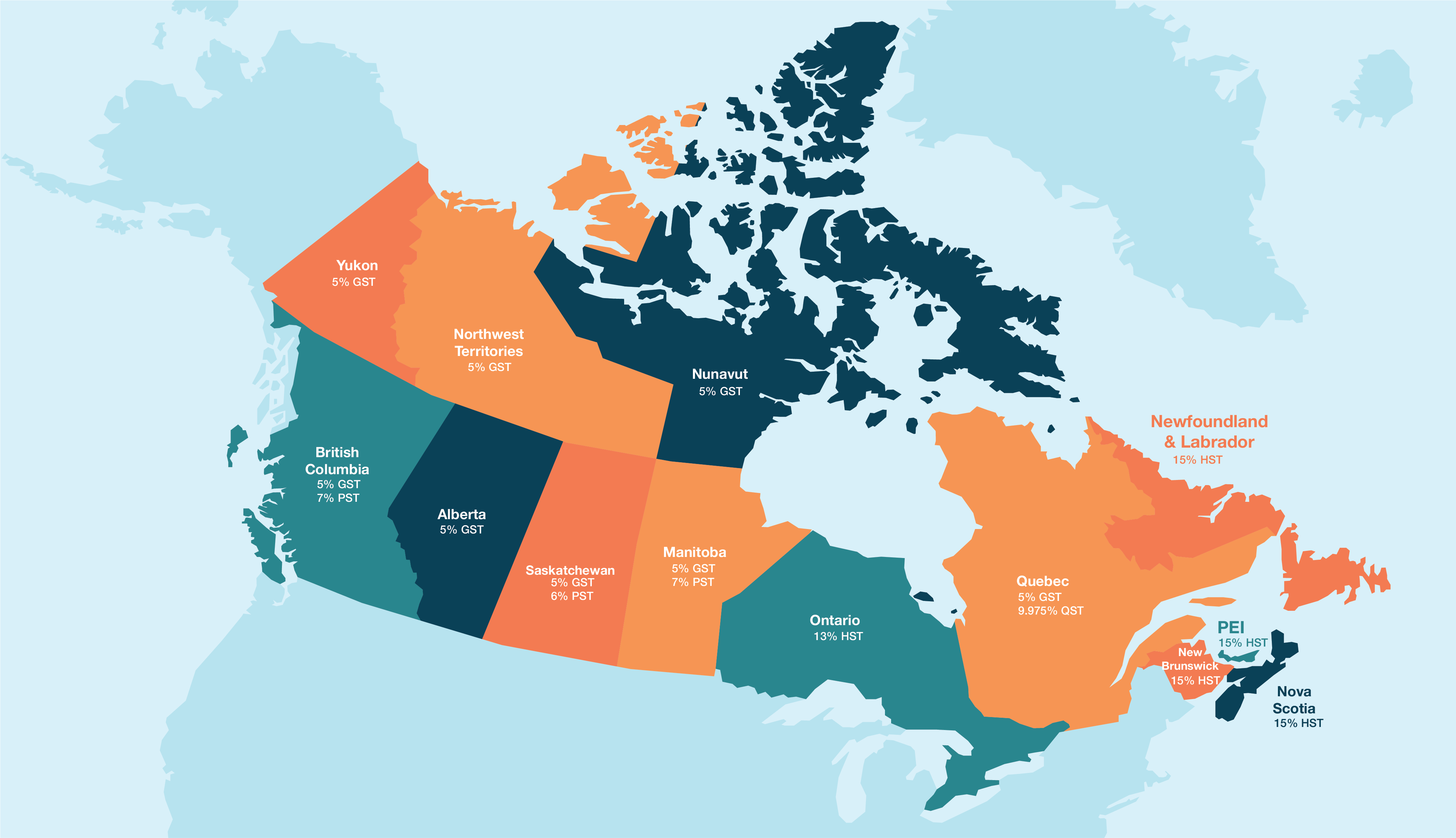

Canadian Federal Corporate Tax Rate 2023 Web Mar 28 2023 nbsp 0183 32 Provincial territorial budgets Prince Edward Island introduced its 2023 budget on May 25 2023 The budget did not announce changes to the province s general

Web Dec 31 2023 nbsp 0183 32 Corporate Tax Rates and Legislation Q4 2023 Accounting status PwC Canada January 03 2024 Issue 4 Q4 2023 Accounting status Legislative changes Web Sep 30 2022 nbsp 0183 32 2023 Corporate Income Tax Rates current to March 28 2023 Published September 30 2022 Updated March 28 2023 5 min read Guide The rates shown are nominal tax rates as at March 28

Canadian Federal Corporate Tax Rate 2023

Canadian Federal Corporate Tax Rate 2023

Canadian Federal Corporate Tax Rate 2023

https://turbotax.intuit.ca/tips/images/self-employed-taxes-canada.jpg

Web Sep 22 2023 nbsp 0183 32 Those businesses registered as Canadian Controlled Private Corporations CCPC can take advantage of the small business tax deduction and pay a lower federal

Templates are pre-designed files or files that can be utilized for numerous purposes. They can conserve time and effort by providing a ready-made format and design for creating various kinds of material. Templates can be utilized for individual or expert jobs, such as resumes, invites, leaflets, newsletters, reports, presentations, and more.

