Tax Tables For 2023 Married Filing Jointly Web Feb 23 2023 nbsp 0183 32 20 800 Head of Household 13 850 Unmarried individuals 13 850 Married filing separately The Standard Deduction is an amount every taxpayer is allowed to take as a deduction from their income to reduce their taxable income

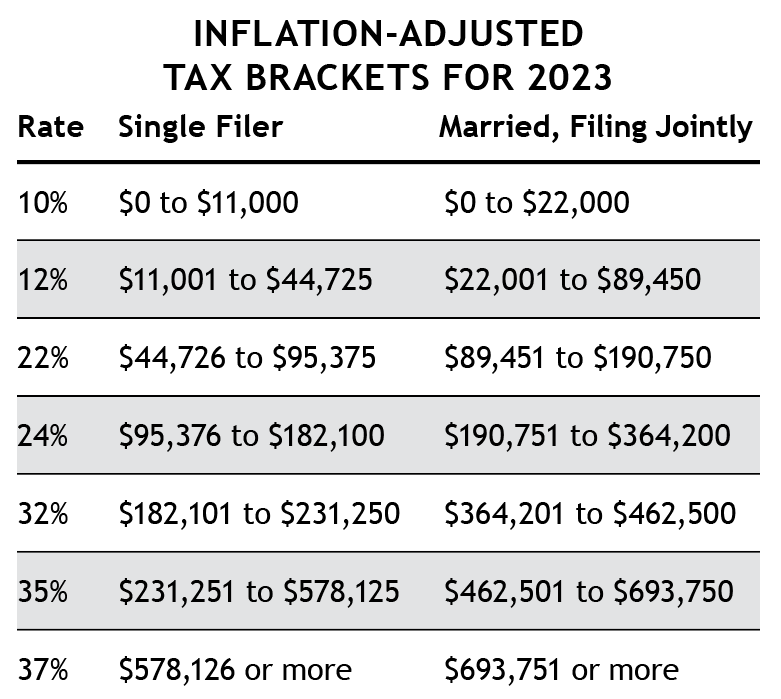

Web Jan 29 2024 nbsp 0183 32 There are seven federal income tax rates and brackets in 2023 and 2024 10 12 22 24 32 35 and 37 Your taxable income and filing status determine which federal tax rates apply Web Oct 25 2022 nbsp 0183 32 For married couples filing jointly the new standard deduction for 2023 will be 27 700 This is a jump of 1 800 from the 2022 standard deduction 2023 Tax Brackets for Married Couples Filing

Tax Tables For 2023 Married Filing Jointly

:max_bytes(150000):strip_icc()/ScreenShot2022-01-31at1.13.55PM-a2b3cbcfea7346ccb4ca3b2564f1692f.png) Tax Tables For 2023 Married Filing Jointly

Tax Tables For 2023 Married Filing Jointly

https://www.investopedia.com/thmb/XEFUK6tcW2xt3Ej2XPwmYcWwc4s=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/ScreenShot2022-01-31at1.13.55PM-a2b3cbcfea7346ccb4ca3b2564f1692f.png

Web Nov 22 2022 nbsp 0183 32 2023 Standard Deductions Mark Kantrowitz The Alternative Minimum Tax AMT exemption is 81 300 for single filers 126 500 for married filing jointly 63 250 for married filing separately and

Templates are pre-designed documents or files that can be used for various purposes. They can conserve effort and time by supplying a ready-made format and layout for producing various sort of content. Templates can be used for personal or professional jobs, such as resumes, invites, leaflets, newsletters, reports, discussions, and more.

