What Is The Irs Business Tax Rate For 2022 WEB There are seven tax brackets for 2023 and 2024 taxes ranging from 10 to 37 This percentage depends on your taxable income and your filing status The IRS made

WEB If you re set up as a pass through entity other than an S corporation then you ll typically have to pay self employment tax on the earnings from your business The current rate WEB The IRS released the federal marginal tax rates and income brackets for 2022 on Wednesday The seven tax rates remain unchanged while the income limits have been

What Is The Irs Business Tax Rate For 2022

What Is The Irs Business Tax Rate For 2022

What Is The Irs Business Tax Rate For 2022

https://static.twentyoverten.com/content/featured/feature-taxrate.jpg

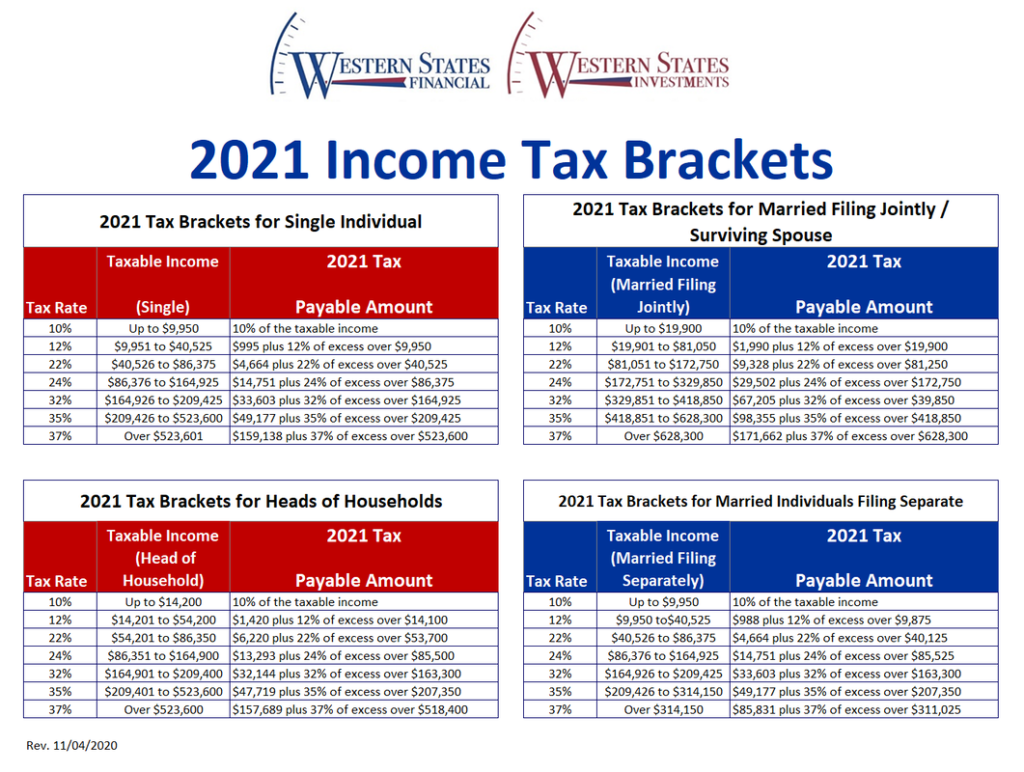

WEB 2022 Tax Bracket and Tax Rates There are seven tax rates in 2022 10 12 22 24 32 35 and 37 Here s how they apply by filing status

Pre-crafted templates provide a time-saving service for developing a diverse variety of files and files. These pre-designed formats and layouts can be used for different personal and expert jobs, including resumes, invites, leaflets, newsletters, reports, discussions, and more, improving the material development procedure.

What Is The Irs Business Tax Rate For 2022

Income Tax Ya 2022 Latest News Update

Corporate Tax Definition And Meaning Market Business News

Federal Income Tax Rate Schedule 2021 Federal Withholding Tables 2021

What Is The IRS Mileage Rate For 2024 R AdvancedTaxStrategies

IRS Opens Atlanta Taxpayer Assistance Center March 11 Special Saturday

Tax Brackets Maryland 2024 Janis Leslie

https://www.irs.gov/publications/p334

WEB This publication provides general information about the federal tax laws that apply to you if you are a self employed person or a statutory employee This publication has information

https://www.irs.gov/publications/p542

WEB Tax Rates Corporations including qualified personal service corporations figure their tax by multiplying taxable income by 21 0 21

https://taxfoundation.org/data/all/federal/2022-tax-brackets

WEB 2022 2023 federal income tax brackets rates for taxes due April 15 2023 Explore 2022 federal income tax brackets and tax brackets 2022 filing season The IRS recently

https://www.irs.gov/filing/federal-income-tax-rates-and-brackets

WEB See current federal tax brackets and rates based on your income and filing status You pay tax as a percentage of your income in layers called tax brackets As your income goes

https://gusto.com/resources/articles/taxes/federal...

