What Is The Medicare Tax Limit For 2023 Web Per the IRS as of 2023 the Medicare tax rates are as follows 2023 Medicare Tax Rates Employer medicare tax rate Employers are responsible for paying 1 45 of the employee s wages as Medicare tax Employee medicare tax rate Employees are required to contribute 1 45 of their wages as Medicare tax Combined medicare tax rate

Web Dec 5 2023 nbsp 0183 32 The Medicare tax rate for 2023 and 2024 is 2 9 and is split between employees and their employer with each paying 1 45 It s a mandatory payroll tax applied to earned income and wages Web Jan 22 2024 nbsp 0183 32 Reviewed by Erika Rasure Fact checked by Pete Rathburn What Is Medicare Tax Medicare tax is a federal employment tax that funds a portion of the Medicare insurance program In 2024

What Is The Medicare Tax Limit For 2023

What Is The Medicare Tax Limit For 2023

What Is The Medicare Tax Limit For 2023

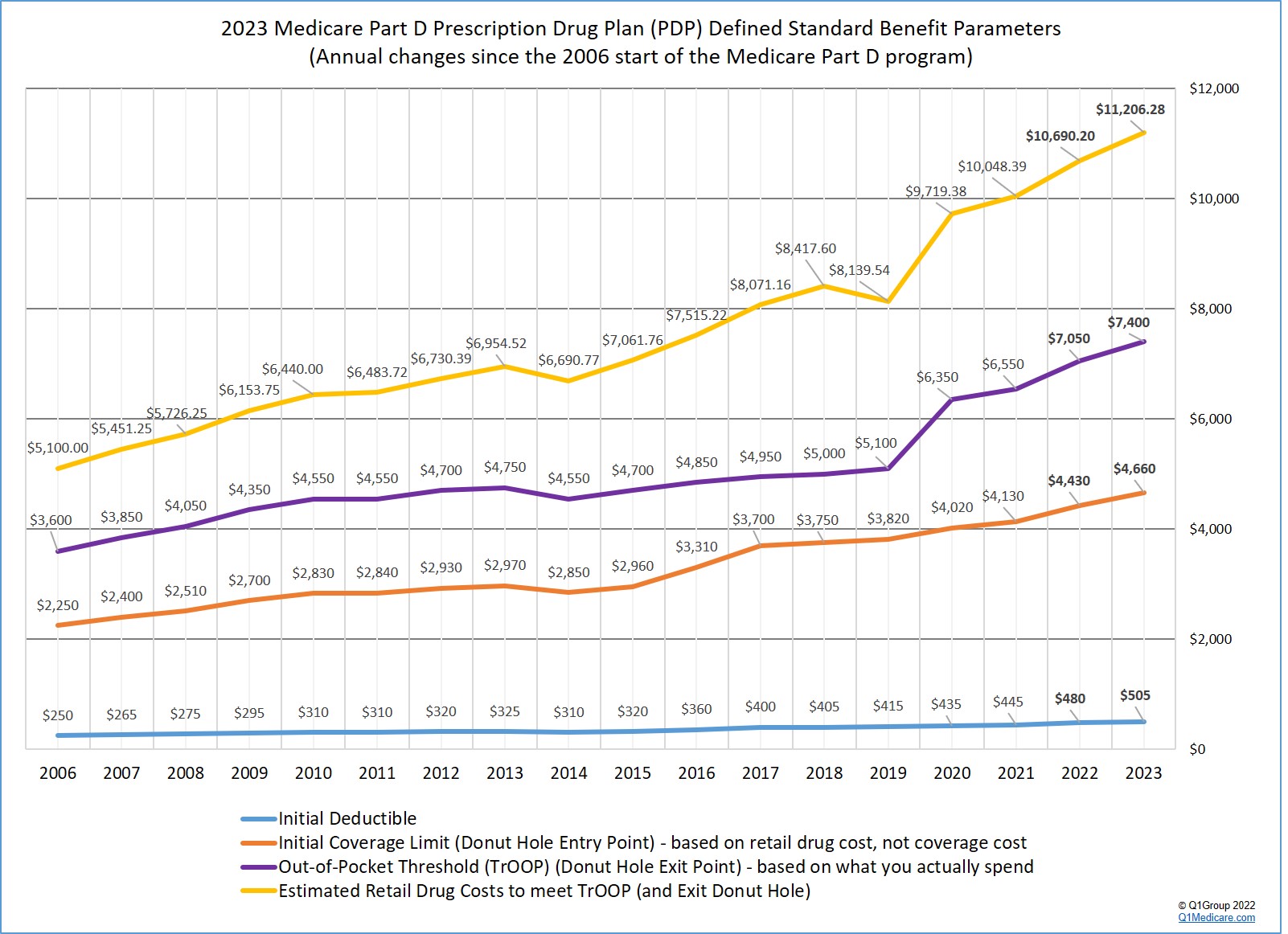

https://q1medicare.com/pics/ContentPics/220203_StandardCMS_2023.jpg

Web Sep 28 2023 nbsp 0183 32 The standard monthly premium amount for Part B in 2023 is 164 90 and applies to those with a MAGI of up to 97 000 as an individual and up to 194 000 as a married couple filing taxes

Templates are pre-designed documents or files that can be utilized for various purposes. They can conserve time and effort by providing a ready-made format and layout for creating various kinds of content. Templates can be utilized for personal or professional jobs, such as resumes, invites, flyers, newsletters, reports, presentations, and more.

