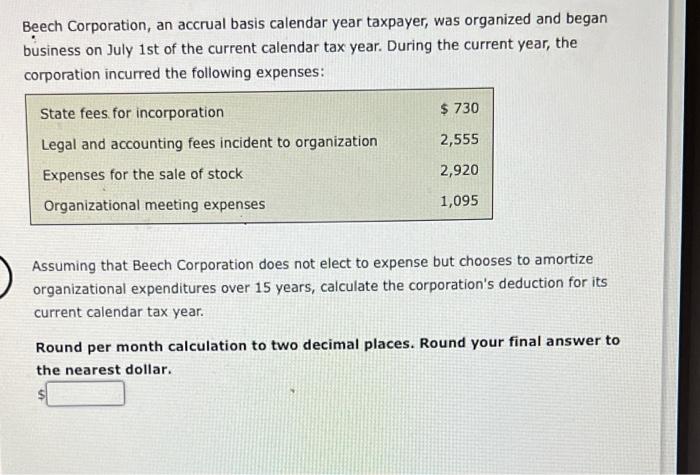

What Is The Calendar Tax Year Jan 26 2023 nbsp 0183 32 A tax year typically lasts 12 months or 52 to 53 weeks and is the period of activity that you consider when calculating your tax bill and filing your tax return Most individual taxpayers will use the calendar tax year which is

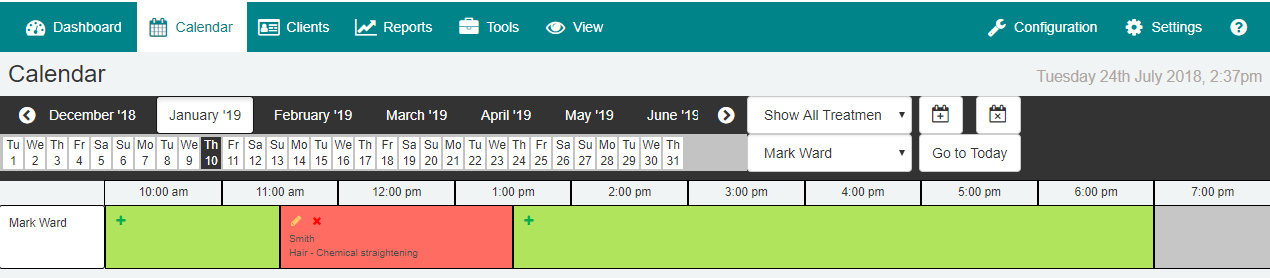

Introduction A tax calendar is a 12 month calendar divided into quarters The calendar gives specific due dates for Filing tax forms Paying taxes and Taking other actions required by Aug 18 2024 nbsp 0183 32 Some businesses file taxes based on the calendar year which is a 12 month period beginning on January 1 and ending on December 31 Others use a fiscal year which

What Is The Calendar Tax Year

What Is The Calendar Tax Year

What Is The Calendar Tax Year

http://s3.amazonaws.com/snd-store/a/21380315/05_01_17_652232976_sbtb_560x292.jpg

Aug 18 2024 nbsp 0183 32 Understanding what each involves can help you determine which to use for accounting or tax purposes In this article we define a fiscal and calendar year list the

Templates are pre-designed documents or files that can be used for numerous functions. They can save effort and time by providing a ready-made format and design for creating various kinds of material. Templates can be utilized for personal or professional tasks, such as resumes, invites, leaflets, newsletters, reports, discussions, and more.

What Is The Calendar Tax Year

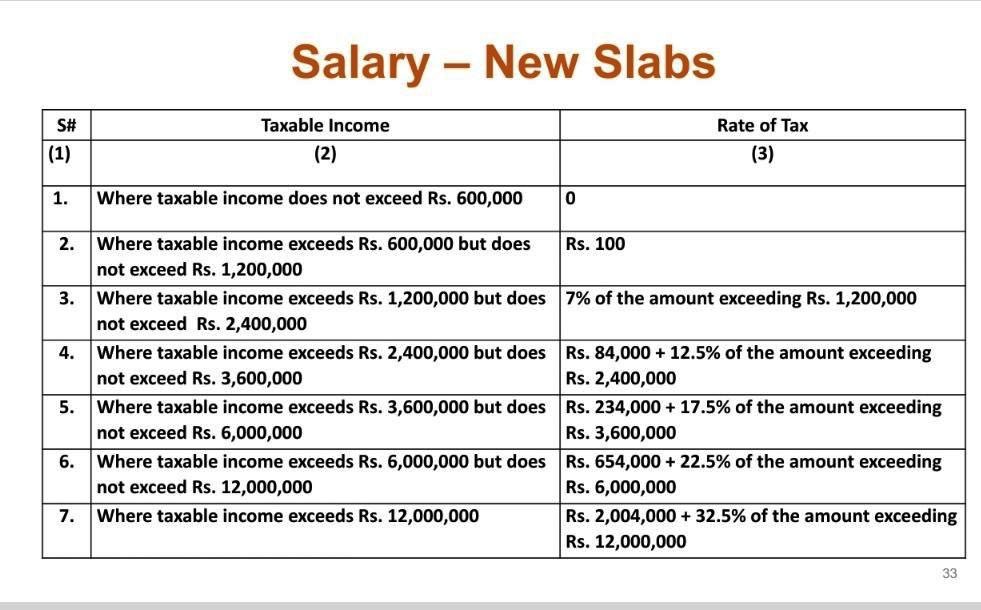

Income Tax Slab For The A Y 2024 25

Safe Days Calendar Calculator CamranKartar

Income Tax Slabs Year 2022 23 Info Ghar Educational News

What Is The Calendar Week Today SITAHW

Choosing Between A Calendar Tax Year And A Fiscal Tax Year Seiler

What Is The Calendar Page Help

https://www.investopedia.com › terms …

Feb 11 2022 nbsp 0183 32 Key Takeaways A calendar year is a one year period between January 1 and December 31 based on the Gregorian calendar The calendar year commonly coincides with the fiscal year for

https://gb-kb.sage.com › portal › app › portlets › results

Tax periods determine the tax and national insurance thresholds used to calculate your employees pay This also depends on what pay date you use and the pay frequency You can

https://support.taxslayerpro.com › hc › en-us › articles

Calendar year is the period from January 1st to December 31st Generally taxpayers filing a version of Form 1040 use the calendar year An individual can adopt a fiscal year if the

https://www.investopedia.com › terms …

Oct 2 2024 nbsp 0183 32 A fiscal year spans 12 months 52 or 53 weeks and corresponds with a company s budgeting process and financial reporting periods Fiscal years can differ from a calendar year and are

https://www.supermoney.com › encyclopedia › tax-year

Sep 20 2024 nbsp 0183 32 A tax year refers to the 12 month period used by individuals businesses and governments to calculate taxes It can follow either a calendar year or a fiscal year with key

Jun 24 2024 nbsp 0183 32 Tax year A business s tax year is 12 months used for financial accounting budgeting and reporting Your business s tax return deadline typically corresponds with the Jun 9 2024 nbsp 0183 32 If your fiscal year ends on December 31 you re using a calendar year as your business tax year Your business fiscal year is almost always your tax year but it doesn t have

May 10 2024 nbsp 0183 32 The fiscal year a period of 12 months ending on the last day of the month does not line up with the traditional calendar year Learn when you should use each