What Is The Federal Tax Rate For 2022 Single Dec 10 2021 nbsp 0183 32 The top tax rate for individuals is 37 percent for taxable income above 539 901 for tax year 2022 The IRS changes these tax brackets from year to year to account for inflation and other changes in economy

Using the 2022 regular income tax rate schedule above for a single person Joe s federal income tax is 5 187 The IRS tax tables MUST be used for taxable income LESS THAN 100 000 to Federal income tax brackets were last changed one year prior to 2022 for tax year 2021 and the tax rates were previously changed in 2017 The latest available tax rates are for 2025 and the

What Is The Federal Tax Rate For 2022 Single

What Is The Federal Tax Rate For 2022 Single

https://ocdn.eu/pulscms-transforms/1/qTck9ktTURBXy8xMDA3MTBjYS1jNzY0LTQ0OTQtOTJhNy0xNjRkNDc0NzU0YzMucG5nkIGhMAA

In 2022 the first 16 000 of gifts to any person are excluded from tax up from 15 000 The exclusion is increased to 164 000 from 159 000 for gifts to spouses who are not citizens of

Templates are pre-designed files or files that can be utilized for numerous purposes. They can save time and effort by providing a ready-made format and layout for creating various sort of material. Templates can be utilized for personal or expert jobs, such as resumes, invites, leaflets, newsletters, reports, presentations, and more.

What Is The Federal Tax Rate For 2022 Single

Printable Federal Withholding Tables 2022 Table Onenow

Irs Tax Table 2022 Married Filing Jointly Latest News Update

Federal Income Tax Rate Schedule 2021 Federal Withholding Tables 2021

California Income Tax Brackets 2020 In 2020 Income Tax Brackets Tax

:max_bytes(150000):strip_icc()/ScreenShot2022-01-31at1.13.55PM-a2b3cbcfea7346ccb4ca3b2564f1692f.png)