What Is The Medicare Tax Limit For 2023

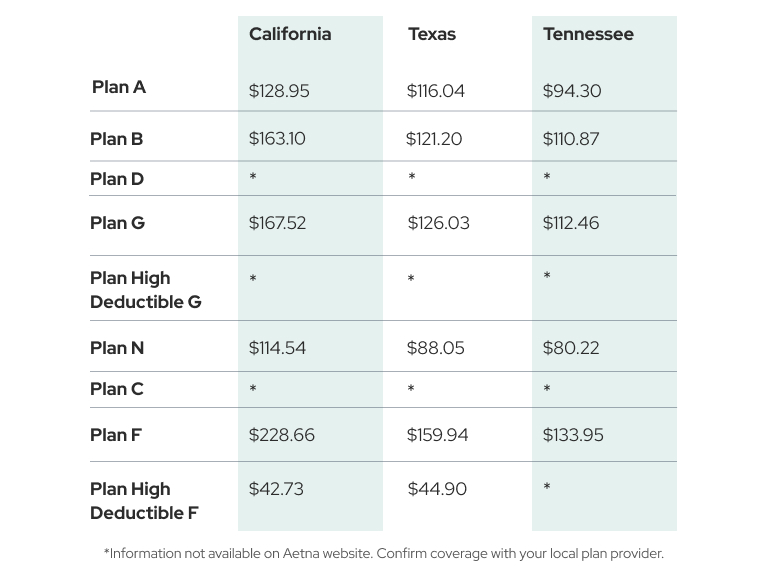

What Is The Medicare Tax Rate Fox Business

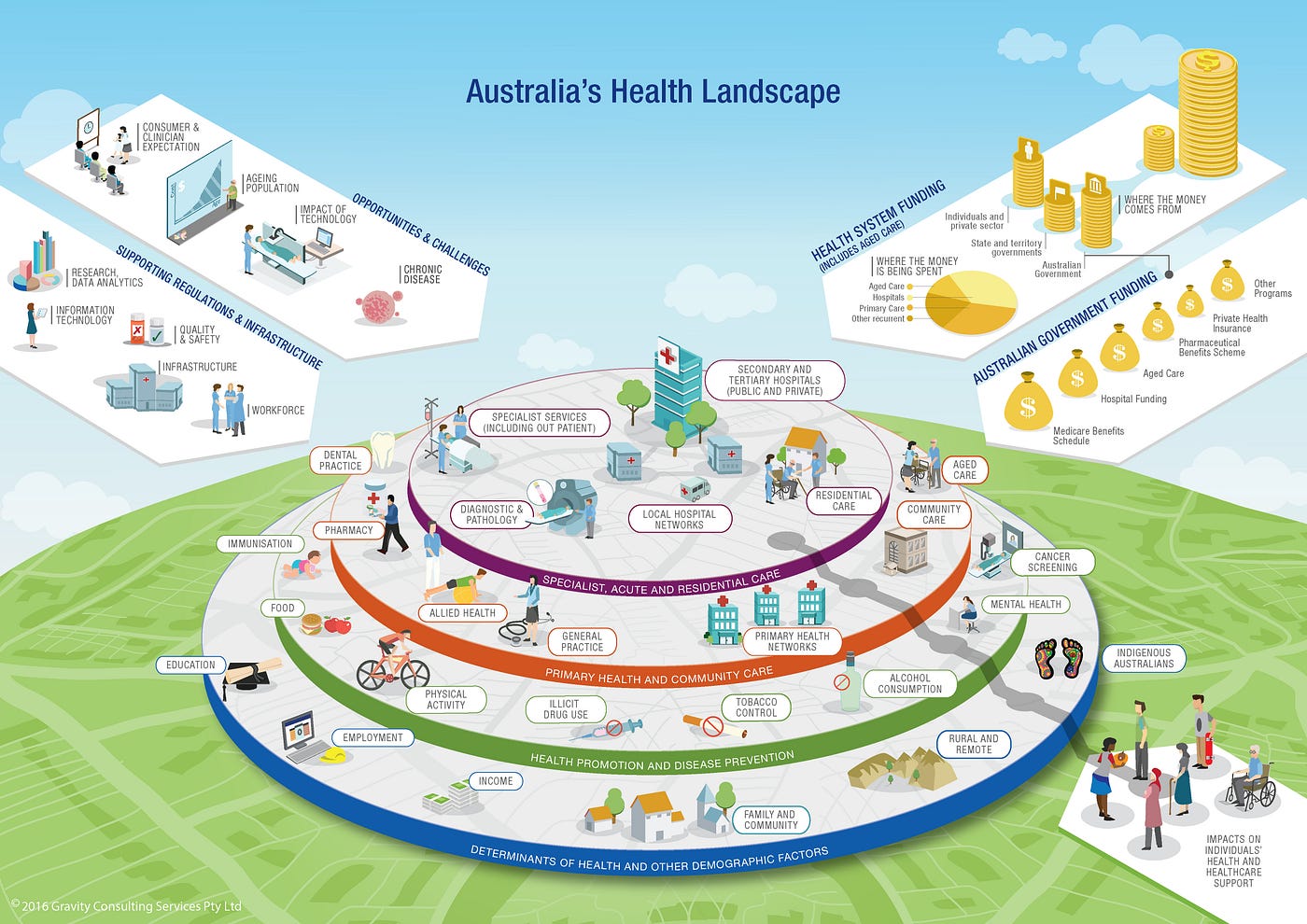

Medicare Blog Moorestown Cranford NJ

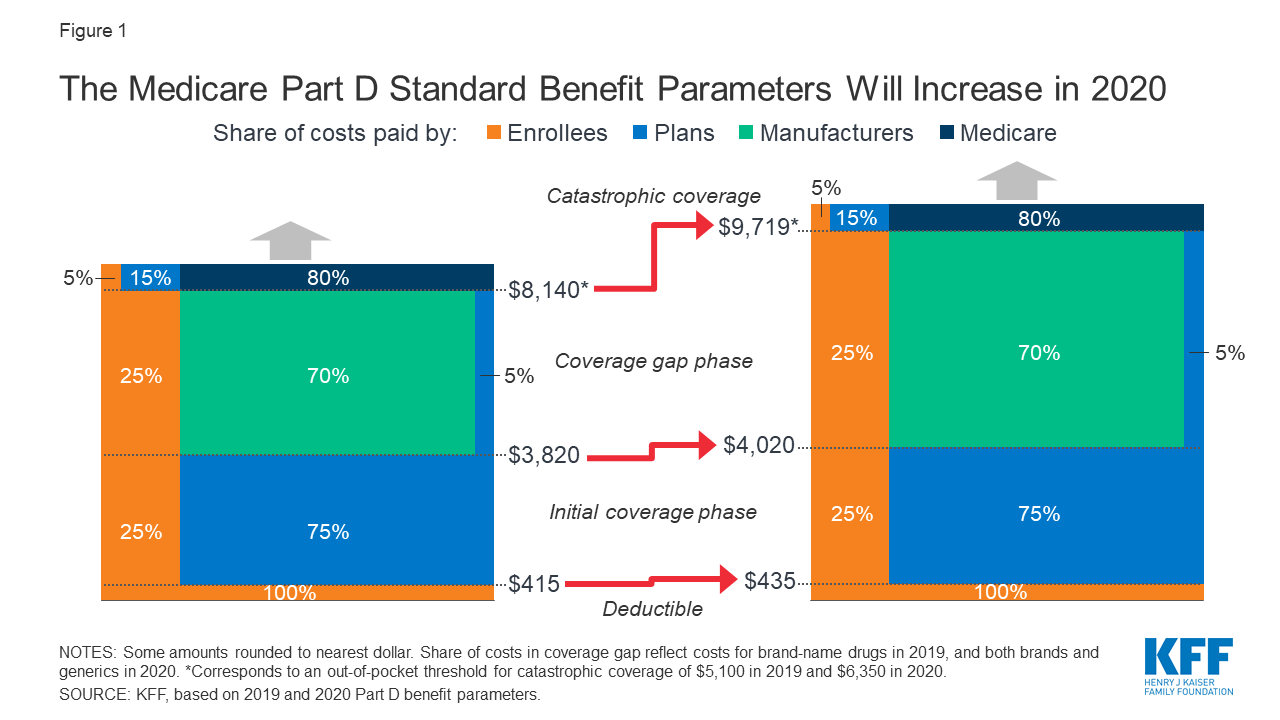

How Will The Medicare Part D Benefit Change Under Current Law And

Medicare Tax Overview What You Need To Know About The Medicare Tax

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver

Medicare You 2023 Your Medicare Handbook

www.ssa.gov/legislation/2023factsheet.pdf

Web Mar 7 2023 nbsp 0183 32 2023 Maximum Taxable Earnings OASDI 160 200 Hospital Insurance HI also called Medicare Part A No limit Federal Tax Rate 1 Max OASDI Max HI

www.irs.gov/publications/p80

Web Jun 22 2011 nbsp 0183 32 The social security wage base limit is 160 200 The Medicare tax rate is 1 45 each for the employee and employer unchanged from 2022 There is no wage base limit for Medicare tax Social security and Medicare taxes apply to the wages of household workers you pay 2 600 or more in cash wages in 2023

