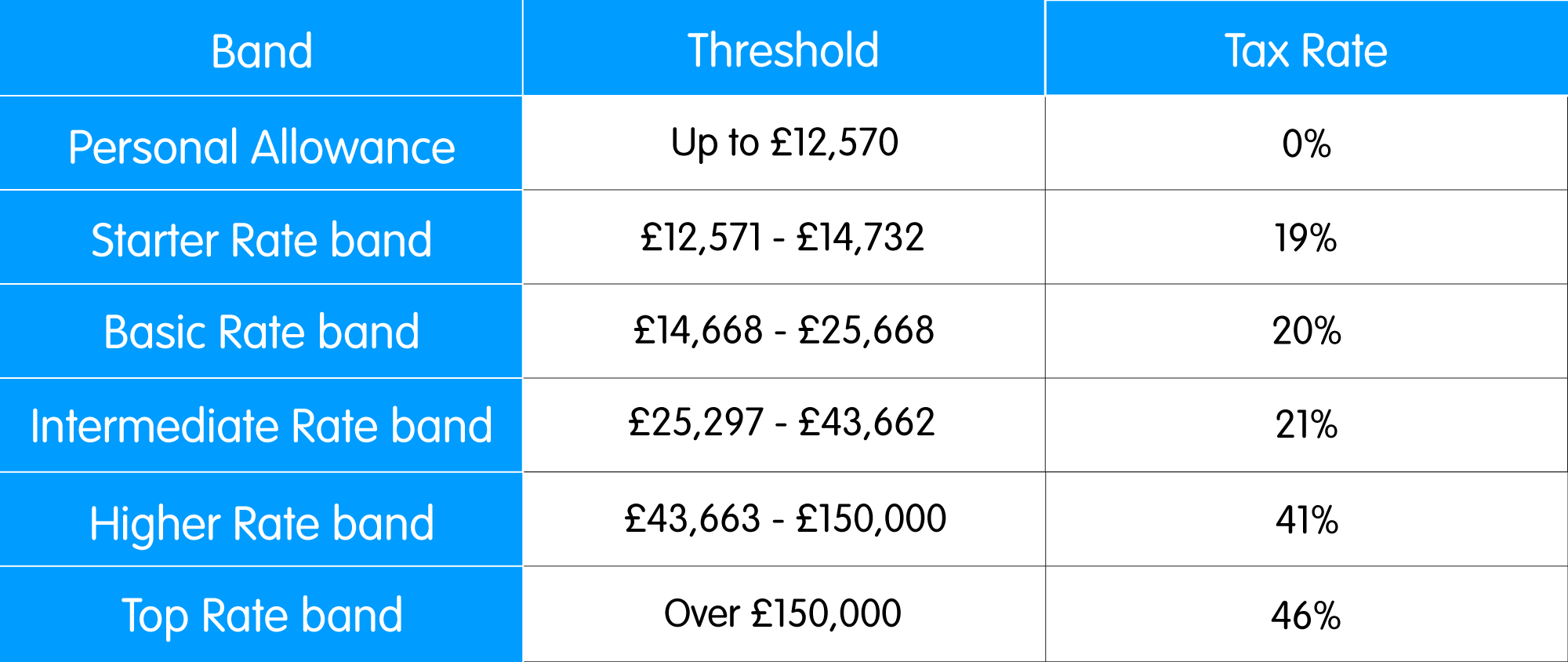

What Is The Uk Tax Threshold 2023 WEB Jun 30 2022 nbsp 0183 32 UK Income Tax bands for 2023 24 Everyone who earns income in the UK has a tax free personal allowance of 163 12 570 per year

WEB Jan 8 2024 nbsp 0183 32 The primary threshold is set at 163 242 per week for 2023 24 The secondary threshold is set at 163 175 per week for 2023 24 The upper earnings limit is set at 163 967 per week for 2023 24 so that it remains aligned with the income tax higher rate threshold All three thresholds are unchanged from 2022 23 WEB Feb 2 2024 nbsp 0183 32 The Personal Tax Amount allows you to earn up to 163 12 570 before you have to start paying any income tax National Insurance Contributions NICs pay for your State Pension and other state benefits and are determined based on income Dividend allowances let you earn up to 163 2 000 in dividends from company shares tax free

