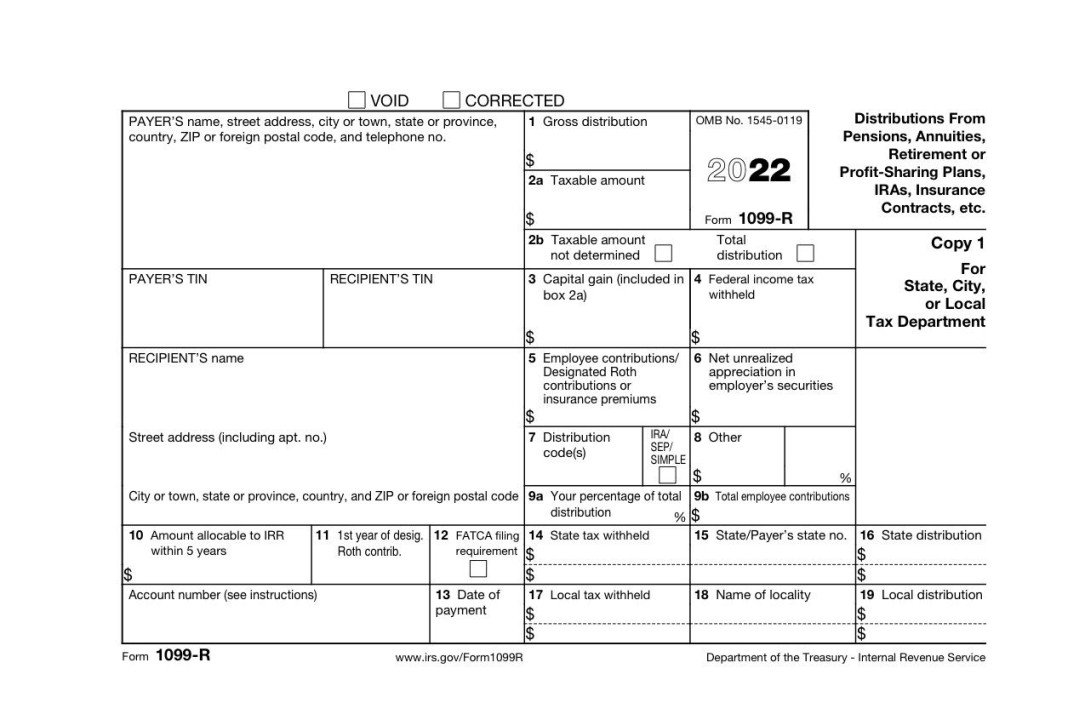

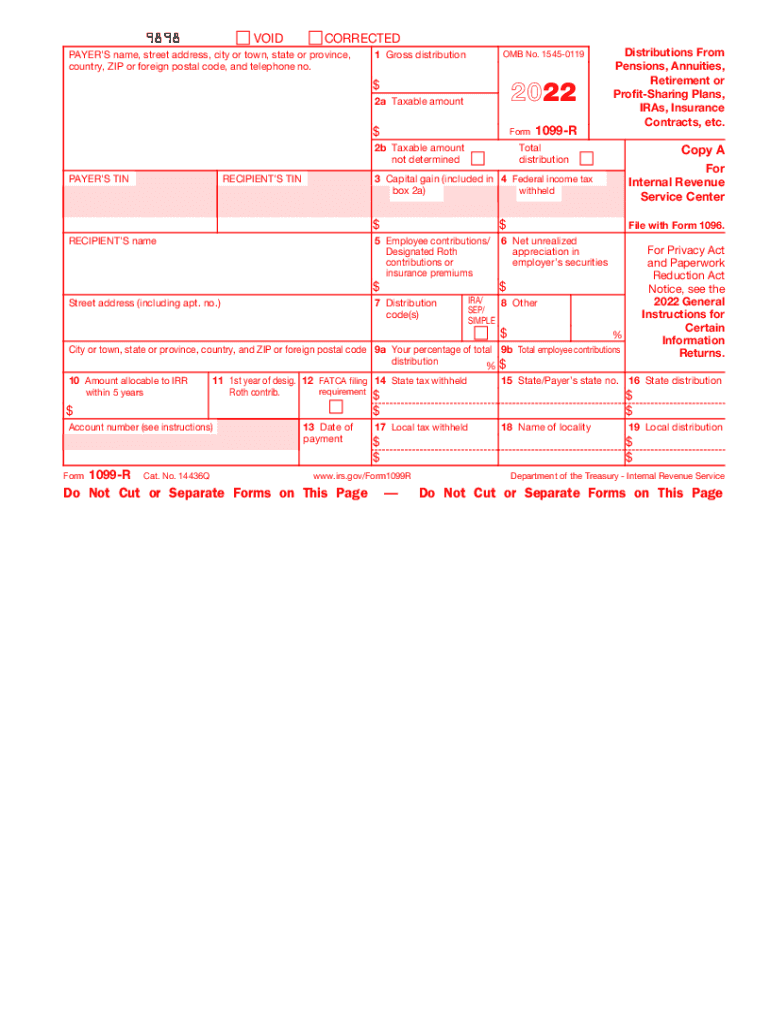

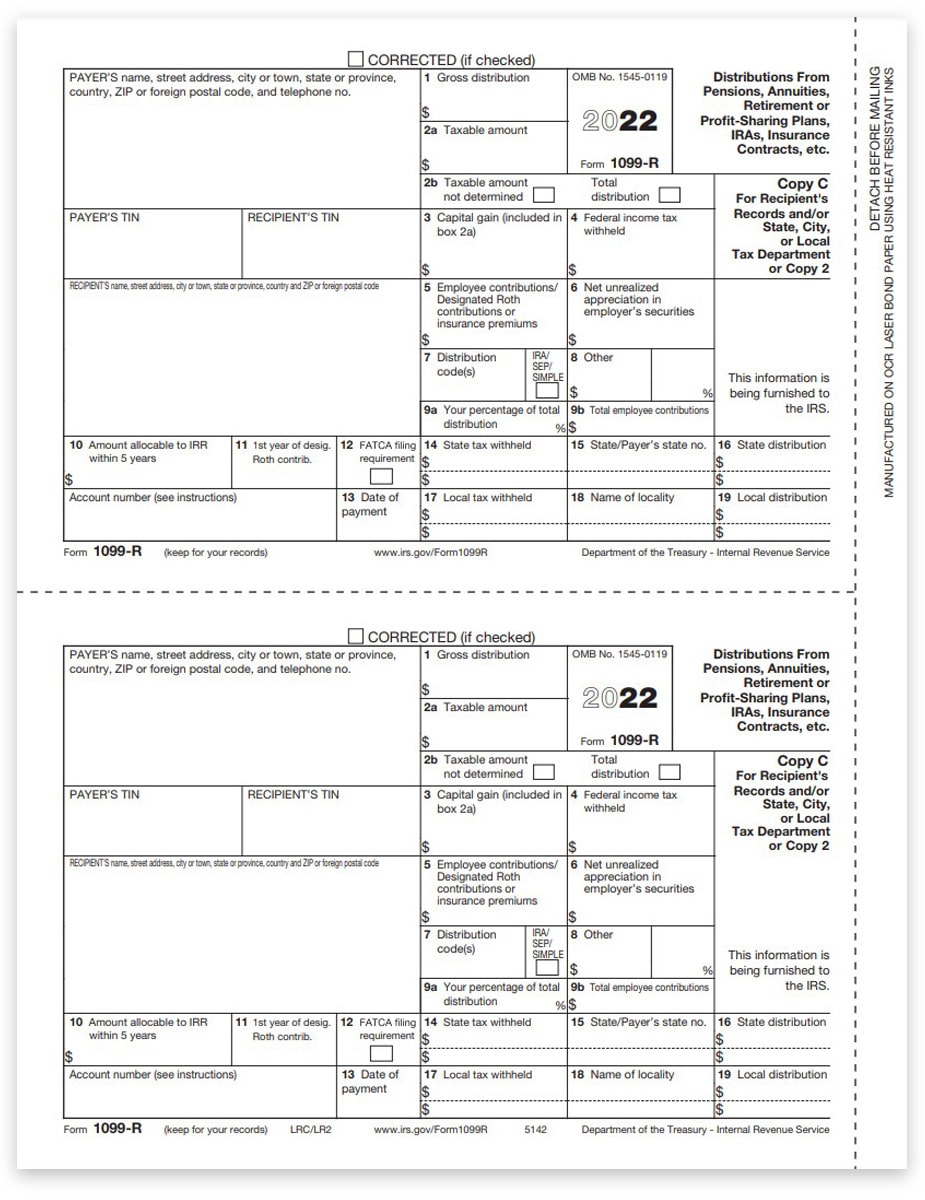

1099 R Form 2022 Pdf To ease statement furnishing requirements Copies B C D 1 and 2 have been made fillable online in a PDF format available at IRS gov Form1099R and IRS gov Form5498 You can

2022 Form 1099 R Attention Copy A of this form is provided for informational purposes only Copy A appears in red similar to the official IRS form The official printed version of Copy A of Form 1099 R 2025 Distributions From Pensions Annuities Retirement or Profit Sharing Plans IRAs Insurance Contracts etc Department of the Treasury Internal Revenue Service Copy

1099 R Form 2022 Pdf

1099 R Form 2022 Pdf

1099 R Form 2022 Pdf

https://www.pdffiller.com/preview/533/156/533156767/big.png

To ease statement furnishing requirements Copies B C 1 and 2 have been made fillable online in a PDF format available at IRS gov Form1099R and IRS gov Form5498 You can complete

Templates are pre-designed files or files that can be used for numerous purposes. They can save effort and time by offering a ready-made format and design for developing different sort of material. Templates can be used for personal or professional projects, such as resumes, invites, leaflets, newsletters, reports, discussions, and more.

