Tax Brackets For Payroll 2022 Tax filing deadline to request an extension until Oct 17 2022 for individuals whose tax return deadline is April 18 2022 Last day to contribute to Roth or traditional IRA or HSA for 2021

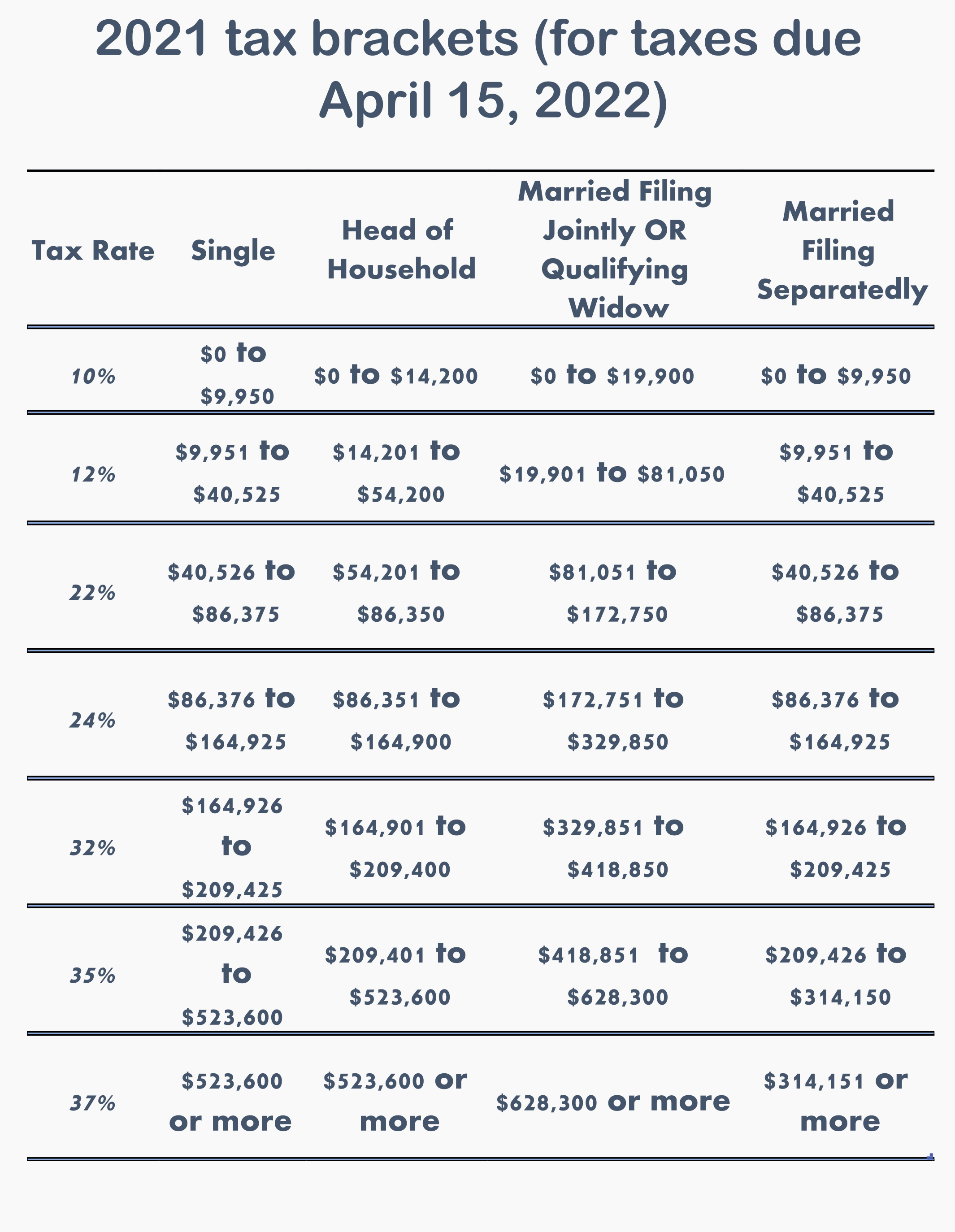

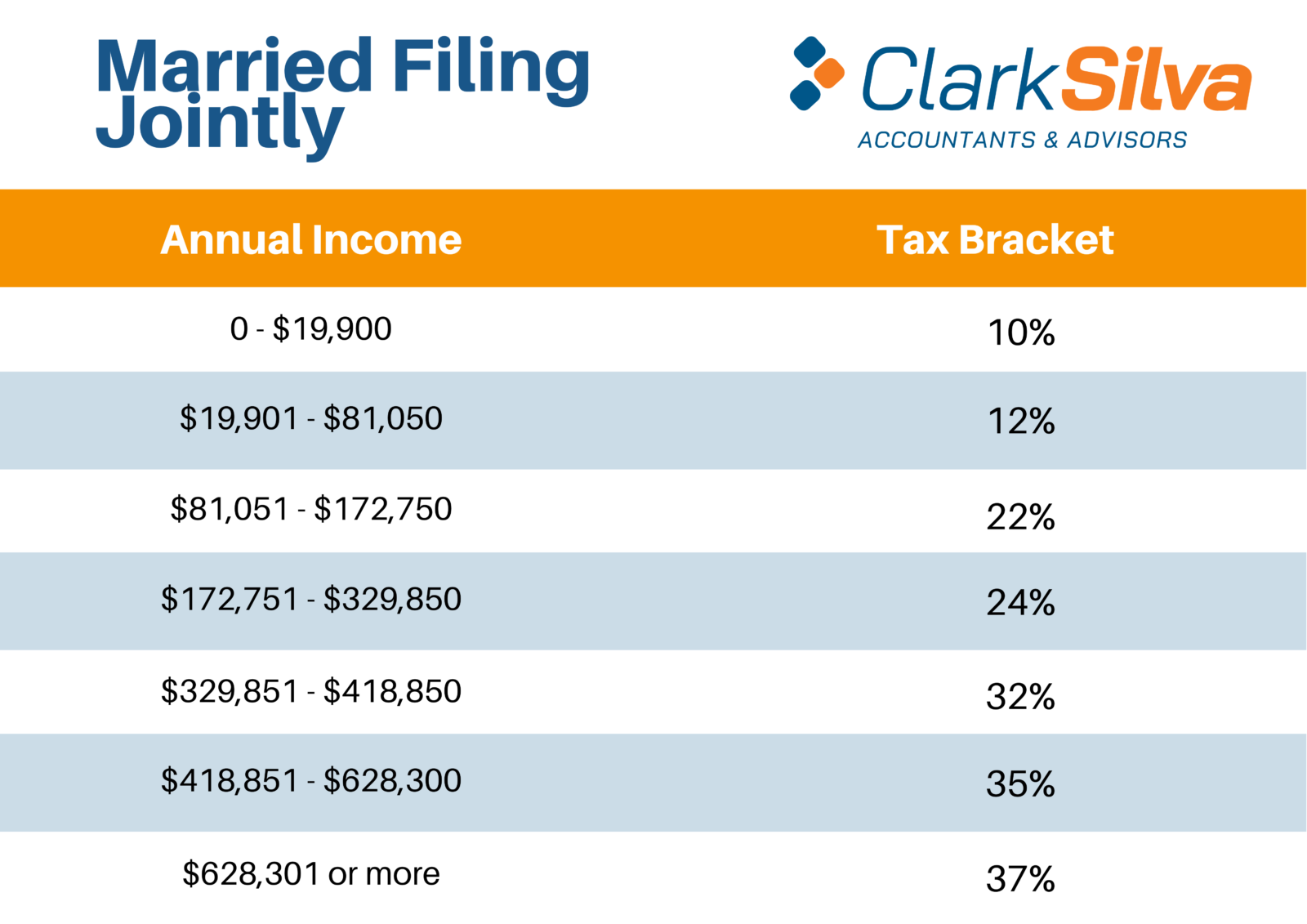

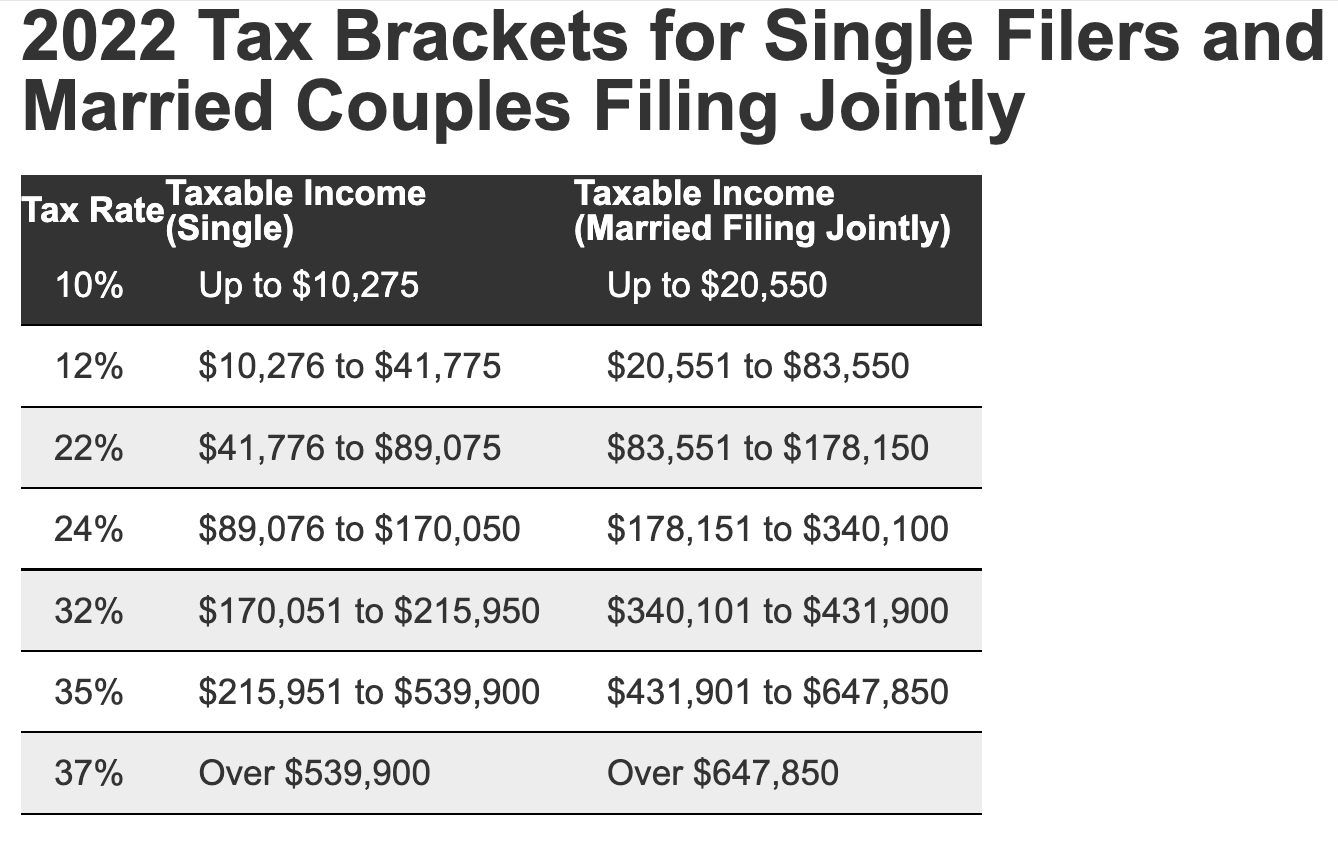

Jan 1 2022 nbsp 0183 32 Update your payroll tax rates with these useful tables from IRS Publication 15 Circular E Employer s Tax Guide The charts include federal withholding income tax FICA Feb 21 2022 nbsp 0183 32 The federal income tax rates for 2022 are 10 12 22 24 32 35 and 37 depending on the tax bracket What are the tax brackets for 2022 The 2022 tax brackets

Tax Brackets For Payroll 2022

Tax Brackets For Payroll 2022

Tax Brackets For Payroll 2022

https://federalwithholdingtables.net/wp-content/uploads/2021/07/federal-income-tax-brackets-released-for-2021-has-yours-1.png

Nov 10 2021 nbsp 0183 32 The IRS released the federal marginal tax rates and income brackets for 2022 on Wednesday The seven tax rates remain unchanged while the income limits have been adjusted for inflation

