How To Encrypt Email In Outlook Desktop App Up to a certain threshold earnings are free of NICs The main rates are payable on earnings above that level but the employee and self employed rates though not the employer rate are lower on earnings above a higher threshold see chart and table below

Employer NIC for employees under the age of 21 and apprentices under the age of 25 is reduced from the normal rate of 13 8 to 0 up to the Upper Secondary Threshold of 163 967 per week Also applies to veterans in the first 12 months of employment Apr 6 2025 nbsp 0183 32 For 2023 to 2024 and 2022 to 2023 the National Insurance contributions rates for directors are different Read CA44 to find out more about rates for directors

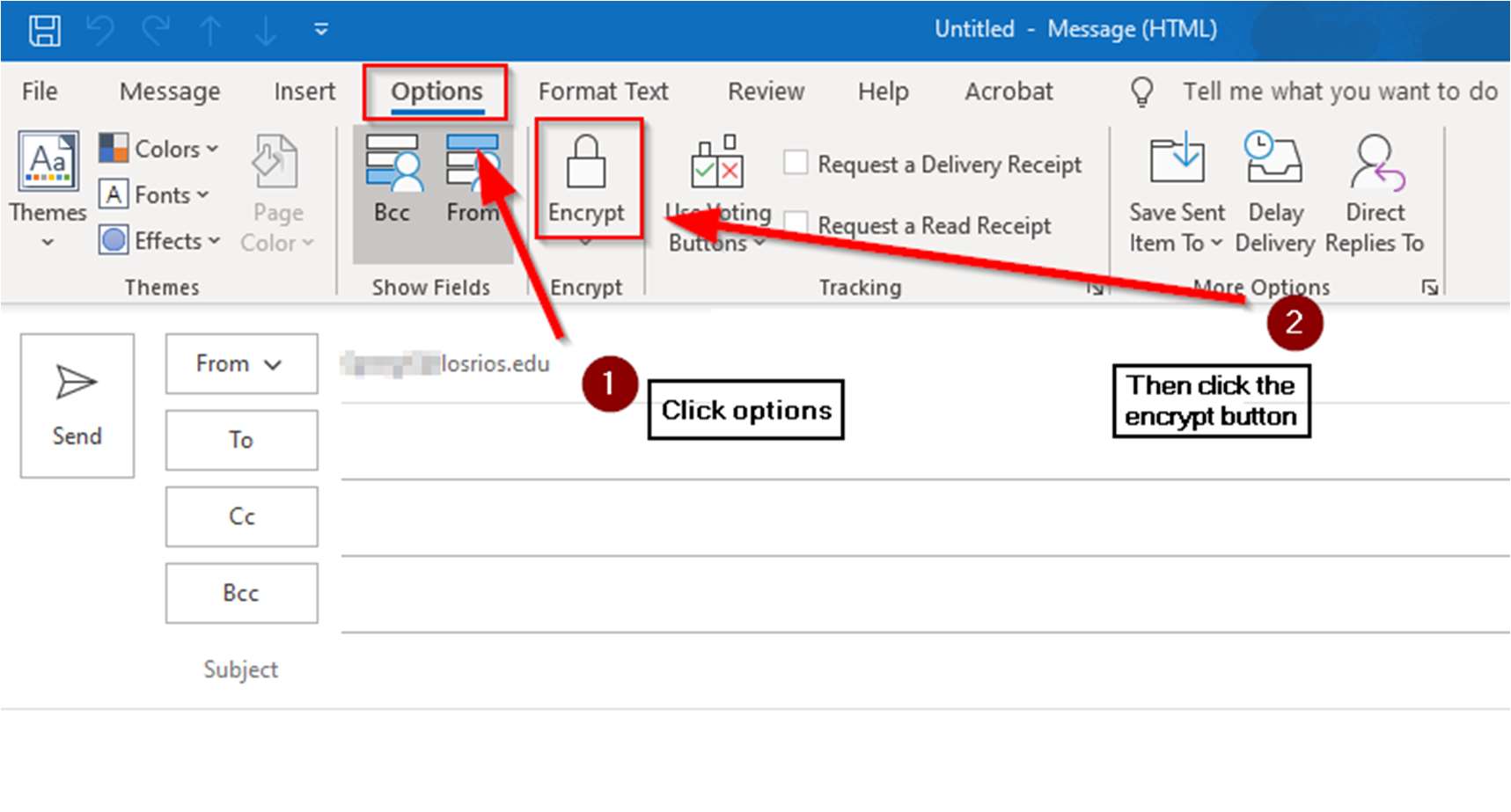

