How Many Days In 2022 Tax Year Web Feb 22 2023 nbsp 0183 32 Tax Time Guide Things to consider when filing a 2022 tax return IR 2023 32 Feb 22 2023 WASHINGTON With the 2023 tax filing season in full swing the Internal Revenue Service reminds taxpayers to gather their necessary information and visit IRS gov for updated resources and tools to help with their 2022 tax return

Web Feb 24 2016 nbsp 0183 32 December 31 2022 Sat Day 365 0 511 Week 52 99 73 171 day numbers for 2021 day numbers for 2023 187 Other years 1920 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 Web You must let the property commercially as furnished holiday accommodation to the public for at least 105 days in the year 70 days for the tax year 2011 to 2012 and earlier

How Many Days In 2022 Tax Year

How Many Days In 2022 Tax Year

How Many Days In 2022 Tax Year

https://photobrunobernard.com/wp-content/uploads/2021/12/take-how-many-days-in-april-2022-1.jpg

Web Seren Morris March 14 2024 The tax year is made up of 12 months but it doesn t run from January until December Instead the tax year begins and ends each April While many people

Pre-crafted templates offer a time-saving service for developing a varied range of files and files. These pre-designed formats and layouts can be utilized for numerous individual and expert projects, including resumes, invites, flyers, newsletters, reports, presentations, and more, improving the content development process.

