Tax Year 2022 23 Personal Allowance If you have a modest income and a simple tax situation the Community Volunteer Income Tax Program CVITP or Income Tax Assistance Volunteer Program for residents of Quebec can

The 25 Part XIII tax also applies to payees in countries with which Canada has a tax treaty that is not yet in effect A Part XIII tax rate of 23 applies to the gross amounts paid credited or If you live outside Canada and receive an Old Age Security OAS pension you must also pay the non resident tax This tax is deducted from monthly OAS pension payments The total of the

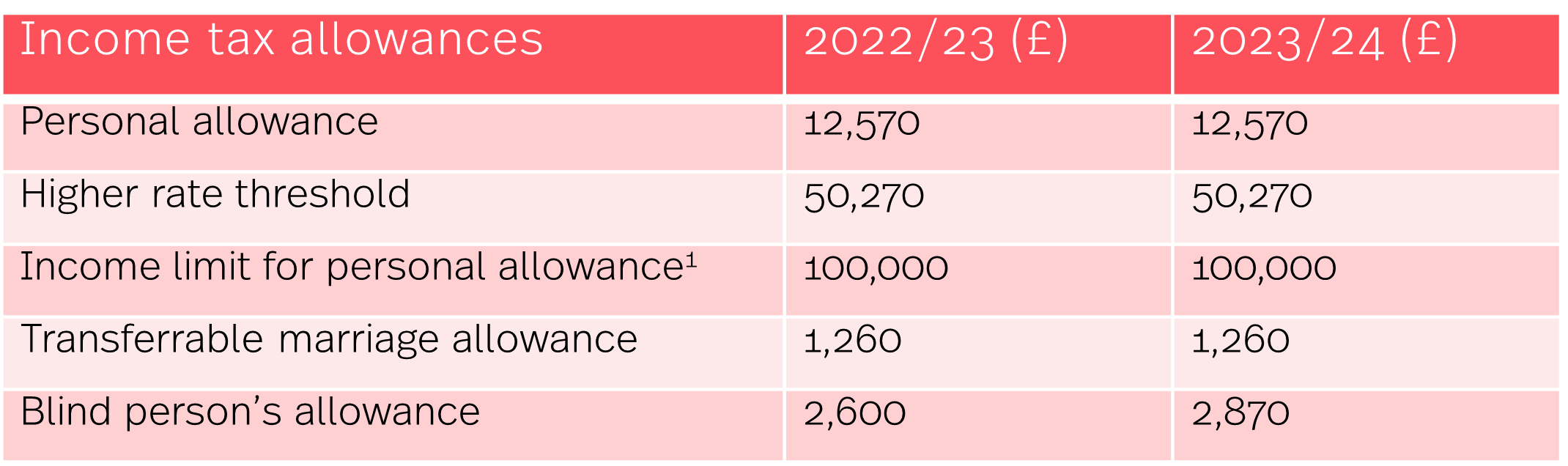

Tax Year 2022 23 Personal Allowance

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=803685758533433

Describe the property and state that you want subsection 45 3 of the Income Tax Act to apply You have to make this election by the earliest of the following dates 90 days after the date the

Pre-crafted templates offer a time-saving option for developing a varied range of files and files. These pre-designed formats and layouts can be used for numerous individual and professional projects, including resumes, invites, leaflets, newsletters, reports, presentations, and more, streamlining the material production procedure.

