Ontario Income Tax Tables 2023 Web Table takes into account federal basic personal amount of 15 000 and Ontario basic personal amount of 11 865 Note that the federal amount of 15 000 is gradually reduced to 13 521 from taxable income of 165 430 until it reaches 235 675 not

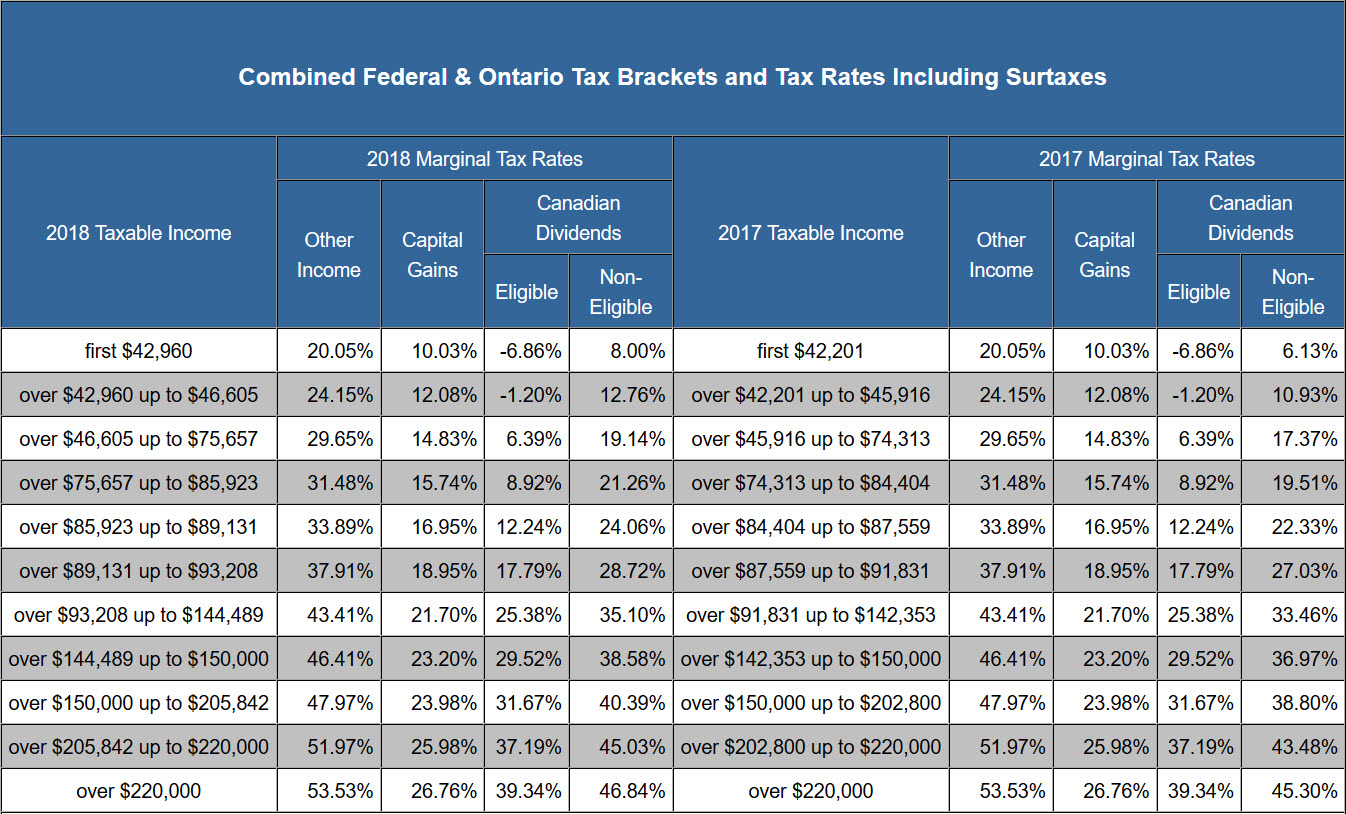

Web Revised October 26 2023 TaxTips ca Ontario tax rates for 2022 and 2023 for eligible and non eligible dividends capital gains and other income Web Rates are subject to change in accordance with federal and provincial budgets 2023 personal tax rates Taxable income Taxes payable on other income Average tax rate on other income Marginal tax rate on Taxable income Taxes payable on other income Average tax rate on other income

