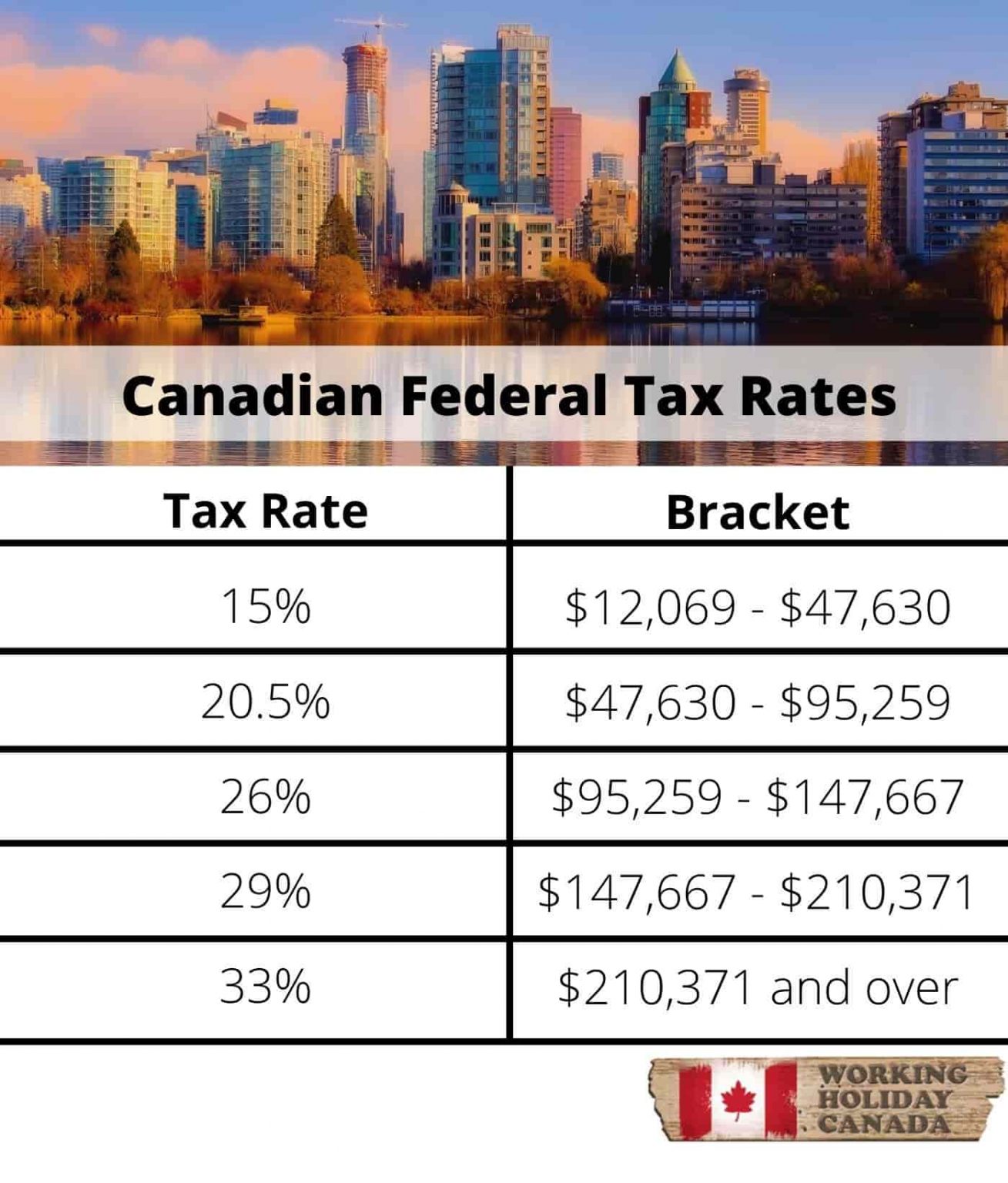

What Are The Cra Federal Tax Rates For 2022 Jan 6 2022 nbsp 0183 32 The 2022 federal brackets are zero to 50 197 of income 15 per cent more than 50 197 to 100 392 20 5 per cent above 100 392 to 155 625 26 per cent over 155 625 to 221 708 29 per cent and anything above that is taxed at 33 per cent