Canadian Federal Corporate Tax Rate 2023

2022 Tax Brackets Lashell Ahern

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

2023 Corporate Tax Rates Federal State 1 800Accountant

Lawrence Summers One Last Time On Who Benefits From Corporate Tax Cuts

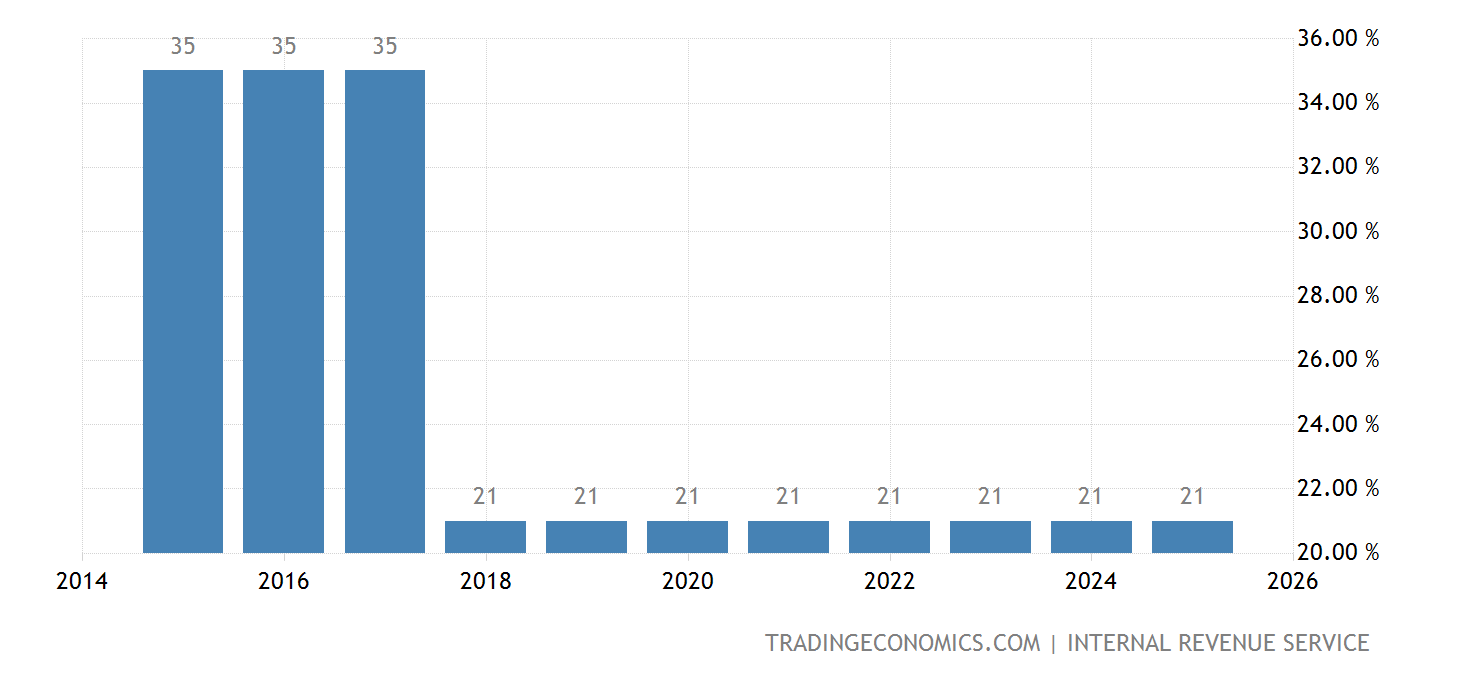

United States Federal Corporate Tax Rate 2022 Data 2023 Forecast

Canadian Sales Tax Registration Requirements Crowe Soberman LLP

https://kpmg.com/ca/en/home/services/tax/tax-facts/...

Web Dec 31 2023 nbsp 0183 32 Canadian corporate tax tables Substantively enacted rates Substantively Enacted Income Tax Rates for Income Earned by a General Corporation for 2023 and

https://www.taxtips.ca/smallbusiness/corporatetax/...

Web The following table shows the general and small business corporate income tax rates federally and for each province and territory for 2023 The small business rates are the applicable rates after deducting the

https://assets.ey.com/content/dam/ey-sites/ey-com/...

