How Much Is Capital Gains Tax On A House In Victoria Sep 11 2024 nbsp 0183 32 Most property except your main residence home is subject to CGT When you sell property you make a capital gain or capital loss How do I calculate CGT We know what

Sep 12 2023 nbsp 0183 32 Capital Gains Tax or CGT is a tax levied on the profit capital gain you make when you sell a property It s not a separate tax but forms part of your income tax The amount Our CGT calculator provides quick accurate results for shares property and investments Easily determine your tax liability and plan effectively

How Much Is Capital Gains Tax On A House In Victoria

How Much Is Capital Gains Tax On A House In Victoria

How Much Is Capital Gains Tax On A House In Victoria

https://i.pinimg.com/originals/97/7c/92/977c92406e7e83fb8bcc2b347571ce41.png

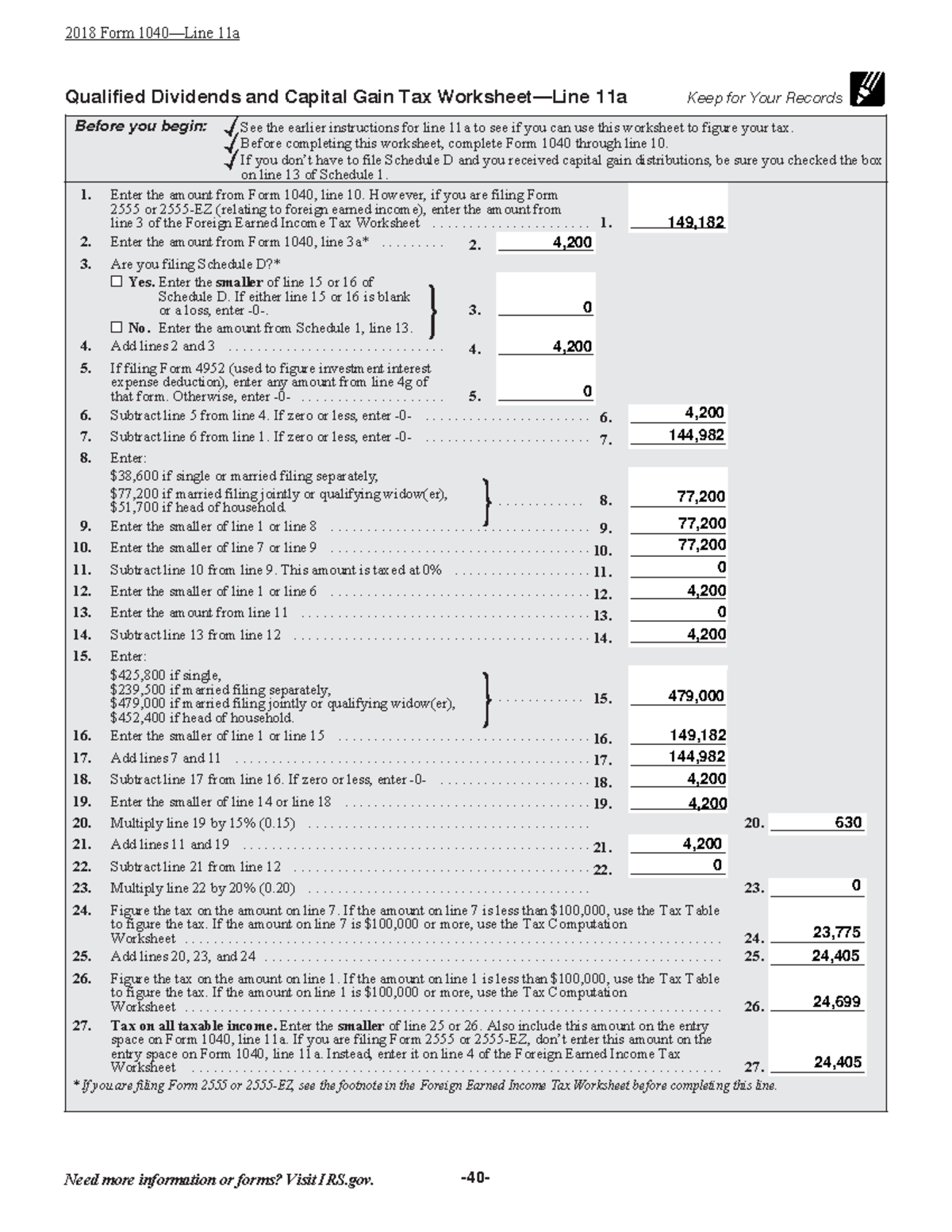

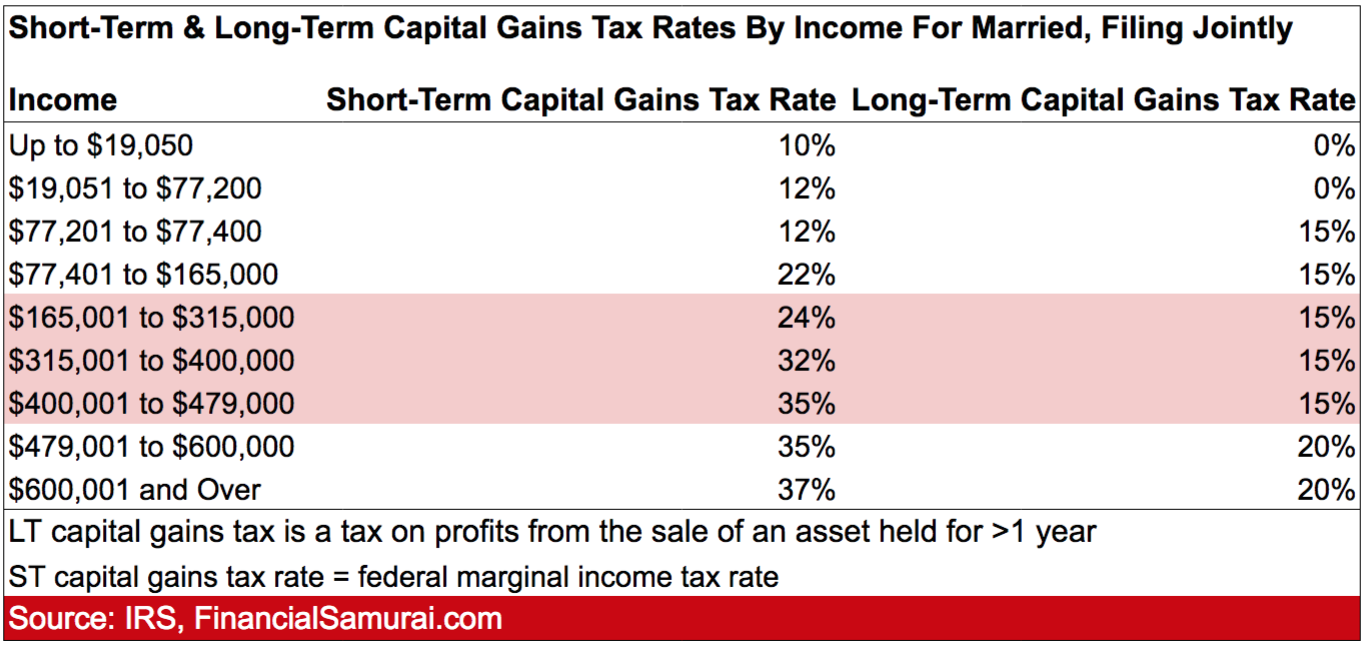

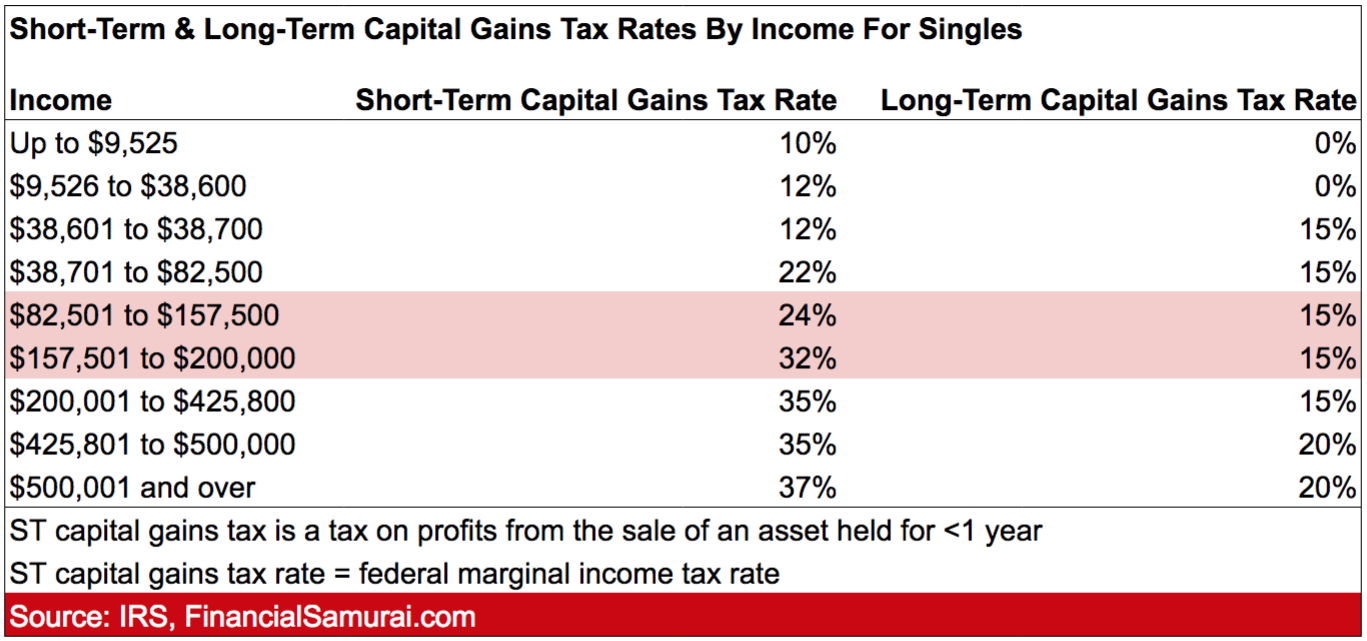

Capital gains are taxed exactly at the same rate as your taxable income that is if you earn 40 000 at 32 5 tax bracket per year and makes a capital gain of 60 000 you will pay income tax for 100 000 at 37 tax bracket and your

