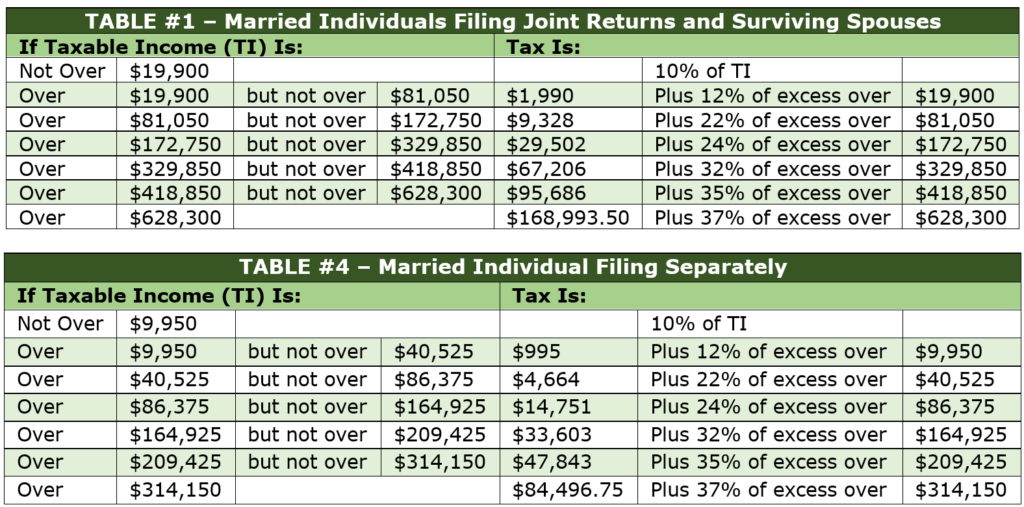

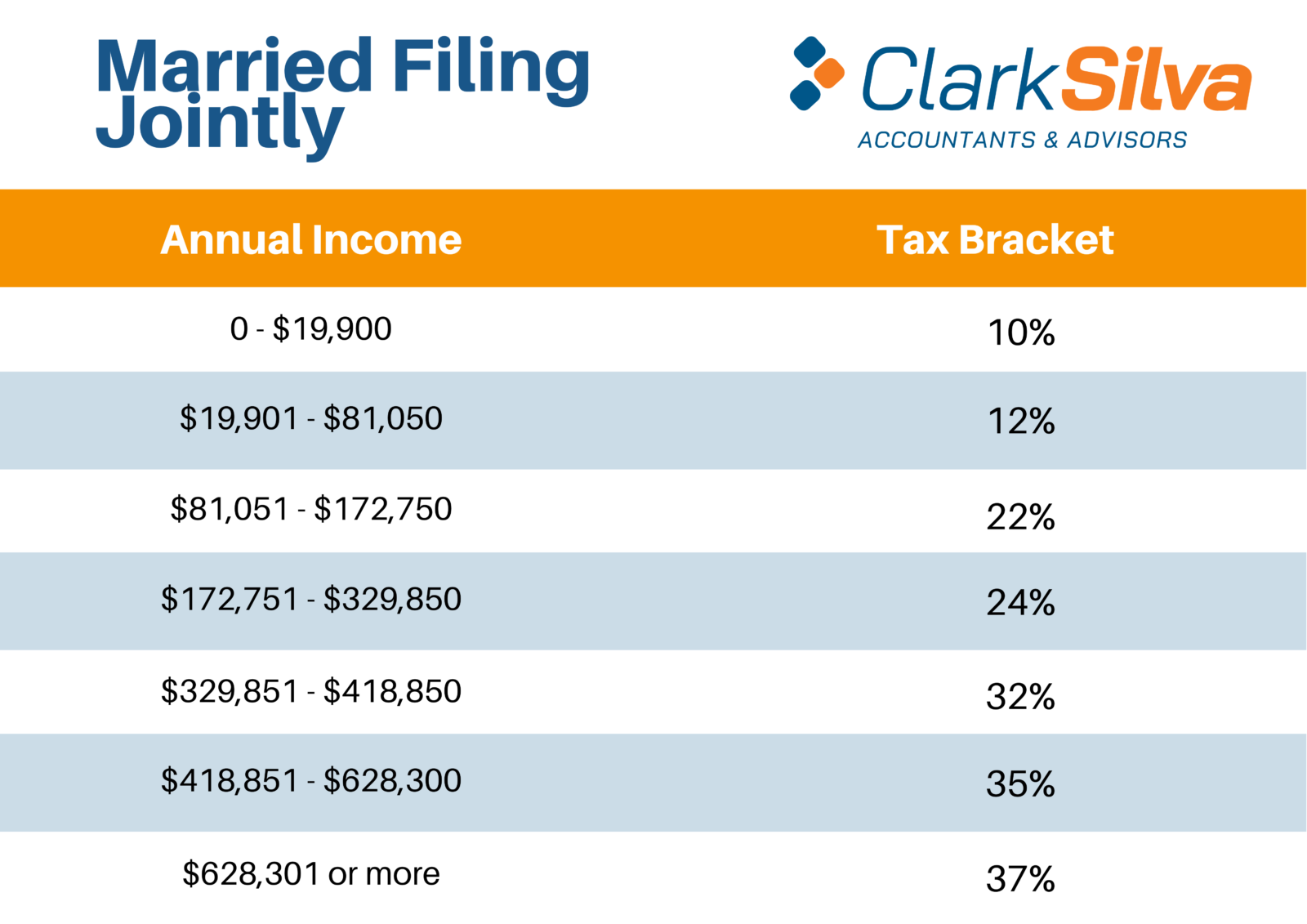

2021 Tax Rate Married Filing Jointly Web Jan 18 2024 nbsp 0183 32 The federal government imposes the federal income tax for individuals in the United States and determines different tax rates depending on the income earned in a given year Married filing jointly tax brackets 2021 Tax rate Taxable income bracket Tax owed 10 0 to 19 900 10 of taxable income 12 19 901 to 81 050

Web 2021 Tax Rate Schedule Standard Deductions amp Personal Exemption HEAD OF HOUSEHOLD For taxable years beginning in 2021 the standard deduction amount under 167 63 c 5 for an individual Kiddie Tax all net unearned income over a threshold amount of 2 200 for 2021 is taxed using the brackets and rates of the child s parents Web Oct 26 2020 nbsp 0183 32 Forbes Money Taxes Editors Pick IRS Releases 2021 Tax Rates Standard Deduction Amounts And More Kelly Phillips Erb Forbes Staff I write about tax news tax policy and tax

2021 Tax Rate Married Filing Jointly

2021 Tax Rate Married Filing Jointly

2021 Tax Rate Married Filing Jointly

https://federalwithholdingtables.net/wp-content/uploads/2021/07/federal-income-tax-brackets-released-for-2021-has-yours-1.png

Web Find out your 2021 federal income tax bracket with user friendly IRS tax tables for married individuals filing joint returns heads of households unmarried individuals married individuals filing separate returns and estates and trusts 1 Married Individuals Filing Joint Returns amp Surviving Spouses Heads of Households

Pre-crafted templates offer a time-saving service for developing a varied range of files and files. These pre-designed formats and layouts can be utilized for different individual and professional projects, including resumes, invitations, flyers, newsletters, reports, presentations, and more, improving the material production process.