How Many Days In 2022 Tax Year

How Many Work Days In A Year 2023 Hanover Mortgages

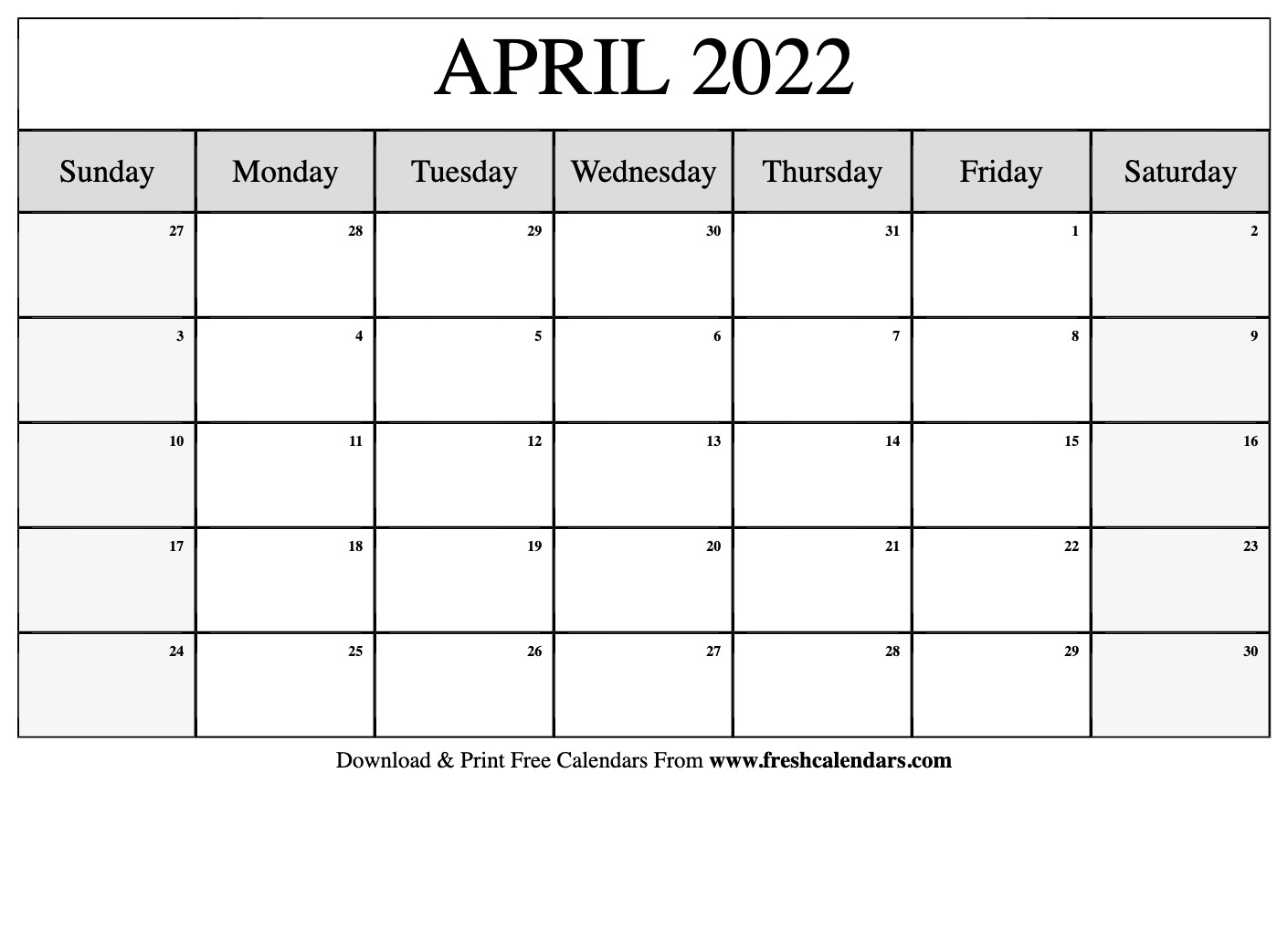

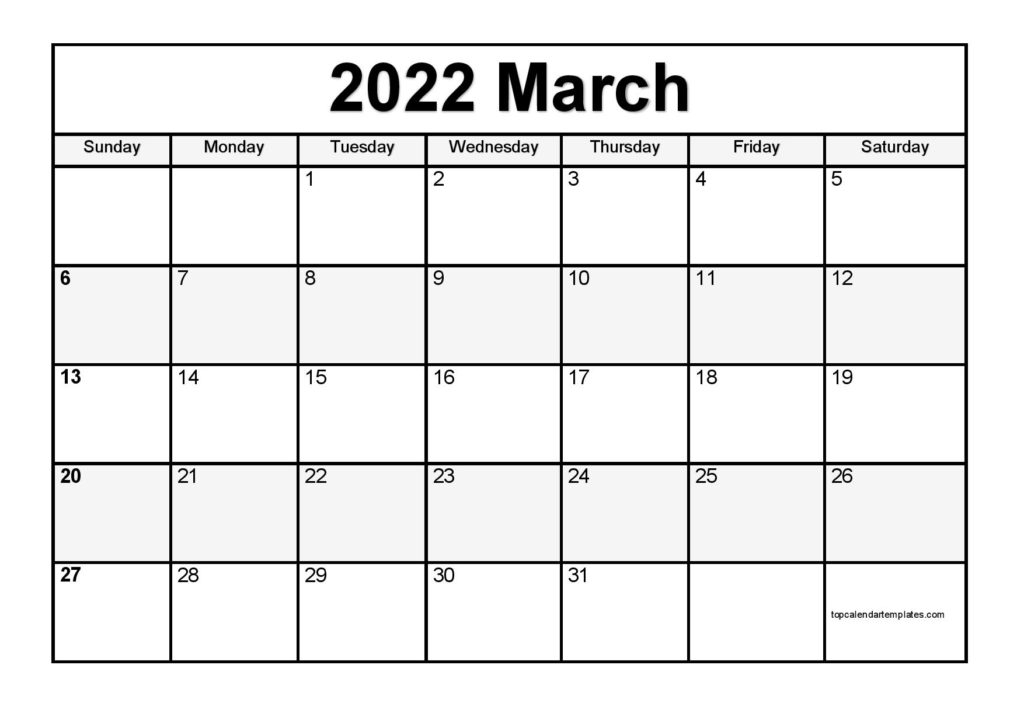

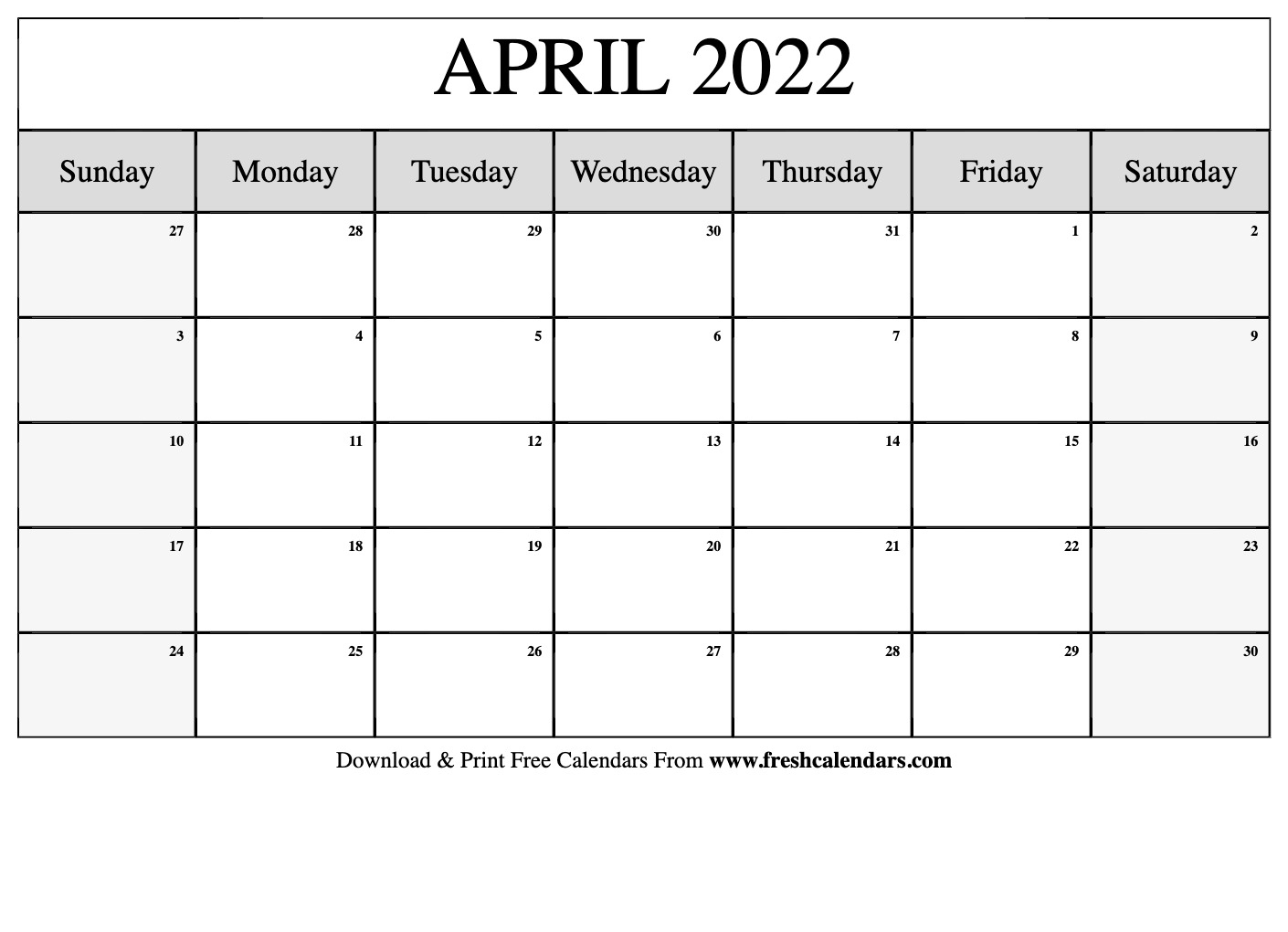

How Many Days In April 2022 Best Calendar Example

Pick How Many Days In April 2022 Best Calendar Example

2022 Tax Brackets Irs Calculator

How Many Days Until 2022 Uk Latest News Update

The Best How Many Weeks In 2022 Calendar Year Photos Fiscal 2022 Calendar

https://www. investopedia.com /terms/t/taxyear.asp

Web Jan 25 2024 nbsp 0183 32 The 2024 federal income tax filing deadline for individuals is April 15 2024 Key Takeaways A tax year refers to the 12 month period that a tax return covers Individuals are subject to a

https:// informi.co.uk /finance/uk-tax-year-dates-deadlines-calendar

Web The new UK tax year begins on 6 April 2022 and ends on 5 April 2023 use our calendar for important tax return deadlines and dates

https://www. calculator.net /date

Web Jan 1 2024 nbsp 0183 32 Days Between Two Dates Find the number of years months weeks and days between dates Click quot Settings quot to define holidays Start Date End Date include end day add 1 day Holiday Settings Do not count holidays Count holidays

https://www. brainpayroll.co.uk /blog/financial-year...

Web Here are some important dates for the 2022 23 tax year April 6 2022 Start of the Tax Year This is the first day of the new tax year If you run a business this is also the day that your new VAT return period and tax year begins Follow the links to read about significant changes for the 2022 23 tax year such as the new NLM and NMW rates

https://www. ato.gov.au /calculators-and-tools/days-calculator

Web Calculate days Use this calculator to help you to work out the number of days from one date to another date Last updated 29 June 2023 Print or Download

Web 330 Full Days Generally to meet the physical presence test you must be physically present in a foreign country or countries for at least 330 full days during a 12 month period including some part of the year at issue You can count days you spent abroad for any reason so long as your tax home is in a foreign country Web May 3 2024 nbsp 0183 32 International Taxpayers Substantial Presence Test You will be considered a United States resident for tax purposes if you meet the substantial presence test for the calendar year To meet this test you must be physically present in the United States U S on at least 31 days during the current year and

Web Jan 25 2024 nbsp 0183 32 Tax season is the period of time generally between Jan 1 and April 15 of each year when individual taxpayers prepare to report their taxable income to the federal government and in most