Tax Brackets 2023 Married Jointly Calculator Enter your tax year filing status and taxable income to calculate your estimated tax rate How tax brackets work How to get into a lower tax bracket and pay a lower federal income tax rate What is a marginal tax rate Estimate your 2023 tax bracket

Find the 2025 tax rates for money you earn in 2025 See current federal tax brackets and rates based on your income and filing status You can use our Federal Tax Brackets Calculator to determine how much tax you will pay for the current tax year or to determine how much tax you have paid in previous tax years To do so all you need to do is

Tax Brackets 2023 Married Jointly Calculator

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA16efiq.img

Efficiently determine your U S tax bracket with our user friendly tool tailored for all filing statuses and precise calculations

Templates are pre-designed documents or files that can be utilized for numerous functions. They can conserve time and effort by offering a ready-made format and layout for creating various type of material. Templates can be utilized for personal or expert tasks, such as resumes, invites, flyers, newsletters, reports, discussions, and more.

Tax Brackets 2023 Married Jointly Calculator

Understanding 2023 Tax Brackets What You Need To Know

10 2023 California Tax Brackets References 2023 BGH

2022 Tax Tables Married Filing Jointly Printable Form Templates And

What Are The Tax Brackets For 2022 Married Filing Jointly Printable

Tax Brackets Chart 2023 IMAGESEE

2023 IRS Inflation Adjustments Tax Brackets Standard Deduction EITC

https://www.calculatorsoup.com › ... › tax-federal-est.php

Mar 28 2024 nbsp 0183 32 Calculator Use Updated to include income tax calculations for 2022 form 1040 and 2023 Estimated form 1040 ES for status Single Married Filing Jointly Married Filing Separately or Head of Household Estimate your US federal income tax for 2023 2022 2021 2020 2019 2018 2017 2016 or 2015 using IRS formulas The calculator will

https://taxfoundation.org › data › all › federal

Oct 18 2022 nbsp 0183 32 The IRS recently released the new inflation adjusted 2023 tax brackets and rates Explore updated credits deductions and exemptions including the standard deduction amp personal exemption Alternative Minimum Tax AMT Earned Income Tax Credit EITC Child Tax Credit CTC capital gains brackets qualified business income deduction 199A

https://www.omnicalculator.com › finance › tax-bracket

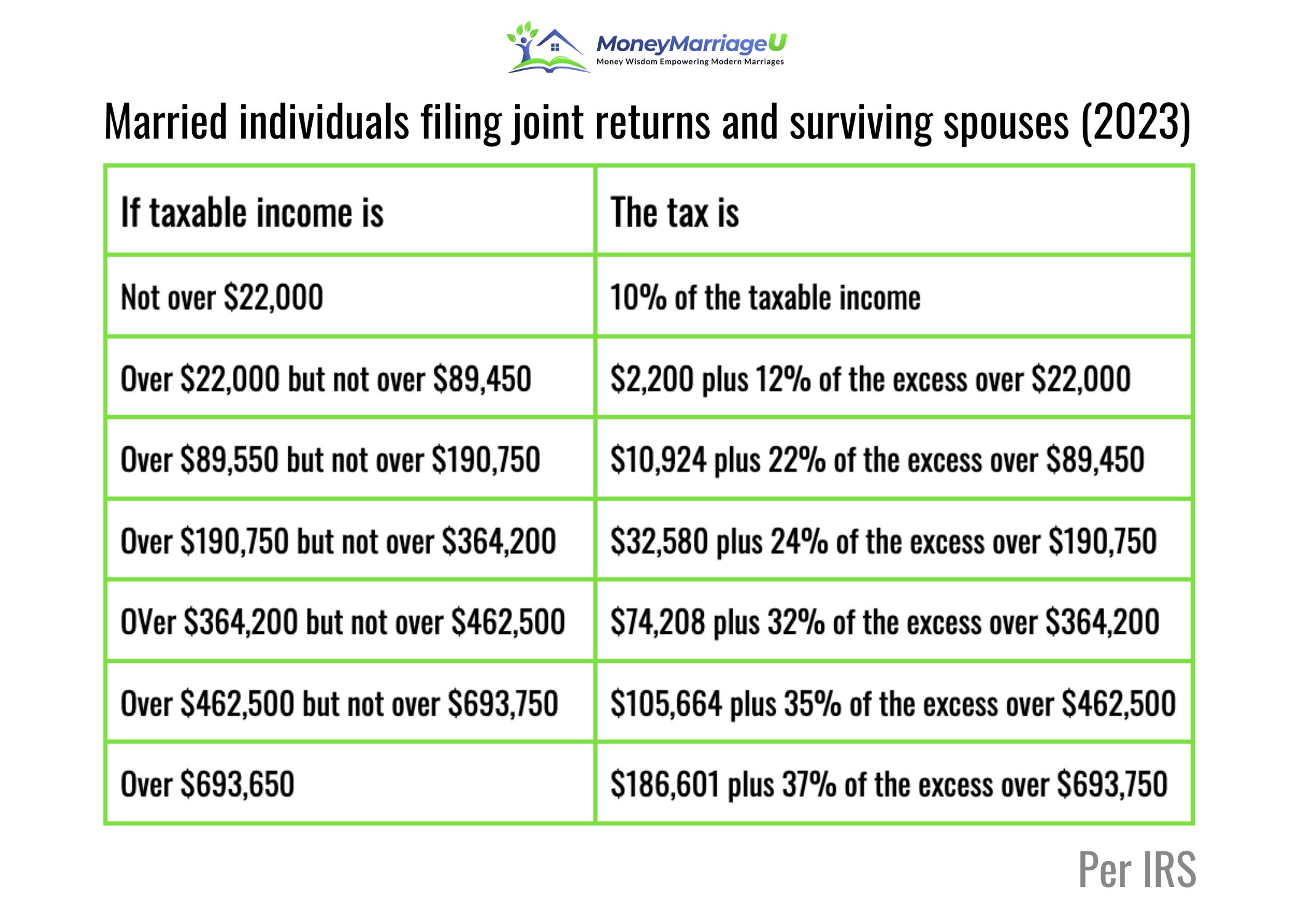

If your taxable income was 100 000 in 2023 and you are married filing jointly your income falls into the following three tax brackets Between 0 22 000 22 000 of your income is taxed at a 10 rate which is 2 200

https://www.forbes.com › advisor › taxes › tax-bracket-calculator

Oct 30 2024 nbsp 0183 32 If you want to determine your marginal tax bracket for the 2023 tax year use our calculator Simply enter your taxable income and filing status to view your top tax rate

https://flyfin.tax › tax-bracket-calculator

This tax calculator calculates federal tax brackets for 2023 and helps you find your income tax rate and how to use credits and deductions to lower your tax bracket

This calculator helps you estimate your average tax rate for 2022 2023 your 2022 2023 tax bracket and your marginal tax rate for the 2022 2023 tax year TaxAct s free tax bracket calculator is a simple easy way to estimate your federal income tax bracket and total tax Use this tool to determine your tax bracket based on your salary or self employment income

The calculator below can help estimate the financial impact of filing a joint tax return as a married couple as opposed to filing separately as singles based on 2025 federal income tax brackets and data specific to the United States