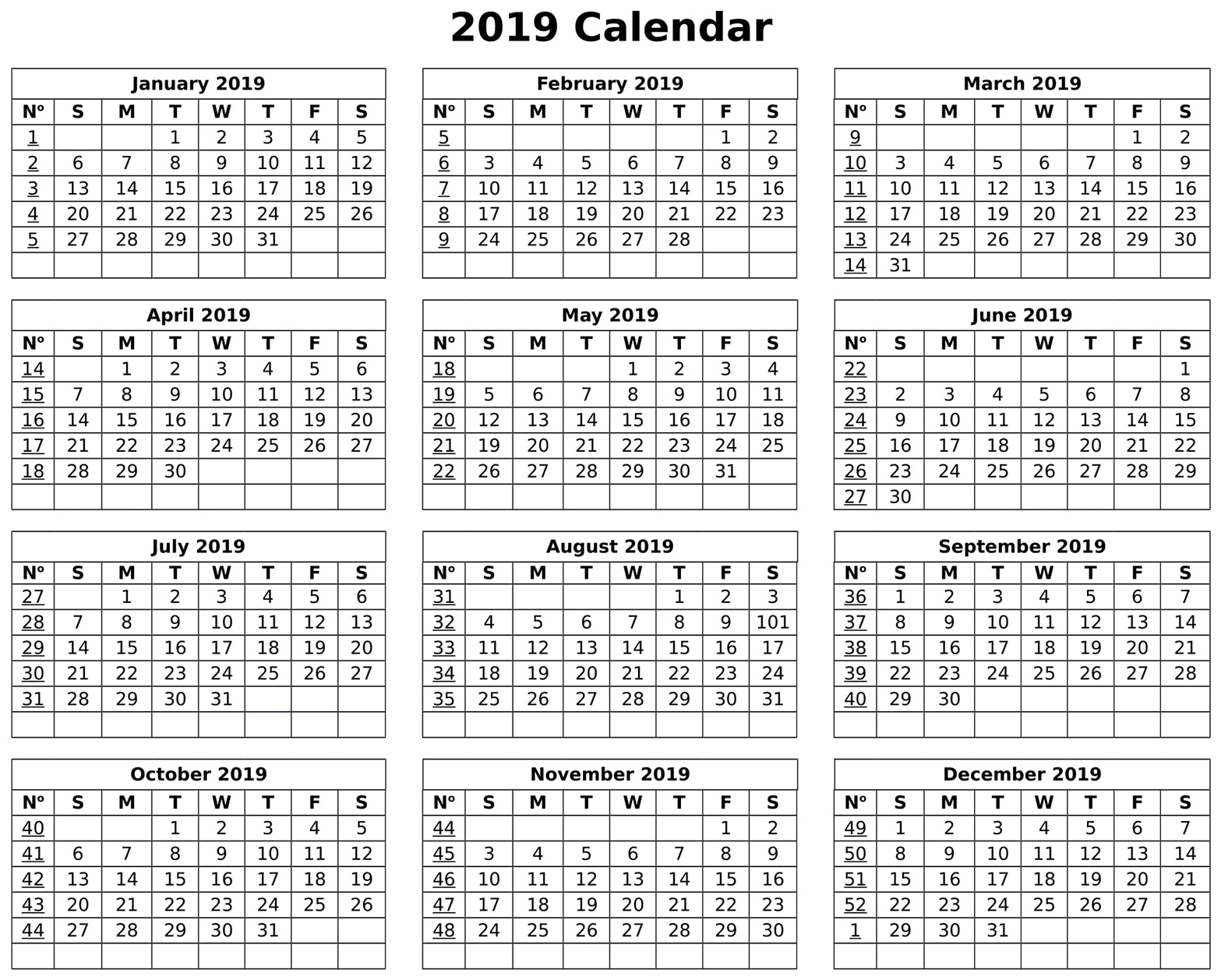

Benefits Of Fiscal Year Vs Calendar Year WEB Jun 1 2024 nbsp 0183 32 The main difference between a fiscal year and a calendar year is when they start and end A fiscal year can begin and end on any date while a calendar year always starts on January 1st and ends on December 31st Another key difference is that taxes are filed differently for each type of year