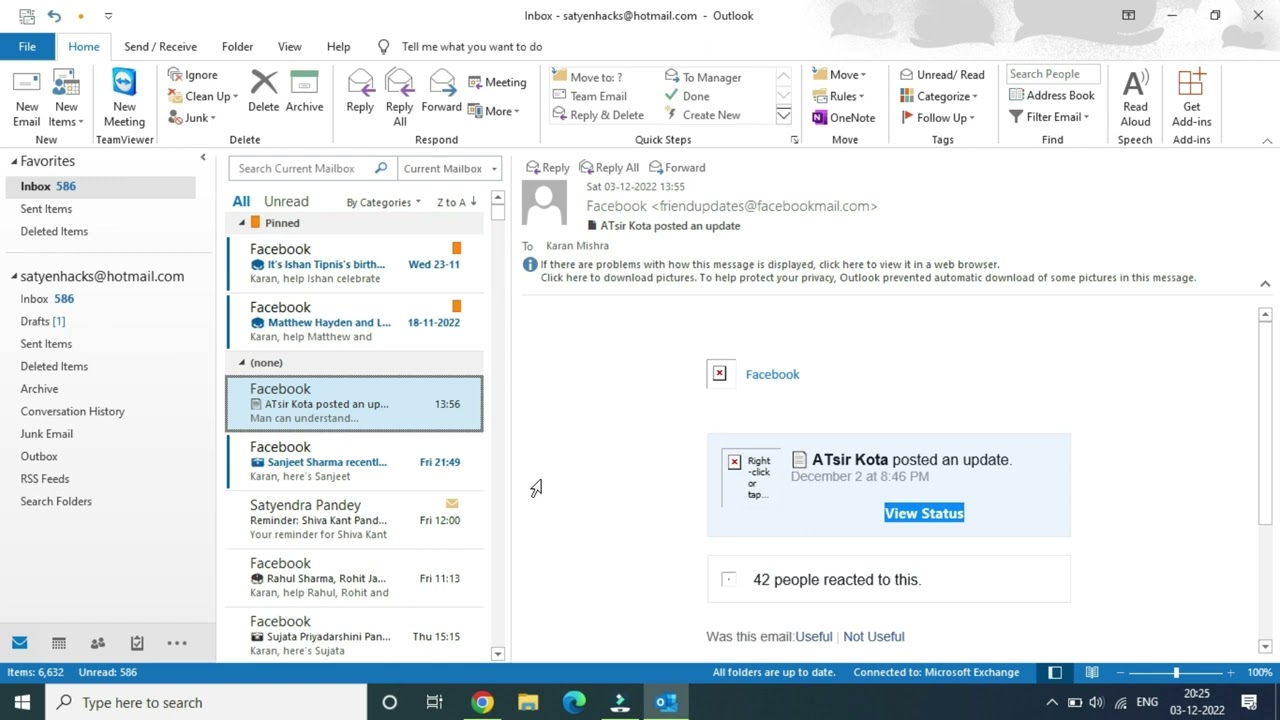

How To Encrypt Email In Outlook Desktop App

How To Encrypt Email In Outlook Desktop App

How To Encrypt Email In Outlook Desktop App

https://i.ytimg.com/vi/NOyqcgp6oEQ/maxresdefault.jpg

2021 22 National Insurance Contributions what you need to know The 2020 21 tax year starts on 6 April 2021 From that date new thresholds apply for National Insurance purposes

Pre-crafted templates provide a time-saving service for developing a diverse range of documents and files. These pre-designed formats and designs can be used for various individual and professional jobs, consisting of resumes, invitations, leaflets, newsletters, reports, presentations, and more, improving the content creation process.

