What Is The Rolling 12 Month Period For 401k Loan Web Oct 5 2021 nbsp 0183 32 A 401 k loan is a loan you take out from your own 401 k account They work like normal loans you pay origination fees and interest only you re borrowing money

Web Feb 18 2023 nbsp 0183 32 In total you can contribute up to 20 500 in 2022 22 500 in 2023 or 27 000 if you re age 50 or older 30 000 in 2023 By borrowing from that 401 k Web Although you can take out more than one 401 k loan at once the maximum combined outstanding loan limit may be lower than 50 000 if you take out more than one loan

What Is The Rolling 12 Month Period For 401k Loan

What Is The Rolling 12 Month Period For 401k Loan

What Is The Rolling 12 Month Period For 401k Loan

https://www.gannett-cdn.com/-mm-/4f1aaefb83599761e560c64d1397c3e4146411c7/c=0-104-3453-2055/local/-/media/USATODAY/None/2014/10/30/635502730928573425-177287438.jpg?width=3200&height=1680&fit=crop

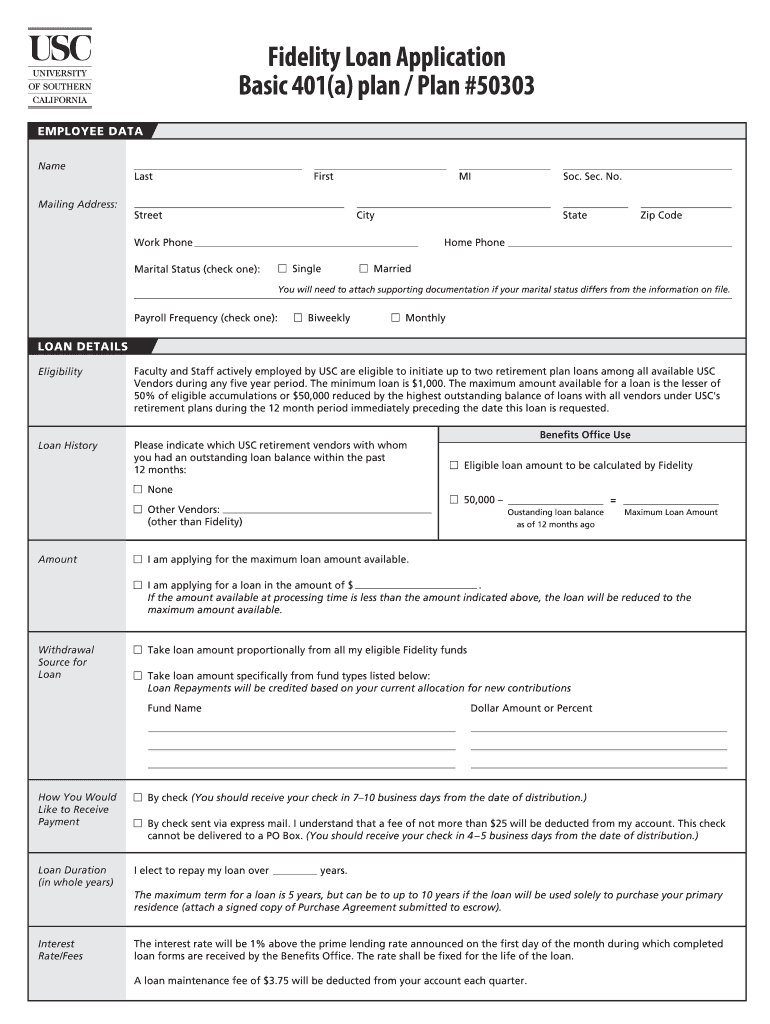

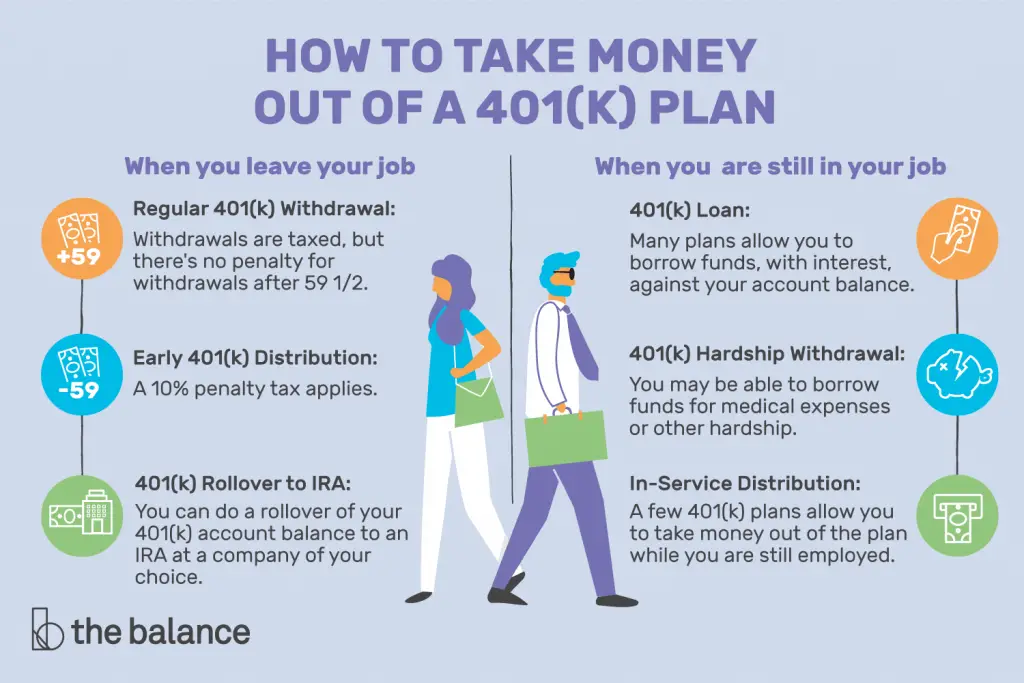

Web Nov 21 2023 nbsp 0183 32 By law individuals are allowed to borrow the lesser of 50 000 or 50 of the total amount of the 401 k in a 12 month period

Templates are pre-designed files or files that can be utilized for numerous functions. They can conserve time and effort by offering a ready-made format and design for developing various sort of material. Templates can be used for individual or professional jobs, such as resumes, invites, leaflets, newsletters, reports, presentations, and more.

What Is The Rolling 12 Month Period For 401k Loan

401k Early Withdrawal Tax Calculator AndrenaCarla

How Much Should I Have In My 401k During My 20 s 30 s 40 s And 50 s

Fidelity 401k Loan Waiting Period Form Fill Out And Sign Printable

+Loan+financial+planning+investment+management+CFP+independent+RIA+retirement+planning+tax+preparation+financial+advisor+Ridgewood+Bergen+County+NJ+Poughkeepsie+NY+fiduciary.png)