WEB Aug 20 2019 nbsp 0183 32 Potential Benefits Calendar year ends are simple and they coincide with the tax filing deadlines for individuals This may be convenient for entities that pass income through to individual owners However fiscal tax years are common in certain industries with fluctuating revenues and expenses WEB May 6 2024 nbsp 0183 32 The critical difference between a fiscal year and a calendar year is that the former can start on any day and end precisely on the 365th day In contrast the latter begins on the first of January and ends every year on the 31st of December

Benefits Of Fiscal Year Vs Calendar Year

Benefits Of Fiscal Year Vs Calendar Year

Benefits Of Fiscal Year Vs Calendar Year

https://jfwaccountingservices.cpa/wp-content/uploads/2022/08/Fiscal-Year-vs-Calendar-Year-1536x864.jpg

WEB A fiscal year is different from a calendar year because it does not begin on January 1 and end on December 31 Instead a fiscal year ends 12 months after it begins While a company can choose to start its fiscal year on any date it

Pre-crafted templates provide a time-saving option for producing a varied variety of documents and files. These pre-designed formats and designs can be utilized for various individual and expert projects, consisting of resumes, invites, flyers, newsletters, reports, presentations, and more, simplifying the material development process.

Benefits Of Fiscal Year Vs Calendar Year

Fiscal Year Vs Calendar Year Which Year Pastor Resources

:max_bytes(150000):strip_icc()/GettyImages-1182677883-c2c508c8615d45f694d11b17b7f4698d.jpg)

Calendar Year Meaning Vs Fiscal Year Pros Cons

Fiscal Year Vs Calendar Year

Fiscal Year VS Calendar Year For Business Taxes FundsNet

Fiscal Year Vs Calendar Year Marketing Calendar Template Yearly

Fiscal Year Vs Calendar Year Top 8 Differences You Must Know

https://www.investopedia.com/terms/c/calendaryear.asp

WEB Feb 11 2022 nbsp 0183 32 Advantages and Disadvantages of a Calendar Year Perhaps the biggest advantage of using the calendar year is simplicity For sole proprietors and small businesses tax reporting is often easier

https://www.investopedia.com/terms/f/fiscalyear.asp

WEB Mar 1 2024 nbsp 0183 32 Fiscal years can differ from a calendar year and are an important concern for accounting purposes because they are involved in federal tax filings budgeting and financial reporting

https://www.fool.com/.../fiscal-year-vs-calendar-year

WEB May 10 2024 nbsp 0183 32 The fiscal year a period of 12 months ending on the last day of the month does not line up with the traditional calendar year Learn when you should use each

https://gocardless.com/en-us/guides/posts/the...

WEB A fiscal year keeps income and expenses together on the same tax return while a calendar year splits them into two Calendar years enable easier year to year comparisons between businesses compared to two companies using different fiscal years How to choose between fiscal year and calendar year

https://smallbiztrends.com/fiscal-year-vs-calendar-year

WEB Apr 10 2023 nbsp 0183 32 Fiscal year Vs Calendar year Should your accounting period be aligned with the regular calendar year or should you define your own start and end dates Find out For tax accounting and even budgeting purposes it s important to know the difference between a fiscal year vs calendar year

WEB The calendar year is the most commonly used fiscal year and is the period from January 1st to December 31st This fiscal year is used by many businesses in the United States One of the benefits of using the calendar year is that it is easy to WEB Fiscal year vs calendar year which one is better for my business If the end of your natural business year isn t obvious a fiscal year might still be better than the standard calendar year Remember this isn t just a tax consideration picking an appropriate fiscal year could also make life easier for you your accountant your investors

WEB Feb 12 2024 nbsp 0183 32 Key Takeaways Fiscal year end refers to the completion of a one year or 12 month accounting period If a company has a fiscal year end that is the same as the calendar year end it