2022 Personal tax calculator Calculate your combined federal and provincial tax bill in each province and territory The calculator reflects known rates as of December 1 2022 Jan 24 2022 nbsp 0183 32 The top bracket now applies to those with taxable income in excess of 221 708 versus 220 000 last year and is taxed at 53 53 Due to the change in bracket threshold an individual with taxable income of 100 000 now pays tax at no more than 37 91 compared with 43 41 last year

What Are The Cra Federal Tax Rates For 2022

What Are The Cra Federal Tax Rates For 2022

What Are The Cra Federal Tax Rates For 2022

https://www.taxtips.ca/smallbusiness/corporatetax/corporate-tax-rates-2022.jpg

Nov 19 2021 nbsp 0183 32 The CRA increased BPA by 590 to 14 398 for 2022 on which the minimum federal tax rate of 15 won t apply This will save you 2 160 15 of 14 398 in the federal tax bill provided your

Templates are pre-designed documents or files that can be utilized for different functions. They can conserve effort and time by offering a ready-made format and layout for developing different kinds of material. Templates can be used for individual or expert tasks, such as resumes, invitations, leaflets, newsletters, reports, discussions, and more.

What Are The Cra Federal Tax Rates For 2022

CARPE DIEM Average Federal Income Tax Rates By Income Group Are Highly

Irs Tax Table 2022 Married Filing Jointly Latest News Update

2023 Tax Rates Federal Income Tax Brackets Top Dollar

Here Are The Federal Tax Brackets For 2023 Vs 2022 Narrative News

Canada T2 Corporation Income Tax Return 2020 2022 Fill And Sign

Irs Tax Brackets 2023 Chart Printable Forms Free Online

https://www.canada.ca › en › revenue-agency › programs › ...

Each table presents taxfiler information by province territory and federal tax bracket for all returns up to the cut off date of January 28 2022 The tables are available in two formats portable document format PDF and comma separated values CSV

https://www.canada.ca › ... › services › tax › rates.html

Information for individuals and businesses on rates such as federal and provincial territorial tax rates prescribed interest rates EI rates corporation tax rates excise tax rates and more

https://www.taxtips.ca › priortaxrates › canada.htm

The federal indexation factors tax brackets and tax rates for 2023 have been confirmed to Canada Revenue Agency CRA information See Indexation adjustment for personal income tax and benefit amounts on the CRA website

https://www.taxtips.ca › priortaxrates › canada.htm

The Federal tax brackets and personal tax credit amounts are increased for 2022 by an indexation factor of 1 024 a 2 4 increase The federal indexation factors tax brackets and tax rates have been confirmed to Canada Revenue Agency CRA information

https://www.moneysense.ca › save › taxes

Dec 6 2022 nbsp 0183 32 What are the federal tax brackets in Canada for 2022 We crunched the numbers so you can find your tax bracket quickly Here s how federal tax brackets work Think of Canada s federal income

Fee calculator 2024 Canada Income Tax Calculator Plug in a few numbers and we ll give you visibility into your tax bracket marginal tax rate average tax rate and payroll tax deductions along with an estimate of your tax refunds and taxes owed in 2024 File your tax return today Your maximum refund is guaranteed Nov 25 2023 nbsp 0183 32 While calculating your taxes can be exhausting confusing or frustrating we re going to help Here we ve collected everything you need to know about this year s income tax rates Federal Tax Bracket Rates for 2024 15 on the first 55 867 of taxable income 20 5 on taxable income over 55 867 up to 111 733

Jan 25 2023 nbsp 0183 32 According to a CRA table the lowest tax bracket on a federal level in Canada is 15 in 2022 for taxable income under 50 197 That rate increases to 20 5 on taxable income between 50 197 and 100 392 If you make between