Tax Tables 2022 23 Cii A tax is a mandatory financial charge or levy imposed on an individual or legal entity by a governmental organization to support government spending and public expenditures

Oct 31 2024 nbsp 0183 32 Each tax is handled differently and there are often exceptions and qualifications for whom the tax pertains to What Are Different Types of Taxes Taxes can be classified in Jun 5 2025 nbsp 0183 32 The objective of stabilization implemented through tax policy government expenditure policy monetary policy and debt management is that of maintaining high

Tax Tables 2022 23 Cii

Tax Tables 2022 23 Cii

Tax Tables 2022 23 Cii

https://www.halfpricesoft.com/payroll-software/images/publication_15_T_2022.jpg

Jun 30 2024 nbsp 0183 32 Taxation refers to the act of levying or imposing a tax by a taxing authority Taxes include income capital gains or estate

Pre-crafted templates use a time-saving solution for developing a varied variety of documents and files. These pre-designed formats and layouts can be made use of for various personal and expert projects, including resumes, invites, leaflets, newsletters, reports, discussions, and more, enhancing the material creation procedure.

Tax Tables 2022 23 Cii

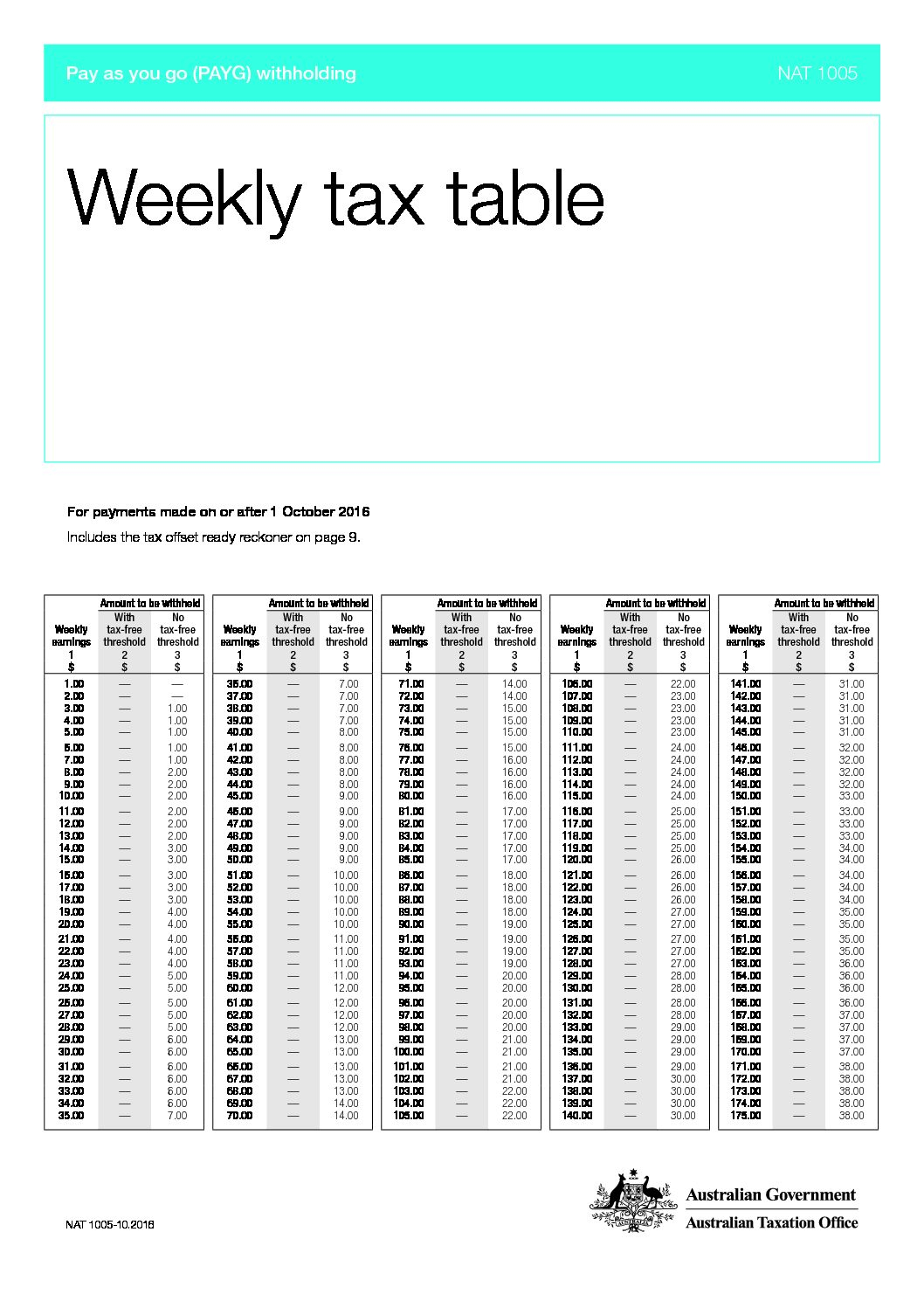

