Tax Bands For 2023 24 Web Oct 18 2022 nbsp 0183 32 There are seven federal income tax rates in 2023 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent The top marginal income

Web Date March 22 2023 Tax brackets for the 2023 24 tax year are updated below following the Budget on 15 March 2023 For the 2023 24 tax year once again many rates Web The following tables show the tax rates rate bands and tax reliefs for the tax year 2024 and the previous tax years Calculating your Income Tax gives more information on how

Tax Bands For 2023 24

Tax Bands For 2023 24

Tax Bands For 2023 24

https://www.income-tax.co.uk/wp-content/uploads/2022/04/do-income-tax-bands-change-1024x683.jpg

Web Jan 2 2024 nbsp 0183 32 Here s a handy round up of the UK tax brackets and allowances for the current tax year 2023 24 2023 24 tax brackets 1 Income tax You pay income tax at the rates applicable to the parts of

Templates are pre-designed files or files that can be used for numerous purposes. They can save time and effort by supplying a ready-made format and layout for producing various sort of content. Templates can be utilized for individual or expert projects, such as resumes, invites, flyers, newsletters, reports, presentations, and more.

Tax Bands For 2023 24

Car Tax Bands 2020 VED Bands Explained Auto Express

Uk Tax Bands How Car Specs

New Vehicle Tax Bands

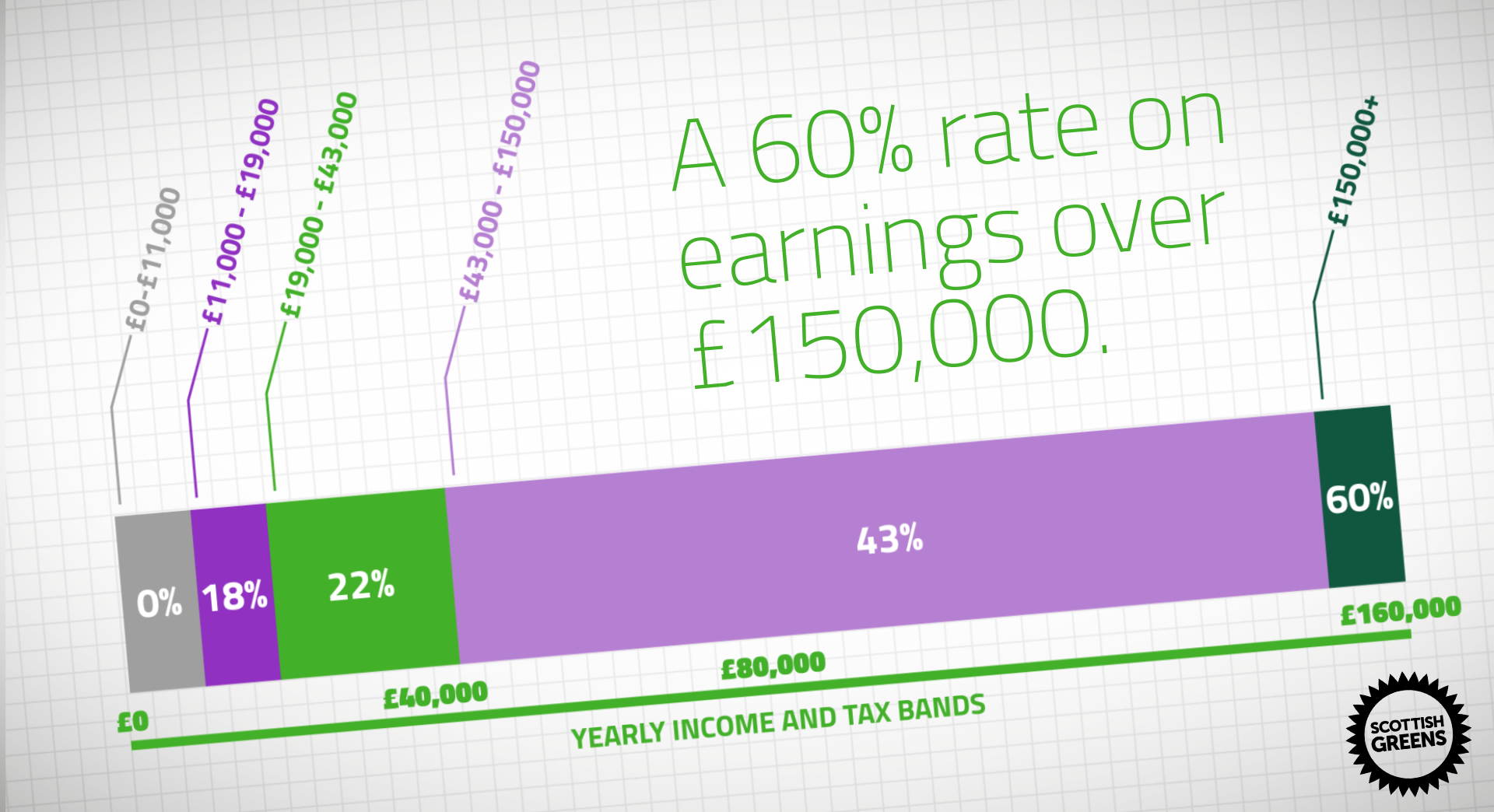

Raise Funds For Public Services Fairly Scottish Greens

Car Tax Bands Everything You Need To Know Carbuyer

Income Tax Bands Rates v2 2017 18 HelloGrads

https://www.gov.uk/guidance/rates-and-thresholds...

Web Feb 27 2023 nbsp 0183 32 The standard employee personal allowance for the 2023 to 2024 tax year is 163 242 per week 163 1 048 per month 163 12 570 per year

https://www.gov.uk/government/publications/rates...

Web Jan 15 2024 nbsp 0183 32 Higher rate for tax year 2023 to 2024 42 31 093 to 163 125 140 Higher rate for tax years up to and including 2022 to 2023 41 163 31 093 to 163 150 000

https://www.icaew.com/insights/viewpoints-on-the...

Web Sep 29 2022 nbsp 0183 32 Chart of the week Provisional tax bands 2023 24 Author ICAEW Insights Published 29 Sep 2022 Our chart this week illustrates how five or seven different

https://www.nerdwallet.com/article/tax…

Web Jan 29 2024 nbsp 0183 32 There are seven federal income tax rates and brackets in 2023 and 2024 10 12 22 24 32 35 and 37 Your taxable income and filing status determine which federal tax rates apply

https://commonslibrary.parliament.uk/research-briefings/cbp-9754

Web Jan 8 2024 nbsp 0183 32 This briefing sets out direct tax rates and principal tax allowances for the 2023 24 tax year as confirmed in the Spring Budget 2023 on 15 March 2023 It also

Web 2023 24 Personal Allowance 163 12 570 Transferable tax allowance for married couples civil partners 163 1 260 Personal Savings Allowance PSA 163 1 000 for Basic rate taxpayers Web Dec 19 2023 nbsp 0183 32 Our guide to business tax explains this year s tax brackets and rates for 2023 24 as well as 2024 25 where that information is available It also looks back to the

Web Apr 5 2023 nbsp 0183 32 The bands for the 2023 24 tax year in Scotland are National Insurance When it comes to your National Insurance Contributions as a sole trader you may pay both