Ohio Tax Brackets 2023 Married Filing Jointly WEB Unlike the Federal Income Tax Ohio s state income tax does not provide couples filing jointly with expanded income tax brackets Ohio s maximum marginal income tax rate is the 1st highest in the United States ranking directly below Ohio s

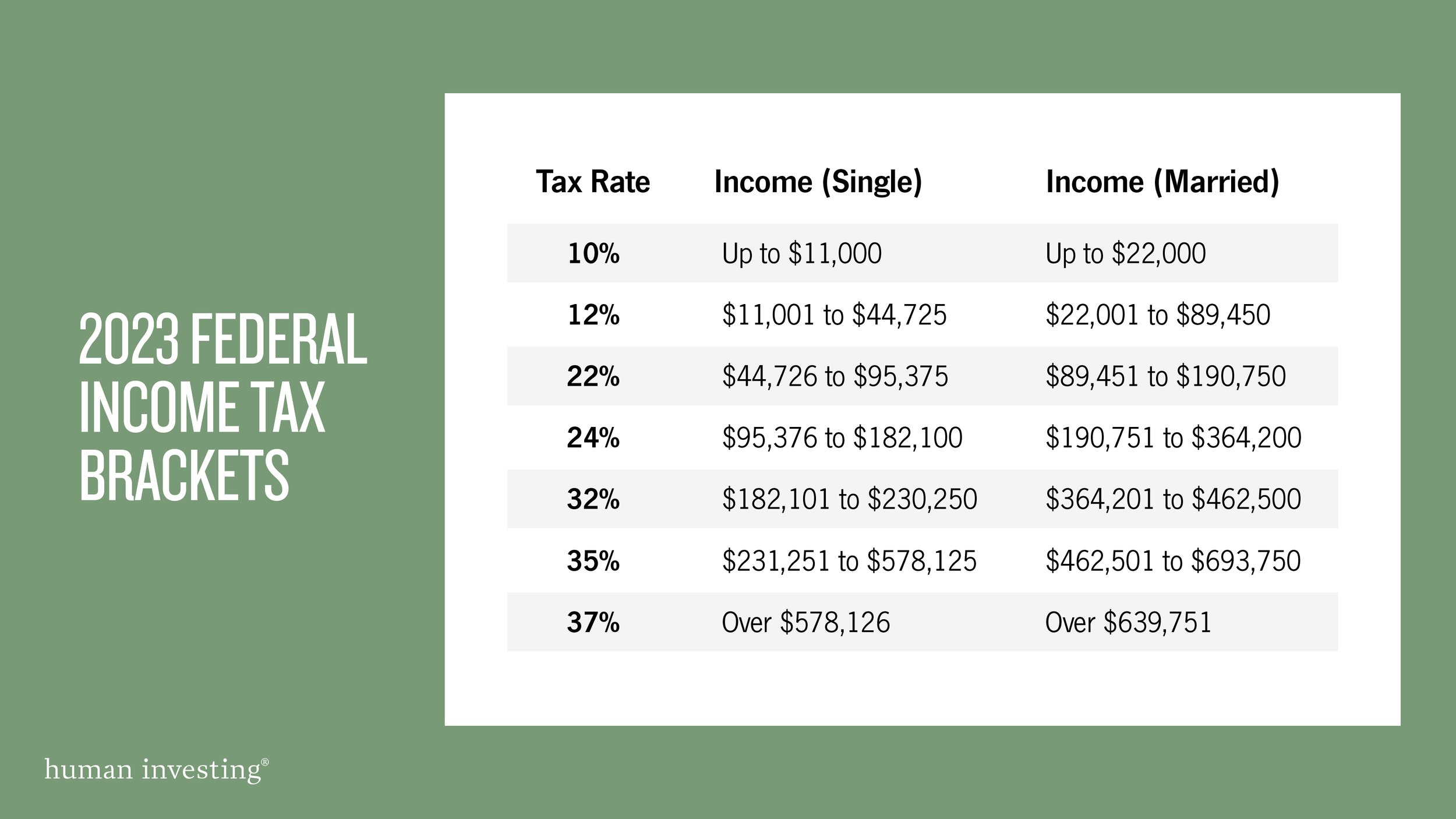

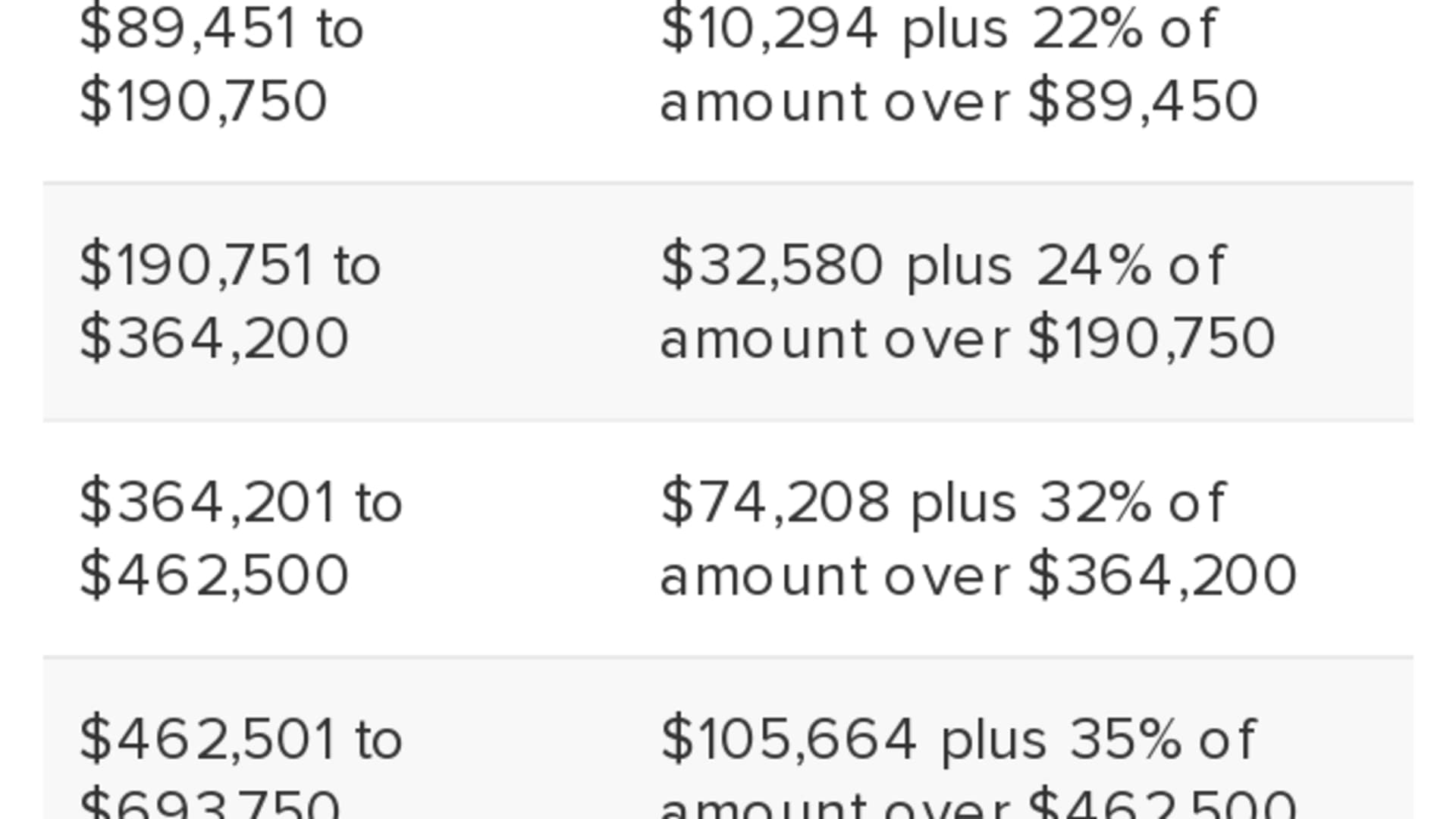

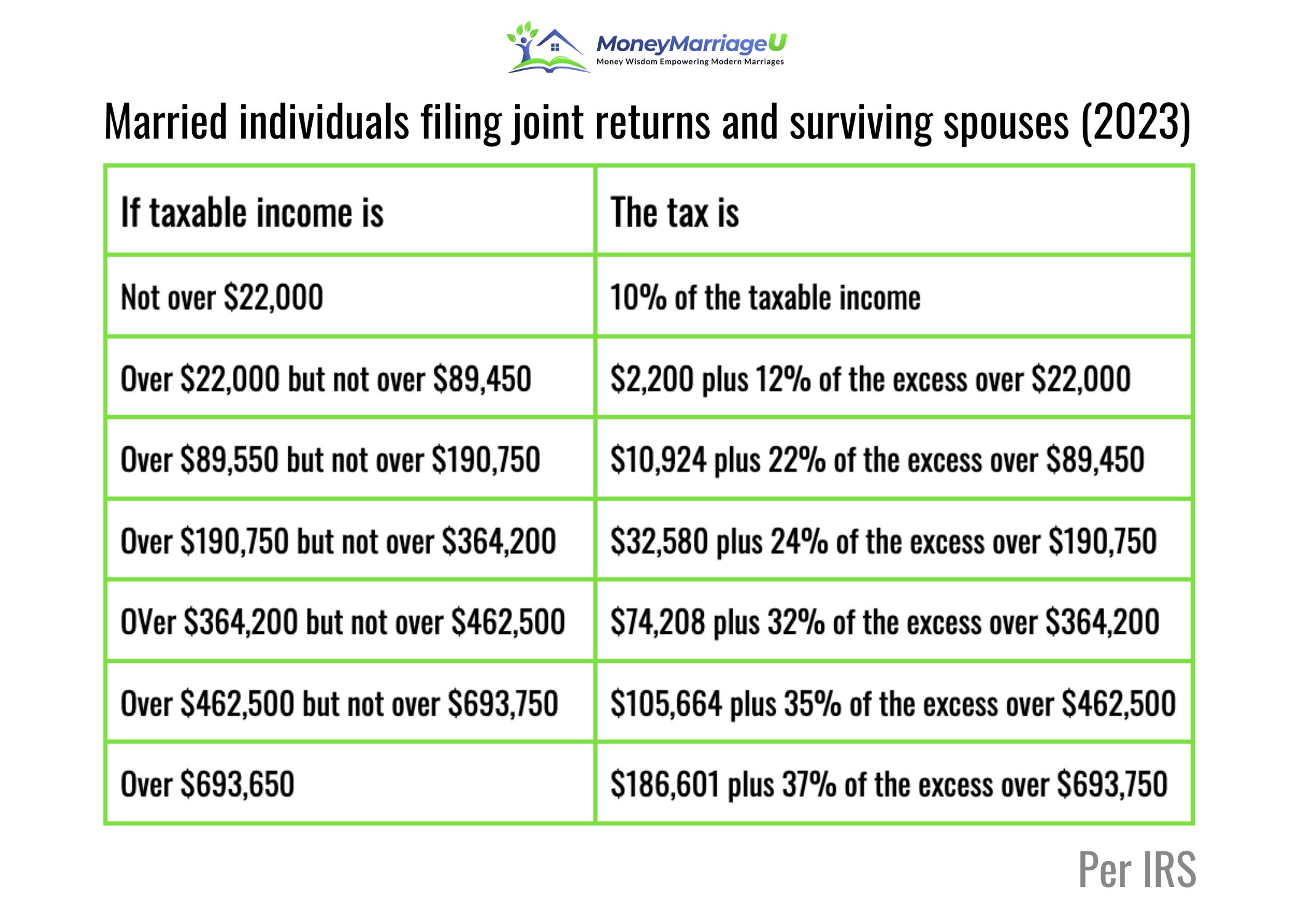

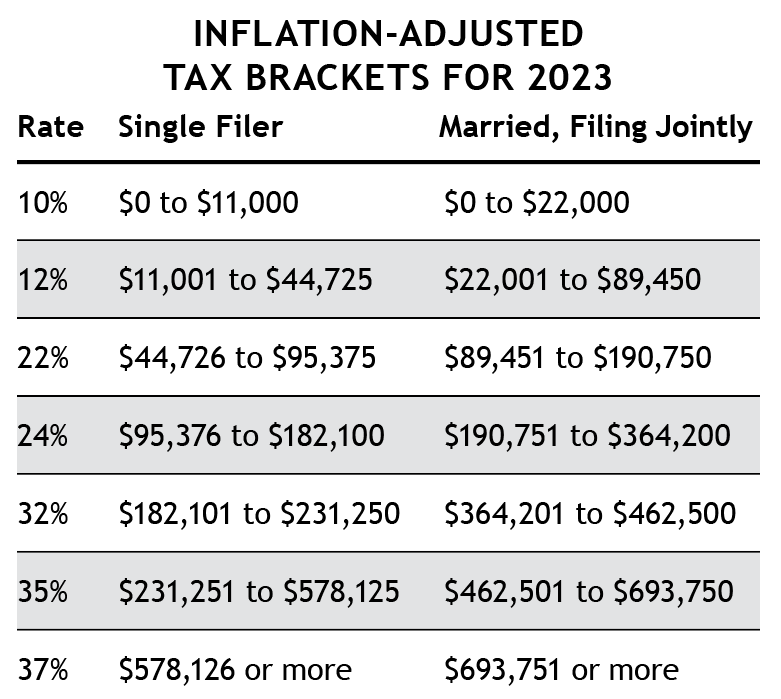

WEB Income Tax Brackets Rates Income Ranges and Estimated Taxes Due This section explains how Ohio taxes your income at different rates depending on the tax bracket you fall into When you file electronically with eFile your income tax will be automatically calculated based on your income WEB For a single taxpayer the rates are Here s how that works for a single person earning 58 000 per year 2023 tax rates for other filers Find the current tax rates for other filing statuses Married filing jointly or qualifying surviving spouse Married filing separately Head of household See the Related

Ohio Tax Brackets 2023 Married Filing Jointly

Ohio Tax Brackets 2023 Married Filing Jointly