How To Fill Out Form W 4 In 2022 2023

Income Tax Rates 2022 Vs 2021 Kami Cartwright

https://taxfoundation.org › data › all › federal

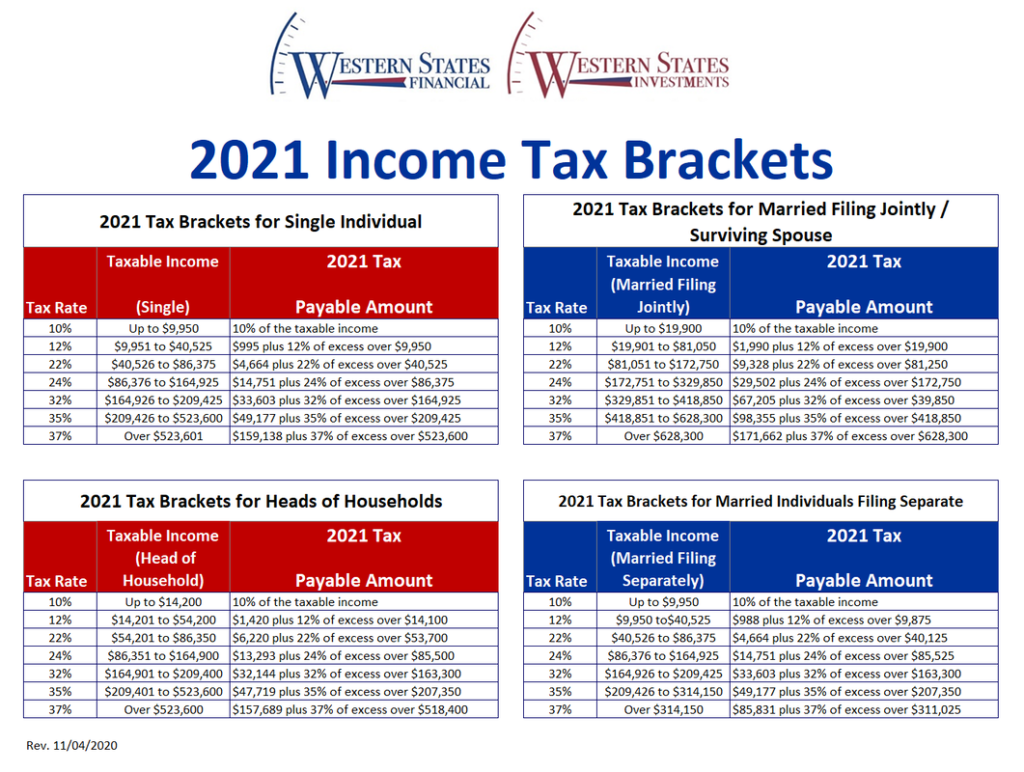

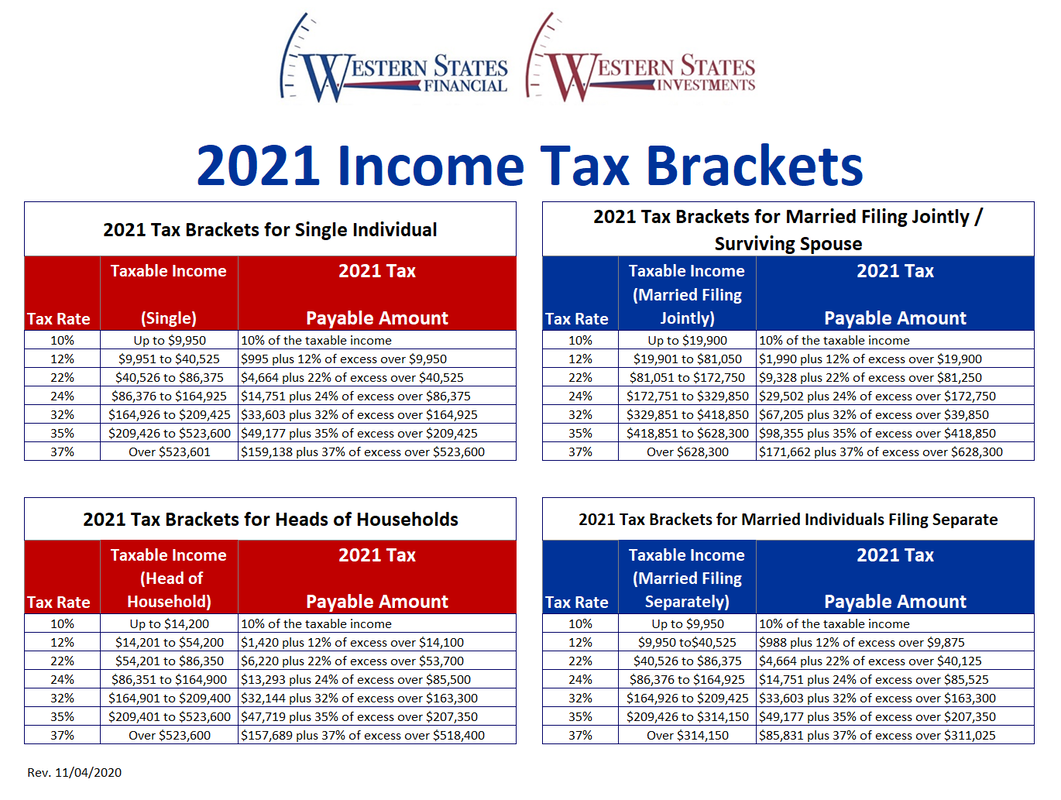

Nov 10 2021 nbsp 0183 32 There are seven federal income tax rates in 2022 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent The top marginal income tax rate of 37 percent will hit taxpayers with taxable income

https://www.forbes.com › sites › ashleaebe…

Nov 10 2021 nbsp 0183 32 The standard deduction amount for the 2022 tax year jumps to 12 950 for single taxpayers up 400 and 25 900 for a married couple filing

https://www.irs.com › en

Feb 21 2022 nbsp 0183 32 Different tax brackets or ranges of income are taxed at different rates These are broken down into seven 7 taxable income groups based on your federal filing statuses e g

https://wealthvogue.com

There are seven federal tax brackets for the 2022 tax year 10 12 22 24 32 35 and 37 Your bracket depends on your taxable income and filing status 2022 Tax brackets for Single filers 0 to 10 275 10 of taxable

https://www.cnbc.com

Nov 10 2021 nbsp 0183 32 These are the rates and income brackets for federal taxes Your state may have different brackets no taxes at all or a flat rate The above rates apply to taxable income after the

Jan 4 2023 nbsp 0183 32 The first 11 000 of your taxable dollars will be taxed at 10 in the 2023 tax year if you re a single filer then your income from 11 001 through 44 725 would be taxed at the rate Dec 22 2022 nbsp 0183 32 The 2022 tax year standard deduction is 12 950 for single filers and married filers who file separately Joint filers will have a 25 900 deduction and heads of household get

Jan 3 2022 nbsp 0183 32 What are the federal income tax rates for 2022 The U S tax code is progressive which means that with higher income your tax rates increase Your tax brackets depend on