How Much Is January 2023 Gst Nov 27 2022 nbsp 0183 32 A GST is charged at 7 per cent on services performed before January 1 2023 and 8 per cent after that In this case 343 days Jan 1 to Dec 9 2023 are subject to 8 per cent GST while

Nov 27 2022 nbsp 0183 32 A GST is charged at 7 per cent on services performed before Jan 1 2023 and 8 per cent after that In this case 343 days Jan 1 to Dec 9 2023 are subject to 8 per cent GST Aug 29 2022 nbsp 0183 32 The Inland Revenue Authority of Singapore IRAS has published an updated guide to the phased rate change of the goods and services tax GST taking effect on 1 January 2023 The GST rate will

How Much Is January 2023 Gst

How Much Is January 2023 Gst

How Much Is January 2023 Gst

https://gstsafar.com/wp-content/uploads/2023/02/Karnataka-collected-record-GST-of-Rs.6085-crore-in-January-2023.jpg

Feb 18 2022 nbsp 0183 32 At the time of writing GST is currently 7 but the government plans to raise it to 8 on 1 Jan 2023 and up to 9 on 1 Jan 2024 When was the last GST hike GST has been around since 1994

Pre-crafted templates offer a time-saving solution for producing a varied range of documents and files. These pre-designed formats and layouts can be utilized for different individual and professional jobs, consisting of resumes, invitations, leaflets, newsletters, reports, presentations, and more, simplifying the material development procedure.

