What Is The Tax Year For 2023 Jan 28 2025 nbsp 0183 32 The payment may include a related provincial or territorial benefit amount Tax filing and payment deadline The tax filing deadline for most individuals is April 30 2025 This is

Tax assessment or reassessment This section provides a summary of the key line numbers and amounts used to assess or reassess your tax return If changes were made to your return an Mar 1 2024 nbsp 0183 32 How much tax will I pay on my retirement lump sum withdrawals From age 55 you can take up to one third of your retirement fund Retirement Annuity Company Pension Fund

What Is The Tax Year For 2023

What Is The Tax Year For 2023

What Is The Tax Year For 2023

https://substackcdn.com/image/fetch/f_auto,q_auto:good,fl_progressive:steep/https://bucketeer-e05bbc84-baa3-437e-9518-adb32be77984.s3.amazonaws.com/public/images/e23b505f-ffa6-4e69-9c23-dde3138f86cc_2100x1500.png

2 days ago nbsp 0183 32 Learn how to file your GST HST return using the online NETFILE form and whether this method meets your needs

Templates are pre-designed files or files that can be used for numerous functions. They can save time and effort by supplying a ready-made format and design for producing various sort of content. Templates can be used for individual or expert jobs, such as resumes, invitations, flyers, newsletters, reports, discussions, and more.