Tax Tables For 2023 Married Filing Jointly

Ca Tax Brackets 2023 2023

Inflation Adjusted Tax Provisions May Boost Your 2023 Take Home Pay

2022 Tax Brackets Table Printable Form Templates And Letter

Printable Federal Withholding Tables 2022 California Onenow

2023 California Tax Brackets W2023H

Louisiana Weekly Income Tax Withholding Table 2021 Federal

:max_bytes(150000):strip_icc()/ScreenShot2022-01-31at1.13.55PM-a2b3cbcfea7346ccb4ca3b2564f1692f.png?w=186)

https://www.irs.gov/filing/federal-income-tax-rates-and-brackets

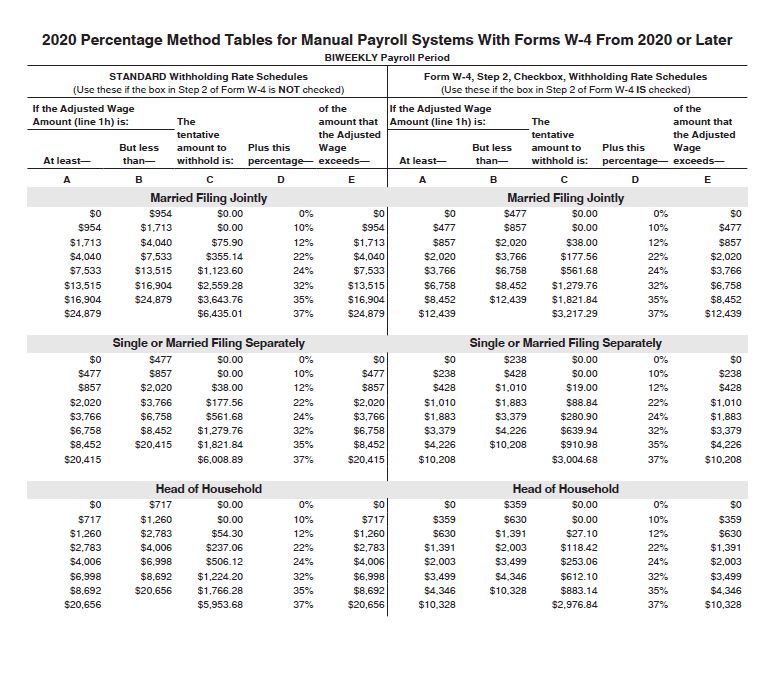

Web Jan 31 2024 nbsp 0183 32 2023 tax rates for a single taxpayer For a single taxpayer the rates are Here s how that works for a single person earning 58 000 per year 2023 tax rates for other filers Find the current tax rates for other filing statuses Married filing jointly or qualifying surviving spouse Married filing separately Head of household

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg?w=186)