2021 Tax Rate Married Filing Jointly

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

Federal Income Tax Deduction Chart My XXX Hot Girl

2022 Tax Brackets Married Filing Jointly Irs Printable Form

Irs Tax Tables 2021 Calculator Federal Withholding Tables 2021

Irs Tax Table 2022 Married Filing Jointly Latest News Update

Consequences Of Filing Married Separately Tax Secrets

IRS Releases Key 2021 Tax Information standarddeduction2021

https://taxfoundation.org/data/all/federal/2021-tax-brackets

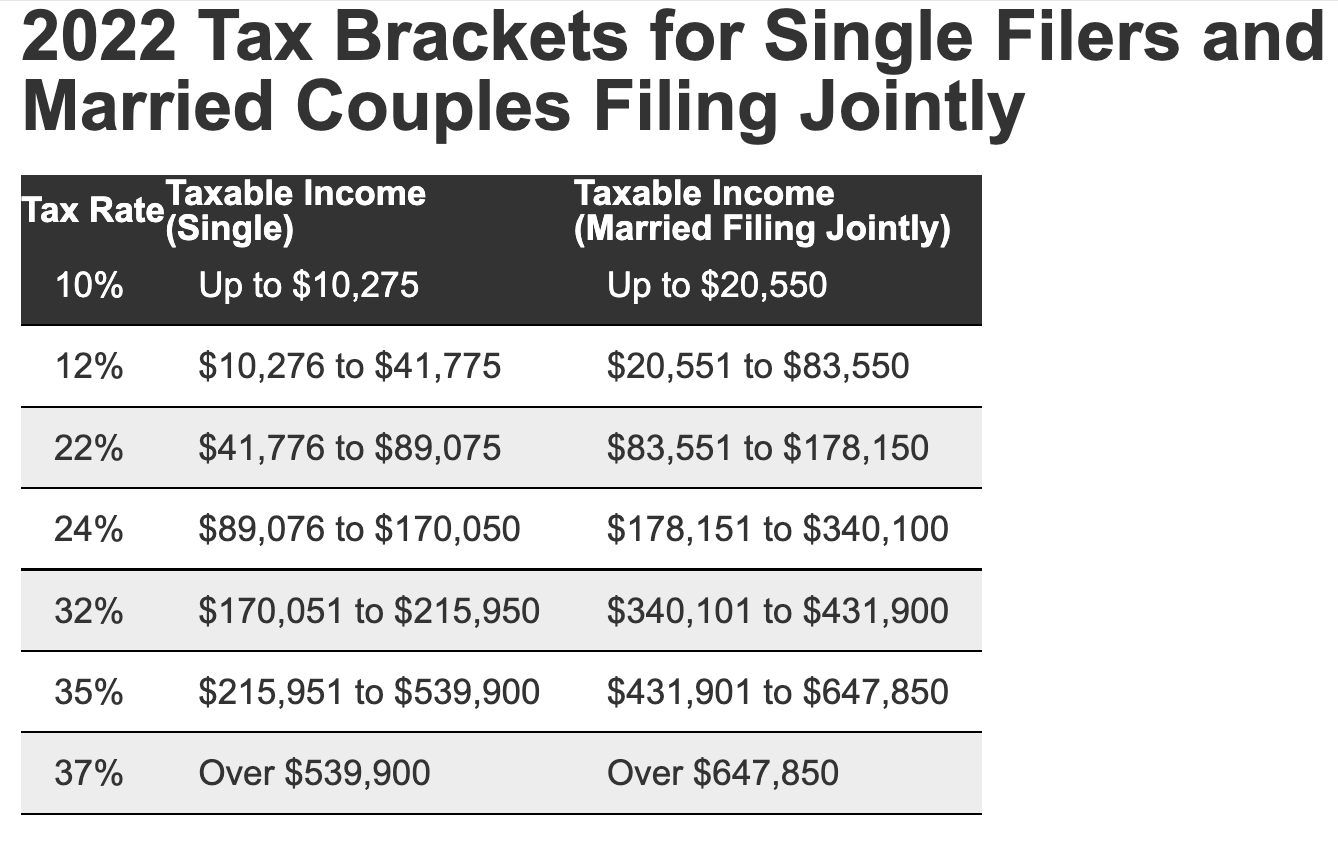

Web Oct 27 2020 nbsp 0183 32 2021 Federal Income Tax Brackets and Rates for Single Filers Married Couples Filing Jointly and Heads of Households Tax Rate For Single Filers Taxable Income For Married Individuals Filing Joint Returns Taxable Income For Heads of Households Taxable Income 10 Up to 9 950 Up to 19 900 Up to 14 200 12

https://www.irs.gov/newsroom/irs-provides-tax...

Web Oct 26 2020 nbsp 0183 32 The standard deduction for married couples filing jointly for tax year 2021 rises to 25 100 up 300 from the prior year For single taxpayers and married individuals filing separately the standard deduction rises to 12 550 for 2021 up 150 and for heads of households the standard deduction will be 18 800 for tax year 2021 up 150

https://www.irs.gov/filing/federal-income-tax-rates-and-brackets

Web 3 days ago nbsp 0183 32 As your income goes up the tax rate on the next layer of income is higher When your income jumps to a higher tax bracket you don t pay the higher rate on your entire income Married filing jointly or qualifying surviving spouse Tax rate on taxable income from up to 10 0 20 550 12 20 551 83 550 22 84 551

https://www.irs.gov/pub/irs-prior/i1040tt--2021.pdf

Web married filing jointly and read down the column The amount shown where the taxable income line and filing status column meet is 2 641 This is the tax amount they should enter in the entry space on Form 1040 line 16 If line 15 taxable income is And you are At least But less than Single Married filing jointly Married filing sepa

https://www.bankrate.com/taxes/2021-tax-bracket-rates

Web Jan 17 2023 nbsp 0183 32 Tax rate Single Head of household Married filing jointly or qualifying widow Married filing separately 10 0 to 9 950 0 to 14 200 0 to 19 900 0 to 9 950 12 9 951 to 40 525

Web Jul 14 2021 nbsp 0183 32 Table of Contents Personal tax bracket for 2021 Married filing separately tax bracket 2021 Head of household tax bracket 2021 Standard Deduction for Tax Year 2021 Alternative Minimum Tax Exemption Alternative Minimum Tax Phaseout 2021 Estate Income Tax Rate 2021 Earned Income Tax Credit Child Tax Credit Web Jan 9 2024 nbsp 0183 32 39 95 2 TaxSlayer Premium Learn More On TaxSlayer s Website Federal Filing Fee 0

Web Income Tax Calculator The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return It is mainly intended for residents of the U S and is based on the tax brackets of 2023 and 2024 The 2024 tax values can be used for 1040 ES estimation planning ahead or comparison Income Person 1 Husband Earned Income