WEB To get ready for this year s upcoming tax deadline and prepare for your 2022 quarterly payments it s important to know which tax bracket your business falls into

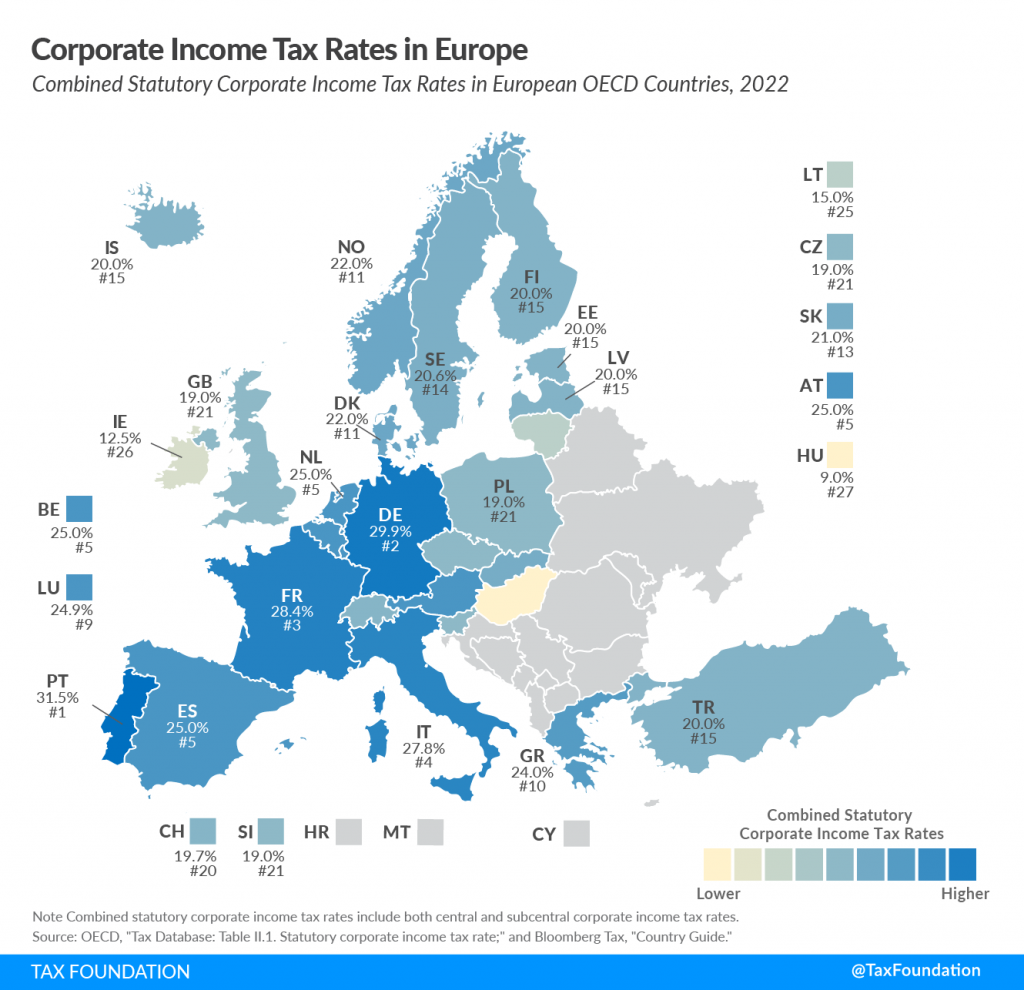

WEB Businesses organized as corporations pay the corporate tax rate which is 21 Other business structures including sole proprietorships partnerships and S corporations WEB The current corporate tax rate federal is 21 Prior to the 2017 Tax Cuts and Jobs Act of 2017 there were taxable income brackets and the maximum tax rate was 35 The Tax

WEB Marginal tax rates for 2022 will not change but the level of taxable income that applies to each rate is going up The top rate of 37 will apply to income over 539 900 for