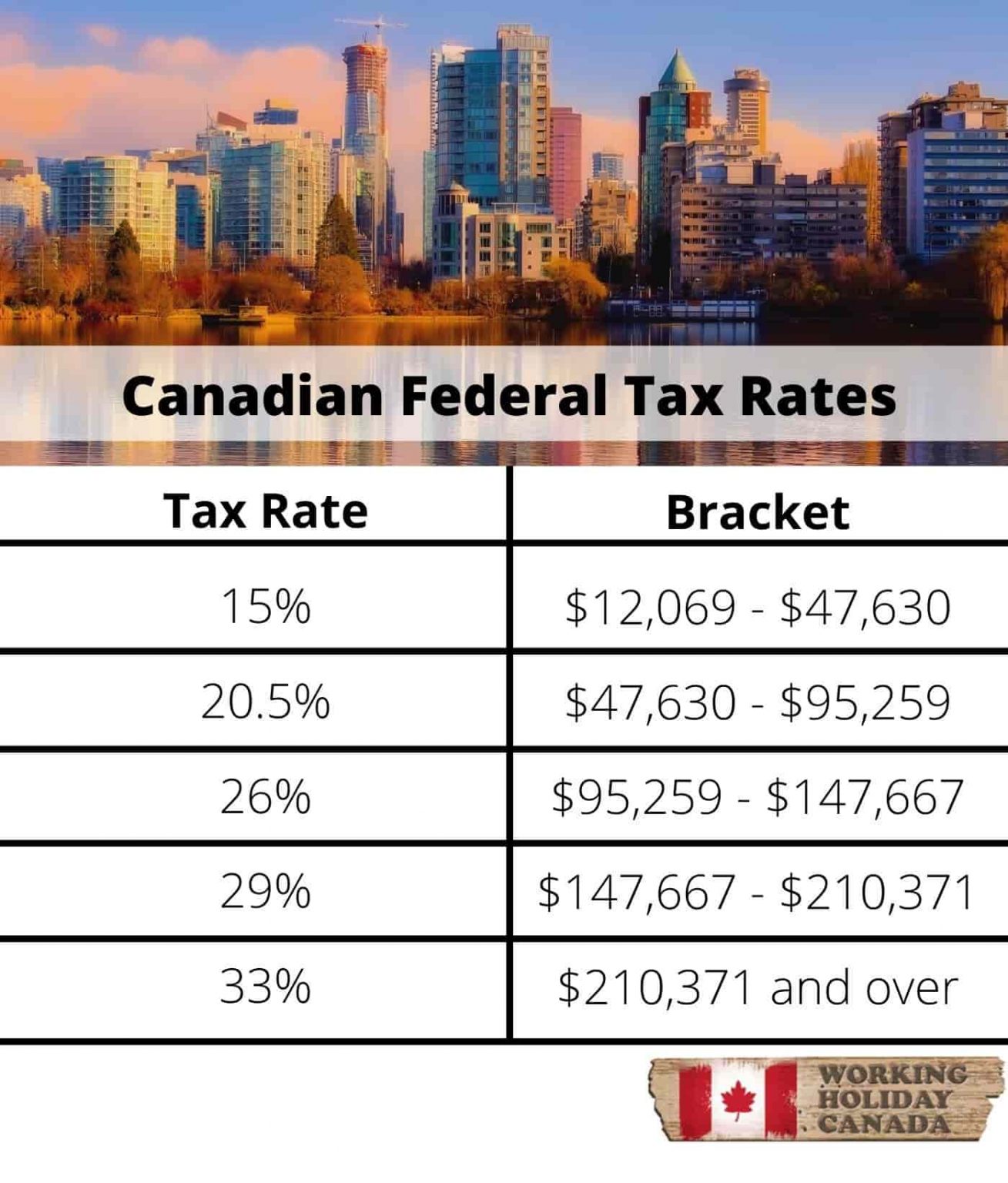

Web Jan 15 2023 nbsp 0183 32 benefit from the federal general rate reduction The tax rate on personal services business income earned by a corporation is 33 00 The federal rate

https://practiceguides.chambers.com/.../canada

Web As of 2023 the federal tax rates applicable to individuals are as follows 15 on the first CAD53 359 of taxable income plus 20 5 on the portion of taxable income between CAD53 359 and CAD106 717 plus 26 on

https://ca.rbcwealthmanagement.com/documents/...

Web The following tables illustrate the 2023 corporate tax rates on income earned in a corporation the corporate and personal combined tax rates if corporate income is

Web Apr 7 2023 nbsp 0183 32 With the exception of the changes noted below for zero emission technology manufacturers there are no changes proposed to the general or small business Web Dec 5 2022 nbsp 0183 32 Based on the Income Tax Act the Federal corporate tax rate starts at 38 This rate has an offsetting 10 Federal income tax abatement and an additional 13

Web The General Corporate Federal Tax rate also known as the higher tax rate is 38 with a 10 federal tax abatement Line 608 and a 13 general tax reduction leaving a total