Tax Tables For 2023 Filing WEB The income limits for all 2023 tax brackets and all filers will be adjusted for inflation and will be as follows Table 1 There are seven federal income tax rates in 2023 10 percent 12 percent 22 percent 24

WEB Find out your 2023 federal income tax bracket with user friendly IRS tax tables for married individuals filing joint returns heads of households unmarried individuals married individuals filing separate returns and estates and trusts 1 WEB Jan 17 2023 nbsp 0183 32 TAXABLE INCOME 3 8 tax on the lesser of 1 Net Investment Income or 2 MAGI in excess of 200 000 for single filers or head of households 250 000 for married couples filing jointly and 125 000 for married couples filing separately

Tax Tables For 2023 Filing

Tax Tables For 2023 Filing

Tax Tables For 2023 Filing

https://i1.wp.com/i.ytimg.com/vi/TZohrS7MU20/maxresdefault.jpg?resize=618%2C348&ssl=1

WEB Jun 6 2024 nbsp 0183 32 You can figure out what tax bracket you re in using the tables published by the IRS see tables above To figure out your tax bracket first look at the rates for the filing status you plan to use single married filing jointly married filing separately or

Pre-crafted templates provide a time-saving service for developing a diverse series of documents and files. These pre-designed formats and layouts can be made use of for different personal and professional projects, including resumes, invites, leaflets, newsletters, reports, discussions, and more, enhancing the material creation procedure.

Tax Tables For 2023 Filing

IRS Tax Brackets For 2023 Taxed Right

2023 Form 1040 Tax Tables Printable Forms Free Online

2021 Federal Tax Rates Married Filing Jointly TaxProAdvice

2023 Tax Tables Australia IMAGESEE

2022 Tax Brackets Married Filing Jointly Irs Printable Form

Payroll Federal Tax Withholding Chart 2023 IMAGESEE

https://www.irs.gov/instructions/i1040tt

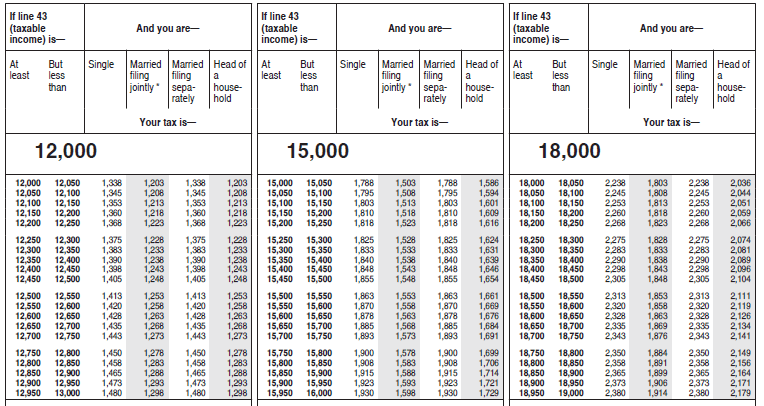

WEB 2023 Tax Table See the instructions for line 16 to see if you must use the Tax Table below to figure your tax

https://www.irs.gov/pub/irs-pdf/i1040tt.pdf

WEB Aug 22 2023 Cat No 24327A TAX AND EARNED INCOME CREDIT TABLES This booklet only contains Tax and Earned Income Credit Tables from the Instructions for Form 1040 and 1040 SR FreeFile is the fast safe and free way to prepare and e le your taxes See IRS gov FreeFile Pay Online It s fast simple and secure Go to IRS gov Payments

https://taxfoundation.org/data/all/federal/2023

WEB Oct 18 2022 nbsp 0183 32 2023 Tax Brackets and Rates The income limits for all 2023 tax brackets and all filers will be adjusted for inflation and will be as follows Table 1 There are seven federal income tax rates in 2023 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent

https://turbotax.intuit.com/tax-tips/irs-tax...

WEB Jan 12 2024 nbsp 0183 32 These tax brackets determine how much you ll pay on your taxable income for that year Each year tax brackets are adjusted based on inflation In many countries including the United States tax brackets are progressive which means the more you earn the higher your tax rate will be

https://www.morganstanley.com/content/dam/msdotcom/...

WEB Jan 17 2023 nbsp 0183 32 2023 Income Tax Tables 2023 Tax Rate Schedule Tax Rates on Long Term Capital Gains and Qualified Dividends Married Filing Jointly and Surviving Spouses Estates and Trusts Kiddie Tax All net unearned income over a threshold amount of 2 500 for 2023 is taxed using the marginal tax and rates of the child s parents

WEB Credits deductions and income reported on other forms or schedules Use our Tax Bracket Calculator to understand what tax bracket you re in for your 2023 2024 federal income taxes Based on your annual taxable income and filing status your tax bracket determines your federal tax rate WEB May 30 2024 nbsp 0183 32 In 2023 and 2024 there are seven federal income tax rates and brackets 10 12 22 24 32 35 and 37 Taxable income and filing status determine which federal tax rates apply to

WEB Feb 23 2023 nbsp 0183 32 The following are the tax numbers impacting most taxpayers which will be in effect beginning January 1 2023 Understanding your potential tax liability for next year will help you make decisions in 2021 to lower the taxes you pay