Ohio Tax Brackets 2023 Married Filing Jointly

https://substackcdn.com/image/fetch/f_auto,q_auto:good,fl_progressive:steep/https://bucketeer-e05bbc84-baa3-437e-9518-adb32be77984.s3.amazonaws.com/public/images/e23b505f-ffa6-4e69-9c23-dde3138f86cc_2100x1500.png

WEB Jan 1 2024 nbsp 0183 32 Starting in 2005 Ohio s state income taxes saw a gradual decrease each year For the 2023 tax year which you file in 2024 the top rate is 3 75 Alone that would place Ohio at the lower end of states with an income tax but many Ohio municipalities also charge income taxes some as high as 3

Templates are pre-designed files or files that can be used for numerous functions. They can conserve time and effort by supplying a ready-made format and design for producing different kinds of content. Templates can be used for personal or professional projects, such as resumes, invitations, leaflets, newsletters, reports, presentations, and more.

Ohio Tax Brackets 2023 Married Filing Jointly

Tax Brackets For 2023 Hot Sex Picture

California Income Tax Withholding Tables Gettrip24

Here s Where To Invest Your Cash To Save On Taxes In 2024

2022 Federal Tax Brackets And Standard Deduction Printable Form

Tax Filers Can Keep More Money In 2023 As IRS Shifts Brackets The Hill

Irs Tax Brackets 2023 Chart Printable Forms Free Online

https://www.tax-brackets.org/ohiotaxtable/married-filing-jointly

WEB Ohio Married Filing Jointly Tax Brackets TY 2023 2024 What is the Married Filing Jointly Income Tax Filing Type Married Filing Jointly is the filing type used by taxpayers who are legally married including common law marriage and file a combined joint income tax return rather than two individual income tax returns

https://tax.ohio.gov/individual/resources/annual-tax-rates

WEB The following are the Ohio individual income tax brackets for 2005 through 2023 Please note that as of 2016 taxable business income is taxed at a flat rate of 3 The tax brackets were adjusted per House Bill 110

https://www.nerdwallet.com/article/taxes/ohio-state-tax

WEB Apr 4 2023 nbsp 0183 32 Ohio state income tax returns for the 2023 tax year were due April 15 2024 or are due Oct 15 2024 with a tax extension Ohio state income tax rates and tax brackets Ohio

https://www.tax-brackets.org/ohiotaxtable/2023

WEB Ohio 2023 Married Filing Jointly Tax Brackets This page shows Tax Brackets s archived Ohio tax brackets for tax year 2022 This means that these brackets applied to all income earned in 2022 and the tax return that uses these tax rates was due in April 2023

https://www.tax-brackets.org/ohiotaxtable

WEB Ohio has four marginal tax brackets ranging from 2 77 the lowest Ohio tax bracket to 3 99 the highest Ohio tax bracket Each marginal rate only applies to earnings within the applicable marginal tax bracket which are the same in Ohio for single filers and couples filing jointly

WEB The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return It is mainly intended for residents of the U S and is based on the tax brackets of 2023 and 2024 The 2024 tax values can be used WEB Tax Brackets 2023 2024 Arkansas standard deduction for tax year 2021 is 4 400 for married filing jointly and 2 200 for all other filers Ohio Oklahoma Oregon Pennsylvania

WEB Jan 10 2024 nbsp 0183 32 Wondering how much to set aside for 1099 taxes We ll show you how tax brackets impact freelancers so you won t get stuck with an oversized tax bill