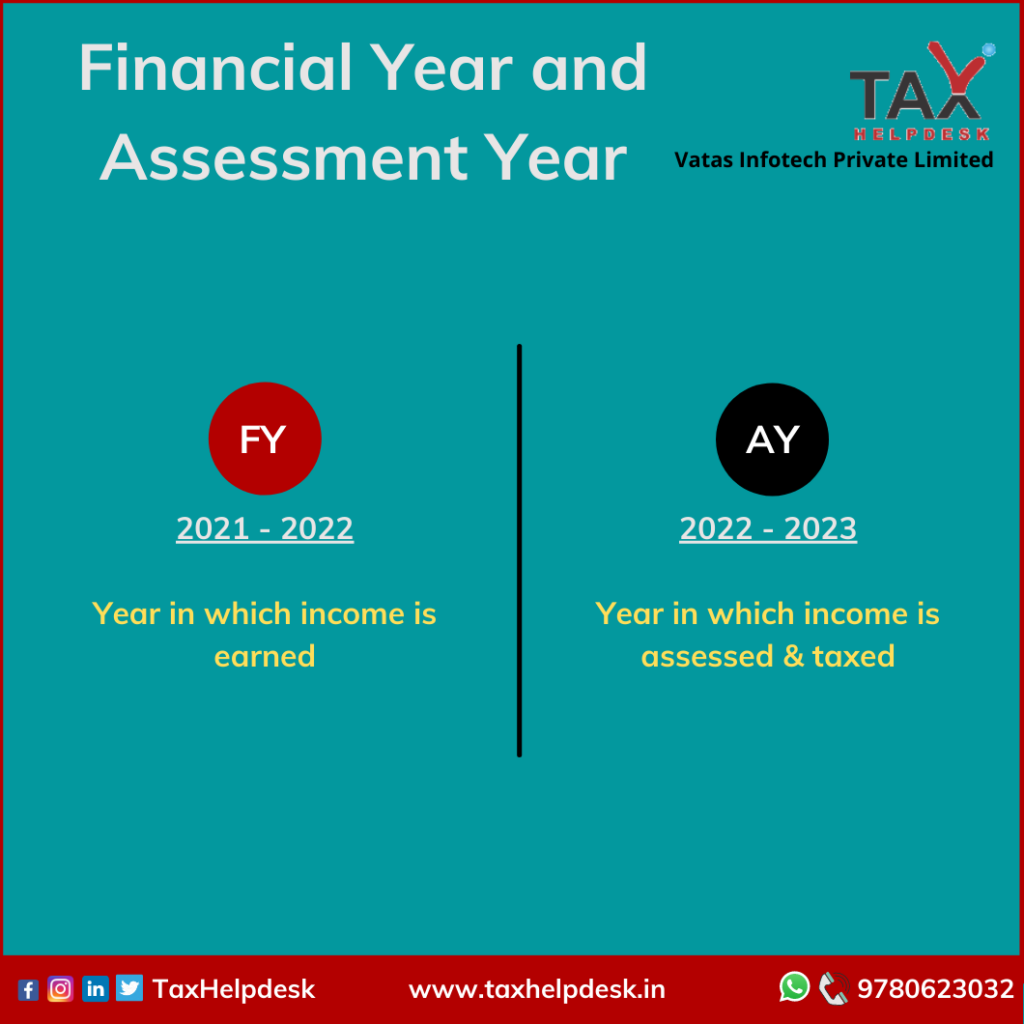

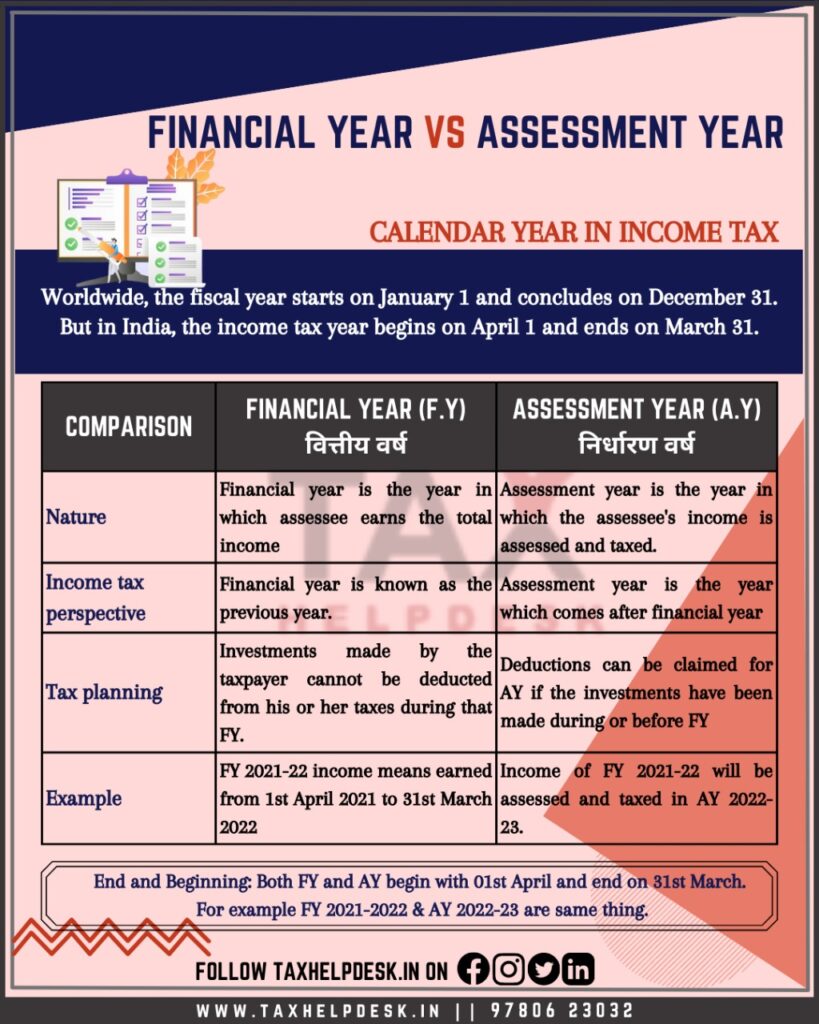

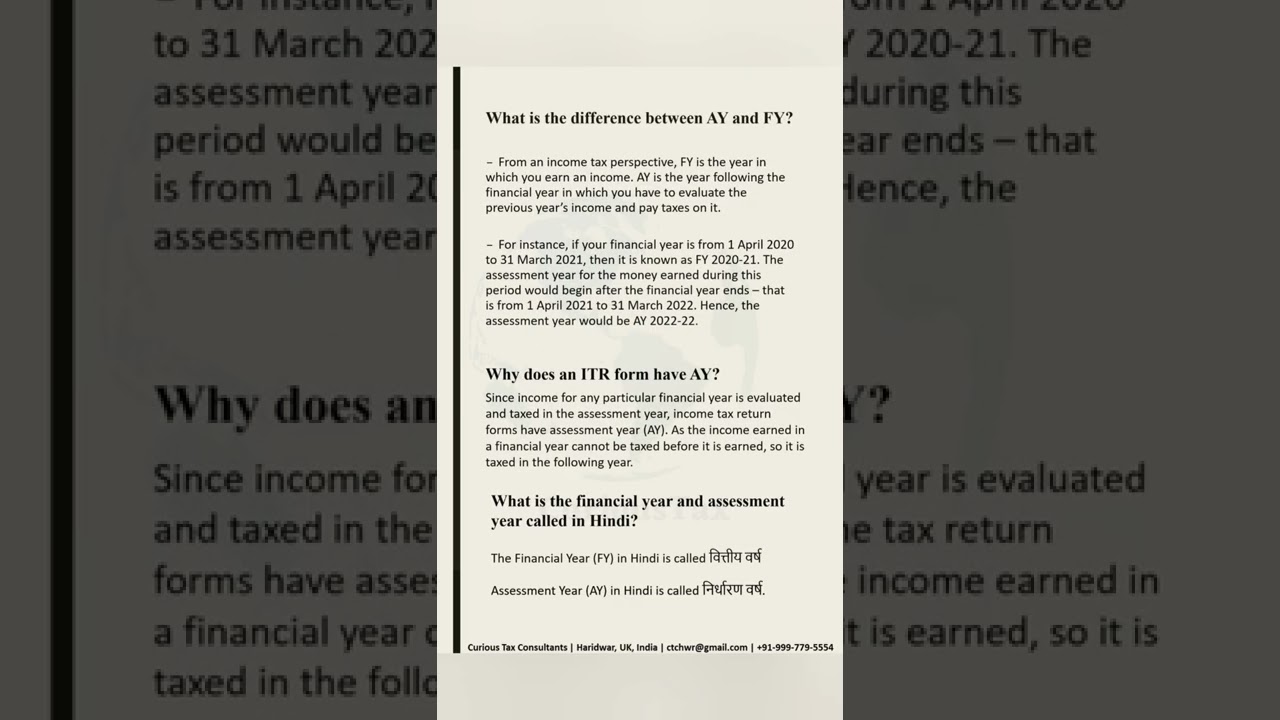

What Is Difference Between Assessment Year And Financial Year Web Oct 18 2022 nbsp 0183 32 Difference between Assessment Year and Financial Year In the tax lexicon a financial year is a year when a person earns an income whereas an assessment year is a year that follows the financial year It is during the assessment year that the previous year s income is taxed

