How To Calculate Capital Gains Tax On Overseas Property In Australia [desc-7]

[desc-6] [desc-8]

How To Calculate Capital Gains Tax On Overseas Property In Australia

How To Calculate Capital Gains Tax On Overseas Property In Australia

How To Calculate Capital Gains Tax On Overseas Property In Australia

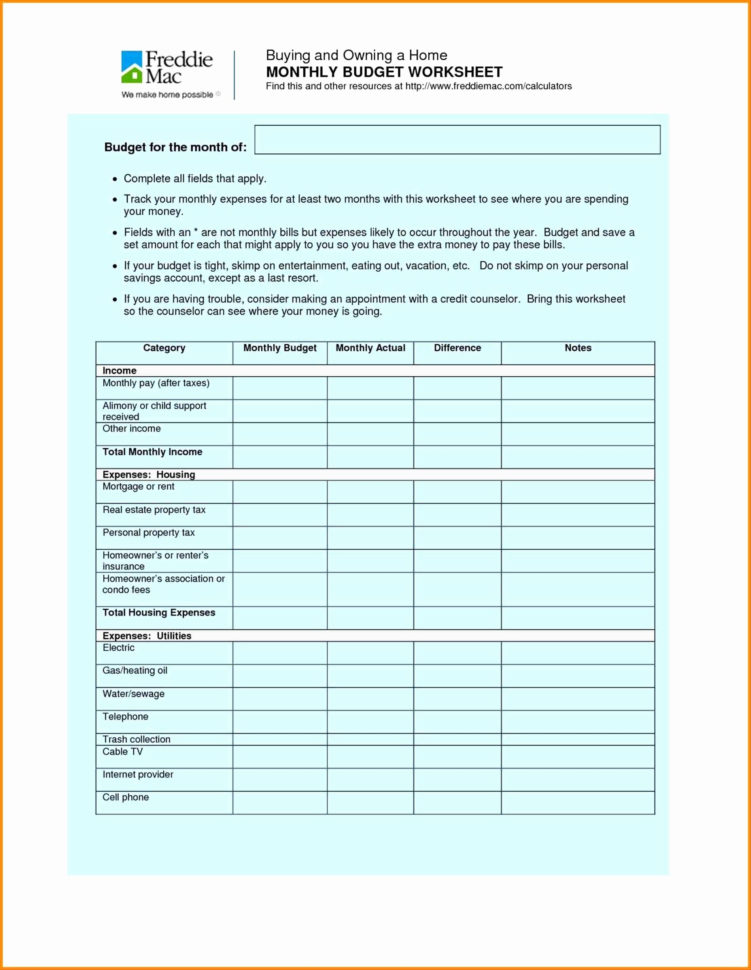

https://db-excel.com/wp-content/uploads/2019/01/mortgage-accelerator-spreadsheet-in-tax-organizer-worksheet-2015-template-rental-property-excel-2016-751x970.jpg

[desc-9]

Pre-crafted templates use a time-saving solution for creating a diverse variety of files and files. These pre-designed formats and layouts can be made use of for numerous personal and expert jobs, consisting of resumes, invitations, leaflets, newsletters, reports, discussions, and more, enhancing the content production process.

