What Is The Effective Federal Tax Rate For 2022 WEB Oct 14 2022 nbsp 0183 32 Average effective tax rate for the following federal taxes under a current law baseline for 2022 by income percentile individual and corporate income taxes payroll taxes for Social Security and Medicare estate taxes and

WEB Jan 27 2023 nbsp 0183 32 Personal income tax rates begin at 10 for the tax year 2022 the return due in 2023 then gradually increase to 12 22 24 32 and 35 before reaching a top rate of 37 Each tax rate applies to a specific range WEB Aug 8 2023 nbsp 0183 32 Freedom of Information Act Applicable Federal Rates AFRs Rulings Each month the IRS provides various prescribed rates for federal income tax purposes These rates known as Applicable Federal Rates AFRs are regularly published as

What Is The Effective Federal Tax Rate For 2022

What Is The Effective Federal Tax Rate For 2022

https://ocdn.eu/pulscms-transforms/1/qTck9ktTURBXy8xMDA3MTBjYS1jNzY0LTQ0OTQtOTJhNy0xNjRkNDc0NzU0YzMucG5nkIGhMAA

WEB Apr 30 2024 nbsp 0183 32 In 2024 there are seven federal income tax rates and brackets 10 12 22 24 32 35 and 37 Taxable income and filing status determine which federal tax rates apply to you

Pre-crafted templates provide a time-saving option for developing a varied range of documents and files. These pre-designed formats and layouts can be made use of for different personal and expert projects, consisting of resumes, invites, flyers, newsletters, reports, discussions, and more, enhancing the material production process.

What Is The Effective Federal Tax Rate For 2022

Capital Gains Tax Rate 2021 And 2022 Latest News Update

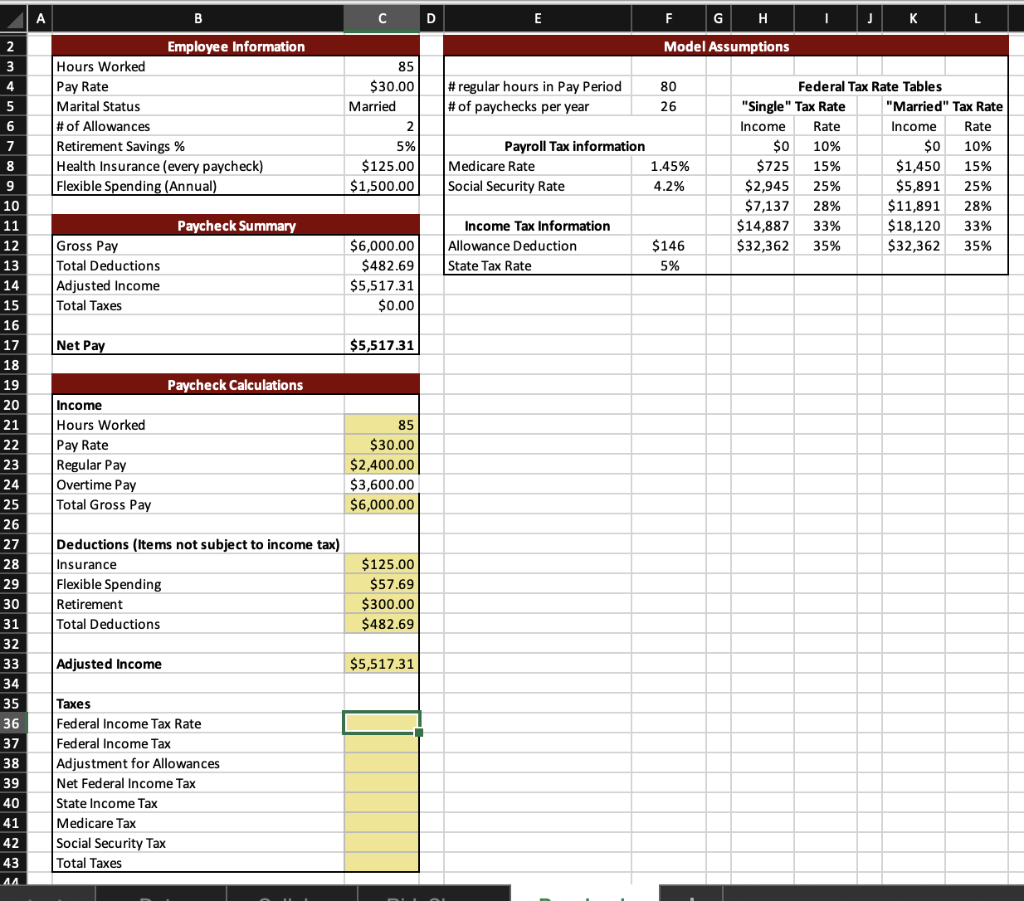

Solved Use An IF Function To Calculate The Federal Income Chegg

2022 Corporate Tax Rates In Europe Tax Foundation

T21 0125 Average Effective Federal Tax Rates All Tax Units By

California Income Tax Brackets 2020 In 2020 Income Tax Brackets Tax

2022 Tax Brackets PersiaKiylah

https://www.irs.com/en/2022-federal-income-tax...

WEB Feb 21 2022 nbsp 0183 32 The federal income tax rates for 2022 are 10 12 22 24 32 35 and 37 depending on the tax bracket What are the tax brackets for 2022 The 2022 tax brackets have been changed since 2021 to adjust for inflation

https://taxfoundation.org/data/all/federal/2022-tax-brackets

WEB Nov 10 2021 nbsp 0183 32 2022 Federal Income Tax Brackets and Rates In 2022 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1 There are seven federal income tax rates in 2022 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent

https://www.thebalancemoney.com/how-to-calculate...

WEB Jan 13 2023 nbsp 0183 32 So if you earned a taxable income of 60 000 in 2022 your effective tax rate would be 10 31 while your marginal tax rate would be 22 Do You Pay the Effective Tax Rate on Your Take Home Pay You won t pay the government your effective tax rate on what you earn during the tax year

https://taxfoundation.org/data/all/federal/summary...

WEB Jan 20 2022 nbsp 0183 32 Total income taxes paid rose by 42 billion to 1 58 trillion a 2 7 percent increase above 2018 The average individual income tax rate was nearly unchanged 13 29 percent in 2019 compared to 13 28 percent in 2018 High Income Taxpayers Paid the Highest Average Income Tax Rates

https://www.cnbc.com/2021/11/10/2022-income-tax...

WEB Nov 10 2021 nbsp 0183 32 The IRS released the federal marginal tax rates and income brackets for 2022 on Wednesday The seven tax rates remain unchanged while the income limits have been adjusted for

WEB Apr 16 2024 nbsp 0183 32 Key Takeaways New income thresholds are in effect for 2023 and 2024 tax brackets Your effective tax rate is the total amount of tax you pay divided by your taxable income Deductions WEB Average effective tax rate for the following federal taxes under a current law baseline for 2020 by income level individual and corporate income taxes payroll taxes for Social Security and Medicare estate taxes and excise taxes October 14 2022 Individual Taxes Distribution Tables by Income Percentile

WEB Mar 24 2021 nbsp 0183 32 Key Takeaways The effective tax rate represents the percentage of their taxable income that individuals pay in taxes For corporations the effective corporate tax rate is the rate