Tax Brackets For Salary 2022 Web Nov 10 2021 nbsp 0183 32 There s one big caveat to these 2022 numbers Democrats are still trying to pass the now 1 85 trillion Build Back Better Act and the latest November 3 legislative

Web Nov 10 2021 nbsp 0183 32 The 2022 tax brackets affect the taxes that will be filed in 2023 These are the 2021 brackets Here are the new brackets for 2022 depending on your income and Web Nov 9 2023 nbsp 0183 32 69 State Filing Fee 59 1 TurboTax Deluxe Learn More On Intuit s Website Federal Filing Fee 54 95 State Filing Fee 39 95 2 TaxSlayer Premium Learn More On

Tax Brackets For Salary 2022

Tax Brackets For Salary 2022

Tax Brackets For Salary 2022

https://hkglcpa.com/wp-content/uploads/2022/10/2022-Tax-Brackets-for-Single-Filers-and-Married-Couples-Filing-Jointly.png

Web Nov 10 2021 nbsp 0183 32 The personal exemption for tax year 2022 remains at 0 as it was for 2021 this elimination of the personal exemption was a provision in the Tax Cuts and Jobs Act

Pre-crafted templates provide a time-saving option for producing a diverse range of files and files. These pre-designed formats and designs can be made use of for different individual and expert tasks, consisting of resumes, invitations, leaflets, newsletters, reports, discussions, and more, streamlining the material creation process.

Tax Brackets For Salary 2022

What Are The Tax Brackets For 2022 Married Filing Jointly Printable

10 2023 California Tax Brackets References 2023 BGH

2022 Tax Brackets PersiaKiylah

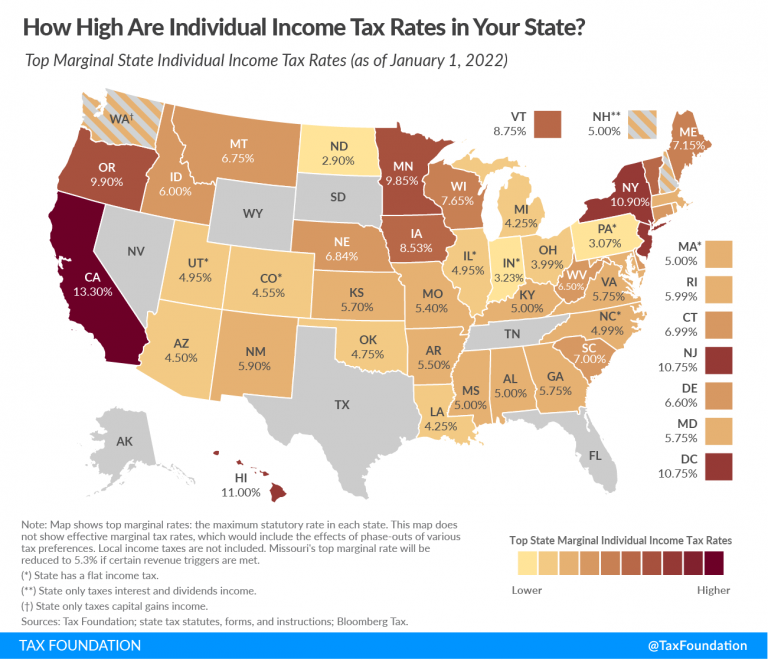

State Income Tax Rates And Brackets 2022 Tax Foundation

2022 Tax Brackets Married Filing Jointly Irs Printable Form

2022 Tax Brackets MeghanBrannan

https://taxfoundation.org/data/all/federal/2022-tax-brackets

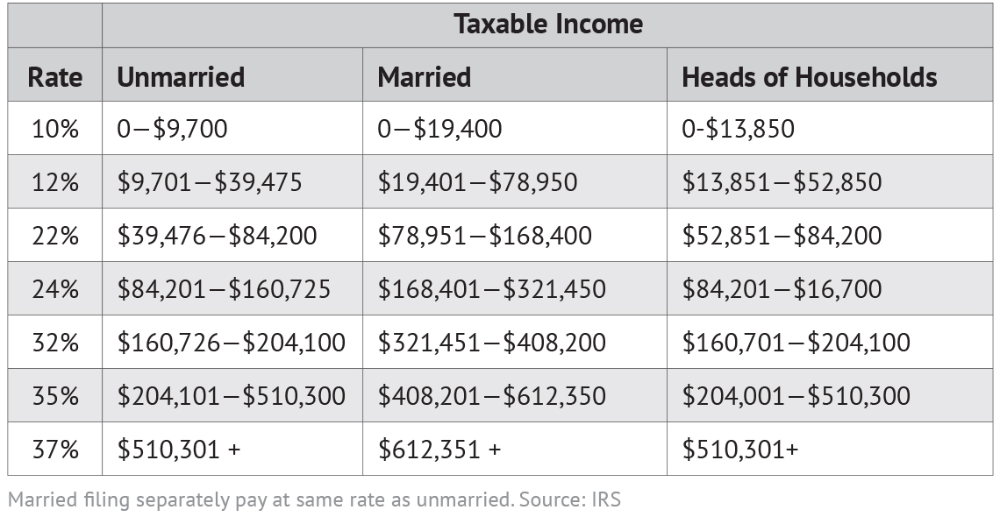

Web Nov 10 2021 nbsp 0183 32 In 2022 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1 There are seven federal income tax rates in

https://www.irs.com/en/2022-federal-income-tax...

Web Feb 21 2022 nbsp 0183 32 The federal income tax rates for 2022 are 10 12 22 24 32 35 and 37 depending on the tax bracket What are the tax brackets for 2022 The 2022

https://www.nerdwallet.com/article/taxes/fed…

Web Jan 29 2024 nbsp 0183 32 The seven federal income tax brackets for 2023 and 2024 are 10 12 22 24 32 35 and 37 Your bracket depends

https://www.ato.gov.au/tax-rates-and-codes/tax-rates-australian-residents

Web Sep 28 2023 nbsp 0183 32 Resident tax rates 2022 23 Taxable income Tax on this income 0 18 200 Nil 18 201 45 000 19c for each 1 over 18 200 45 001 120 000

https://www.sars.gov.za/tax-rates/income-tax/rates-of-tax-for-individuals

Web Dec 27 2023 nbsp 0183 32 On this page you will see Individuals tax table as well as the Tax Rebates and Tax Thresholds scroll down To see tax rates from 2014 5 see the Archive Tax

Web Nov 11 2021 nbsp 0183 32 The maximum Earned Income Tax Credit for 2022 will be 6 935 vs 6 728 for tax year 2021 for taxpayers with three or more qualifying children Basic exclusion for Web Nov 22 2021 nbsp 0183 32 As you can see from the chart the biggest income tax rate jump goes from 24 to 32 when your income is between 170 051 to 215 950 Further the widest

Web Use our Tax Bracket Calculator to understand what tax bracket you re in for your 2023 2024 federal income taxes Based on your annual taxable income and filing status your