How Much Is January 2023 Gst

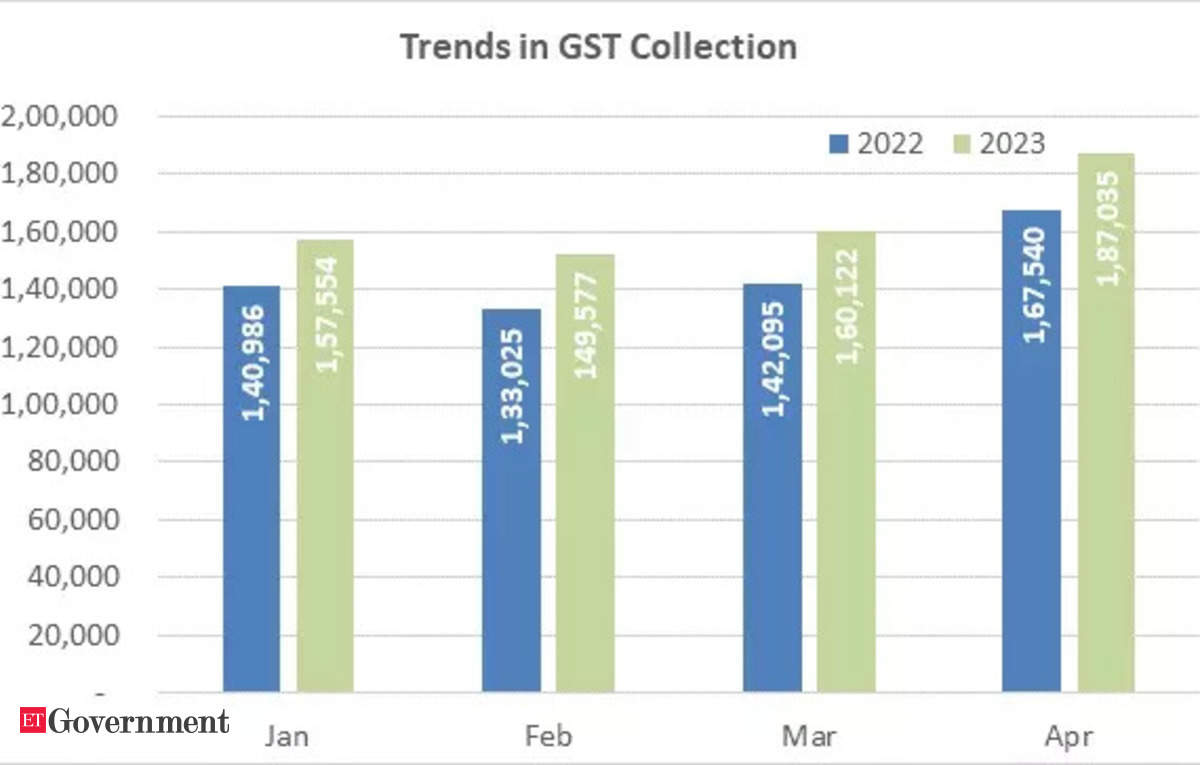

GST Collection April 2023 Is Rs 1 87 Lakh Crore Highest GST Collection

GST Collection For April 2023 Highest Ever At Rs 1 87 Lakh Crore ET

GST Revenue Collection For December 2019 1 03 184 Of Gross GST

March 2023 GST Revenue Collection Crosses 1 60 Lakh Crores

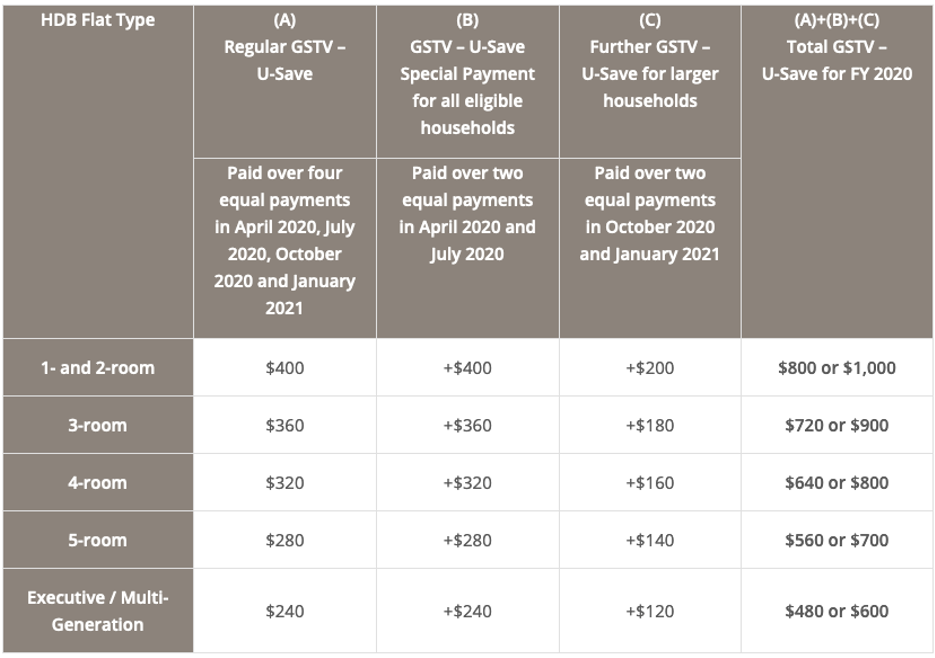

You Can Check Your GST Vouchers For Year 2016 Online Now Great Deals

Budget 2022 GST Will Go Up To 8 Next Year Then 9 From 2024 Extra S

https://www.aba.com.sg › post

Nov 2 2022 nbsp 0183 32 183 GST is charged at 8 from 1 Jan 2023 183 Be aware of transitional rules if a transaction straddles the date of the rate change 183 Ensure that Point of sales and accounting

https://www.channelnewsasia.com › singapore

Dec 28 2022 nbsp 0183 32 The GST rate is currently 7 per cent It will go up to 8 per cent on Jan 1 2023 and to 9 per cent on Jan 1 2024 Are there any transitional rules

https://www.apactrust.com

Dec 31 2022 nbsp 0183 32 As announced by the Minister of Finance in Budget 2022 GST will be increased from 7 to 9 This increase will be staggered over 2 steps i from 7 to 8 from 1 Jan

https://www.tofler.in › blog

Aug 27 2023 nbsp 0183 32 These recommendations sanctioned by the GST Council and subsequently announced by the Central Board of Indirect Taxes and Customs CBIC are slated to take

https://taxguru.in › ...

Jan 1 2023 nbsp 0183 32 GST Rate Changes 1 No GST is payable where the residential dwelling is rented to a registered person if it is rented it in his her personal capacity for use as his her own residence and on his own

Mar 24 2022 nbsp 0183 32 The above provides a quick overview of the GST rate change from 7 to 8 effective from 1 January 2023 There may also be scenarios where both the payment is made Before 1 Jan 2023 you should charge GST at 7 as the time of supply has been triggered before 1 Jan 2023 If the goods are delivered or services are performed for your customer before 1

For standard rated supplies of goods or services made on or after 1 Jan 2023 you must charge GST at 8 For instance if you issue an invoice and receive payments for your supply on or