Pre-crafted templates provide a time-saving option for developing a diverse variety of documents and files. These pre-designed formats and designs can be made use of for different individual and expert tasks, consisting of resumes, invitations, flyers, newsletters, reports, presentations, and more, enhancing the material development procedure.

Tax Brackets For Payroll 2022

2022 Income Tax Brackets Chart Printable Forms Free Online

The Truth About Tax Brackets Legacy Financial Strategies LLC

Federal Tax Brackets 2021 Newyorksilope

2022 Federal Tax Brackets And Standard Deduction Printable Form

2021 2022 Tax Brackets And Federal Income Tax Rates Kiplinger

These Are The Us Federal Tax Brackets For 2021 And 2020 Vs 2021 Free

https://taxfoundation.org › data › all › federal

Nov 10 2021 nbsp 0183 32 There are seven federal income tax rates in 2022 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent The top marginal income tax rate of 37 percent will hit taxpayers with taxable income

https://www.irs.gov › pub › irs-prior

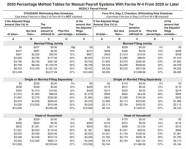

The employer has a manual payroll system and prefers to use the Wage Bracket Method tables to figure withholding The em ployer will use Worksheet 3 and the withholding tables in section 3

https://www.irs.gov › filing › federal-incom…

Feb 13 2025 nbsp 0183 32 See current federal tax brackets and rates based on your income and filing status

https://www.forbes.com › advisor › business › payroll-tax-rates

May 2 2024 nbsp 0183 32 In most cases the federal payroll tax rate is about 15 3 with the employee covering 7 65 and the employer covering 7 65 If you re self employed as a sole

https://www.gov.uk › guidance

Feb 7 2022 nbsp 0183 32 Use these rates and thresholds when you operate your payroll or provide expenses and benefits to your employees

Table 1 Brackets for wage tax national insurance contributions 2022 For employees of the state pension age and older born in 1945 or before the following grades apply The rate in Jul 24 2009 nbsp 0183 32 Following is a summary of the federal 2023 payroll tax changes including Social Security Medicare Unemployment Tax Minimum Wage 401 k limits and more The wage

Nov 29 2021 nbsp 0183 32 Below are federal payroll tax rates and benefits contribution limits for 2022 In 2022 the Social Security tax rate is 6 2 for employers and employees unchanged from