1099 R Form 2022 Pdf

As A Freelancer Am I Required To File A 1099 Form

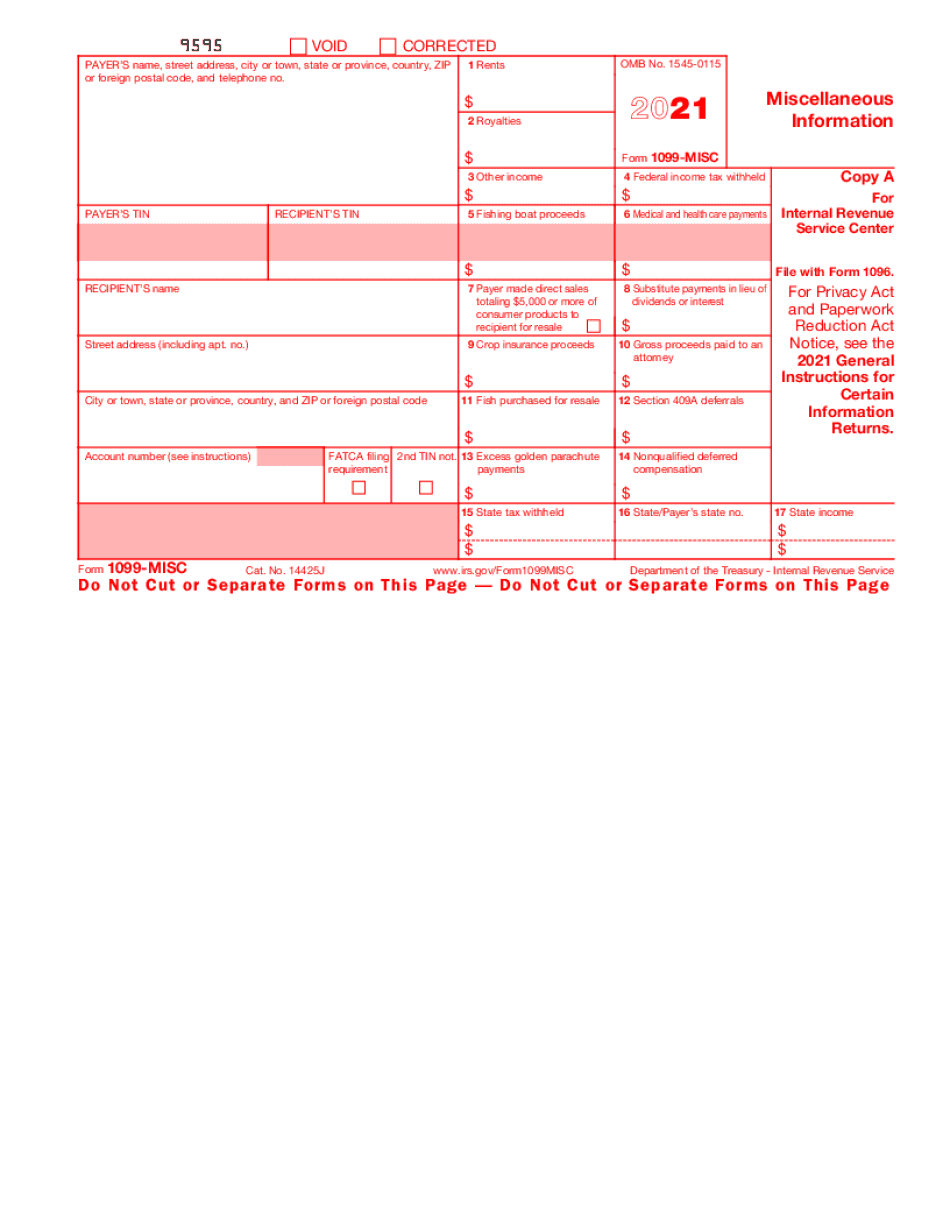

1099 Form 2022

2023 Form 1099 R Printable Forms Free Online

1099 R Form 2022 Fill Out Sign Online DocHub

1099 Form 2022

1099R Tax Forms For 2022 Copy C 2 Recipient ZBPforms

https://eforms.com › irs › r

Jan 28 2025 nbsp 0183 32 A 1099 R form is used by payers trustees and plan administrators to report designated distributions from profit sharing and retirement plans when

https://www.pdfrun.com › form

Form 1099 R Distributions From Pensions Annuities Retirement or Profit Sharing Plans is an Internal Revenue System IRS tax form used for reporting

:max_bytes(150000):strip_icc()/1099B2022-95af0a55817a4b8ea69f159a8c8451c1.jpg?w=186)

https://pdf4pro.com › view

Generally distributions from retirement plans IRAs qualified plans section 403 b plans and governmental section 457 b plans insurance contracts etc are reported to recipients on Form 1099 R

https://www.pdffiller.com

Form 1099 R is the Internal Revenue Service form reporting a taxpayer s distributions from pensions annuities IRAs insurance contracts profit sharing plans and or retirement plans

:max_bytes(150000):strip_icc()/1099-R2022-2372bb9e77514c4a8af4bcc393b6cd36.jpeg?w=186)

https://www.opm.gov › support › retirement › how-to

Get your 1099 R tax form Learn how to view download print or request by mail your annual 1099 R tax form that reports how much income you earned from your annuity

Feb 28 2025 nbsp 0183 32 If you have questions about reporting on Form 1099 R call the information reporting customer service site toll free at 866 455 7438 or 304 263 8700 not toll free Your IRS 1099 R shows the money paid to you by TCDRS in 2022 You will need it to fill out your 2022 income tax forms TCDRS will post your 1099 R to your online account and mail you a

2022 1099 R Instructions for Recipient Generally distributions from retirement plans IRAs qualified plans section 403 b plans and governmental section 457 b plans insurance