What Is The Uk Tax Threshold 2023

What Is The Uk Tax Threshold 2023

What Is The Uk Tax Threshold 2023

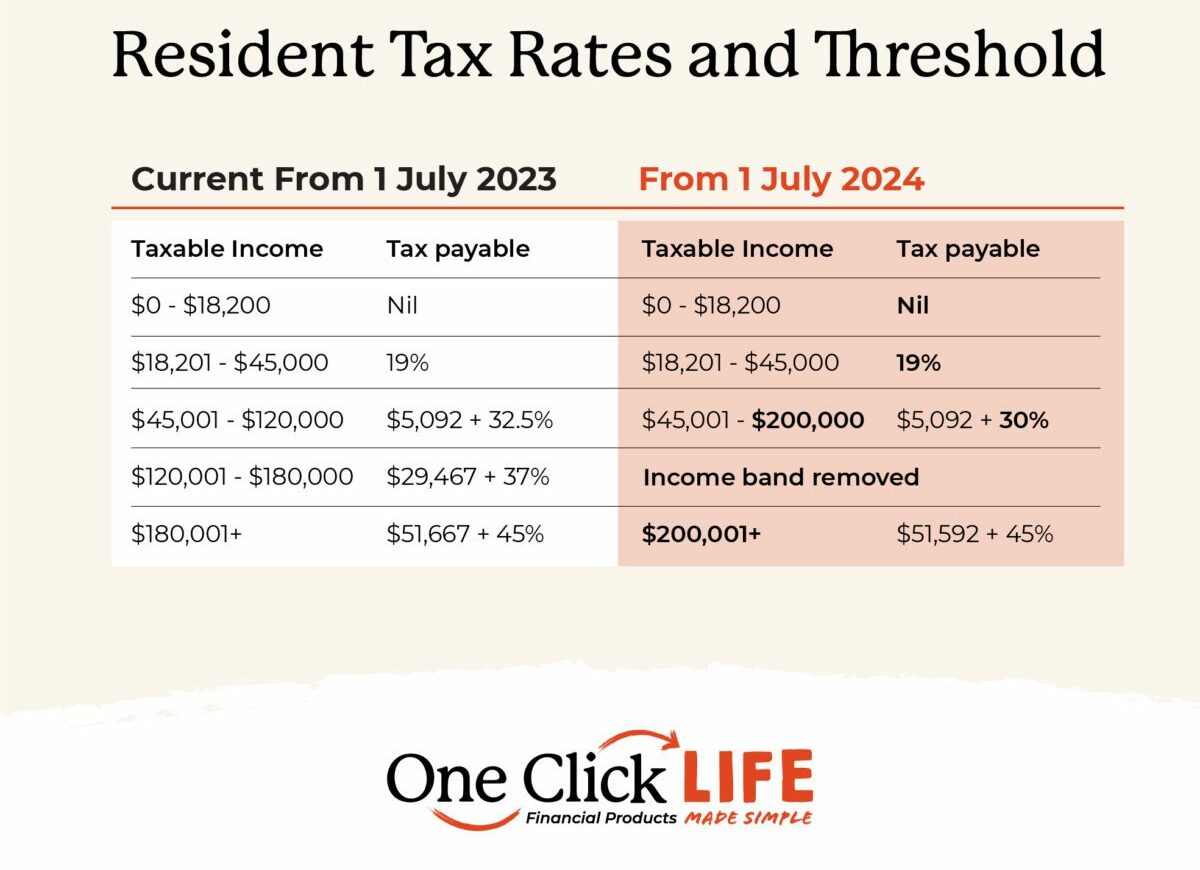

https://oneclicklife.com.au/wp-content/uploads/2023/04/Budget-Tax-Rates-Threshold-01-scaled-e1681366579595.jpg

WEB Apr 5 2024 nbsp 0183 32 What are the income tax rates across the UK in 2023 24 and 2024 25 Most people in the UK have a 163 12 570 tax free personal allowance If you live in England Wales or Northern Ireland there are three income tax bands and rates above the tax free personal allowance that apply depending on your income

Templates are pre-designed documents or files that can be used for different purposes. They can conserve time and effort by offering a ready-made format and design for developing various type of material. Templates can be utilized for personal or expert tasks, such as resumes, invitations, leaflets, newsletters, reports, presentations, and more.

What Is The Uk Tax Threshold 2023

2022 Tax Brackets Irs Calculator

Income Tax Threshold Rates And Allowances For 2023 24

VAT Threshold Tax Taccount

Oct 19 Irs Here Are The New Income Tax Brackets For 2023 Free Nude

Choosing A Tax Expert To Prepare Your Self Assessment Return

Personal Tax Planning Guide 22

https://www.gov.uk/government/publications/rates...

WEB Jan 15 2024 nbsp 0183 32 Higher rate for tax years up to and including 2022 to 2023 41 163 31 093 to 163 150 000 163 31 093 to 163 150 000 Advanced rate for tax years up to and including 2024 to 2025 45

https://www.gov.uk/guidance/rates-and-thresholds...

WEB Feb 27 2023 nbsp 0183 32 The standard employee personal allowance for the 2023 to 2024 tax year is 163 242 per week 163 1 048 per month 163 12 570 per year

https://www.which.co.uk/money/tax/income-tax/tax...

WEB Apr 5 2024 nbsp 0183 32 If you live in England Wales or Northern Ireland there are three income tax bands and rates above the tax free personal allowance the basic rate 20 the higher rate 40 and the additional rate 45 The rate you pay depends on the portion of your taxable income that fits into the tax bands

https://www.uktaxcalculators.co.uk/tax-rates/2023-2024

WEB 2023 2024 Tax Rates and Allowances Click to select a tax section Income Tax Use our Tax Calculator to Calculate Income Tax Tax Free Personal Allowance the amount of gross income you can earn before you are liable to paying income tax

https://www.moneysavingexpert.com/banking/tax-rates

WEB For the 2024 25 tax year if you live in England Wales or Northern Ireland there are three marginal income tax bands the 20 basic rate the 40 higher rate and the 45 additional rate also remember your personal allowance starts to

WEB Jan 1 2014 nbsp 0183 32 Corrected the Income Tax starting rate for savings for England Northern Ireland Wales and Scotland to 0 6 April 2023 Rates allowances for Income Tax have been updated for the tax year 2023 WEB Jun 15 2023 nbsp 0183 32 UK Tax rates tax thresholds tax bands and tax allowances for the 2022 23 and 2023 24 tax years Lucinda Watkinson Updated on June 15 2023 Self Assessment tax returns done for you Get tax sorted Find out more The UK has many different tax rates thresholds and allowances affecting individuals and businesses

WEB Money Tax 01 Jan 2023 6 tax changes to watch out for in 2023 From income tax freezes to capital gains tax allowance cuts find out what changes will affect your money this year Matthew Jenkin Senior writer