How To Encrypt Email In Outlook Desktop App

Sending Encrypted Email Exchange And Office Online

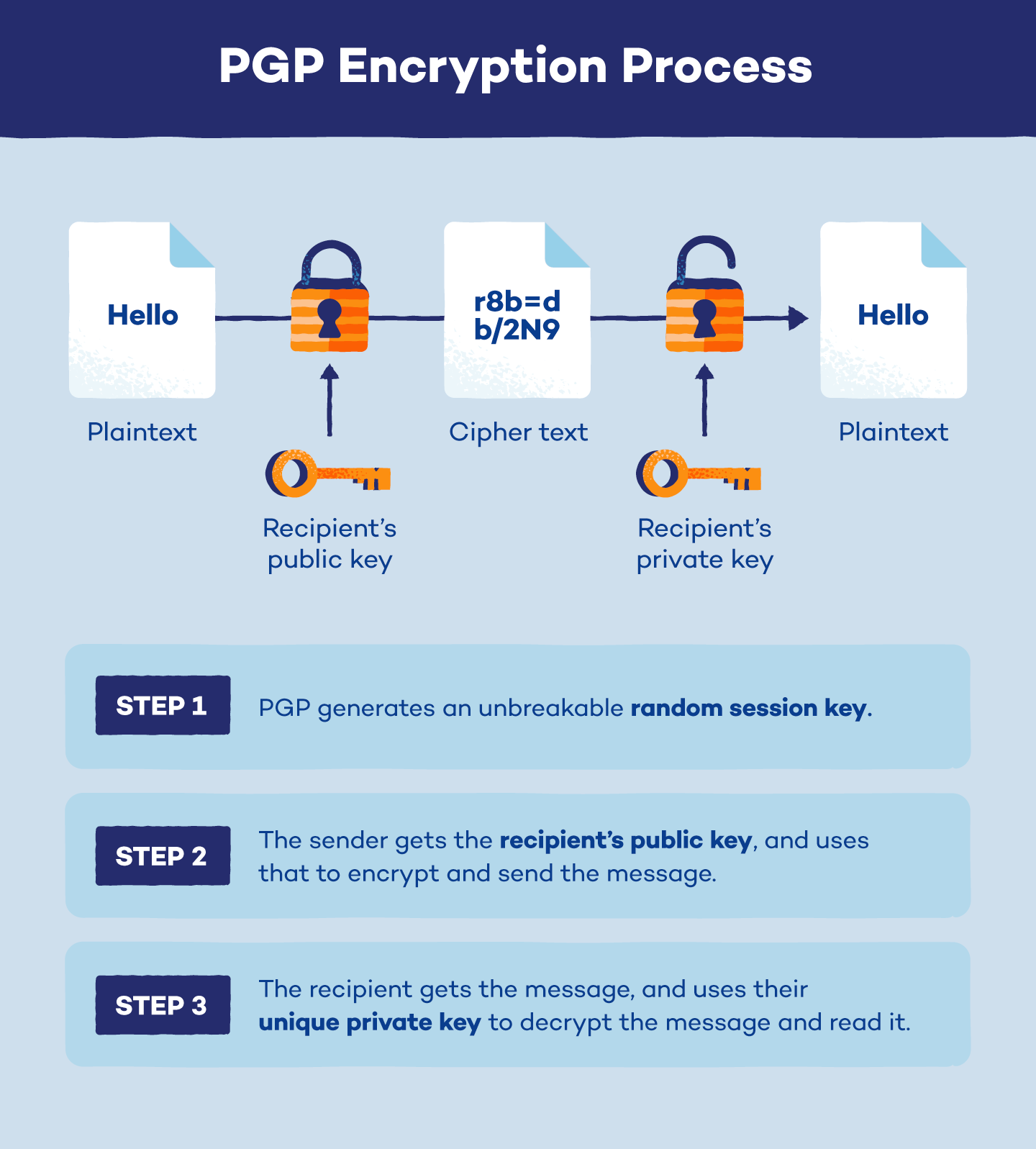

What Is PGP Encryption And How Does It Work 53 OFF

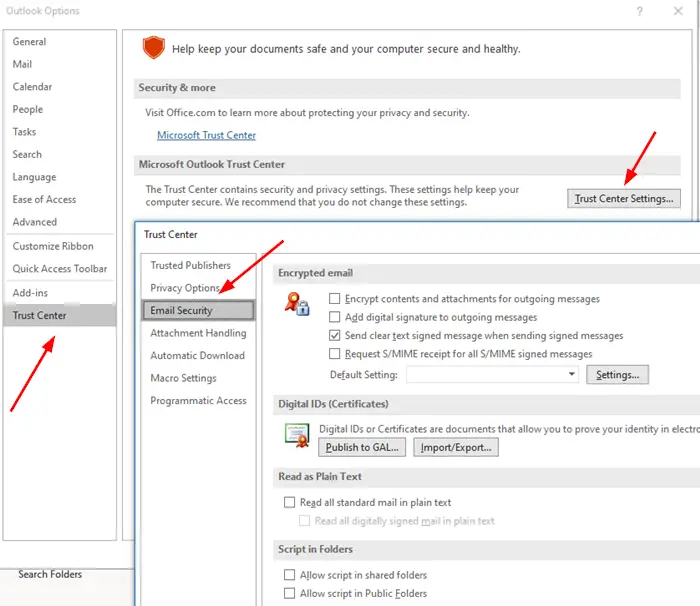

CUIMC IT Knowledge Portal

Outlook Amocrm

Outlook SaroopJoules

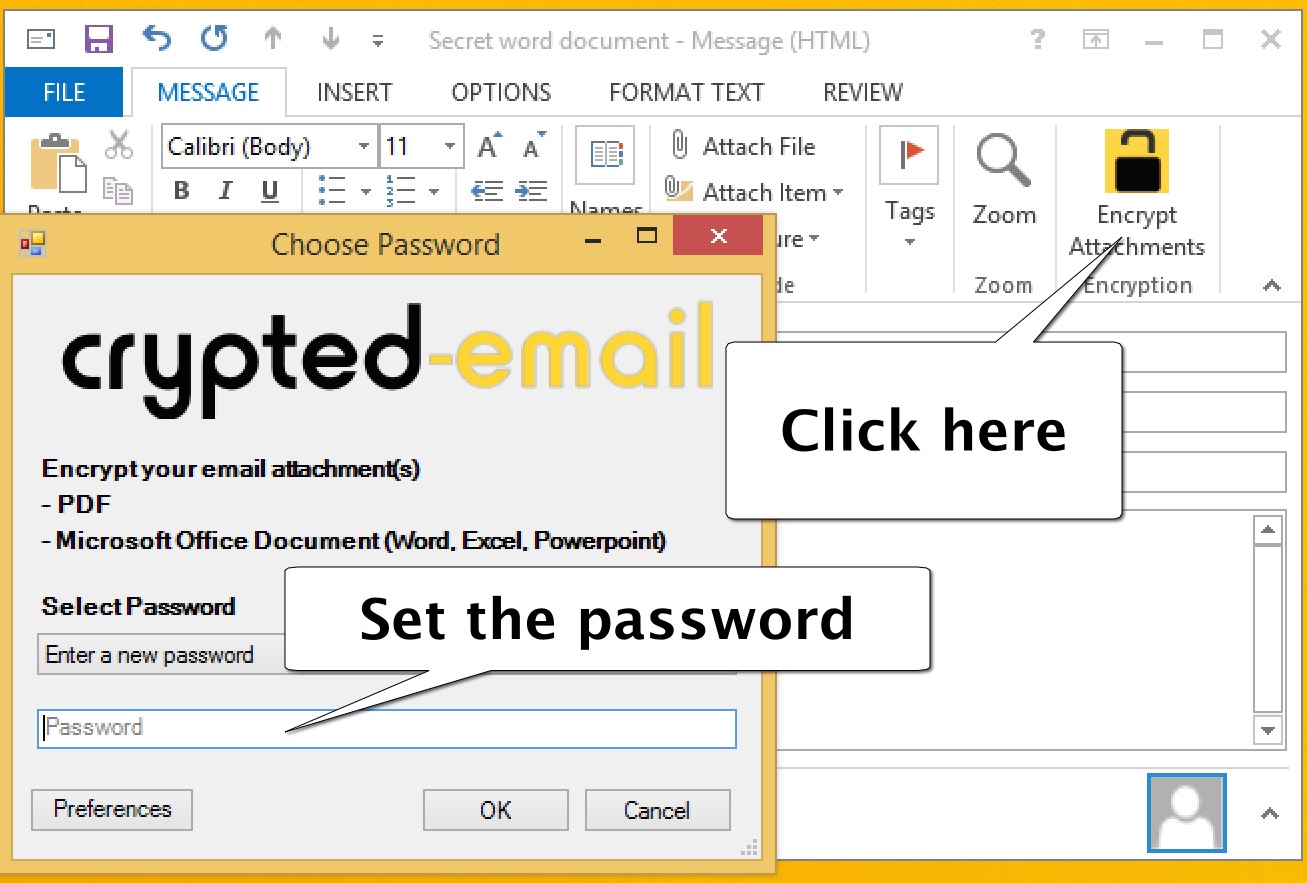

Encrypt Outlook EMail Encrypted EMail

https://jonesandgraham.co.uk

Apr 9 2021 nbsp 0183 32 If you re paying voluntary contributions for the previous 2 tax years 2020 to 2021 or 2019 to 2020 you ll pay the original rates for those years For all other years you ll pay the current rate 2021 to 2022

https://www.taxrebateservices.co.uk

Jun 7 2021 nbsp 0183 32 For Class 1A and 1B contributions the rate for 2021 22 tax year stays the same at 13 8 Remember you need to check you re paying the correct NIC s or your state pension and access to benefits won t be right

https://assets.publishing.service.gov.uk › government › upl…

Use this table for all employees who are under the age of 21 for whom you hold form CA2700 allowing them to defer payment of employee s NICs at the full main percentage rate

https://lordslibrary.parliament.uk › national-insurance-rates-limits-and...

Feb 3 2021 nbsp 0183 32 The draft Social Security Contributions Rates Limits and Thresholds Amendments and National Insurance Funds Payments Regulations 2021 would set the national insurance contributions rates limits and thresholds for the upcoming 2021 22 tax year

https://accountants247.co.uk

For qualifying employers the 163 4 000 Employer s National Insurance allowance remains in force for the 2021 22 year This means that for you don t pay Employer s National Insurance for the first 163 4 000 in the tax year

[desc-11] [desc-12]

[desc-13]