Tax Rate For Ay 2022 23 Companies Web We re giving the easy scheme in which you can switch between Old and New Tax Slab Rates when you wish to make an investment for tax deduction 1 The taxpayers earning

Web Mar 28 2023 nbsp 0183 32 Section 115BAA states that domestic companies have the option to pay tax at a rate of 22 plus sc of 10 and cess of 4 The Effective Tax rate being 25 17 Web Tax Slabs for Foreign Company for AY 2023 24 Condition Income Tax Rate Royalty from Government or an Indian concern in pursuance of an agreement made with the Indian

Tax Rate For Ay 2022 23 Companies

Tax Rate For Ay 2022 23 Companies

Tax Rate For Ay 2022 23 Companies

https://i.ytimg.com/vi/3cEPghWPVz0/maxresdefault.jpg

Web Apr 1 2023 nbsp 0183 32 Income Tax Rate for Domestic Companies and Indian Companies in AY 2023 24 is 25 if the turnover is up to Rs 400 crore and 30 in other cases where

Pre-crafted templates offer a time-saving service for creating a diverse variety of files and files. These pre-designed formats and designs can be made use of for various personal and professional projects, consisting of resumes, invites, flyers, newsletters, reports, discussions, and more, streamlining the content production process.

Tax Rate For Ay 2022 23 Companies

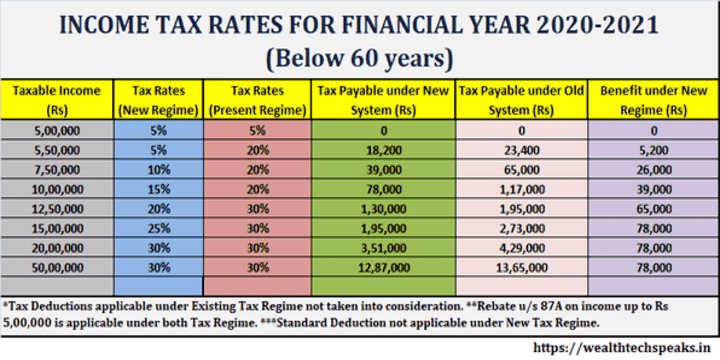

Income Tax Slab Fy 2022 23 Ay 2023 24 Old New Regime Home Interior Design

Income Tax Slab Fy 2022 23 Ay 2023 24 New Income Tax Slab Rate For Fy

Income Tax Calculation Fy 2020 21 Income Tax Calculator Ay 2020 21

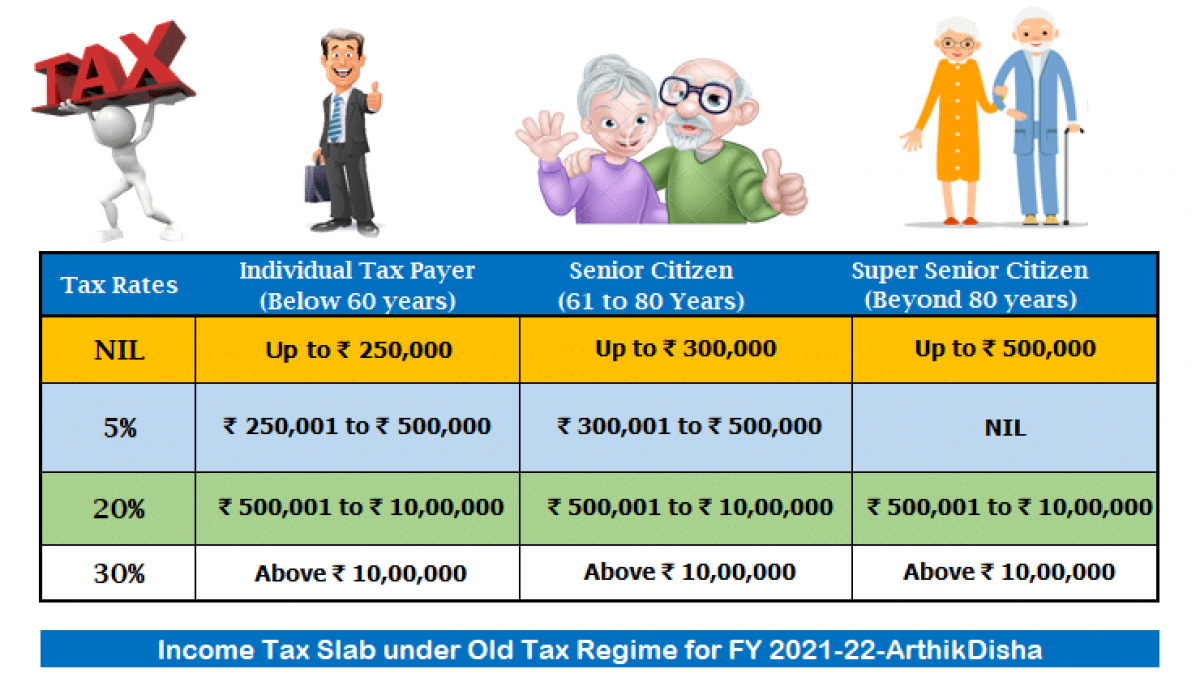

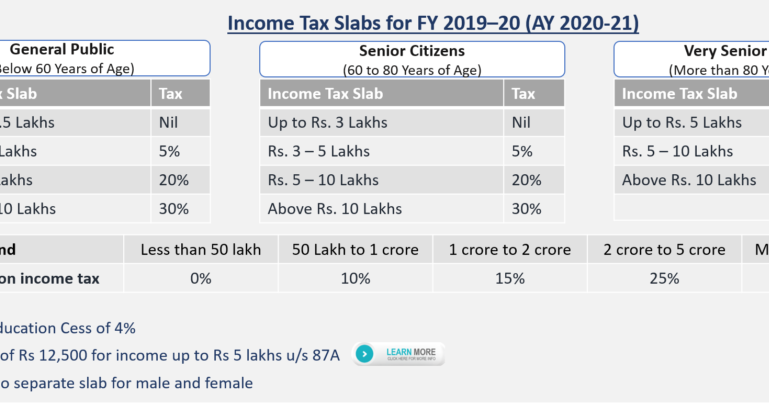

Latest Income Tax Slab Rates FY 2019 20 AY 2020 21 Budget 2019

Income Tax Slab FY 2023 24 AY 2024 25 Old New Regime