Tax Year 2022 23 Personal Allowance

Personal Allowance For 2023 24 Image To U

Tax Schedule 2025 Australia Alix Bernadine

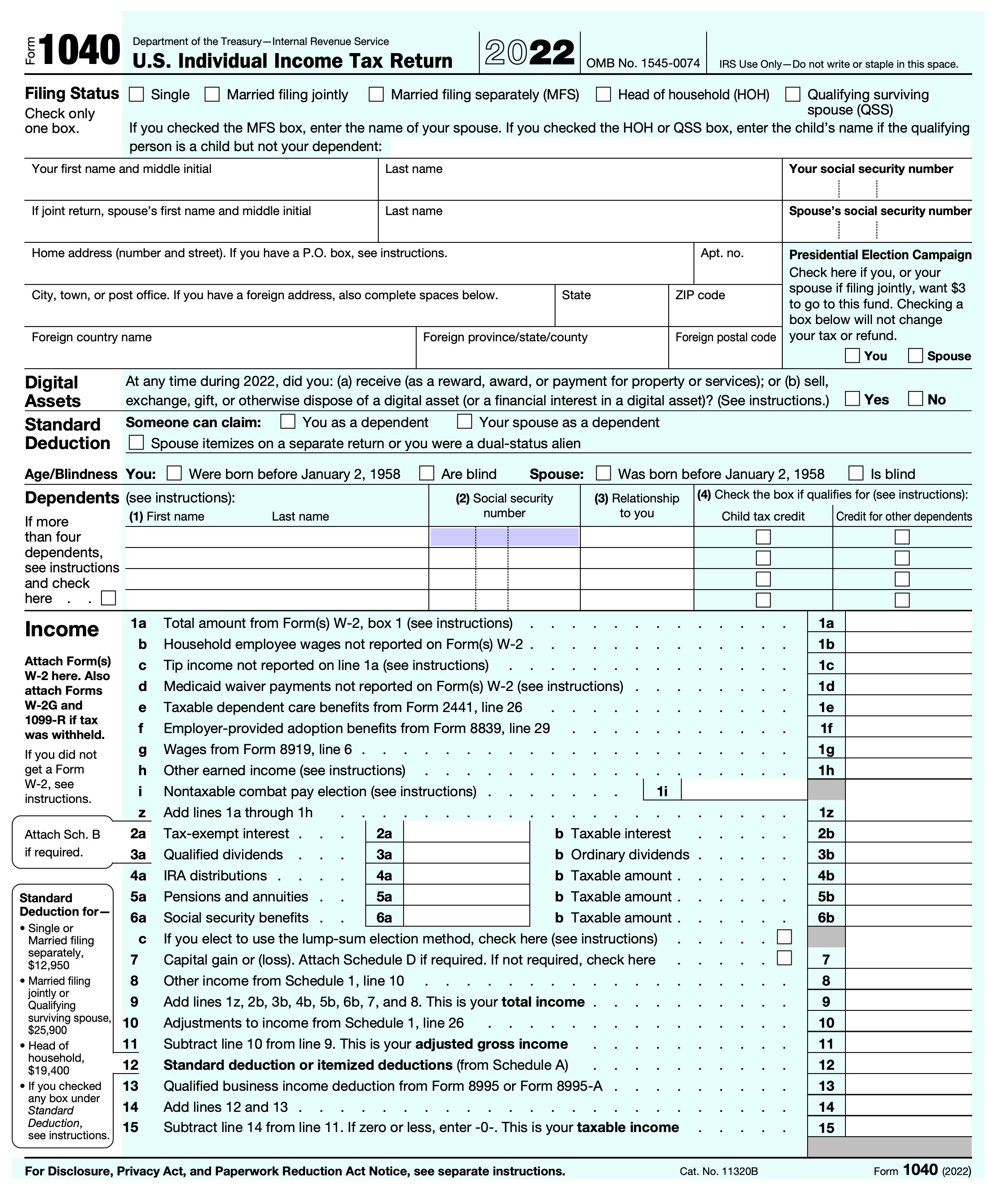

Form 1040 Schedule B 2025 Cruz Faith

Tax Bracket 2025 Philippines Ruby Amira

2022 2023 en Ad Pacem Servandam

Fiscal Year Calendar 2025 26 Ruby Amira

https://www.canada.ca › en › revenue-agency › news › newsroom › tax-ti…

Tax preparers use EFILE certified software to file your taxes online To find an EFILE certified tax preparer in your area try our postal code search Filing a paper return If online filing is not an

https://www.canada.ca › en › services › taxes › income-tax

File non resident corporations income tax file non residents income tax get information on tax treaties country by country reporting Doing taxes for someone who died Report the date of

https://howtaxworks.co.za › questions › tax-implications-retiring-from-ra

The first R550 000 of your retirement lump sum is tax free as of 1 March 2024 Any previous withdrawals or retirement lump sums you ve taken will reduce your tax free amount The

https://www.canada.ca › en › revenue-agency › services › e-services › cr…

If you are signing in on behalf of someone else including friends and family members you must use Represent a Client in your CRA account to access their information Do not use autofill on

https://www.canada.ca › en › services › taxes

Tax free savings accounts registered savings plans pooled pension plans and plan administration Excise and specialty taxes Duties customs charges tax on underused

[desc-11] [desc-12]

[desc-13]