https://www.irs.gov/pub/irs-pdf/i1040tt.pdf

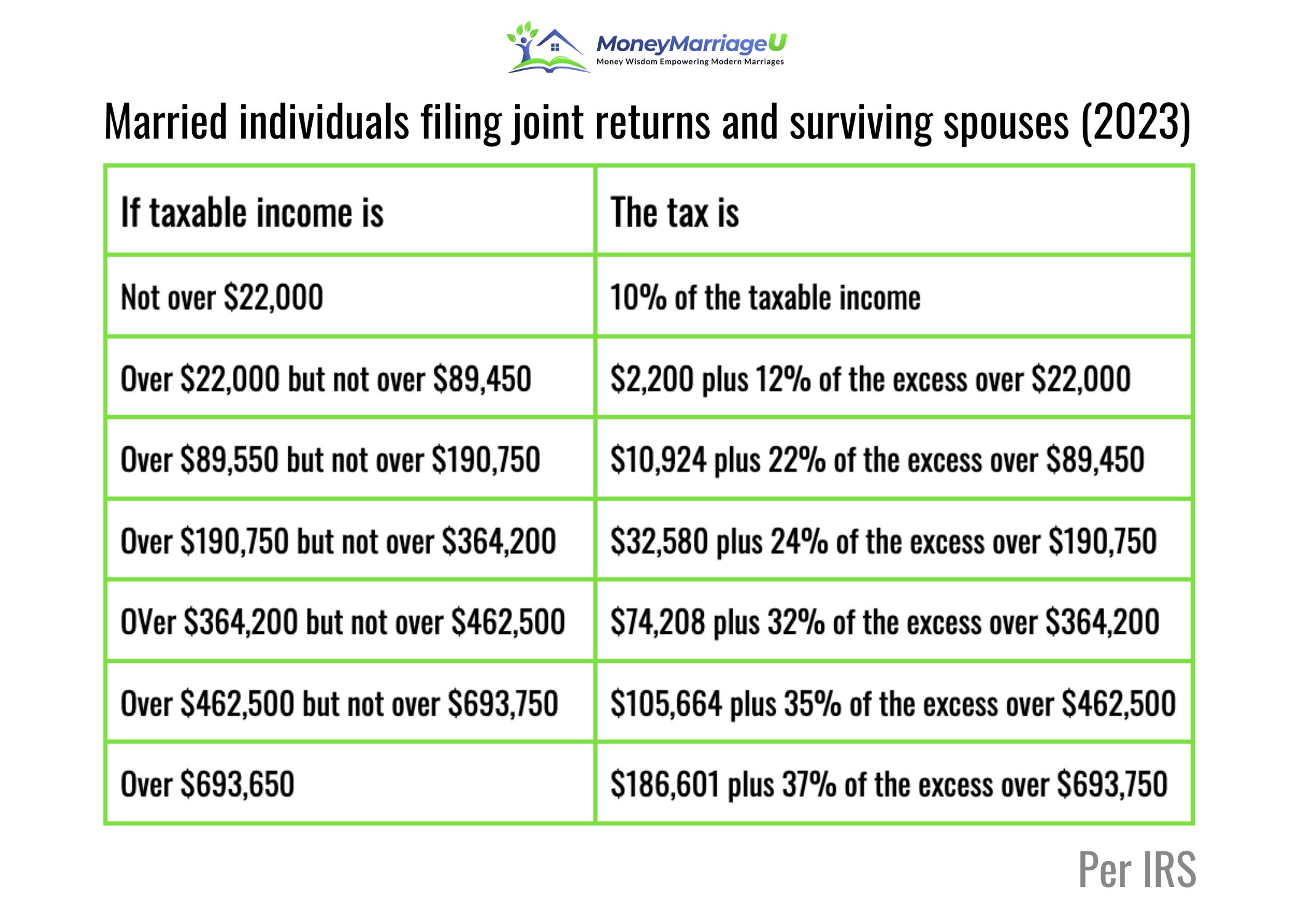

Web Their taxable income on Form 1040 line 15 is 25 300 First they find the 25 300 25 350 taxable income line Next they find the column for married filing jointly and read down the column The amount shown where the taxable income

https://www.morganstanley.com/content/dam/msdotcom/...

Web 3 8 tax on the lesser of 1 Net Investment Income or 2 MAGI in excess of 200 000 for single filers or head of households 250 000 for married couples filing jointly and 125 000 for married couples filing separately 231 250 578 100 51 226 00

https://www.irs.gov/newsroom/irs-provides-tax...

Web 35 for incomes over 231 250 462 500 for married couples filing jointly 32 for incomes over 182 100 364 200 for married couples filing jointly 24 for incomes over 95 375 190 750 for married couples filing jointly 22 for incomes over 44 725 89 450 for married couples filing jointly 12 for incomes over 11 000 22 000 for

https://turbotax.intuit.com/tax-tips/irs-tax...

Web Jan 12 2024 nbsp 0183 32 For example if you re married and filing jointly for 2023 taxes with a taxable income of 95 000 you d fall under the 22 tax bracket even though a majority of your taxable income 89 450 falls under the 12 tax bracket

Web Find out your 2023 federal income tax bracket with user friendly IRS tax tables for married individuals filing joint returns heads of households unmarried individuals married individuals filing separate returns and estates and trusts 1 Married Individuals Filing Joint Returns amp Surviving Spouses Heads of Households Web Married Filing Separately Rates for married individuals filing separate returns are one half of the Married Filing Jointly brackets Note Gains on the sale of collectibles e g antiques works of art and stamps are taxed at a maximum rate of 28

Web Jan 9 2024 nbsp 0183 32 Tax Rate Single Married filing separately Head of household Married filing jointly 10 Not over 11 600 Not over 11 600 Not over 16 550 Not over 23 200 12 Over 11 600 but not over 47 150