How Is Capital Gains Tax Calculated On Property In Nsw Apr 10 2024 nbsp 0183 32 Use our straightforward Capital Gains Tax Calculator to quickly estimate the tax on profits from your asset sales Whether you ve sold property stocks or any other investment get a clear view of your potential tax liabilities in just a few clicks

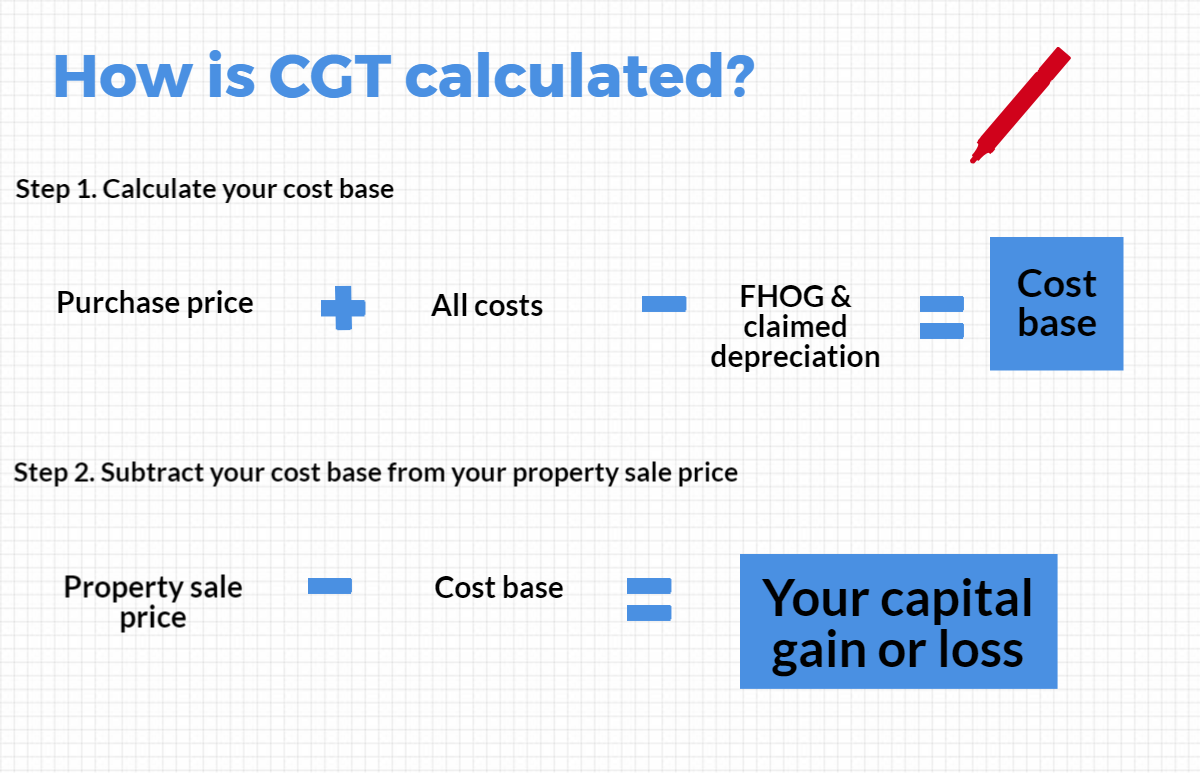

Your Mortgage s Capital Gains Tax Calculator can help you estimate the CGT you may have to pay when you sell your investment property To use the tool simply answer these questions How much did you buy your property for So to calculate capital gains tax I m going to go through a bunch of different steps that you can use to get a rough guide of how much capital gains tax you going to need to pay Step 1 is to work out what called your cost base Your cost base is your purchase price plus other costings like stamp duty fees for tax advice title cost etc

How Is Capital Gains Tax Calculated On Property In Nsw

How Is Capital Gains Tax Calculated On Property In Nsw

How Is Capital Gains Tax Calculated On Property In Nsw

https://info.realrenta.com.au/hs-fs/hubfs/How-to-calculate-your-capital-gains-tax.png?width=2310&height=1488&name=How-to-calculate-your-capital-gains-tax.png

Sep 11 2024 nbsp 0183 32 Most property except your main residence home is subject to CGT When you sell property you make a capital gain or capital loss How do I calculate CGT We know what you re thinking dreading manual calculations We ve got a calculator over on our website to help you calculate CGT

Templates are pre-designed files or files that can be used for different functions. They can save time and effort by providing a ready-made format and design for producing various type of material. Templates can be used for personal or professional jobs, such as resumes, invites, leaflets, newsletters, reports, discussions, and more.

How Is Capital Gains Tax Calculated On Property In Nsw

Capital Gains Tax Definition Calculation

Current Long Term Capital Gains Tax Rate 2024 Lok Aleen Roxana

Short Term Capital Gains Tax 2024 India Lexy Sheela

Long Term Capital Gains Tax Calculator 2025 Lillian G Cline

Calculate Schedule C Income Tax

Capital Gains Tax Rental Property Calculator

https://www.ato.gov.au › individuals-and-families › ...

Use the calculator or steps to work out your CGT including your capital proceeds and cost base How CGT affects real estate including rental properties land improvements and your home

https://www.realestate.com.au › advice › what-is-capital-gains-tax

Apr 22 2021 nbsp 0183 32 Capital gains tax CGT is the levy you pay on the capital gain made from the sale of that asset It applies to property shares leases goodwill licences foreign currency contractual rights and personal use assets purchased for more than 10 000

https://www.money.com.au › calculators › capital-gains-tax-calculator

Capital Gains Tax Calculator accurately works out your CGT on shares property amp investments CGT is calculated on your taxable income

https://www.ato.gov.au › ... › capital-gains-tax

Use the calculator or steps to work out your CGT including your capital proceeds and cost base How CGT affects real estate including rental properties land improvements and your home Find out what can trigger a CGT event such as selling shares or receiving certain distributions

https://www.realestate.com.au › advice › how-to-avoid...

Sep 23 2024 nbsp 0183 32 How are capital gains calculated on property Gross capital gain is defined as the sale price minus the purchase price and associated costs To calculate your capital gain subtract the price you paid for the property and associated costs such as legal fees and stamp duty from the price you sold it for

Jul 3 2024 nbsp 0183 32 So in this article we ll outline what CGT is how to legally minimise your Capital Gains Tax obligation and how to go about calculating Capital Gains Tax so there are no surprises when the taxman or woman comes calling How Much is Capital Gains Tax If you re an individual property investor the capital gains tax rate you ll pay is the same as your marginal tax rate for that year because the capital gain forms part of your taxable income and is not a separate tax How To Calculate Capital Gains Tax

What is capital gains tax Investors who make a profit from selling an investment property are required to pay tax on their financial gain This is referred to as capital gains tax CGT and is part of your normal tax assessment each year