Tax Brackets For 2022 Vs 2023 Web Feb 4 2024 nbsp 0183 32 Here are the 2023 federal tax brackets and income tax rates for the four most common filing statuses Due to inflation these brackets were adjusted significantly from the 2022 tax

Web Oct 18 2022 nbsp 0183 32 The additional standard deduction for someone who is 65 or older will rise to 1 500 per person from 1 400 in 2022 if that senior is unmarried the additional deduction will be 1 850 in 2023 Web IR 2022 182 October 18 2022 The Internal Revenue Service today announced the tax year 2023 annual inflation adjustments for more than 60 tax provisions including the tax rate schedules and other tax changes Revenue Procedure 2022 38 provides details about these annual adjustments

Tax Brackets For 2022 Vs 2023

Tax Brackets For 2022 Vs 2023

Tax Brackets For 2022 Vs 2023

https://www.ntu.org/Library/imglib/2021/11/ntuf-table1.png

Web Oct 14 2022 nbsp 0183 32 The US Bureau of Labor Statistics reported that the consumer price index increased just 0 1 for August after no change in July However inflation remains a concern because over the last 12 months the index rose 8 3 before seasonal adjustment And those rates could impact your 2023 tax picture The CPI measures the cost of goods and

Templates are pre-designed files or files that can be used for various purposes. They can save effort and time by offering a ready-made format and design for developing different type of material. Templates can be used for personal or professional jobs, such as resumes, invites, leaflets, newsletters, reports, discussions, and more.

Tax Brackets For 2022 Vs 2023

2022 Tax Brackets Irs Calculator

What Are The Tax Brackets For 2022 Married Filing Jointly Printable

10 2023 California Tax Brackets References 2023 BGH

2022 To 2023 Tax Brackets TAX

What Are The Capital Gains Tax Brackets For 2022 Latest News Update

2023 California Tax Brackets W2023H

https://www.ntu.org/foundation/detail/what-are...

Web Oct 18 2022 nbsp 0183 32 Income Tax Brackets for Single Taxpayers 2022 2023 2022 Income 2023 Filing Season due April 17 2023 2023 Income 2024 Filing Season due April 15 2024 Income Difference for Top of Bracket 2023 vs 2022 Income Tax Income Tax Difference 0 10 275 10 of income 0 11 000 10 of income 725 7 1

