What Is 20 500 After Tax Web Use SmartAsset s paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes

Web Jan 30 2024 nbsp 0183 32 Calculate annual income Based on the information provided the calculator will automatically display your total annual income before taxes Deduct taxes for net salary Enter your tax rate percentage to see your net salary which is your take home pay after taxes have been deducted This calculator also allows for reverse calculations Web The income tax estimator will project your 2023 2024 federal taxes based on your income deductions and credits Taxable income 86 150 Effective tax rate 16 6 Estimated federal taxes

What Is 20 500 After Tax

What Is 20 500 After Tax

What Is 20 500 After Tax

https://data1.ibtimes.co.in/en/full/626459/demonetisation-demonetization-currency-rbi-rs-500-rs-1000-note-currency-pm-modi-arun-jaitley-trends.jpg

Web 2 days ago nbsp 0183 32 Cutting national insurance 2p is worth almost 163 250 to someone earning 163 25 000 and 163 750 for those earning 163 50 000 Read this the latest consumer news and build up to Wednesday s budget below

Templates are pre-designed documents or files that can be used for different purposes. They can conserve effort and time by supplying a ready-made format and design for developing various kinds of material. Templates can be used for individual or professional projects, such as resumes, invitations, flyers, newsletters, reports, discussions, and more.

What Is 20 500 After Tax

60 000 After Tax 2023 2024 Income Tax UK

About Us

10 50 Percent Off 20 Dollars 2022 IBikini cyou

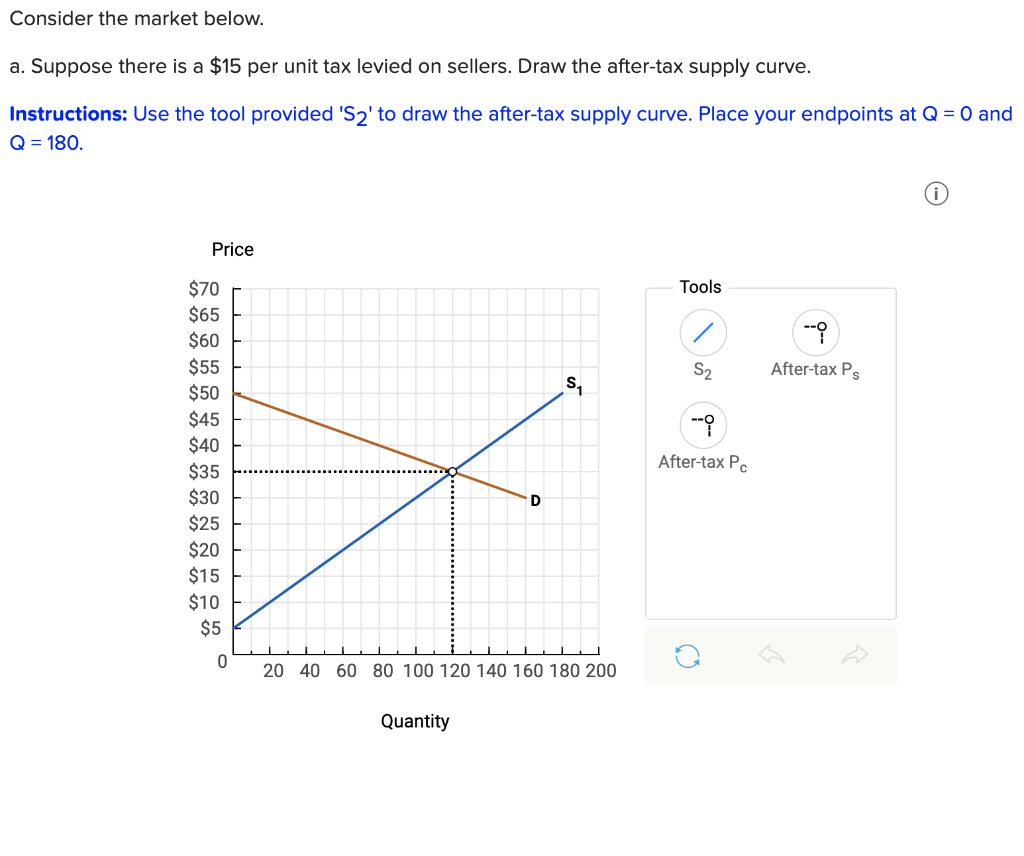

Solved 2 Taxes And Welfare Consider The Market For Air Chegg

20 Of 500 Calculate 20 Percent Of 500 Rapid Calculator

What Is 20 Percent Of 11520 Solution With Free Steps

https://www.omnicalculator.com/finance/net-to-gross

Web Jan 18 2024 nbsp 0183 32 The sales tax or VAT doesn t really matter in this case is 25 The gross price would be 40 25 215 40 40 10 50 Net price is 40 gross price is 50 and the tax is 25 You perform a job and your gross pay is 50 The income tax is 20 so your net income is 50 20 50 10 40

https://www.reed.co.uk/tax-calculator/20500

Web On a 163 20 500 salary your take home pay will be 163 17 507 after tax and National Insurance This equates to 163 1 459 per month and 163 337 per week If you work 5 days per week this is 163 67 per day or 163 8 per hour at 40 hours per week

https://www.calculator.net/take-home-pay-calculator.html

Web Take Home Paycheck Calculator Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary It can also be used to help fill steps 3 and 4 of a W 4 form This calculator is intended for use by U S residents

https://www.uktaxcalculators.co.uk/20500-after-tax

Web The calculation above shows that after tax a gross income of 163 20 500 per year in 2024 leaves you with 163 18 004 taken home This is equivalent to around 163 1 500 per month There is about 12 pence taken away for taxes and national

https://www.calculatorsoup.com/calculators/financial/tax-federal-est.php

Web Jan 3 2023 nbsp 0183 32 gt Financial gt Money Pay Taxes gt Income Tax Calculator Tax Year Filing Status Taxable Income Answer Estimated Income Tax 9 934 Tax Bracket 22 0 Tax as a percentage of your taxable income 11 69 Net Income after Tax is paid 75 066 How could this calculator be better Share this Answer Link help

Web Calculate your take home pay given income tax rates national insurance tax free personal allowances pensions contributions and more Web 1 minutes On this page Helps you work out how much Australian income tax you should be paying what your take home salary will be when tax and the Medicare levy are removed your marginal tax rate This calculator can also be

Web Tax Breakdown For a gross annual income of 72 020 our US tax calculator projects a tax liability of 1 370 per month approximately 23 of your paycheck The table below breaks down the taxes and contributions levied on these employment earnings in California What Is a Good Salary in the US