www.valuepenguin.com/irmaa-medicare-income-brackets

Web Jan 10 2024 nbsp 0183 32 What are the IRMAA brackets for 2023 and 2024 The IRMAA income brackets for 2023 start at 97 000 103 000 in 2024 for a single person and 194 000 206 000 in 2024 for a married couple Which bracket you fall into depends on your taxable income with a few deductions such as IRA contributions and interest from tax free bonds

tax.thomsonreuters.com/news/2023-social...

Web Oct 17 2022 nbsp 0183 32 Medicare Social Security The Social Security Administration SSA has announced that the maximum earnings subject to Social Security tax Social Security wage base will increase from 147 000 to 160 200 in 2023 an increase of 13 200

www.retireguide.com/medicare/costs-and-coverage/tax

Web Oct 23 2023 nbsp 0183 32 In 2023 the Medicare tax rate is 2 9 with the employee and employer each paying half of the tax What Is the Medicare Tax Medicare tax is a federal payroll tax that helps pay for the Medicare program

Web On September 27 2022 the Centers for Medicare amp Medicaid Services CMS released the 2023 premiums deductibles and coinsurance amounts for the Medicare Part A and Part B programs and the 2023 Medicare Part D income related monthly adjustment amounts Medicare Part B Premium and Deductible Web Aug 19 2023 nbsp 0183 32 At What Income Limit Do Medicare cost Increase in 2023 Medicare bases your Part B and Part D premium costs on your taxable income from two years prior If your income exceeds certain thresholds you ll pay extra income related monthly adjustment amounts IRMAA in addition to standard premiums

Web Nov 15 2023 nbsp 0183 32 If you work for an employer you are responsible for half of the total bill 7 65 which includes a 6 2 Social Security tax and 1 45 Medicare tax on your earnings On your paycheck the