What Is The Tax Year For 2023

How To Calculate Tax In Australia One Click Life

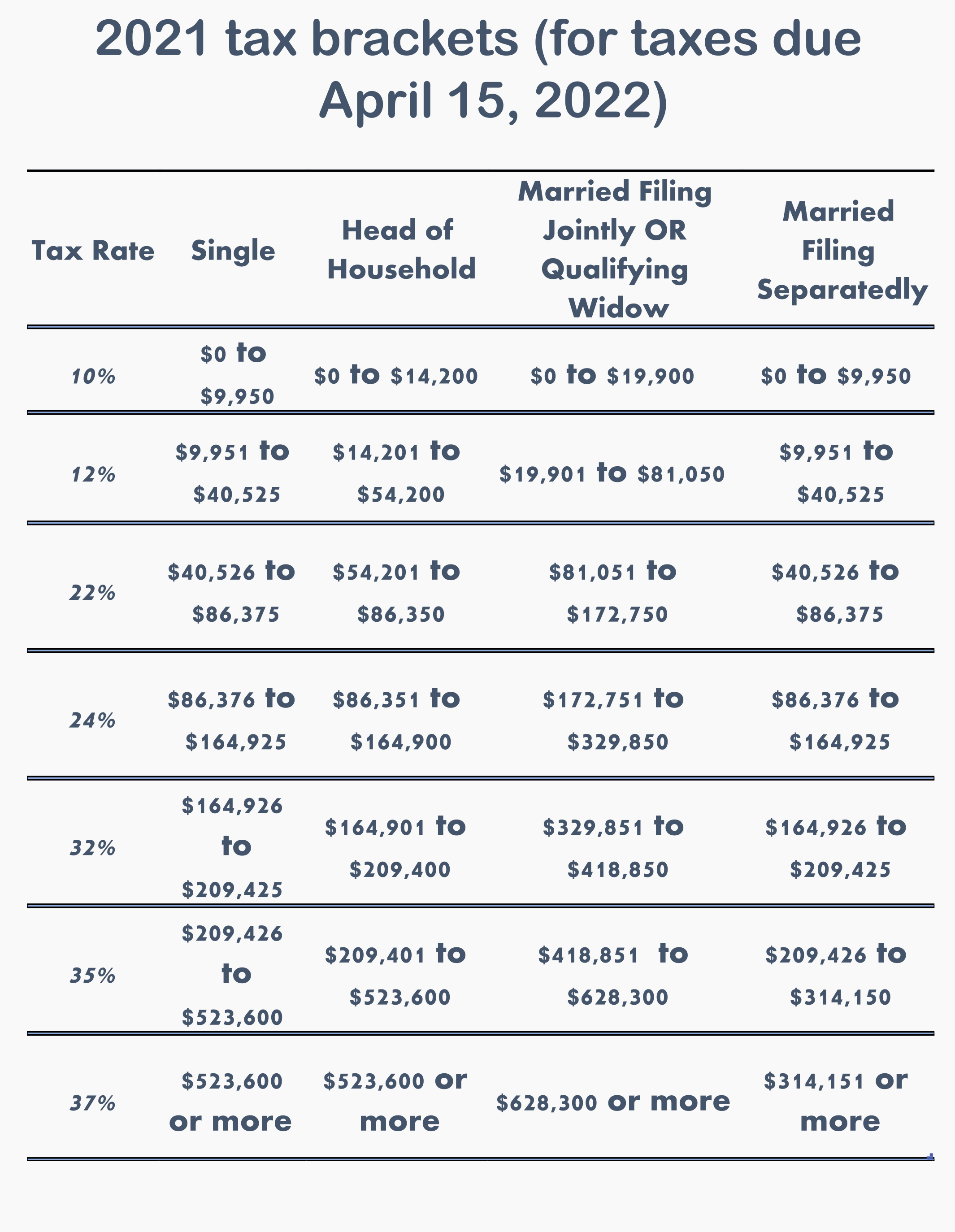

These Are The Us Federal Tax Brackets For 2021 And 2020 Vs 2021 Free

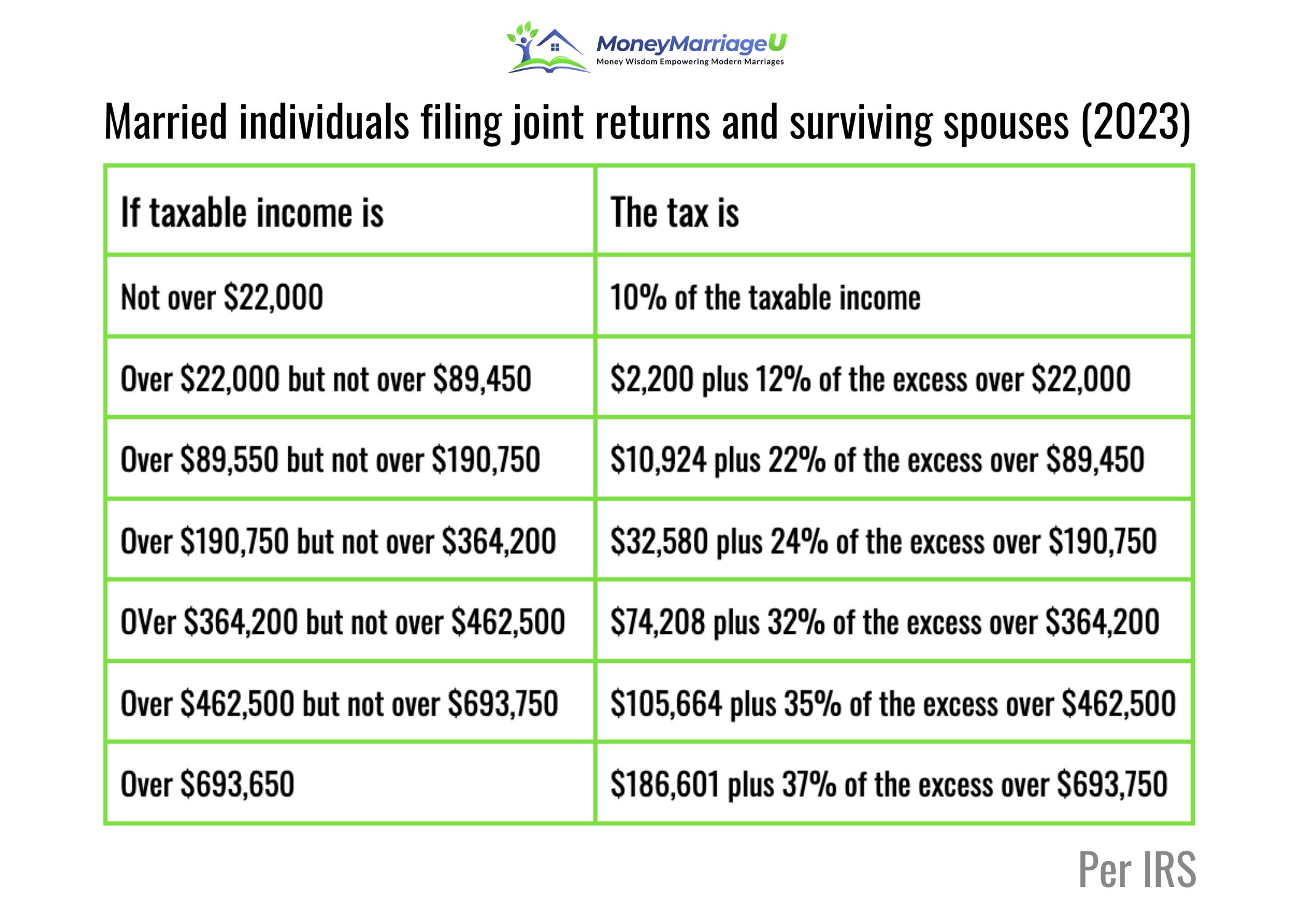

2023 Federal Tax Brackets 2023

What Is The Tax Rate In America

CARPE DIEM Average Federal Income Tax Rates By Income Group Are Highly

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

Exoticbatman Blog

https://www.canada.ca › en › revenue-agency

The Canada Revenue Agency CRA administers tax laws for the government providing contacts services and information related to payments taxes and benefits for individuals and businesses

https://www.canada.ca › en › department-finance › news › delivering-a-…

May 27 2025 nbsp 0183 32 The middle class tax cut would reduce the tax rate that is applied to the first 57 375 in 2025 of an individual s taxable income regardless of their income level As shown

https://www.canada.ca › en › revenue-agency › news › newsroom › tax-ti…

Filing through a tax preparer If you don t do your taxes on your own an EFILE certified tax preparer like an accountant can file your income tax and benefit return for you Tax preparers

https://www.canada.ca › en › revenue-agency › news › newsroom › tax-ti…

Jan 15 2025 nbsp 0183 32 This tax season the Canada Revenue Agency CRA has simplified its sign in process making it easier to access the My Account My Business Account and Represent a

https://www.canada.ca › en › services › taxes › income-tax › personal-in…

Jul 9 2025 nbsp 0183 32 NETFILE service in tax software that allows most people to submit a personal income tax return electronically to the Canada Revenue Agency

[desc-11] [desc-12]

[desc-13]