Pre-crafted templates use a time-saving service for developing a diverse series of files and files. These pre-designed formats and layouts can be used for numerous personal and professional jobs, including resumes, invites, leaflets, newsletters, reports, presentations, and more, improving the content production process.

How Much Is Capital Gains Tax On A House In Victoria

Capital Gains Tax 20 Kaile Marilee

Capital Gains Tax 202420243 Marie Gwenette

Capital Gains Tax Rate 2025 Philippines 2025 Danny B English

Capital Gains Tax Rate 2025 Philippines 2025 Danny B English

Short Term Capital Gains Tax 2024 India Lexy Sheela

Long Term Capital Gains Tax Calculator 2025 Lillian G Cline

https://www.money.com.au › calculators › c…

Capital gains are taxed at the same rate as taxable income i e if you earn 40 000 32 5 tax bracket per year and make a capital gain of 60 000 you will pay income tax for 100 000 37 income tax and your capital gains will be

https://www.ato.gov.au › individuals-and-families › ...

Use the calculator or steps to work out your CGT including your capital proceeds and cost base How CGT affects real estate including rental properties land improvements and your home

https://www.ato.gov.au › ... › capital-gains-tax

Use the calculator or steps to work out your CGT including your capital proceeds and cost base How CGT affects real estate including rental properties land improvements and your home

https://www.rtedgar.com › news › how-calcu…

If you are selling a property in Victoria it is important to understand how to calculate the capital gains tax on the sale This article will walk you through the steps to take in order to determine how much tax you will need to pay on the

https://whichrealestateagent.com.au › calculators › ...

Below you will find our capital gains tax calculator which will give you the capital gains base you can use to find out how much tax you will need to pay upon sale of your property You can then

Apr 10 2024 nbsp 0183 32 How much is capital gains tax on property in Australia It depends on your income tax bracket and whether you qualify for any discounts or exemptions Our calculator can give Jan 30 2025 nbsp 0183 32 Investors pay CGT when selling an investment property but there s a 50 discount if you ve owned the property for 12 months You can use a CGT calculator to estimate

So does that mean that you have to pay CGT when you sell your house Fortunately in most cases the answer is no The tax law provides an automatic exemption for any capital gain or