have tax rates of 0 5 10 15 20 and 30 Unlike the old system the new one does not offer various exemptions and deductions Web Aug 15 2023 nbsp 0183 32 Income Tax Slab Rates for FY 2022 23 AY 2023 24 In this system Specifically there are 2 slabs one is the old slab and the second is the New Slab rate Let s check both with the use of Table Assessee having net taxable income less than or equal to 5 lacks will be eligible for a Tax Rebate of Rs 12 500 u s 87A

Income Tax Rate For Ay 2022 23 Old Regime

Income Tax Rate For Ay 2022 23 Old Regime

Income Tax Rate For Ay 2022 23 Old Regime

https://i.ytimg.com/vi/oGY7IvASNds/maxresdefault.jpg

Web A new tax regime has been established by the insertion of section 115 BAC in the Income Tax Act 1961 vide the Finance Act 2020 Individuals and HUFs can choose between the new or old tax regime and pay applicable income tax as per slabs and rates for FY 2021 22 AY 2022 23

Pre-crafted templates provide a time-saving option for developing a varied range of files and files. These pre-designed formats and layouts can be made use of for numerous individual and expert tasks, including resumes, invitations, leaflets, newsletters, reports, presentations, and more, improving the material development procedure.

Income Tax Rate For Ay 2022 23 Old Regime

Mutual Fund Taxation Fy 2022 23 Ay 2023 24 Financial Point Gambaran

Tax Slabs 2022 Old Regime

Income Tax Slab Fy 2022 23 Ay 2023 24 Old New Regime Home Interior Design

New Income Tax Slab Rate For AY 2021 22 FY 2020 21 IDeal ConsulTax

Income Tax Calculator For FY 2020 21 AY 2021 22 Excel Download

Income Tax Slab Rate 2022 23 Slab Rate For Ay 2023 24 Fy 2022 23 Which

https://cleartax.in/s/income-tax-slabs

Web 3 days ago nbsp 0183 32 Income Tax Slab Rates For FY 2022 23 AY 2023 24 a New Tax regime Refer to the above image for the rates applicable to FY 2023 24 AY 2024 25 for the upcoming tax filing season b Old Tax regime Select your Age Group Income tax slabs for individual aged below 60 years amp HUF NOTE

https://www.news18.com/news/business/tax/income...

Web Jul 13 2022 nbsp 0183 32 Under the new tax regime the annual income between Rs 5 lakh and Rs 7 5 lakh will be taxed at 10 per cent while the earning ranging Rs 7 5 lakh Rs 10 lakh a year will attract a 15 per cent tax Under the old regime those having an income between Rs 7 lakh and Rs 10 lakh came under a flat 20 per cent tax bracket

https://cleartax.in/s/old-tax-regime-vs-new-tax-regime

Web 3 days ago nbsp 0183 32 Old regime if tax saving investments gt Rs 3 75 000 New regime if tax saving investments lt Rs 3 75 000 Which tax regime is better for 25 lakhs salary If you have an income of Rs 20 lakhs the best regime for you will depend on the tax deductions you are eligible for Old regime if tax saving investments gt Rs 3 75 000

https://life.futuregenerali.in/.../old-tax-regime

Web Mar 9 2023 nbsp 0183 32 Income Tax slabs amp Rates as Per Old Regime FY 2022 23 Given below are the three tables for the alternative Income Tax Slabs Income Tax Slab for Individual who are below 60 years Individuals who have an income up to 5 lakh are eligible for tax deductions under Section 87A

https://taxguru.in/income-tax/income-tax-rates...

Web Sep 9 2023 nbsp 0183 32 Net Income Range Rate of Income tax Assessment Year 2024 25 Assessment Year 2023 24 Up to Rs 3 00 000 Rs 3 00 000 to Rs 5 00 000 5 5 Rs 5 00 000 to Rs 10 00 000 20 20 Above Rs 10 00 000 30 30 Resident Super Senior Citizen who is 80 years or more at any time during the previous year Net

Web Jun 13 2022 nbsp 0183 32 Net Income Range Rate of Income tax Assessment Year 2023 24 Assessment Year 2022 23 Up to Rs 3 00 000 Rs 3 00 000 to Rs 5 00 000 5 5 Rs 5 00 000 to Rs 10 00 000 20 20 Above Rs 10 00 000 30 30 Super Senior Citizen who is 80 years or more at any time during the previous year Net Income Web Mar 30 2021 nbsp 0183 32 Income tax rates applicable to Individuals and HUF under new optional tax regime Section 115BAC Income tax applicable to Co operative Society under new optional tax regime Section 115BAD 1 Income Tax Slab Rate for Individuals opting for old tax regime

Web Apr 24 2023 nbsp 0183 32 As ITR filing is expected to start soon for AY 2023 24 read on to find the Income Tax Slabs for FY 2022 23 under old and new tax regimes As ITR filing is expected to start soon for AY 2023 24