Tax Due Date Calendar 2022 23 Nz Web Feb 1 2023 nbsp 0183 32 15 January 2024 January of next year is the horizon many businesses will be looking to when it comes to medium term tax and general business planning On this date provisional tax is due to be paid the second instalment for the 2024 year as well as the GST for the period ended 30 Nov 2023

Web 7 April 2023 2022 end of year income tax payment due for clients of tax agents with a valid extension of time 31 March 2023 2022 income tax return due for clients of tax agent with a valid extension of time 7 July 2023 2023 income tax return due for people and organisations who do not have a tax agent or extension of time Web Most people need to pay their tax by 7 February the year after receiving a bill For example a tax bill for the 1 April 2022 to 31 March 2023 tax year is due on 7 February 2024 Refunds and tax bills When we work out your tax for you income tax assessments If you need to file an income tax return IR3 Early April to May returns

Tax Due Date Calendar 2022 23 Nz

Tax Due Date Calendar 2022 23 Nz

Tax Due Date Calendar 2022 23 Nz

https://advisorint.scotiawealthmanagement.com/content/uploads/sites/31/frustrated-couple-checking-bills-at-home-using-laptop-picture-id1159334654.jpg

Web Provisional and terminal tax due dates Select your balance date to see your provisional tax and terminal tax due dates Mar Apr May Jun Jul Sep Oct Nov Dec Jan Feb Aug 28 August First provisional tax payment due 15 January Second provisional tax payment due 7 May Third provisional tax payment due 7 February Terminal tax without EOT due 7 April

Templates are pre-designed documents or files that can be utilized for various purposes. They can save effort and time by providing a ready-made format and layout for creating different type of material. Templates can be used for individual or professional jobs, such as resumes, invites, flyers, newsletters, reports, presentations, and more.

Tax Due Date Calendar 2022 23 Nz

Premium Photo Tax Due Date Marked On Calendar

2021 2022 Tax Refund Calculator GG2022

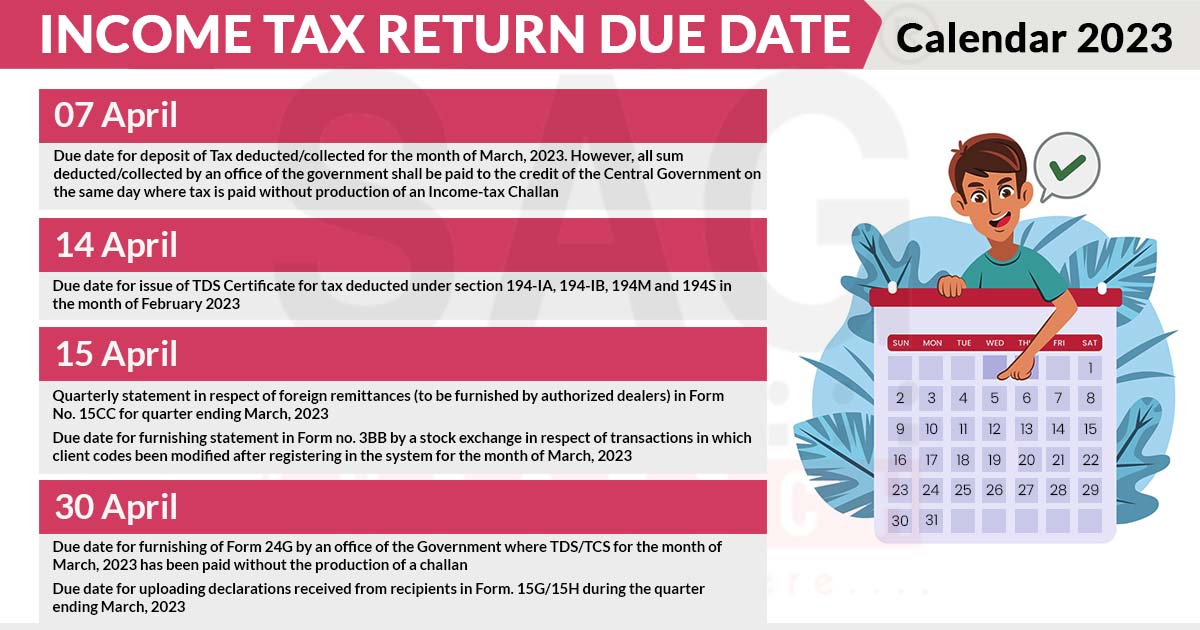

Revise Income Tax Due Date Chart For Fy 2021 22 After 20th May Photos

2021 E calendar Of Income Tax Return Filing Due Dates For Taxpayers

ITR Filing Last Date FY 2021 22 Income Tax Return Due Date

Digital Calendar Of Tax Due Date 2019 2020

https://www.ird.govt.nz/index/key-dates

Web If a due date falls on a weekend or public holiday we can receive your return and payment on the next working day without a penalty being applied Where a payment due date falls on a provincial anniversary date this only applies if you re in the province celebrating the holiday and only if you usually make tax payments over the counter at

https://www2.deloitte.com/content/dam/Deloitte/nz/...

Web Provisional tax due months are determined by balance date and method per Table 1 May 7 GST return and payment for taxable period ending 31 March Provisional tax is also due this date for certain balance dates per Table 1 May 31 Annual basis or final quarter FBT return and payment NB Income Year FBT return and

https://www.ird.govt.nz/-/media/project/ir/home/...

Web Mar 31 2023 nbsp 0183 32 2022 end of year income tax due for clients of tax agents with a valid extension of time 7 February 2024 2023 end of year income tax due for people and organisations who do not have a tax agent Income tax return 7 July 2023

https://www2.deloitte.com/nz/en/pages/tax-alerts/...

Web 2023 Deloitte tax calendar out now Our latest handy tax calendar is now available for download This spans 1 April 2022 to 31 March 2023 and contains key payment dates tax rates and useful tax facts for easy reference

https://taxsummaries.pwc.com/new-zealand/corporate/...

Web Jan 16 2024 nbsp 0183 32 Where the 2022 23 return of income has been filed 2023 24 provisional tax can be based on 105 of the 2022 23 residual income tax Where the 2022 23 return of income has not been filed due to an extension of time for filing 2023 24 provisional tax can be based on 110 of the 2021 22 residual income tax but only for the first two instalments

Web Apr 11 2023 nbsp 0183 32 This order which comes into force on its notification in the Gazette extends specified time frames under the Income Tax Act 2007 the Act that relate to distributing beneficiary income section HC 6 1B b ii of the Act This order appoints 31 May 2023 as a further date on or before which a person may perform those actions Web Minister of Finance Minister of Revenue Extending the tax due date on 28 October 2021 to 4 November 2021 This report seeks your agreement to extend the due date for the filing of returns and payment of income tax including provisional tax and goods and services tax GST from 28 October 2021 to 4 November 2021

Web Provisional tax due months are determined by balance date and method per Table 1 May 7 GST return and payment for taxable period ending 31 March Provisional tax is also due this date for certain balance dates per Table 1 May 31 Annual basis or final quarter FBT return and payment NB Income Year FBT return and