How To Calculate Capital Gains Tax On Overseas Property In Australia

Capital Gains Tax Rate 2025 Ireland Danny B English

Capital Gains Tax 202420243 Marie Gwenette

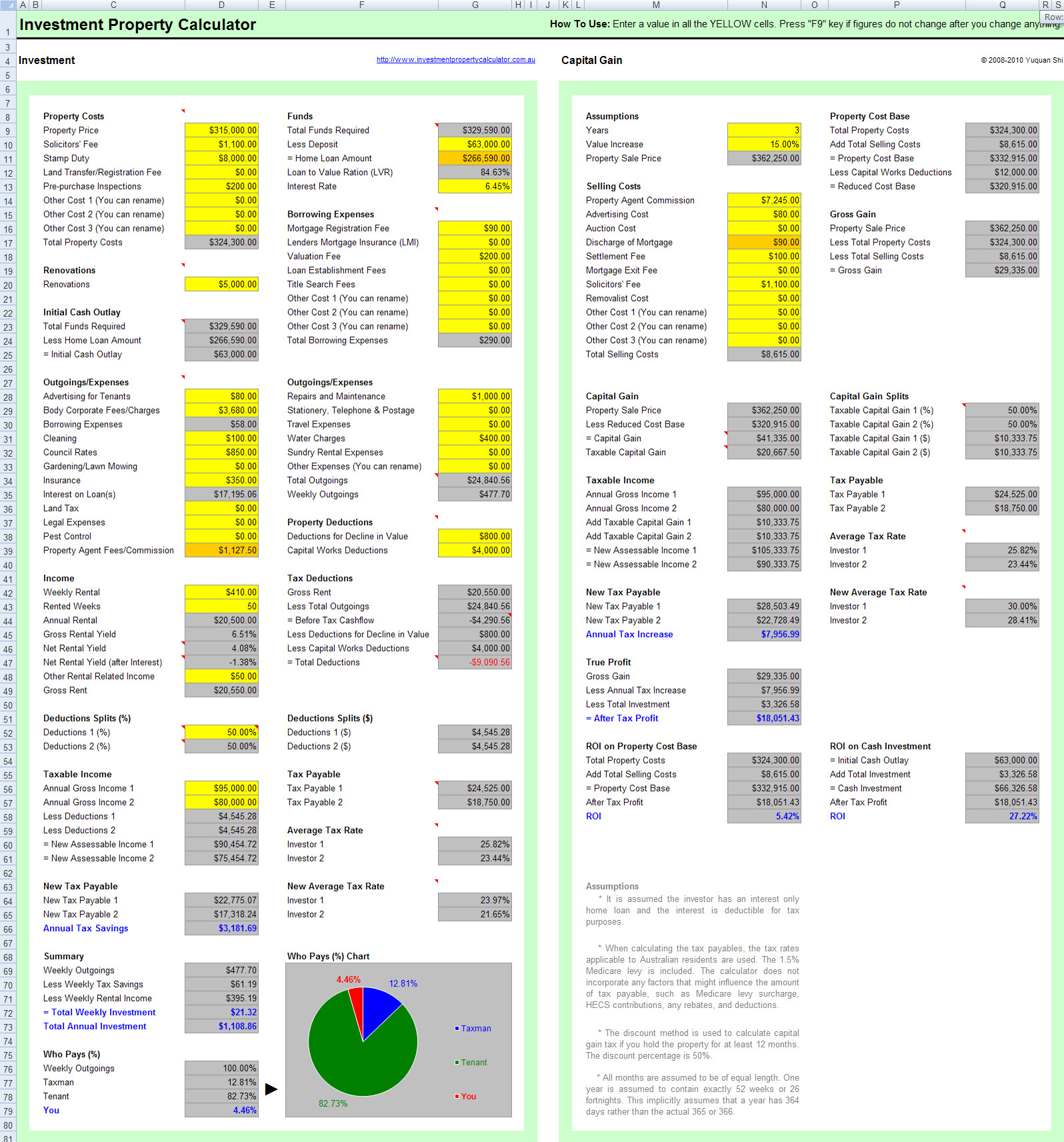

Free Investment Property Calculator Spreadsheet

Capital Gains Tax Rate 2025 Philippines 2025 Danny B English

Worksheet To Calculate Capital Gain Tax

2023 Tax Computation Worksheet New York State Standard Deduc

https://jingyan.baidu.com › article

https://jingyan.baidu.com › article

Apr 30 2020 nbsp 0183 32 SUMIF SUMIF range criteria sum range

https://jingyan.baidu.com

[url-4]

[desc-4]

[url-5]

[desc-5]

[desc-11] [desc-12]

[desc-13]