Tax Rates For Ay 2022 23 Uk Web Value Added Tax From 1 April 2021 From 1 April 2022 Standard rate 20 20 Reduced rate 5 Annual Registration limit 163 85 000 163 85 000 Annual Deregistration limit 163 83 000 163 83 000 Temporary reduced rate for hospitality and tourism 5 12 5 20 The 5 rate applies to 30 September 2021 and the 12 5 rate applies from 1 October 2021 to 31

Web Apr 6 2022 nbsp 0183 32 Statutory pay standard rates 2022 23 2021 22 Average weekly earnings 163 123 or over 163 120 or over Sick Pay 163 99 35 163 96 35 Maternity Adoption Pay 163 156 66 163 151 97 Shared Parental Pay 163 156 66 163 151 97 Paternity Pay 163 156 66 163 151 97 Web Jun 15 2023 nbsp 0183 32 Basic rate taxpayers pay 8 75 in the 2023 24 and 2022 23 tax years Higher rate taxpayers pay 33 75 in the 2023 24 and 2022 23 tax years Additional rate taxpayers pay 39 35 in the 2023 24 and 2022 23 tax years Dividends are money paid or returned to shareholders from the profits made by a company

Tax Rates For Ay 2022 23 Uk

Tax Rates For Ay 2022 23 Uk

Tax Rates For Ay 2022 23 Uk

https://taxguru.in/wp-content/uploads/2022/02/icome-tax-rates.jpg

Web Feb 25 2022 nbsp 0183 32 Self Assessment Running your own business means paying your own income tax It s not much fun but it doesn t have to be confusing To help you navigate the exciting world of income tax rates just follow this simple guide What is income tax What are the income tax rates for 2022 23 in the UK Can I reduce my income tax rates

Templates are pre-designed files or files that can be used for various functions. They can conserve time and effort by offering a ready-made format and design for producing various sort of material. Templates can be used for individual or professional jobs, such as resumes, invites, leaflets, newsletters, reports, discussions, and more.

Tax Rates For Ay 2022 23 Uk

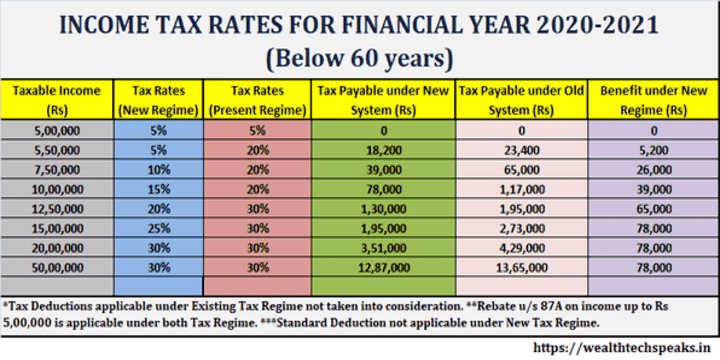

Income Tax Rates For Fy 2021 22 Pay Period Calendars 2023

Latest Income Tax Slab Rates FY 2019 20 AY 2020 21 Budget 2019

Income After Taxes Calculator California

Income Tax Rates For FY 2021 22 FY 2022 23 AY 2022 23 2023 24

Income Tax Slab FY 2023 24 AY 2024 25 Old New Regime

Income Tax Rates Slab For FY 2023 24 AY 2024 25 Ebizfiling

https://www.gov.uk/government/publications/rates...

Web Jan 15 2024 nbsp 0183 32 Higher rate for tax years up to and including 2022 to 2023 41 163 31 093 to 163 150 000 163 31 093 to 163 150 000 163 30 931 to 163 150 000 Top rate for tax year 2023 to 2024 47 Over 163 125 141

https://www.gov.uk/guidance/rates-and-thresholds...

Web Feb 7 2022 nbsp 0183 32 PAYE tax rates and thresholds 2022 to 2023 Employee personal allowance 163 242 per week 163 1 048 per month 163 12 570 per year English and Northern Irish basic tax rate

https://www.uktaxcalculators.co.uk/tax-rates/2022-2023

Web 1 25 taken off all rates from 6th November 2022 Blended NIC rate used for annual calculations 13 25 12 73 3 25 2 73 15 05 14 53 Between Primary Threshold and Upper Earnings Limit

https://www.which.co.uk/money/tax/income-tax/tax...

Web Jan 24 2024 nbsp 0183 32 What are the income tax rates across the UK in 2023 24 Most people in the UK have a 163 12 570 tax free personal allowance If you live in England Wales or Northern Ireland there are three income tax bands and rates above the tax free personal allowance that apply depending on your income

https://commonslibrary.parliament.uk/research-briefings/cbp-9489

Web Income tax on earned income is charged at three rates the basic rate the higher rate and the additional rate For 2022 23 these three rates are 20 40 and 45 respectively Tax is charged on taxable income at the basic rate up to the basic rate limit set at 163 37 700

Web Last updated 9 Oct 2023 For the tax year 2022 2023 the UK basic income tax rate was 20 This increased to 40 for your earnings above 163 50 270 and to 45 for earnings over 163 150 000 Your earnings below 163 12 570 were tax free Web Feb 16 2024 nbsp 0183 32 Your taxable income is the amount you earn above the personal allowance 163 12 570 for 2022 23 and 2023 24 and any other tax free allowances you are eligible for Here are the current tax bands rates and thresholds for England Wales and Northern Ireland for the tax year 2023 24 Band Tax rate Taxable income Personal allowance

Web Jan 1 2014 nbsp 0183 32 HM Revenue amp Customs Published 1 January 2014 Last updated 15 January 2024 See all updates Get emails about this page Documents Income Tax rates and allowances for current and past years HTML