What Expenses To Keep Track Of For Small Business December 30 2024 Ottawa Ontario Department of Finance Canada Today the Department of Finance Canada announced the automobile income tax deduction limits and expense benefit

Jan 30 2025 nbsp 0183 32 T2SCH130 Excessive Interest and Financing Expenses Limitation 2023 and later tax years Download instructions for fillable PDFs These types of expenses include fixing up expenses finders fees commissions brokers fees surveyors fees legal fees transfer taxes and advertising costs Personal use property This

What Expenses To Keep Track Of For Small Business

What Expenses To Keep Track Of For Small Business

What Expenses To Keep Track Of For Small Business

https://leonackermann.github.io/images/profile.png

Report the accrued interest on a T5 slip The bank charges do not represent an amount payable to the bondholder Bondholders that are individuals can deduct this amount as outlays and

Templates are pre-designed documents or files that can be utilized for different purposes. They can conserve time and effort by offering a ready-made format and layout for developing various type of material. Templates can be utilized for individual or professional jobs, such as resumes, invites, leaflets, newsletters, reports, presentations, and more.

What Expenses To Keep Track Of For Small Business

Rastreamento Correios For Android Download

Scorpio s Homepage Notion Template

Cafe Dashboard Notion Template

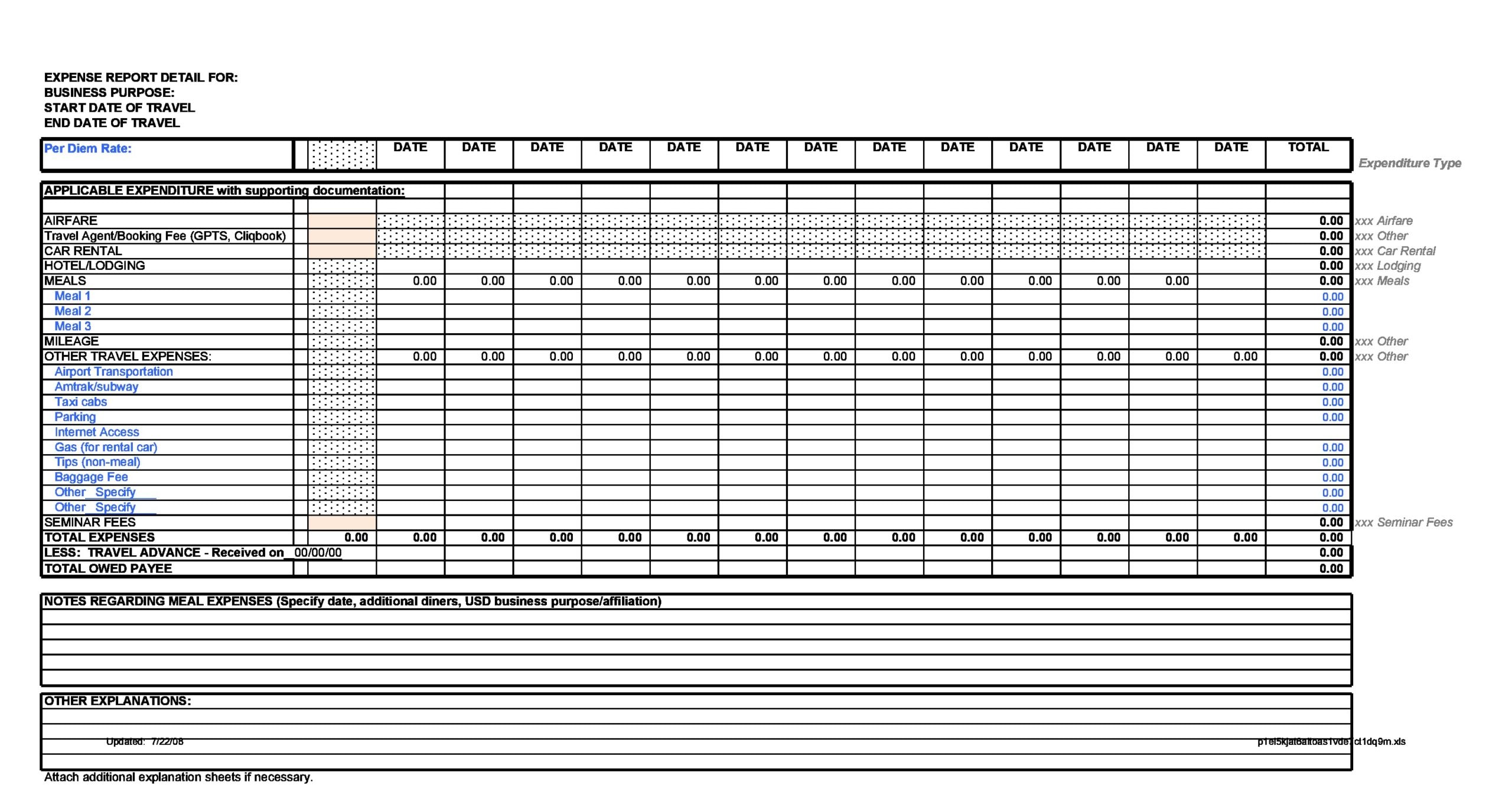

Contractor Expenses List Sakiimaging

The Film Files Notion Template

30 Best Business Expense Spreadsheets 100 Free TemplateArchive

https://www.canada.ca › ...