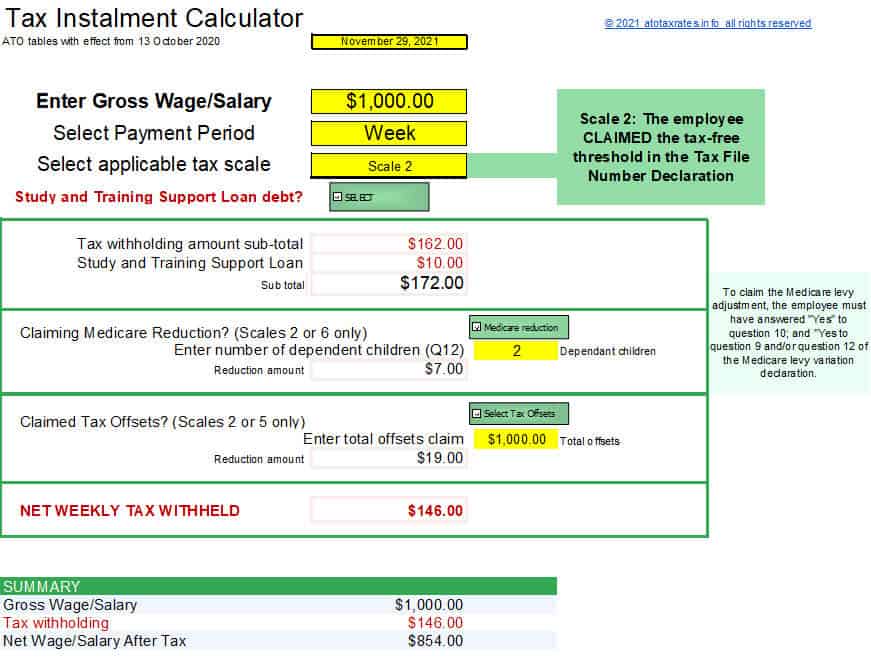

Weekly Federal Tax Chart Federal Withholding Tables 2021

2022 Tax Brackets AnnmarieEira

Irs Withholding Rates 2021 Federal Withholding Tables 2021 Free Nude

Weekly Deduction Tables 2021 Federal Withholding Tables 2021

Debbie Garcia 2022 Tax Brackets Australia

Sars Tax Tables 2022 Pocket Guidelines Brokeasshome

https://www.gov.me › mif › porezi-i-carine

Poreska politika Crne Gore zasniva se na sveobuhvatnosti poreskih obveznika niskim i konkurentnim poreskim stopama i veoma selektivnim poreskim olak icama

https://www.gov.me › poreskauprava › porezi

Informacije za poreske obveznike Uprava prihoda i carina naplatila je 2 33 milijarde eura u bruto iznosu od januara do kraja novembra to je vi e za 430 miliona eura 22 5 nego u istom pr

https://www.gov.me › en › taxadministration

Tax Administration

https://eprijava.tax.gov.me › DMZPortal › Pages › Home › Home.aspx

3 U okvir Add Dodaj ovu veb lokaciju unesite URL lokacije quot https eprijava tax gov me quot i kliknite na stavku Add Dodaj

https://invest.podgorica.me › tax-system

Corporate income tax amounts to 9 while the tax rate on personal income is 9 or 11 Upon payment of the corporate income tax business entities operating in Montenegro have the

[desc-11] [desc-12]

[desc-13]