Do 401k Loans Count As Debt Leia Aqui Does A 401k Loan Count Against

4 Reasons You Need A 401k Loan Repayment Calculator Small Business Brain

Can You Take Loans From 401k Forkesreport

https://www.meetbeagle.com/.../post/when-can-i-take-another-401…

Web If you have an existing 401 k loan you can take another 401 k loan at any time based on the highest outstanding balance in the previous 12 months However if you have

https://about401k.com/loan

Web Rather the IRS has established rules that allow a plan participant to take no more than 50 of his or her vested balance up to a maximum of 50 000 in a rolling 12 month

https://feelingfinancial.com/how-to-borrow-from-your-401k

Web If you need funds find out as soon as possible how long turnaround times typically are Your HR or benefits contact is the best person to ask Ultimately it depends on how quickly

https://seekingalpha.com/article/4484440-401k-loan

Web Apr 25 2022 nbsp 0183 32 A 401k loan can be used to consolidate debt and can often provide a more flexible repayment schedule There is also no credit check or credit impact associated

https://www.cnbc.com/select/when-a-401k-loan-makes-sense

Web Dec 29 2023 nbsp 0183 32 You have no other viable options A 401 k loan may make sense if you ve explored all other avenues or if the alternative is high interest credit card debt All else

Web Dec 5 2022 nbsp 0183 32 The Repayment Period for 401 k Loans You re required to repay the money with interest over a period of 60 months when you borrow from your 401 k account Web May 27 2022 nbsp 0183 32 Key Takeaways 401 k loans are typically limited to 50 000 or 50 of your vested account balance whichever is less In most cases you have up to five years to

Web 50 000 reduced by the excess of the highest outstanding balance of all Jim s loans during the 12 month period ending on the day before the new loan in this example 27 000