The expenses you can deduct include any GST HST you incur on these expenses minus the amount of any input tax credit claimed However since you cannot deduct personal expenses

https://www.canada.ca › en › revenue-agency › news › newsroom › tax-ti…

For more information on deductible expenses go to Rental expenses you can deduct Non compliant amount For tax years after 2023 if a short term rental is non compliant for any

https://www.canada.ca › en › revenue-agency › services › tax › business…

Dec 31 2024 nbsp 0183 32 However as a rule you can deduct any reasonable current expense you incur to earn income The deductible expenses include any GST HST you incur on these expenses

https://www.canada.ca › ... › forms-publications › publications › employm…

Expenses you incurred when your employer was not a GST HST registrant expenses that relate to an allowance you received from your employer that is not reported in Part C of the GST HST

https://www.canada.ca › en › revenue-agency › programs › about-canad…

Variable B is the taxpayer s ratio of permissible expenses for the year multiplied by the taxpayer s ATI unless the taxpayer made an election under subsection 18 21 2 The ratio of permissible

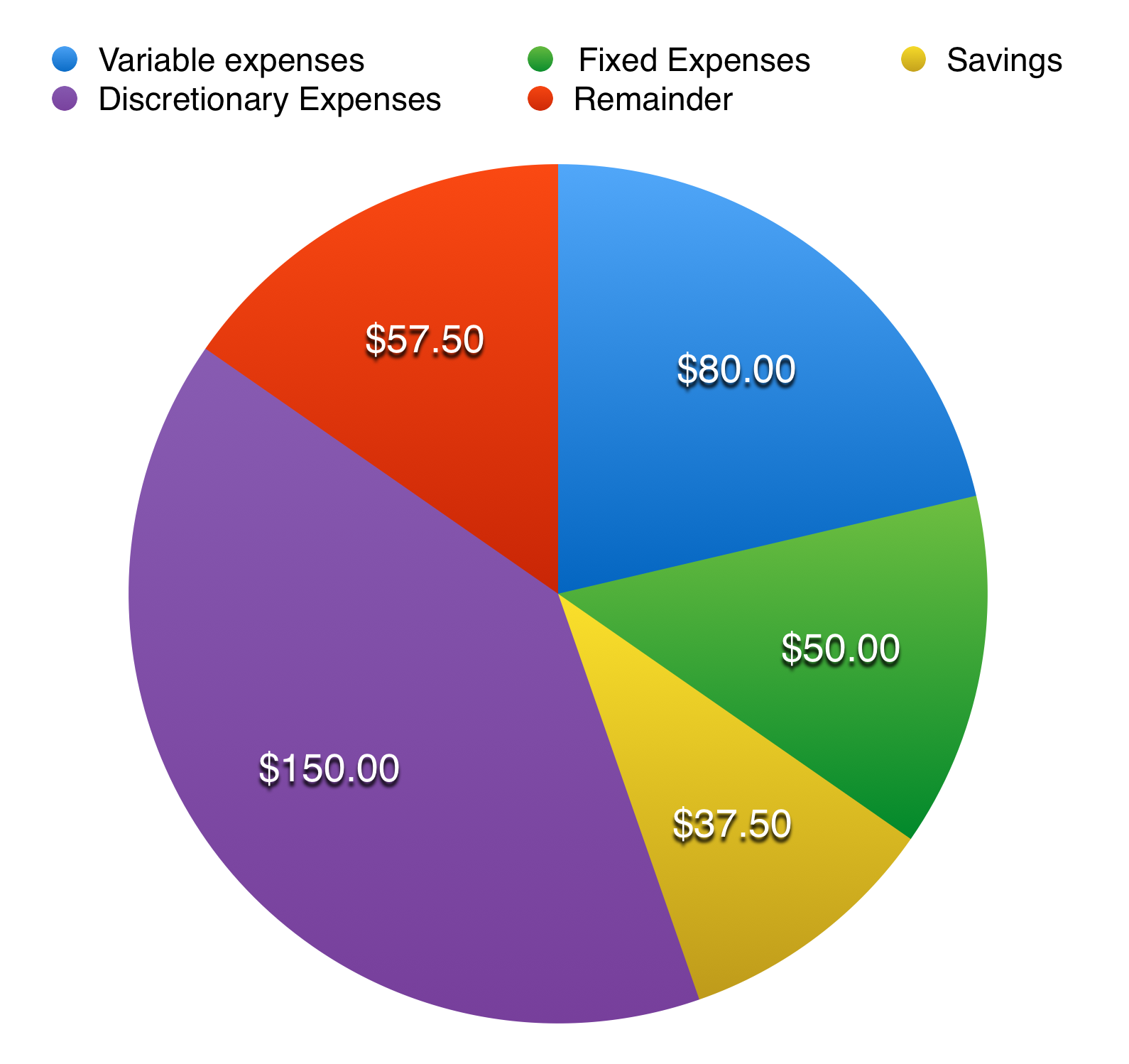

[desc-11] [desc-12]

[desc-13]