2022 Tax Rates Review the latest income tax rates thresholds and personal allowances in Finland which are used to calculate salary after tax when factoring in social security contributions pension contributions and other salary taxes in Finland

Personal income tax rates for resident individuals Finland taxes residents on their worldwide income Earned income received by residents is taxed at progressive tax rates for national tax How much Income Tax you pay in each tax year depends on Some income is tax free The current tax year is from 6 April 2025 to 5 April 2026 This guide is also available in Welsh

2022 Tax Rates

2022 Tax Rates

2022 Tax Rates

https://topdollarinvestor.com/wp-content/uploads/2022/11/2022-Federal-Income-Tax-Brackets-1.png

Return Form RF Filing Programme For The Year 2022 Return Form RF Filing Programme For The Year 2021 Filing Program For Documents Specified Under Section 82B Through MITRS

Templates are pre-designed files or files that can be used for numerous functions. They can save effort and time by offering a ready-made format and design for producing various type of content. Templates can be utilized for personal or professional jobs, such as resumes, invitations, leaflets, newsletters, reports, presentations, and more.

2022 Tax Rates

:max_bytes(150000):strip_icc()/2022TaxTableExample-a04b9e0f21ae4f0080ae5017bba3cb7f.png)

Tax Table 2022

Listed Here Are The Federal Tax Brackets For 2023 Vs 2022 Finapress

2022 Tax Rates

Income Tax Rates 2022 Vs 2023 PELAJARAN

Income Tax Rate Year 2023 Onwards

2022 Tax Rates Standard Deduction Amounts To Be Prepared In 2023

https://www.ato.gov.au › tax-rates-and-codes › tax...

Use the Simple tax calculator to work out just the tax you owe on your taxable income for the full income year Use the Income tax estimator to work out your tax refund or debt estimate

https://fi.icalculator.com › income-tax-rates

Finland Personal Income Tax Tables in 2022 The Income tax rates and personal allowances in Finland are updated annually with new tax tables published for Resident and Non resident taxpayers The Tax tables below include the tax

https://www.vero.fi › en › individuals › tax-cards-and...

You can use the tax rate calculator to estimate whether the tax rate indicated in your tax card needs to be changed This may be necessary if you have started or stopped working for

http://vero2.stat.fi › PXWeb › pxweb › en › Vero › Vero...

A Wage earners Wage income during the tax year is at least 10 000 euros and accounts for over 50 of the taxable total income earned income taxable capital income b Pensioners

https://taxfoundation.org › data › all › federal

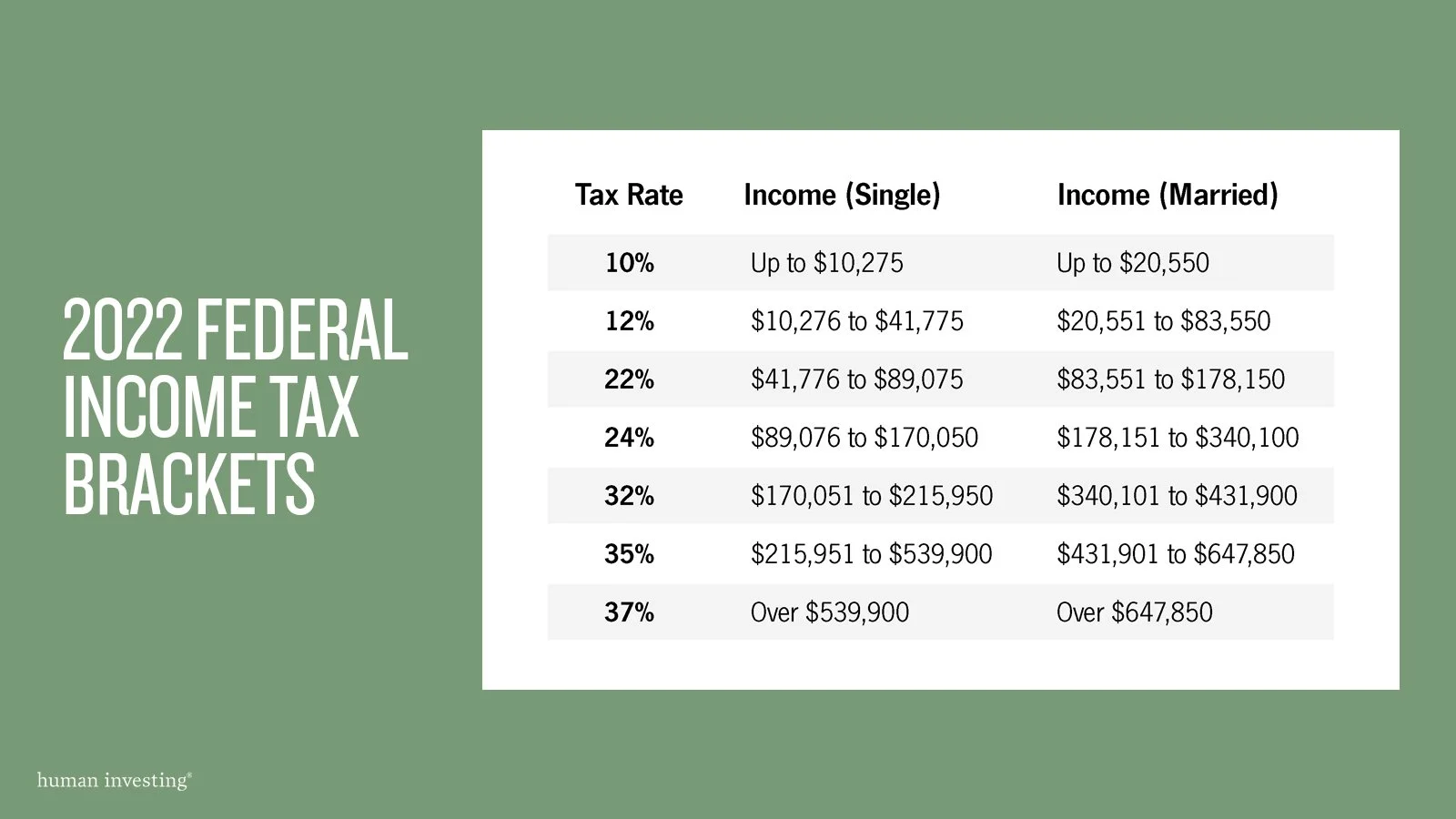

Nov 10 2021 nbsp 0183 32 Find out the income limits and tax rates for seven federal income tax brackets in 2022 adjusted for inflation by the IRS Learn about the standard deduction personal exemption alternative minimum tax and other tax

Feb 13 2025 nbsp 0183 32 See current federal tax brackets and rates based on your income and filing status Mar 15 2015 nbsp 0183 32 Corporate Tax Rates 2022 Corporate Tax Rates 2022 includes information on statutory national and local corporate income tax rates applicable to companies and branches

1 25 taken off all rates from 6th November 2022 Blended NIC rate for the year to be used for tax return self employed 10 25 9 73 3 25 2 73