https://taxfoundation.org/data/all/federal/2023-tax-brackets

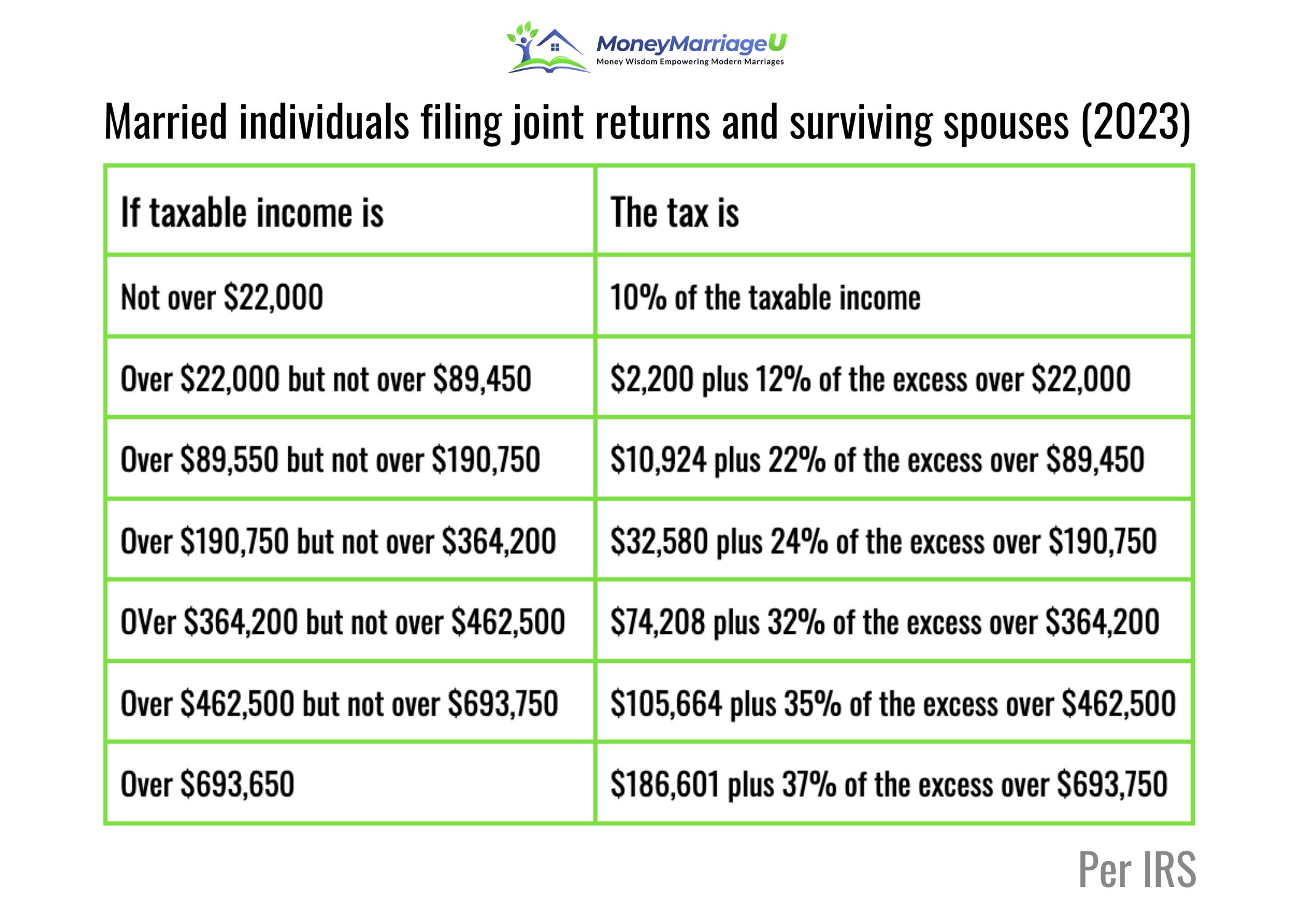

Web Oct 18 2022 nbsp 0183 32 2023 Tax Brackets and Rates The income limits for all 2023 tax brackets and all filers will be adjusted for inflation and will be as follows Table 1 There are seven federal income tax rates in 2023 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent

https://finance.yahoo.com/news/taxes-here-are-the...

Web Jan 22 2023 nbsp 0183 32 Changes to 2023 federal income tax brackets For the 2023 tax year there are seven federal tax brackets 10 12 22 24 32 35 and 37 Your tax bracket is determined by

https://www.nasdaq.com/articles/federal-tax...

Web May 16 2023 nbsp 0183 32 The federal income tax brackets that will apply to your 2023 tax return based on the filing status you use single married filing separately married filing jointly surviving spouse or

https://www.zrivo.com/2022-vs-2023-irs-tax-brackets-comparison

Web The top income limits are higher in 2023 than they were in 2022 which means you ll have to earn more income to be in these brackets While this is positive it s important to remember that these changes will only affect people earning more money than you do now

Web Oct 25 2022 nbsp 0183 32 For married couples filing jointly the new standard deduction for 2023 will be 27 700 This is a jump of 1 800 from the 2022 standard deduction The 2023 standard deduction for single taxpayers Web Jan 29 2024 nbsp 0183 32 The seven federal income tax brackets for 2023 and 2024 are 10 12 22 24 32 35 and 37 Your bracket depends on your taxable income and filing status

Web Jan 9 2024 nbsp 0183 32 The 2023 tax year meaning the return you ll file in 2024 will have the same seven federal income tax brackets as the last few seasons 10 12 22 24 32 35 and 37