Income Tax Useful Information In Gujarati For AY 2020 21

https://www.sars.gov.za/tax-rates/income-tax/...

Web 3 days ago nbsp 0183 32 Companies Trusts and Small Business Corporations SBC To see tax rates from 2014 5 see the Archive Tax Rates webpage Companies 21 February 2024 No

https://cleartax.in/s/income-tax-slabs

Web Apr 14 2017 nbsp 0183 32 Income Tax Slab Rates For FY 2022 23 AY 2023 24 a New Tax regime Refer to the above image for the rates applicable to FY 2023 24 AY 2024 25 for the

https://www.gov.uk/government/publications/rates...

Web Dec 21 2022 nbsp 0183 32 Companies with profits between 163 50 000 and 163 250 000 will pay tax at the main rate reduced by a marginal relief This provides a gradual increase in the effective

https://www.incometax.gov.in/iec/foportal/help/company/return-applicable

Web Surcharge is an additional charge levied for persons earning income above the specified limits it is charged on the amount of income tax calculated as per applicable rates 7

https://www.ato.gov.au/tax-rates-and-codes/company-tax-rates

Web Last updated 4 June 2023 Print or Download Tax rates 2022 23 Company tax rates for the 2022 23 income year Tax rates 2021 22 Company tax rates for the 2021 22

Web Jun 4 2023 nbsp 0183 32 2022 23 tax rates Not for profit companies that are base rate entities see note 5 Income category Rate Taxable income 0 416 Nil Taxable income Web From the 2021 22 income year onwards companies that are base rate entities must apply the 25 company tax rate The rate was previously 27 5 from the 2017 18 to

Web Apr 24 2023 nbsp 0183 32 Get all the details of income tax rates for FY 2022 23 AY 2023 24 with various rates provided such as Individual HUF Companies and Partnership Firms