Tax Rate For Indian Companies For Ay 2022 23 Corporate Income Tax Rate for AY 2022 23 Below are details of the Income Tax Rates for Pvt Ltd Companies in India slab wise for FY 2021 22 or AY 2022 23 This also corresponds to income tax slab for private limited company The tax

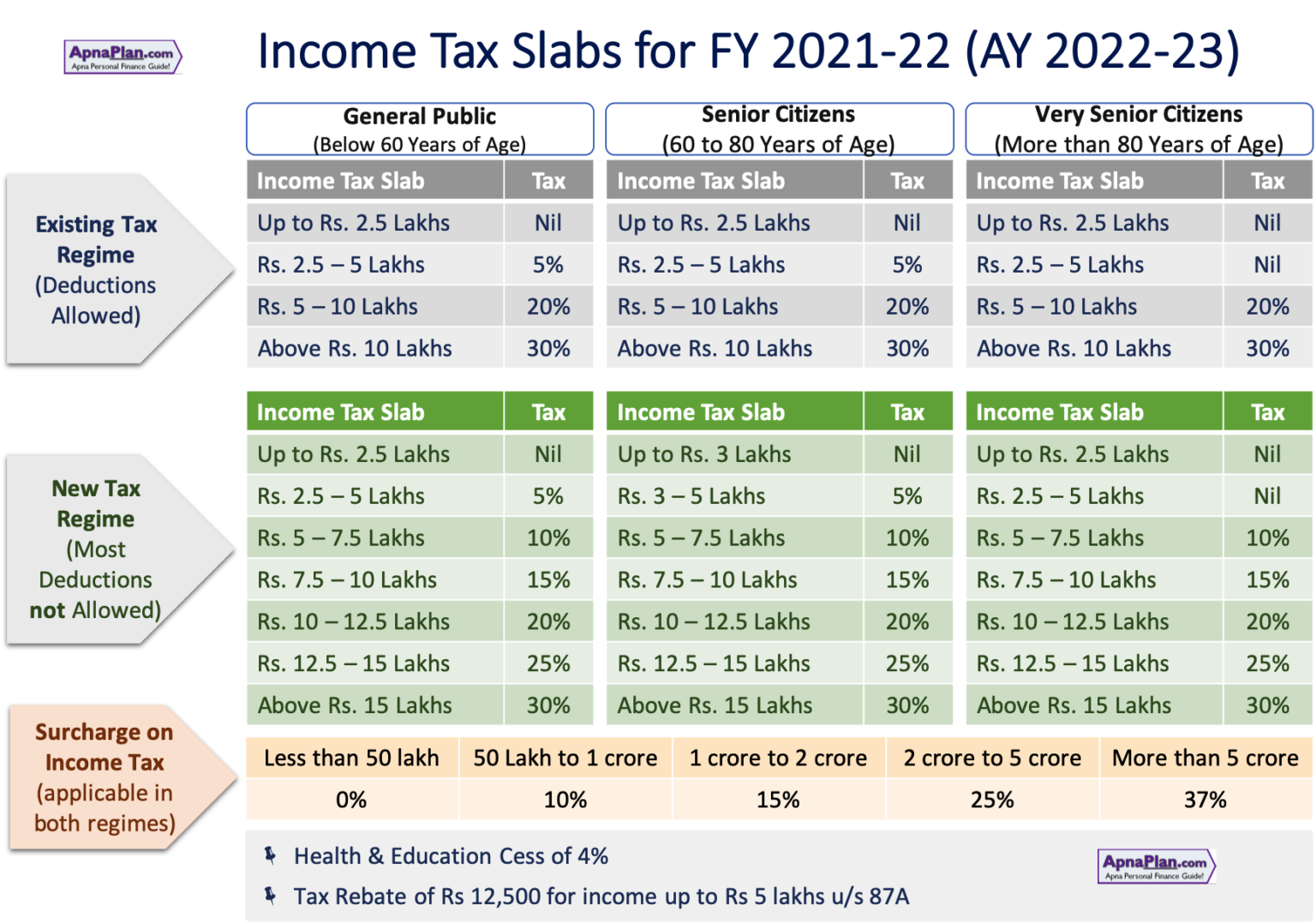

Apr 6 2021 nbsp 0183 32 Income Tax Slabs and Tax Rates for AY 2021 22 amp AY 2022 23 for Individual HUF Firm Local Authority Co op amp Companies for both regimes in user friendly format Feb 4 2022 nbsp 0183 32 Rates of Income Tax for FY 2021 22 AY 2022 23 and FY 2022 23 AY 2023 24 applicable to various categories of persons viz Individuals Firms companies etc