Web May 26 2023 nbsp 0183 32 Financial year Assessment year Meaning The financial year starts from 1st April of a year up to 31st March of the following year The assessment year is the year immediately following the financial year Relevance The Financial Year is used for financial reporting budgeting and financial planning purposes Web Mar 31 2021 nbsp 0183 32 Many New Years in India What is the Financial Year and Assessment Year The calendar year starts on January 1 and ends on December 31 but a Financial year is from April 1 to March 31 As per the Income Tax Act income earned by the individual company in a financial year FY is assessed checked verified in the next

What Is Difference Between Assessment Year And Financial Year

What Is Difference Between Assessment Year And Financial Year

What Is Difference Between Assessment Year And Financial Year

https://i.ytimg.com/vi/P2qRRpYG6CA/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4AbYIgAKAD4oCDAgAEAEYciBeKEYwDw==&rs=AOn4CLA8fNsNE2VEtWg50HweRPkcZVQcOQ

Web Mar 19 2024 nbsp 0183 32 Understanding the distinctions between the financial year and the assessment year is crucial if you want to make sure you abide by tax laws and guidelines The assessment year indicates when taxes are due on those incomes but the financial year shows when money is generated and expenses are incurred

Templates are pre-designed files or files that can be used for different functions. They can conserve effort and time by offering a ready-made format and design for producing different type of material. Templates can be used for individual or professional projects, such as resumes, invites, leaflets, newsletters, reports, presentations, and more.

What Is Difference Between Assessment Year And Financial Year

What Is Financial Year And Assessment Year

Accounting And Taxation Difference Between Assessment Year And

Difference Between Assessment Year And Financial Year Salma Sony CFP

What Is Financial Year And Assessment Year

Difference Between Assessment Year And Financial Year Previous Year

What Is The Difference Between Assessment Year AY And Financial Year

https://tax2win.in/guide/what-is-financial-year-assessment-year

Web Apr 30 2024 nbsp 0183 32 From the tax perspective a Financial year is a year in which a person earns an income On the other hand The assessment year is the year followed by the financial year in which the previous year s income is evaluated tax is paid on the same and an Income tax Return ITR is filed

https://learn.quicko.com/difference-between...

Web Apr 9 2021 nbsp 0183 32 The financial year is the year in which income is earned Assessment year is the year in which ITR is filed it is the year following the Financial year

https://thisvsthat.io/assessment-year-vs-financial-year

Web While the Financial Year captures the entire income and expenses the Assessment Year focuses on assessing the tax liability based on the income earned and expenses incurred during the Financial Year

https://www.taxbuddy.com/blog/difference-between...

Web Apr 18 2024 nbsp 0183 32 Understand the crucial Difference Between Financial Year and Assessment Year to file taxes accurately Learn the distinctions for a seamless tax filing process The distinction between the Assessment Year AY and the Financial Year FY is often unclear to taxpayers

https://groww.in/p/tax/financial-year-and-assessment-year

Web Apr 1 2022 nbsp 0183 32 The assessment year is the year after the financial year in which the prior year s revenue is assessed tax is collected and the ITR is filed For example the financial year beginning on April 1 2022 and ending on March 31 2023 is known as Financial Year 2022 23

Web Jul 20 2023 nbsp 0183 32 The assessment year is when income earned in the financial year is assessed and taxed while the financial year is the 12 month period during which income is earned An assessment year starts on April 1st and ends on March 31st of the following year while the financial year begins on April 1st and ends on March 31st of the same year Web Mar 21 2024 nbsp 0183 32 Assessment Year AY This is the year you evaluate and pay taxes on the income earned in the previous FY Connecting the dots a timeline for clarity Let s illustrate the relationship between FY and AY with a timeline April 1 2023 March 31 2024 This is the Financial Year 2023 24 FY 2023 24 You earn your income throughout this

Web From a tax perspective the financial year is the year in which you earn income while the assessment year is the year in which the income is evaluated taxed and an Income Tax Return ITR is filed