Ontario Income Tax Tables 2023

Ontario Income Tax Tables 2023

Ontario Income Tax Tables 2023

https://kalfalaw.com/wp-content/uploads/2019/01/Marginal-Tax-Rates-2020-01.png

Web Estimated amount 0 All set to file your taxes We ve got your back Get started 2023 Ontario provincial and federal income tax brackets Here are the tax brackets for Ontario and Canada based on your taxable income Do your taxes with the TurboTax mobile app Work on your tax return anytime anywhere

Templates are pre-designed documents or files that can be utilized for various functions. They can save effort and time by offering a ready-made format and design for creating different type of material. Templates can be utilized for personal or expert jobs, such as resumes, invites, flyers, newsletters, reports, discussions, and more.

Ontario Income Tax Tables 2023

2022 Tax Brackets PersiaKiylah

Irs Tax Brackets 2023 Chart Printable Forms Free Online

Tax Bracket 2024 Canada Agathe Ardelis

2024 Income Tax Brackets Ontario Abbie Shanda

:max_bytes(150000):strip_icc()/2020IRSTaxTablesScreenShot-16679838387b47b492ac296463926902.jpg)

Astounding Gallery Of Eic Tax Table Concept Turtaras

Listed Here Are The Federal Tax Brackets For 2023 Vs 2022 FinaPress

https://assets.ey.com/content/dam/ey-sites/ey-com/...

Web Jan 15 2023 nbsp 0183 32 The federal basic personal amount comprises two elements the base amount 13 521 for 2023 and an additional amount 1 479 for 2023 The additional amount is reduced for individuals with net income in excess of 165 430 and is fully eliminated for individuals with net income in excess of 235 675 Consequently the additional amount

https://www.canada.ca/en/revenue-agency/services/...

Web Jan 1 2024 nbsp 0183 32 Canada Employment Amount Basic personal amounts Ontario tax for 2024 Ontario indexing for 2024 Tax rates and income thresholds Chart 2 2024 Ontario tax rates and income thresholds Ontario health premium Surtax Tax reduction Personal amounts Canada Pension Plan CPP and Employment Insurance EI CPP

https://www.canada.ca/.../general-income-tax-benefit-package/ontario.html

Web Federal Worksheet Use this worksheet to calculate some of the amounts to report on your return Ontario tax Form ON428 Ontario Tax Calculate the Ontario tax and credits to report on your return Optional Ontario Tax Information Find out what s new for residents of Ontario for 2023 and get help completing your Ontario tax and credits form

https://on-ca.icalculator.com/income-tax-rates/2023.html

Web The following tax tables are supported by iCalculator CA as part of the suite of free tax tools we provide for Ontario Discover the Ontario tax tables for 2023 including tax rates and income thresholds Stay informed about tax

https://www.canada.ca/.../ontario/5006-pc.html

Web New for 2023 The personal income levels used to calculate your Ontario tax have changed The amounts for most provincial non refundable tax credits have changed The Ontario seniors home safety tax credit is no longer available for 2023 and later tax years The Ontario jobs training tax credit is no longer available for 2023 and later tax years

Web Oct 23 2023 nbsp 0183 32 Ontario s income tax brackets for Tax Year 2023 Ontario s progressive tax rate structure Ontario s provincial income tax credits Avoiding interest and penalties Paying income taxes owed to the CRA Web Tax table 2023 Raymond Chabot Grant Thornton Ontario Tax table 2023 This document is up to date as of August 31 2023 and reflects the status of legislation including proposed amendments at this date For rates in 2024 consult this pdf Marginal rate applies on each dollar of additional income Federal

Web TABLE I1 ONTARIO 2023 CONTINUED TABLE I2 MAIN NON REFUNDABLE TAX CREDITS 2023 Marginal rate applies on each dollar of additional income Federal Basic personal credit of 2 250 gradually reduced when income is greater than 165 430 up to a minimum credit of 2 028 Indexation rate of 6 3