Tax Rate For Indian Companies For Ay 2022 23

Tax Rate For Indian Companies For Ay 2022 23

Tax Rate For Indian Companies For Ay 2022 23

https://i.ytimg.com/vi/6QRgZOL0cPY/maxresdefault.jpg

Apr 21 2025 nbsp 0183 32 Corporate Tax The income tax paid by domestic companies and foreign companies on their income in India is corporate income tax CIT The CIT is at a specific rate

Templates are pre-designed documents or files that can be used for various purposes. They can save effort and time by providing a ready-made format and layout for creating various type of material. Templates can be used for individual or professional jobs, such as resumes, invites, flyers, newsletters, reports, discussions, and more.

Tax Rate For Indian Companies For Ay 2022 23

Company Slab Rate For Ay 2024 25 Image To U

Tax Rates For Ay 2025 25 Sarah Davis

Ay Sales 2025 Leon Tanner

Income Tax Cess For Ay 2024 25 Image To U

Ato Tax Calculator 2025 India Diane F Sholar

Income Tax Ay 2025 25 Slab Olathe Moon

https://razorpay.com › rize › blogs › private-limited...

Dec 31 2024 nbsp 0183 32 Below is a detailed explanation of the corporate income tax rates for FY 2021 22 or AY 2022 23 For companies with a turnover of up to 400 crore Income up to 1 crore is taxed at 25

https://www.taxmanagementindia.com › visitor › tmi_faq_details.asp

Jan 2 2023 nbsp 0183 32 The tax rate is 15 in section 115BAB and 22 in section 115BAA Surcharge is 10 in both cases 2 In the case of company other than domestic company the rates of tax

https://taxconcept.net › income-tax

Apr 17 2022 nbsp 0183 32 Minimum Alternate Tax for A Y 2021 22 and A Y 2022 23 Period of carried forward of MAT credit is available for 15 AYs immediately succeeding the AY in which such credit has become allowable This is with

https://www.companiesnext.com › blog › corporate-tax...

Type of company Tax Rate All domestic companies u s 115BAA without availing prescribed deduction exemption applicable from FY 2019 20 22 plus surcharge of 10 and cess of 4 thus effective tax rate of 25 17

https://instafiling.com › private-limited-company-tax-rate

Feb 20 2023 nbsp 0183 32 Corporate Income Tax Rate AY 2022 23 There are two categories of the Taxation of Private Limited Companies in the Finance Budget Turnover above 400 Crore amp Turnover below 400 Crore Read The slab wise

In order to promote growth and investment a new provision has been inserted in the Income tax Act with effect from FY 2019 20 which allows any domestic company an option to pay income Income tax rates and thresholds for India in 2022 with supporting 2022 India Salary Calculator 2022 corporate tax rates individual capital gains income tax rates and salary allowances for

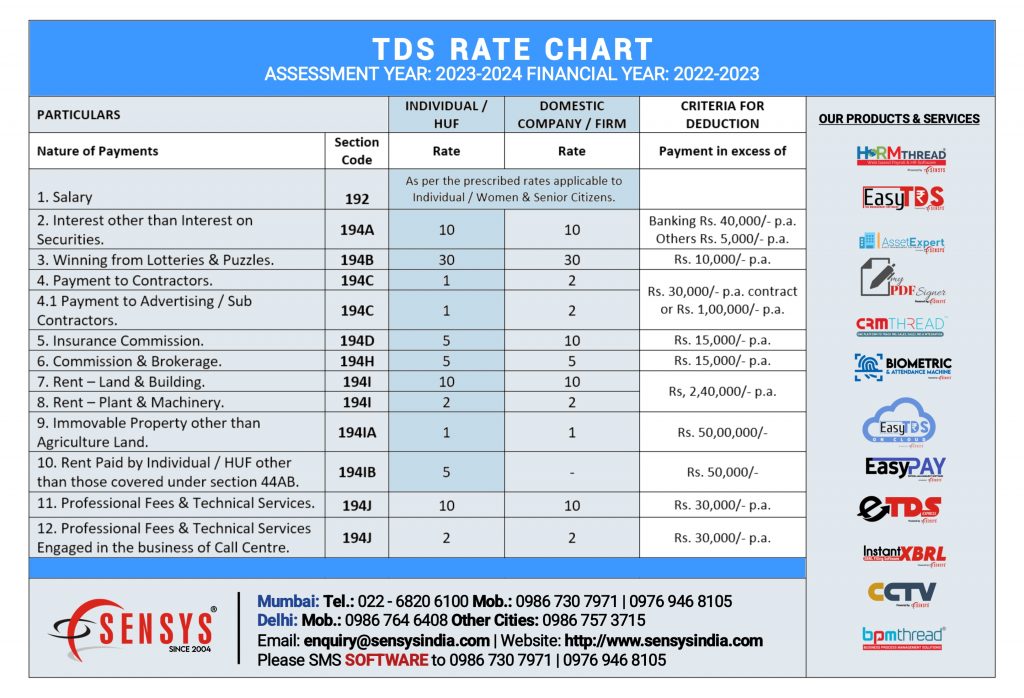

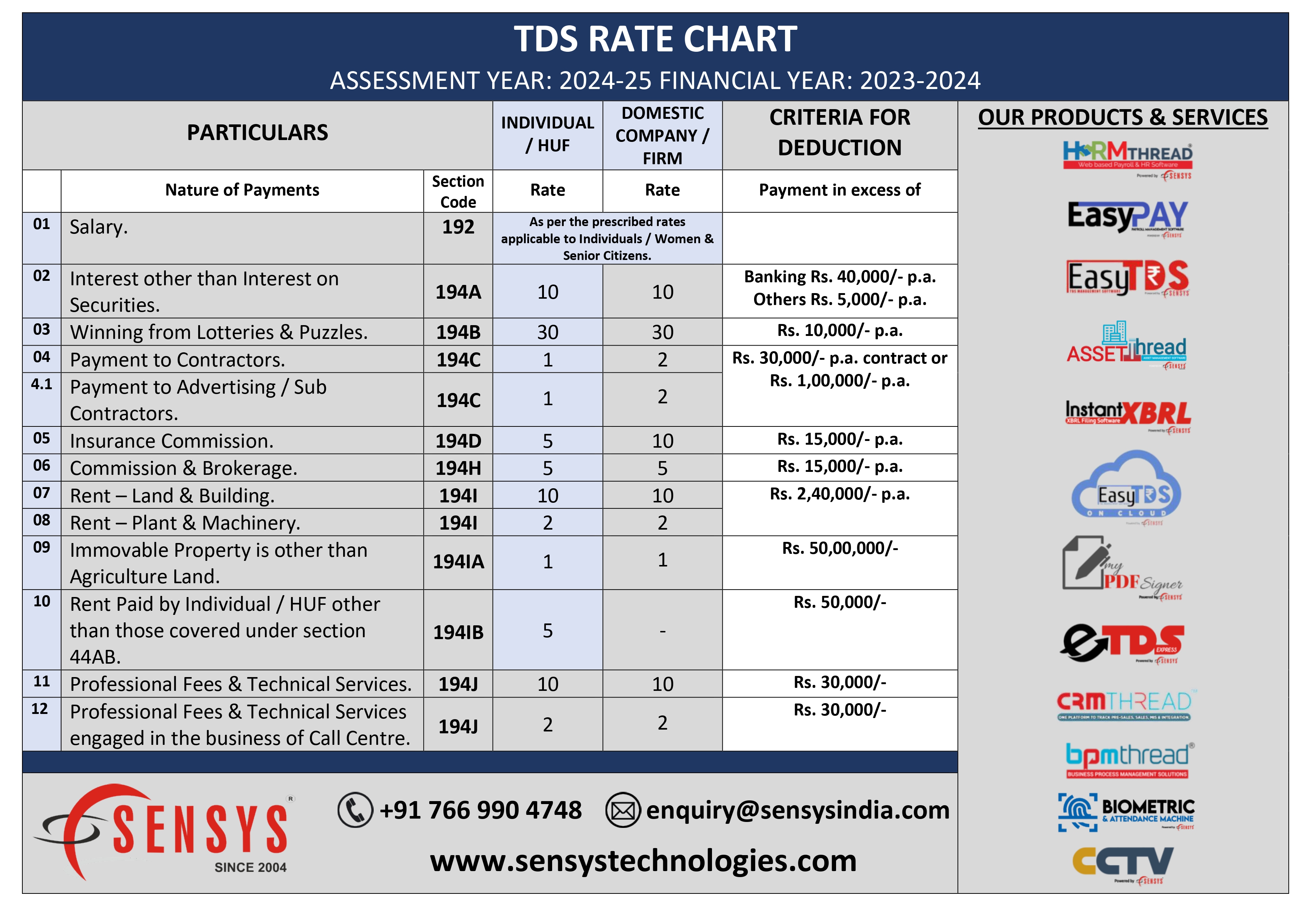

Jun 13 2022 nbsp 0183 32 Stay informed about the Income Tax Rates for the Financial Year 2022 23 and Assessment Year 2023 24 Explore different tax slabs for individuals HUFs companies and